Checklist For Buying A House For The First-time

Description

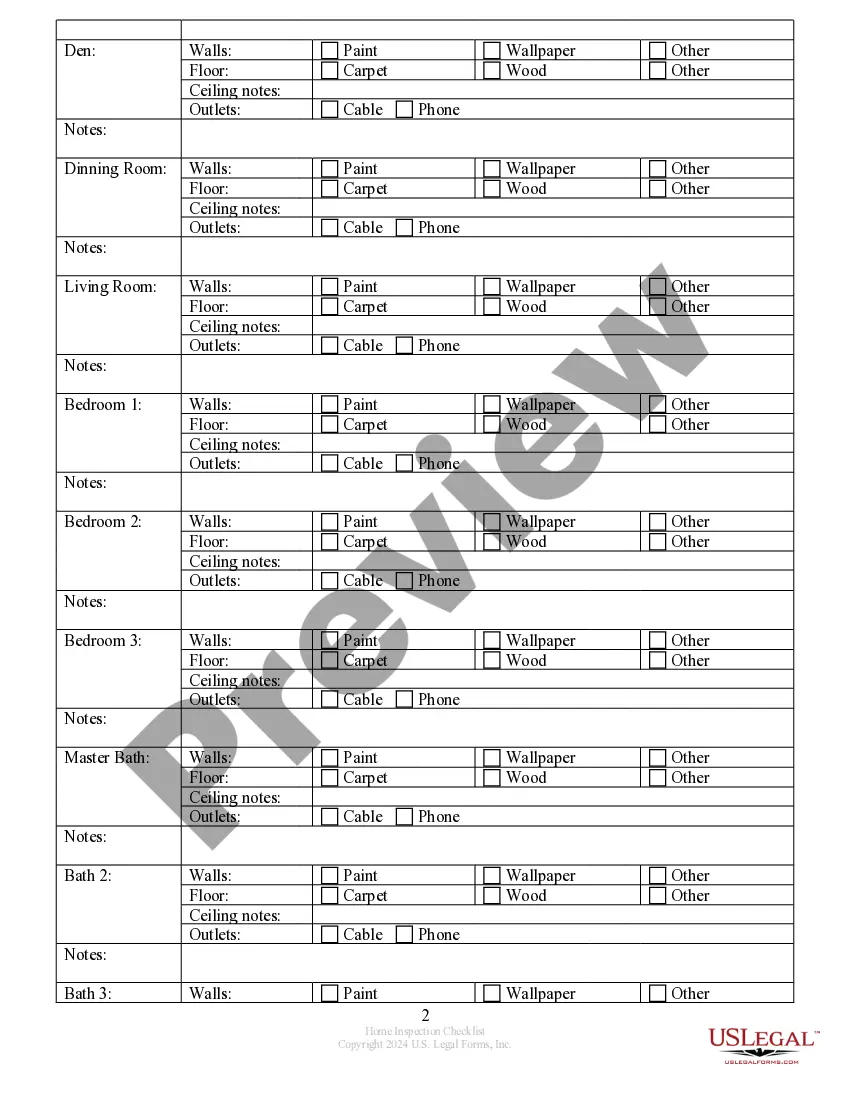

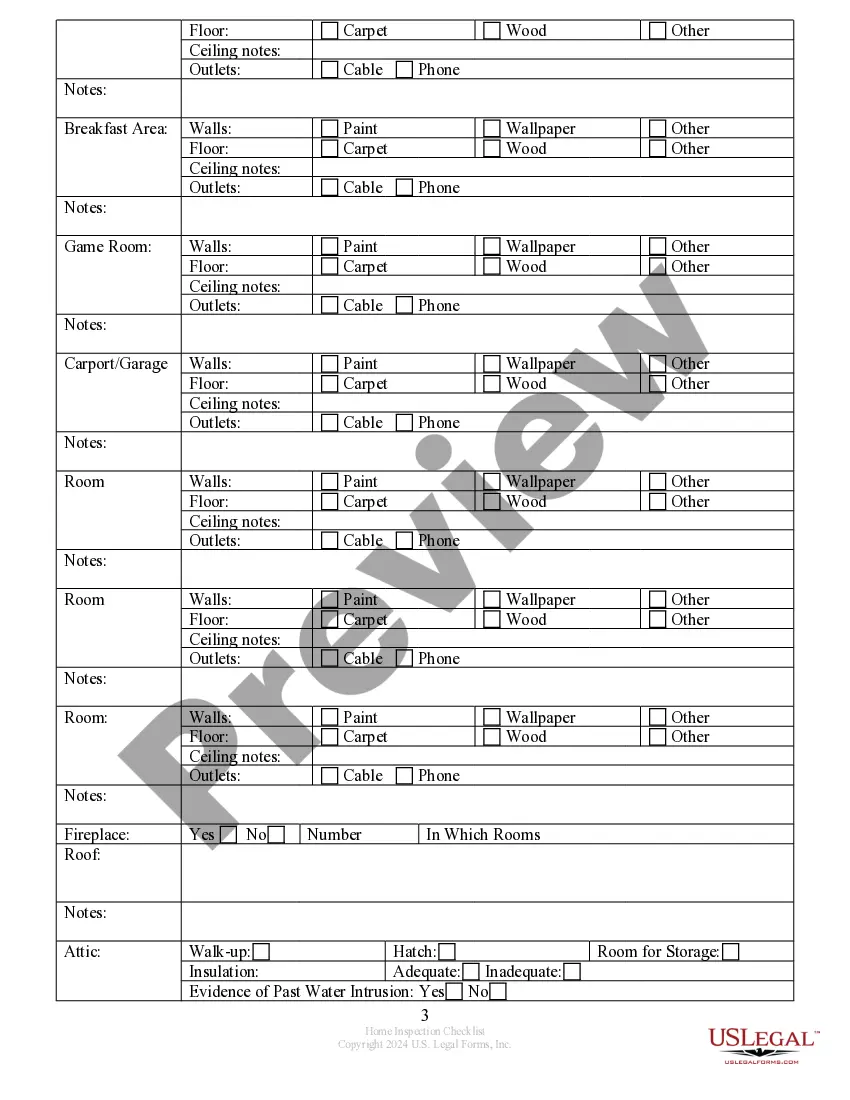

