Community Property Joint Form 8958

Description

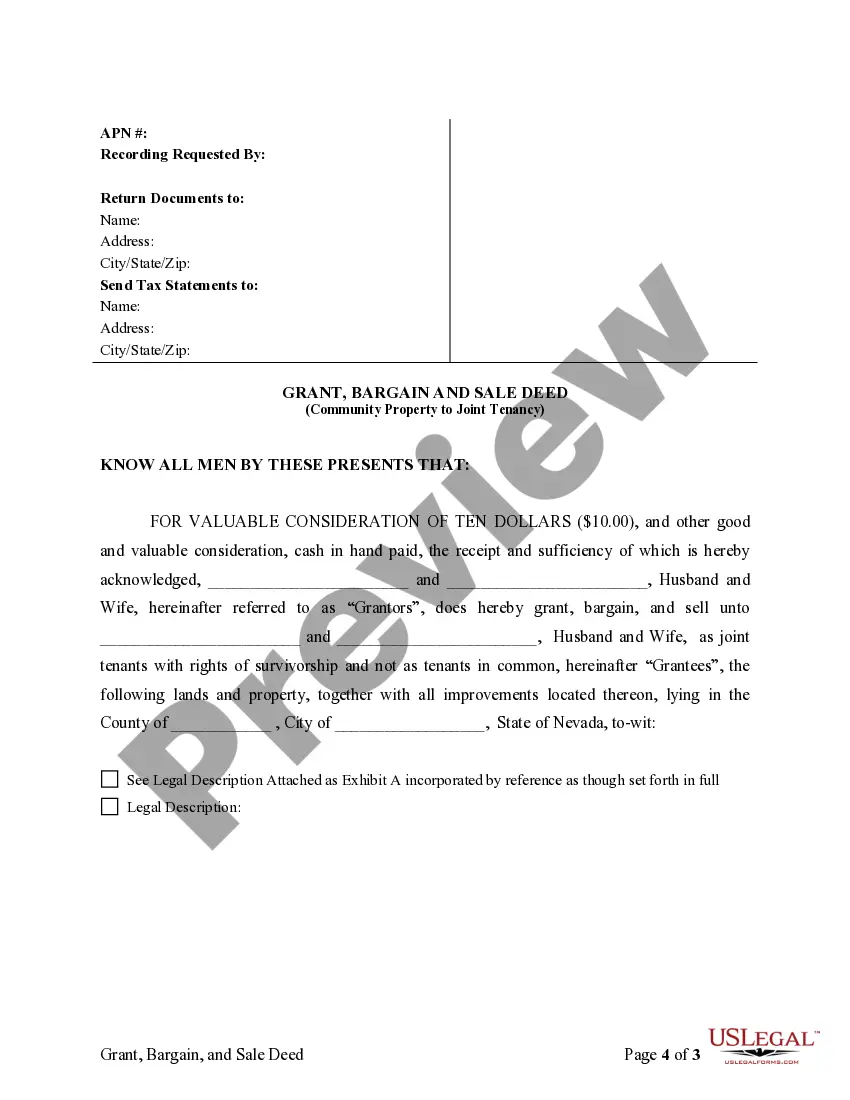

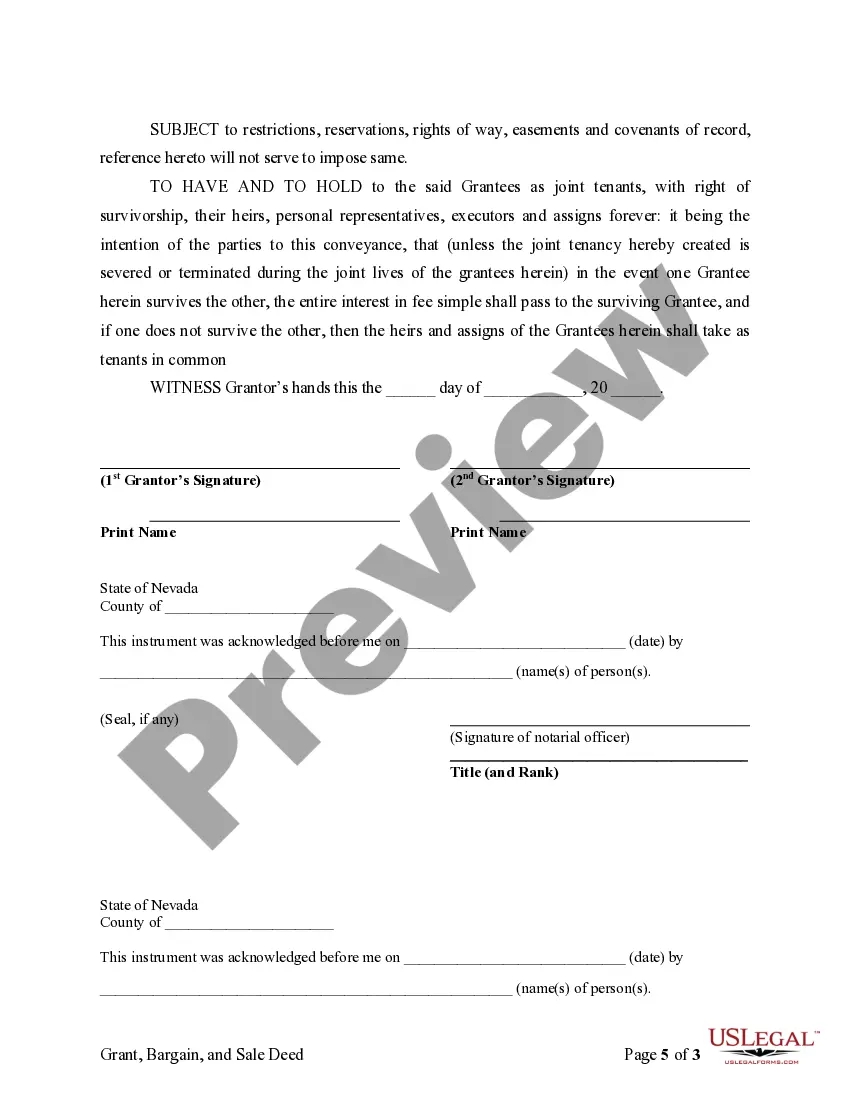

How to fill out Nevada Warranty Deed To Convert Community Property To Joint Tenancy?

There is no longer a need to squander hours sifting through legal documents to fulfill your local state requirements.

US Legal Forms has gathered all of them in one place and enhanced their accessibility.

Our website provides over 85k templates for any business and personal legal matters categorized by state and purpose.

Completing legal documents in accordance with federal and state laws and regulations is swift and simple with our platform. Experience US Legal Forms now to maintain your paperwork in order!

- All forms are meticulously drafted and validated for authenticity, ensuring you receive an up-to-date Community Property Joint Form 8958.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time needed by accessing the My documents tab in your profile.

- For those unfamiliar with our service, the process will require a few additional steps to finalize.

- Here's how new users can locate the Community Property Joint Form 8958 in our catalog.

- Review the page content carefully to ensure it features the sample you need.

- To assist, utilize the form description and preview options if available.

Form popularity

FAQ

You can obtain the community property joint form 8958 directly from the IRS website or through tax preparation software. Many resources, including uslegalforms, provide easy access and guidance on filling out the form correctly. Make sure to get the latest version to ensure compliance. This approach helps you avoid errors and ensures your taxes are processed smoothly.

The community property joint form 8958 is mandatory in specific situations, especially when you file taxes in community property states. This form documents the allocation of community income between spouses. If you choose joint filing or are required to do so, compliance with this form becomes essential. Ignoring this requirement may lead to tax complications.

Not filing the community property joint form 8958 can cause issues later with the IRS. If they can't verify your income allocations, they may adjust your tax return, leading to unexpected tax bills or audits. Additionally, failing to file could result in penalties. Always ensure timely and accurate submission by utilizing resources like uslegalforms to help navigate these requirements.

