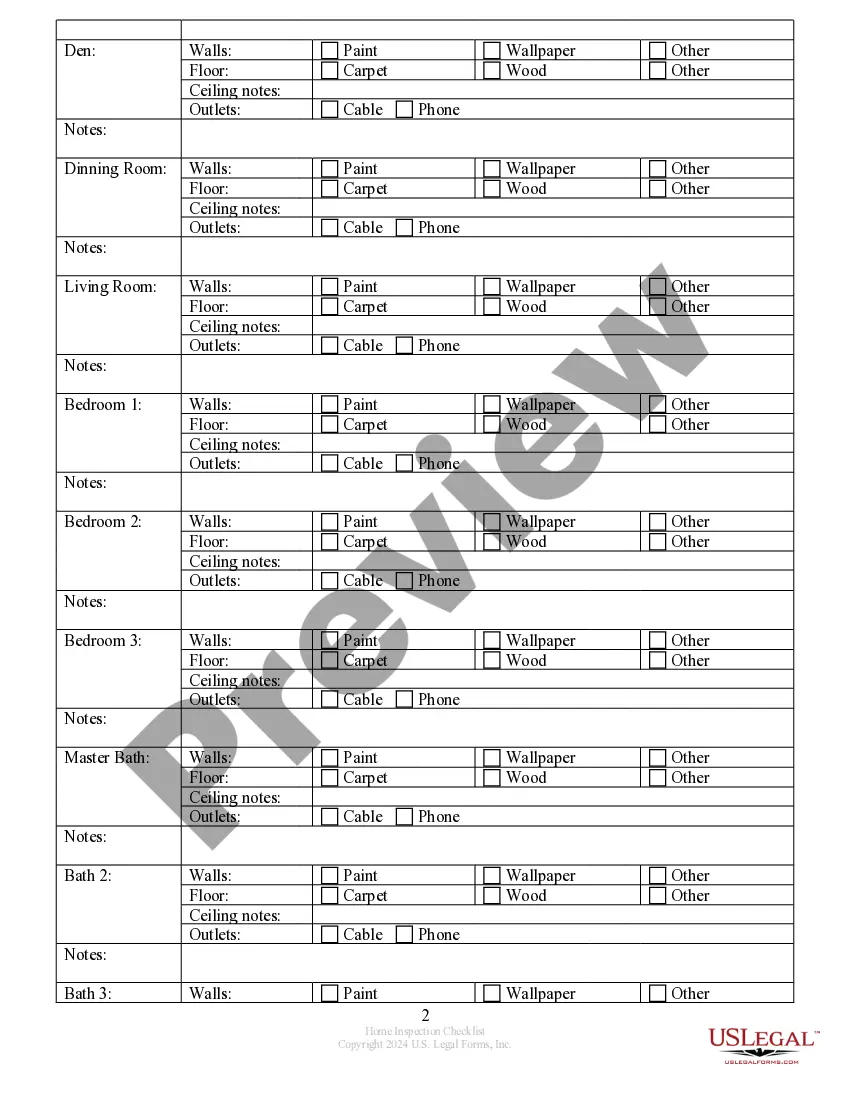

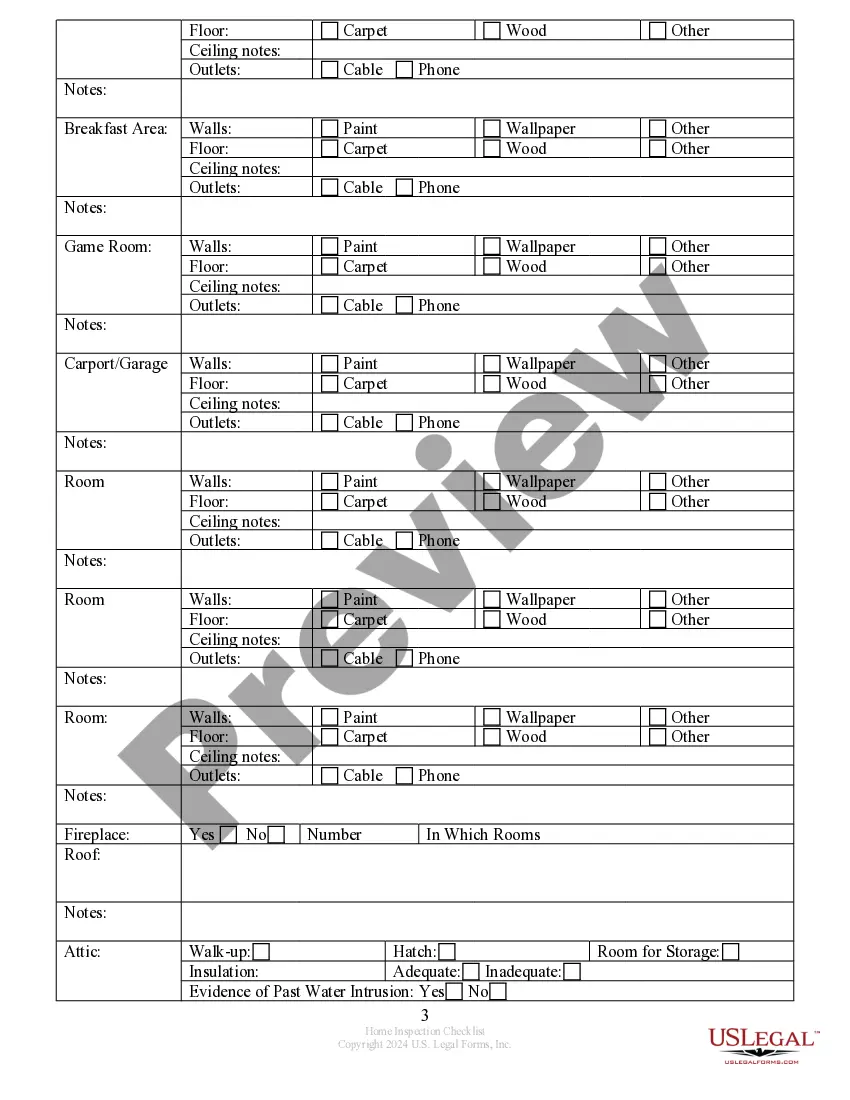

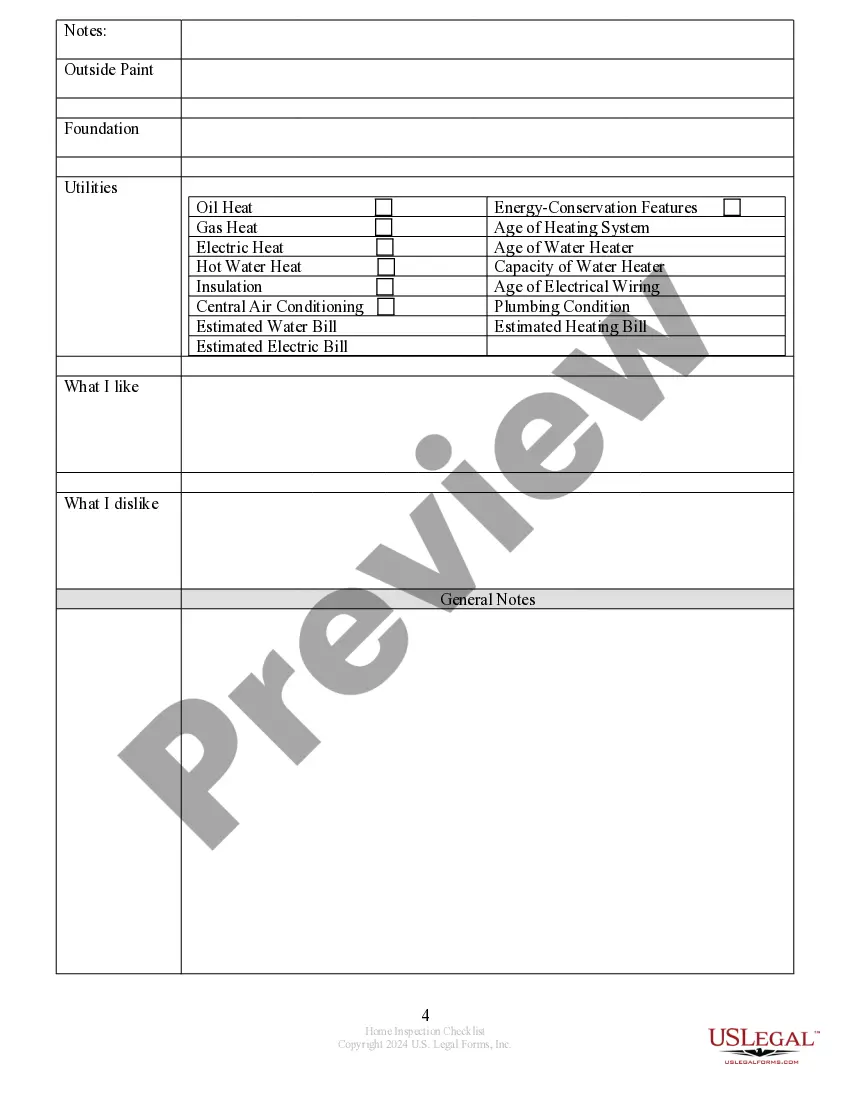

Home Inspection Checklist Form For Seller

Description

How to fill out New York Buyer's Home Inspection Checklist?