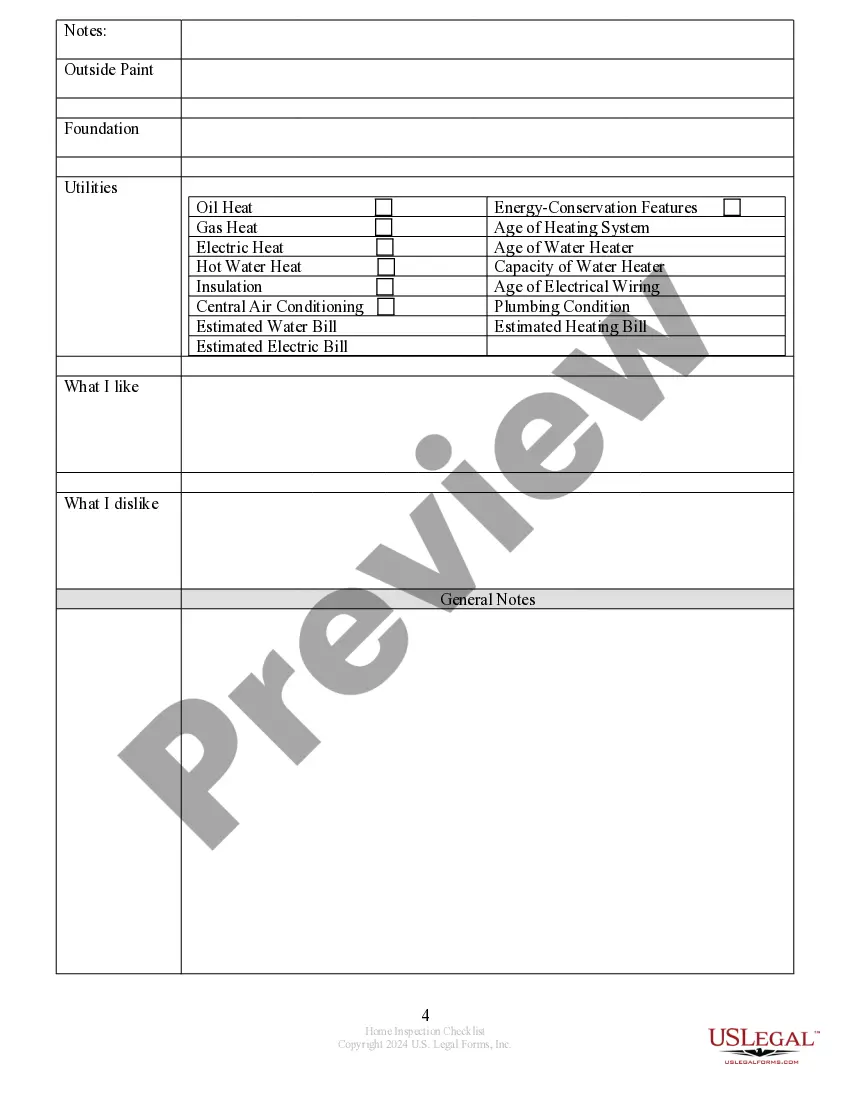

How to fill out New York Buyer's Home Inspection Checklist?

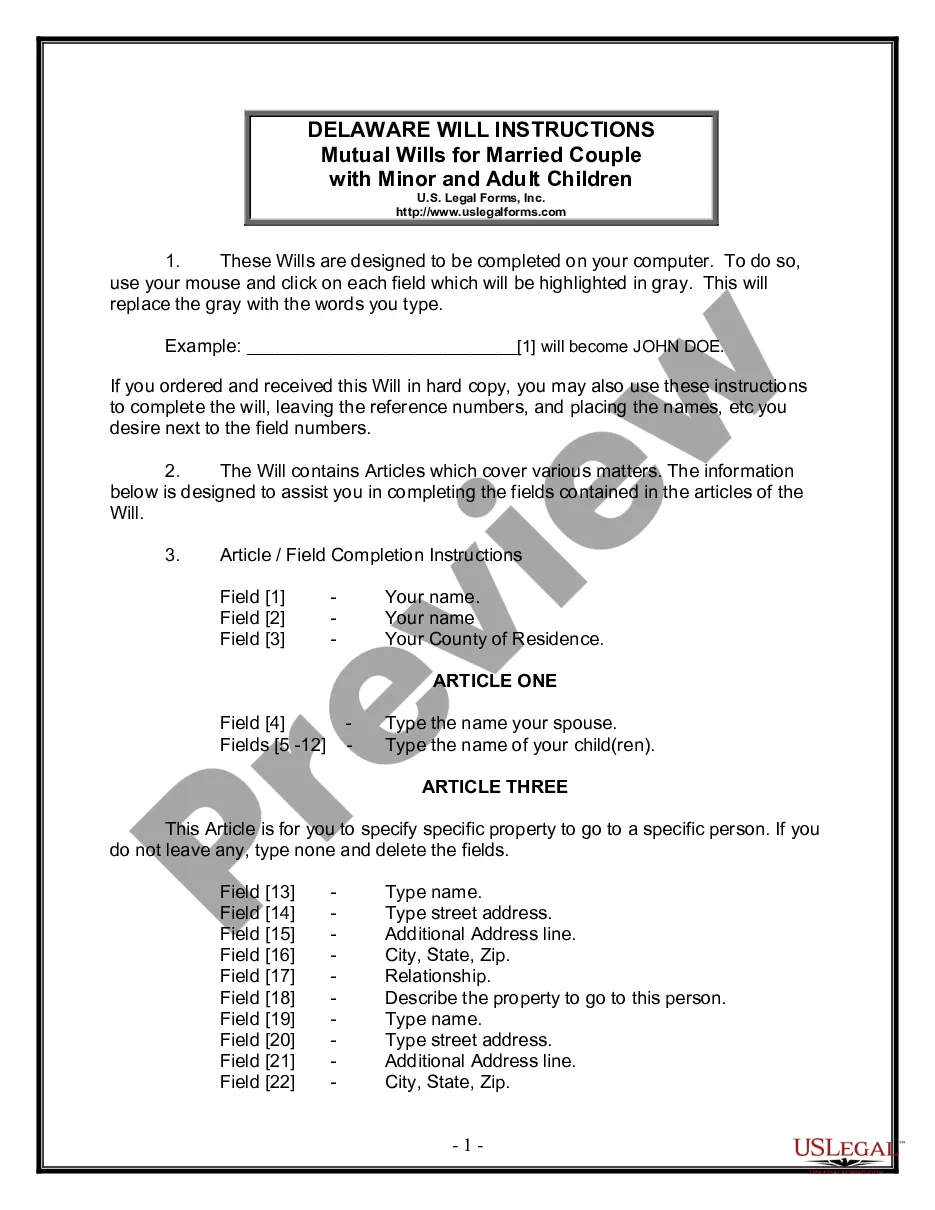

Obtaining legal document examples that align with federal and state laws is crucial, and the internet provides numerous choices to select from.

