Community Property Joint Form

Description

How to fill out Nevada Warranty Deed To Convert Community Property To Joint Tenancy?

When you are required to fill out Community Property Joint Form that adheres to your local state's laws, there can be many alternatives to select from.

There's no need to examine every form to ensure it satisfies all the legal requirements if you are a US Legal Forms member.

It is a trustworthy resource that can assist you in obtaining a reusable and current template on any topic.

Navigate through the recommended page and check it for alignment with your specifications.

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use documents for personal and business legal matters.

- All templates are verified to meet each state's laws.

- Hence, when you download Community Property Joint Form from our platform, you can be confident that you possess a valid and up-to-date document.

- Obtaining the necessary example from our site is remarkably simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents section in your profile and maintain access to the Community Property Joint Form at any time.

- If this is your initial experience with our collection, kindly follow the instructions below.

Form popularity

FAQ

The primary difference between joint and community property lies in ownership and the type of property acquired. Joint property typically refers to assets owned together by any two or more individuals, while community property is specifically for married couples, indicating that both spouses equally share ownership. Understanding these differences is essential for tax purposes and estate planning. USLegalForms can assist you in navigating these distinctions with the right forms and resources.

Yes, a husband and wife can file a joint Schedule C to report income or loss from their business. Filing together can simplify the process and may provide tax benefits. You'll need to use the appropriate community property joint form to ensure accurate reporting of your business income. USLegalForms provides easy-to-use forms and guidance for filing jointly.

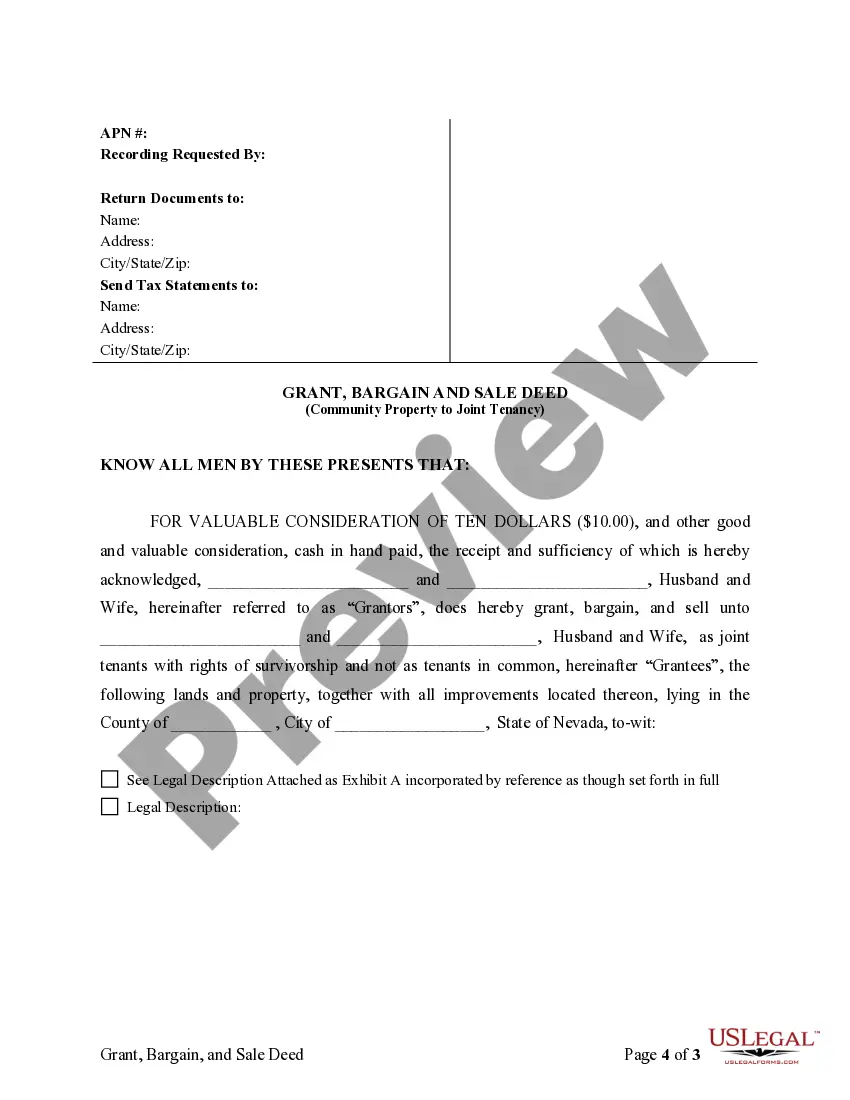

Yes, you can change joint tenancy to community property, which can be beneficial for married couples. To do this, you typically need to file a community property joint form with your local authorities. This process may involve legal paperwork, so consider consulting a legal expert to ensure you meet all requirements. USLegalForms offers resources and templates to simplify this transition.

To file as married filing separately (MFS) in a community property state, you need to allocate your community income accurately between you and your spouse. Utilize the community property joint form to help determine how much income each partner must report. Additionally, check with a tax professional to ensure you meet all the requirements and maximize your tax benefits, as community property laws can be intricate.

If you fail to fill out form 8958, you may miss important tax benefits linked to your community property. This form helps to report income for taxpayers in community property states, ensuring proper allocation between spouses. Not completing it can lead to incorrect tax filings and potential fines. To avoid these issues, consider using a community property joint form to guide you through this process.

The main difference between community and joint property lies in ownership rights. Community property typically refers to assets acquired during a marriage, which both spouses own equally, while joint property can include any assets held together, regardless of when they were acquired. When navigating these distinctions, it is beneficial to refer to a community property joint form for accurate documentation and understanding of ownership.

Joint community property refers to assets owned equally by both partners in a marriage. In such cases, each spouse has an equal right to manage and control the property. Understanding joint community property is essential for any couple, as it affects financial decisions and responsibilities. Utilizing a community property joint form can clarify ownership rights, ensuring fair management of shared assets.

One disadvantage of joint ownership is the potential for disagreements between owners regarding the use or sale of the property. If one party needs to sell their share and the other disagrees, this can lead to conflict. Additionally, all owners are equally responsible for debts associated with the property, which can create financial complications. It’s important to consider these factors when deciding on a community property joint form.

To allocate federal amounts to your spouse, you will need to accurately report your combined income. This process typically involves using the community property joint form, which helps delineate the specific amounts each partner earned. By understanding how to allocate these amounts, you ensure compliance and transparency in your tax reporting, ultimately benefiting both parties.

An example of joint property is a home owned by both spouses. In this situation, both partners share equal rights to the property, making decisions together about its use and management. This setup is common in community property joint forms, which outline how property is divided in the event of a divorce or death. You can think of joint property as a shared investment between partners.