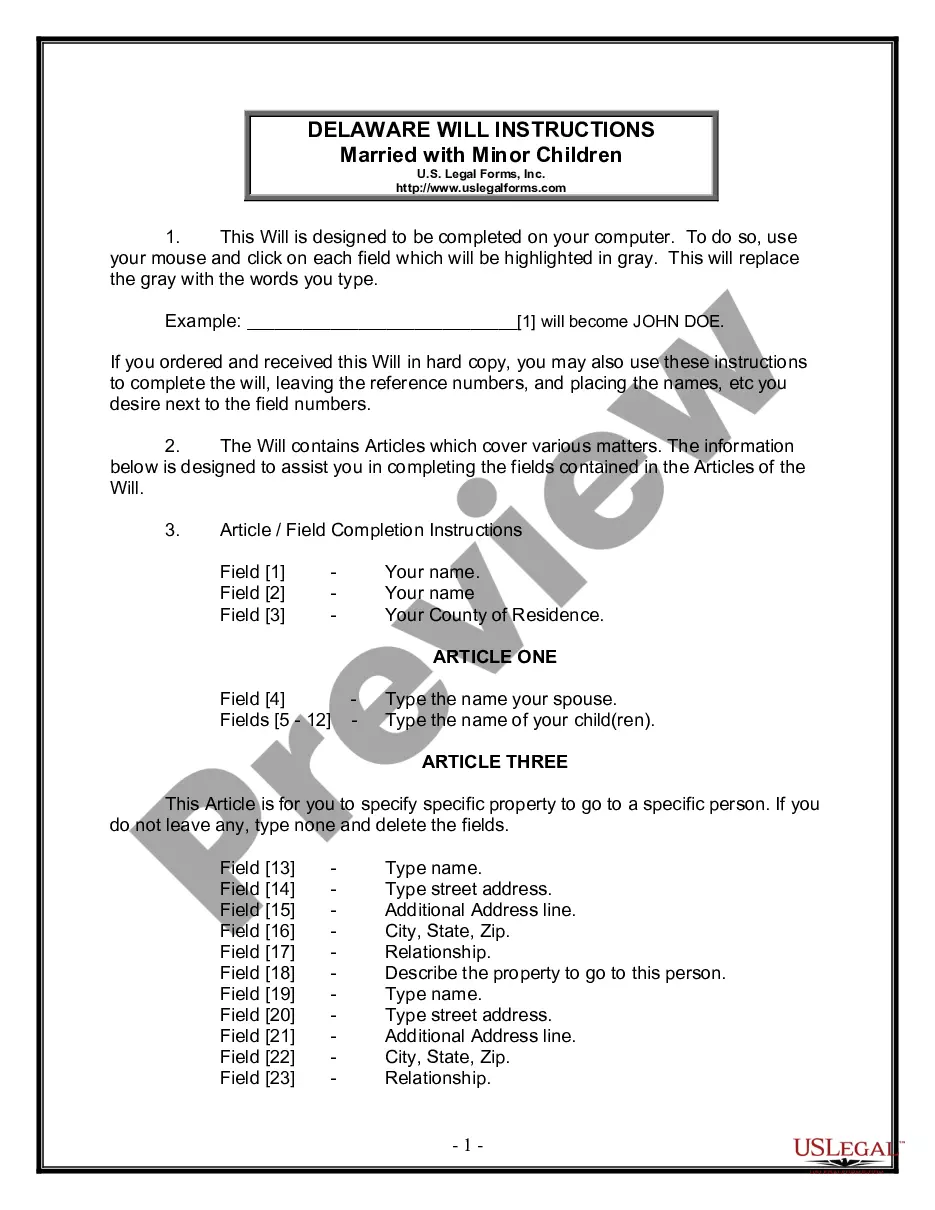

The Residential Inspection Checklist Template For Seller presented on this page is a versatile official format crafted by expert attorneys in compliance with national and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal professionals with more than 85,000 authenticated, state-specific documents for any business and personal needs. It’s the quickest, easiest, and most dependable method to access the paperwork you require, as the service promises the highest standards of data security and anti-malware safeguards.

Select the format you prefer for your Residential Inspection Checklist Template For Seller (PDF, Word, RTF) and save the document on your device.

- Search for the document you require and examine it.

- Browse through the sample you've located and preview it or review the form description to verify it meets your requirements. If it doesn't, utilize the search feature to find the appropriate one. Click Buy Now when you have found the template you need.

- Subscribe and Log In.

- Select the pricing package that fits your needs and create an account. Use PayPal or a credit card for a fast payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

The riskiest part of a home inspection often involves the property's structural integrity. Issues such as foundation cracks, roof leaks, or improperly installed framing can lead to costly repairs and deter potential buyers. Addressing these concerns in advance using a home inspection checklist form for seller can mitigate risks. Being proactive allows you to strengthen your position in negotiations.

Typically, sellers have the right to be present during the home inspection, although it is not always required. This presence can provide insight into the inspector's findings and allow for immediate questions and answers. Using a home inspection checklist form for seller can be beneficial during this process, as you can reference areas of concern in real-time. Engaging with the inspector may also help sellers better understand the condition of their property.

Providing the seller with a copy of the home inspection can benefit both parties. It allows the seller to understand any potential issues and address them before putting the property on the market. Using a comprehensive home inspection checklist form for seller ensures that you communicate all relevant details effectively.

