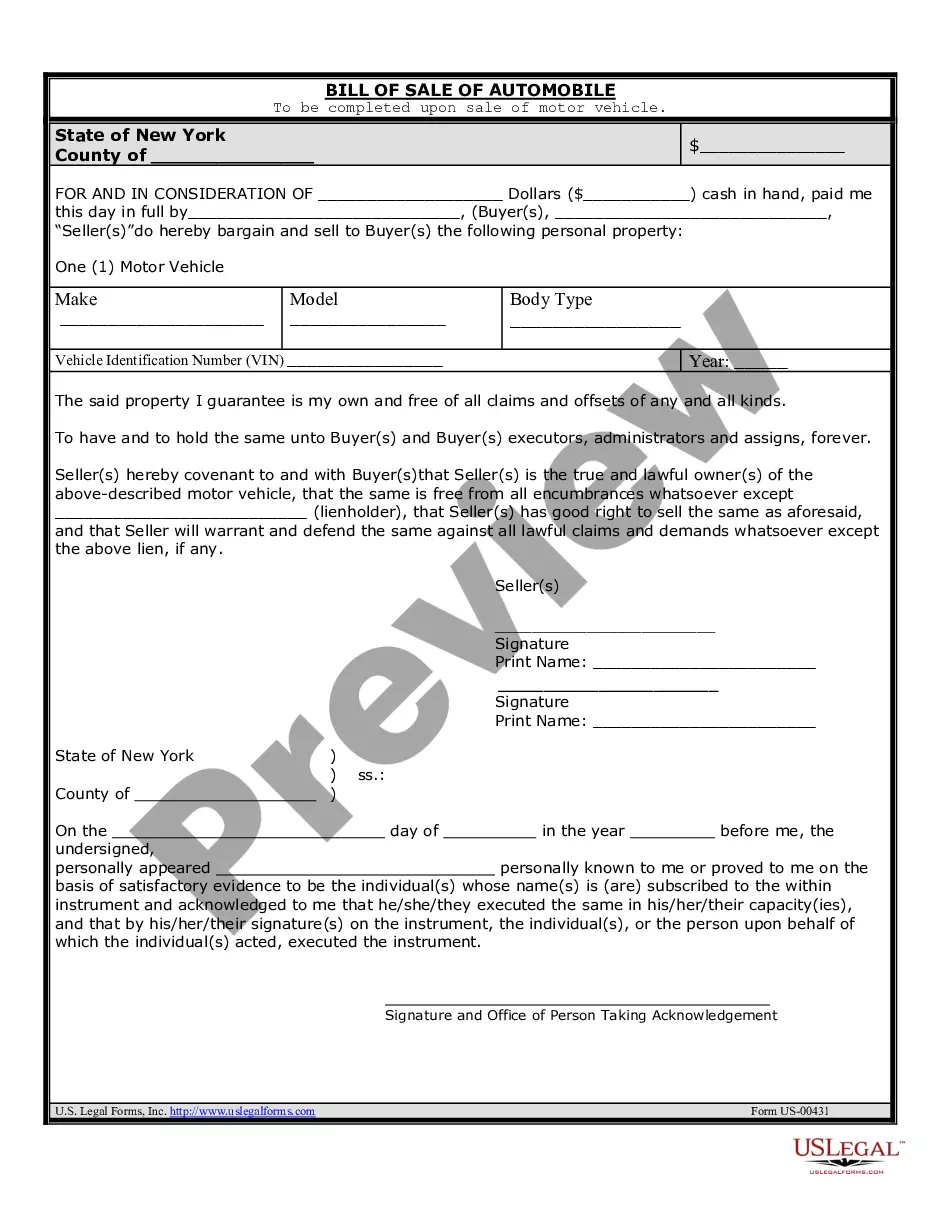

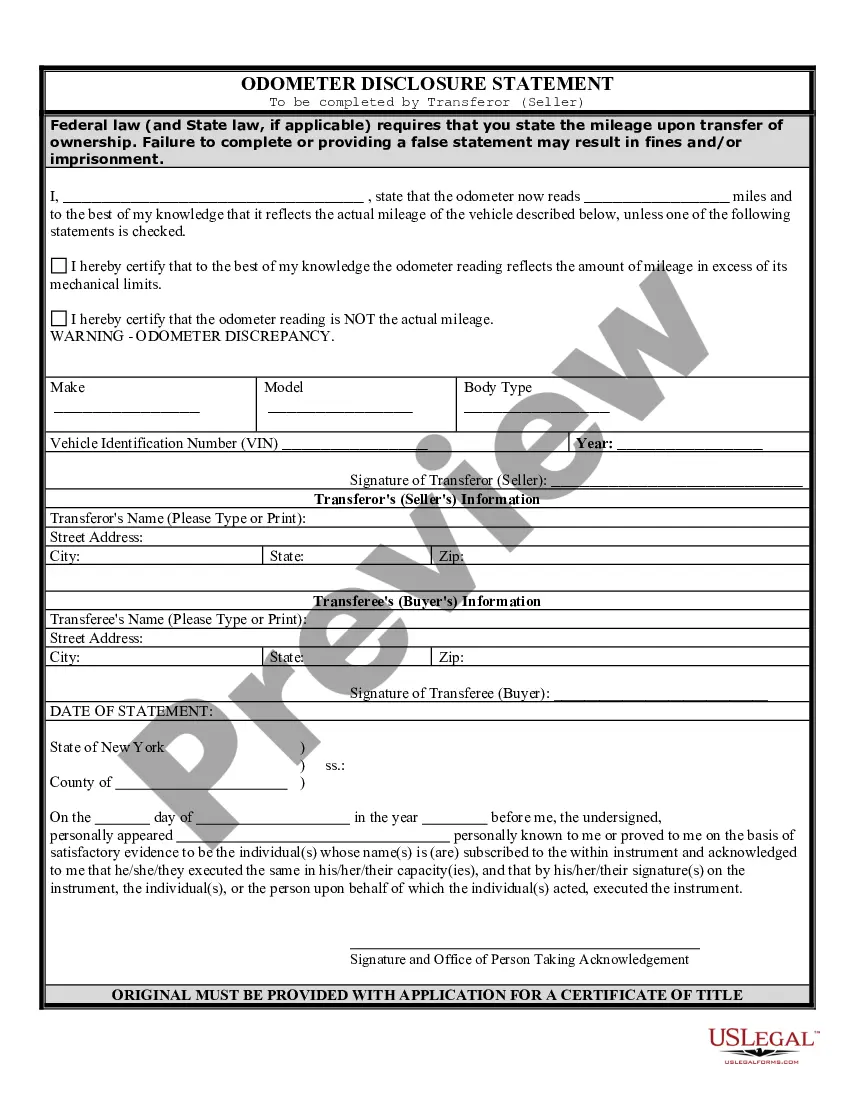

Bill Sale Automobile Form With Lien Holder

Description

How to fill out New York Bill Of Sale Of Automobile And Odometer Statement?

The management of legal documents can be overwhelming, even for experienced experts.

If you're in need of a Bill of Sale for Automobile with Lien Holder and find you lack the time to search for the suitable and latest version, the experience can be stressful.

US Legal Forms caters to all your requirements, whether they're personal or business-related, all centralized in one location.

Leverage cutting-edge tools to fill out and manage your Bill of Sale for Automobile with Lien Holder.

After securing the form you need, here are the steps to follow: ensure that this is the correct form by previewing it and examining its description; confirm that the template is vetted in your state or county; click Buy Now when you're ready; choose a monthly subscription plan; locate the file format you need, and Download, complete, eSign, print, and submit your documents. Harness the US Legal Forms online repository, backed by 25 years of expertise and reliability. Transform your routine document management into a seamless and user-friendly experience today.

- Access a valuable repository of articles, tutorials, and guides associated with your circumstances and requirements.

- Conserve time and energy locating the documentation you require, and use US Legal Forms’ advanced search and Preview feature to discover the Bill of Sale for Automobile with Lien Holder and retrieve it.

- For existing members, sign in to your US Legal Forms account, search for the form, and download it.

- Visit My documents section to review the documents you've previously downloaded and manage your files as needed.

- If it's your first encounter with US Legal Forms, create a free account and gain unlimited access to all features of the library.

- Utilize a comprehensive online form repository that can revolutionize how anyone tackles these scenarios effectively.

- US Legal Forms stands as a frontrunner in online legal forms, offering over 85,000 state-specific legal documents available at any time.

- Benefit from access to specific legal and business forms pertinent to your state or county.

Form popularity

FAQ

Furthermore, services are not taxable unless specifically included by law. Examples of taxable services include lodging, laundry and cleaning services, pet grooming, lawn care, digital downloads, and telecommunications. A remote seller is a retailer that does not have a physical presence in the state.

Storage fees for storing golf carts, boats, campers, and icehouses are not taxable.

Minnesota sales and use tax is due when a business buys storage or warehouse services for its tangible personal property, except as noted below. ?Tangible? refers to property that can be seen, weighed, measured, felt or touched. The tax does not apply to digital storage services.

Items Exempt by Law Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs.

The sales price from the sale of the storage of household goods and mini-storage are subject to sales and use tax.