Seller Disclosure Form With The Secretary Of State

Description

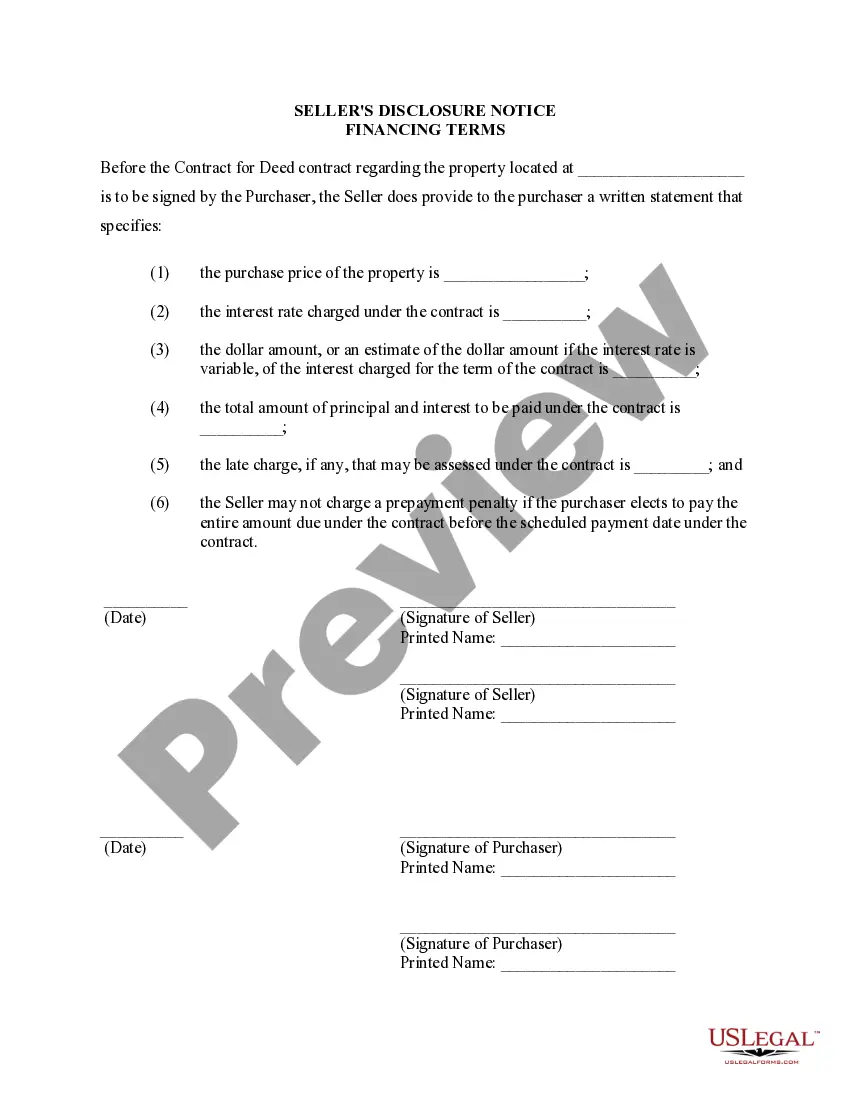

How to fill out New York Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

When you must present the Seller Disclosure Form With The Secretary Of State that adheres to your local state's laws, there can be various selections to consider.

There's no need to inspect every document to ensure it fulfills all the lawful requirements if you are a subscriber of US Legal Forms.

It is a reliable source that can assist you in acquiring a reusable and current template on any subject.

Utilize the Preview mode and review the form description if available. Find another template through the Search bar in the header if needed. Click Buy Now once you find the appropriate Seller Disclosure Form With The Secretary Of State. Select the most fitting pricing plan, Log In to your account, or create a new one. Purchase a subscription (options for PayPal and credit cards are available). Download the template in the preferred file format (PDF or DOCX). Print the document or complete it electronically in an online editor. Acquiring professionally drafted official documentation becomes effortless with US Legal Forms. Additionally, Premium users can also utilize the robust integrated tools for online PDF editing and signing. Give it a go today!

- US Legal Forms is the largest online repository with a collection of over 85k ready-to-use documents for business and personal legal matters.

- All templates are authenticated to satisfy each state's regulations.

- For that reason, when downloading the Seller Disclosure Form With The Secretary Of State from our platform, you can be confident that you possess a legitimate and current document.

- Acquiring the necessary template from our platform is quite simple.

- If you already have an account, just Log In to the system, verify your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and have access to the Seller Disclosure Form With The Secretary Of State anytime.

- If this is your initial experience with our library, please adhere to the following instructions.

- Browse through the recommended page and verify it complies with your needs.

Form popularity

FAQ

In California, several categories of sellers may be exempt from the seller disclosure requirements. These include certain transfers such as inheritance, court orders, or sales by government agencies. It's important to review the specifics of California law to understand when disclosures are necessary. To ensure compliance, sellers can refer to the seller disclosure form with the secretary of state, which outlines the guidelines and requirements.

In Colorado, realtors are not legally required to disclose a death that occurs in a house. However, ethical considerations may lead realtors to discuss such events if they believe it could impact the buyer's perception of the property. It is wise for both buyers and sellers to understand the local regulations surrounding disclosures. Utilizing a seller disclosure form with the secretary of state can clarify many important aspects of a property’s history.

Yes, a seller's property disclosure is required in Colorado. According to state law, sellers must provide the seller disclosure form with the secretary of state to inform potential buyers about known issues with the property. This form helps buyers make informed decisions and ensures transparency in the real estate transaction process. If you need assistance in preparing this form, consider using resources from uslegalforms.

The purpose of the disclosure document is to protect both buyers and sellers during a real estate transaction. It serves as a means to communicate any known property defects, which can influence buyer decisions. The seller disclosure form with the secretary of state plays a crucial role in promoting honesty and accountability. Utilizing this document can prevent disputes down the line.

An example of a disclosure statement could include information about a leaky basement or past renovations. This statement needs to be clear and detailed so that potential buyers are aware of any issues. Utilizing a seller disclosure form with the secretary of state ensures that critical information is communicated effectively. USLegalForms can help you create this essential document.

The disclosure form's meaning lies in its function of revealing crucial property information to potential buyers. Essentially, it is a safeguard for sellers, helping to avoid disputes after the sale. The seller disclosure form with the secretary of state often includes essential information about the property’s history. This reinforces buyer confidence and supports fair transactions.

A disclosure document is a formal record that outlines key information regarding a property’s condition. This can include details about previous repairs, issues, and legal obligations. By providing a seller disclosure form with the secretary of state, sellers can protect themselves from future liabilities. It is a vital tool in real estate that promotes clear communication.

A disclosure form acts as a document where sellers report specific details about a property. This includes any known issues, repairs, or improvements made over time. The seller disclosure form with the secretary of state helps foster trust and transparency in real estate transactions. Utilizing this form can significantly benefit both buyers and sellers.

The most commonly used disclosure in real estate is the seller disclosure form with the secretary of state. This document allows sellers to provide detailed information about the property. Buyers can assess potential issues, ensuring transparency in real estate transactions. Having this form readily available can facilitate smoother closings and enhance trust between parties.

In Texas, exemptions from seller disclosure apply to specific situations, such as sales by a government entity or if the property is sold at a foreclosure auction. Additionally, if a seller has never occupied the property, they may also be exempt. It is essential to review state regulations and consult resources like uslegalforms to accurately determine whether you need to complete a seller disclosure form with the secretary of state.