How to Write a Contractor Agreement Outline Services Provided. The contractor agreement should list all services the contractor will provide. ... Document Duration of the Work. Specify the duration of the working relationship. ... Outline Payment Terms. ... Outline Confidentiality Agreement. ... Consult with a Lawyer.

Your municipality or town office can provide you with licenses and permits. Becoming a contractor may also require permits from the federal or provincial governments, such as health and environmental permits. The type of industry you're in, and your location determines the business licenses and permits you'll need.

Self-Employed Tax Deductions You Should Claim In Canada Business-Use-of-Home-Office. Operating expenses. Entertainment and meals. Vehicle expenses. Travel expenses. Professional development and educational expenses. Bank charges on your business' bank account, including interest. Deductions for bad debts.

The Act requires any contractor engaging in the business of making or selling home improvements, whether an individually owned business or a corporation, limited liability company, partnership, or association, to register annually with the Division, unless specifically exempted from registration under the Act.

IRS Form W-8BEN or IRS Form W-8BEN-E You will need to collect information and file Form W-8BEN for any foreign individuals you contract with over the course of the tax year. If you contract with a foreign company or self-employed workers who operate under a business entity, you'll need to collect IRS Form W-8BEN-E.

How to become a general contractor in New Jersey Complete an application packet. The first step in earning your contractor license is completing and submitting your application packet . ... Register with the New Jersey Department of Banking and Insurance (DOBI) ... Buy business insurance. ... Receive your license.

Self-employed business income is reported on the form T2125, Statement of Business or Professional Activities. This form can help you calculate your gross income and your net income (loss), which are required when you complete your T1, General income and benefit return.