However, what’s the purpose of spending time searching for the suitable Checklist For Buying A House For The First-time example online if the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms is the most extensive online legal repository with over 85,000 fillable templates crafted by attorneys for various professional and personal scenarios. They are straightforward to navigate with all documents organized by state and intended use. Our experts stay current with legislative changes, so you can always be assured that your form is updated and compliant when acquiring a Checklist For Buying A House For The First-time from our site.

Click Buy Now once you’ve found the correct form and select a subscription option. Create an account or Log In and pay using PayPal or a credit card. Choose the format for your Checklist For Buying A House For The First-time and download it. All templates you locate through US Legal Forms are reusable. To re-download and complete forms you've previously obtained, access the My documents section in your account. Take advantage of the most extensive and user-friendly legal documentation service!

- Getting a Checklist For Buying A House For The First-time is straightforward and fast for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you need in your desired format.

- For newcomers to our site, follow these instructions.

- Review the template using the Preview feature or through the text description to confirm it satisfies your requirements.

- Search for another sample using the search tool at the top of the page if necessary.

Form popularity

FAQ

The biggest red flag in a home inspection typically involves significant structural damage or foundation issues. These problems can lead to costly repairs down the line, making it critical to address them early. During your checklist for buying a house for the first time, ensure a thorough inspection is conducted to spot these concerns. By being informed, you can make better decisions regarding your potential new home.

A red flag on a property signals potential issues that might concern buyers during the checklist for buying a house for the first time. This could range from structural problems to legal disputes, which may affect the property's value or livability. It's important to investigate these flags carefully. Using platforms like US Legal Forms can provide you with necessary legal documents to address any concerns.

Your first home checklist should include financial documents, a budget plan, a list of desired home features, and a record of potential neighborhoods. You may also want to consider whether you will need assistance from professionals like real estate agents. By following a solid checklist for buying a house for the first-time, you can make informed decisions throughout this exciting journey.

Most first-time home buyers may expect to get approved for a mortgage that ranges from $150,000 to $350,000, depending on their financial situation and local housing prices. Factors such as income, employment history, and credit score play significant roles. To align your expectations, consider using a checklist for buying a house for the first-time to estimate what you can afford.

First-time home buyers typically need to meet specific criteria, which may include being a U.S. citizen, having a steady income, and demonstrating a good credit history. Additionally, you must provide documentation of employment and possibly complete a home-buying education course. A comprehensive checklist for buying a house for the first-time will ensure you understand these requirements clearly.

There isn't a specific 'best' age to buy your first home, as it varies based on personal circumstances, career stability, and financial readiness. Many first-time buyers are in their late 20s to early 30s, but what's most important is ensuring you are prepared mentally and financially. Utilizing a checklist for buying a house for the first-time can help you evaluate your situation and determine if you are ready to make this significant investment. Remember, timing should align with your goals and readiness, not just numbers.

A first home checklist typically includes essential items such as furniture, kitchen appliances, and basic tools for maintenance. Don’t forget to include items like linens, toiletries, and kitchenware to make your new space functional. You can create a detailed checklist for buying a house for the first-time to cover everything you need and avoid last-minute shopping trips. This preparation ensures you feel settled sooner rather than later.

When moving into a new house, the first item you should bring is a sense of comfort and security. However, practically, you might want to start with basics like cleaning supplies to prepare your space. Once you have a fresh environment, you can refer to your checklist for buying a house for the first-time to help you move in essentials smoothly and effectively. This also sets the tone for a welcoming home.

The 30 rule states that you should not spend more than 30% of your gross monthly income on housing costs. This guideline helps ensure that you maintain financial stability while owning a home. It's an essential step in your checklist for buying a house for the first-time. This approach allows for budgeting other expenses, making the transition easier and more manageable.

A significant red flag when buying a house is any sign of foundation issues, such as cracks in walls or uneven floors. Additionally, be cautious of properties with a history of frequent repairs or renovations. Incorporating these insights into your checklist for buying a house for the first-time will help you avoid potential pitfalls.