Failing to file the community property joint form 8958 online can result in complications with your tax return. The IRS may delay processing your return, leading to potential penalties or questions about your reported income. It's essential to ensure you file this form to maintain compliance with tax regulations. Using uslegalforms can simplify this process, guiding you through necessary filings.

If you file separately, generally, you do not include your spouse's income. However, in community property states, specific rules may require you to report your spouse's income on your community property joint form 8958. You should verify how your state treats community property when filing separately. This attention helps you avoid potential discrepancies or issues with the IRS.

Completing the community property joint form 8958 is necessary under certain circumstances. If you and your spouse are using community property for tax purposes, this form ensures the proper allocation of income and expenses between you. It is particularly important if one of you files separately. Overall, the form helps clarify your tax situation and ensures compliance with IRS regulations.

When filing jointly or as community property states, you may need to claim your wife's income on your taxes. The IRS views both spouses as equal contributors to the household income. Therefore, if you choose community property joint filing, you must include all income earned by both spouses. This inclusion helps provide an accurate picture of your joint financial situation.

If one spouse fails to file taxes, it can complicate the situation, especially in community property states. The IRS could hold both spouses accountable for unpaid taxes, potentially leading to fines and increased liability. In such cases, filing the Community property joint form 8958 can clarify the financial responsibilities of both partners. It's advisable to seek advice from tax professionals to navigate this challenge properly.

Filing as single when you are married can lead to significant legal and financial consequences. The IRS may classify your tax return incorrectly, which could expose you to penalties. Moreover, if you live in a community property state like California, you need to file the Community property joint form 8958 to ensure your income and expenses are reported appropriately. It's best to consult with a tax expert to avoid misfiling.

Yes, if you and your spouse are residents of California and file your taxes separately, you are required to file the Community property joint form 8958. This form helps allocate income and expenses accurately according to community property laws. Filing form 8958 ensures transparency and prevents potential disagreements regarding income distribution. Always check with a tax advisor to confirm your specific filing requirements.