Nevada Dissolution Of Corporation

Description

How to fill out Nevada Dissolution Package To Dissolve Limited Liability Company LLC?

Handling legal documents and operations could be a time-consuming addition to your day. Nevada Dissolution Of Corporation and forms like it often require that you look for them and understand the best way to complete them effectively. As a result, regardless if you are taking care of economic, legal, or personal matters, using a extensive and convenient online catalogue of forms when you need it will significantly help.

US Legal Forms is the top online platform of legal templates, offering over 85,000 state-specific forms and numerous tools to assist you to complete your documents effortlessly. Discover the catalogue of relevant papers available with just a single click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Protect your document administration processes having a top-notch support that lets you make any form within minutes without additional or hidden fees. Just log in in your account, identify Nevada Dissolution Of Corporation and acquire it right away within the My Forms tab. You may also gain access to formerly saved forms.

Would it be your first time utilizing US Legal Forms? Register and set up up an account in a few minutes and you will have access to the form catalogue and Nevada Dissolution Of Corporation. Then, follow the steps listed below to complete your form:

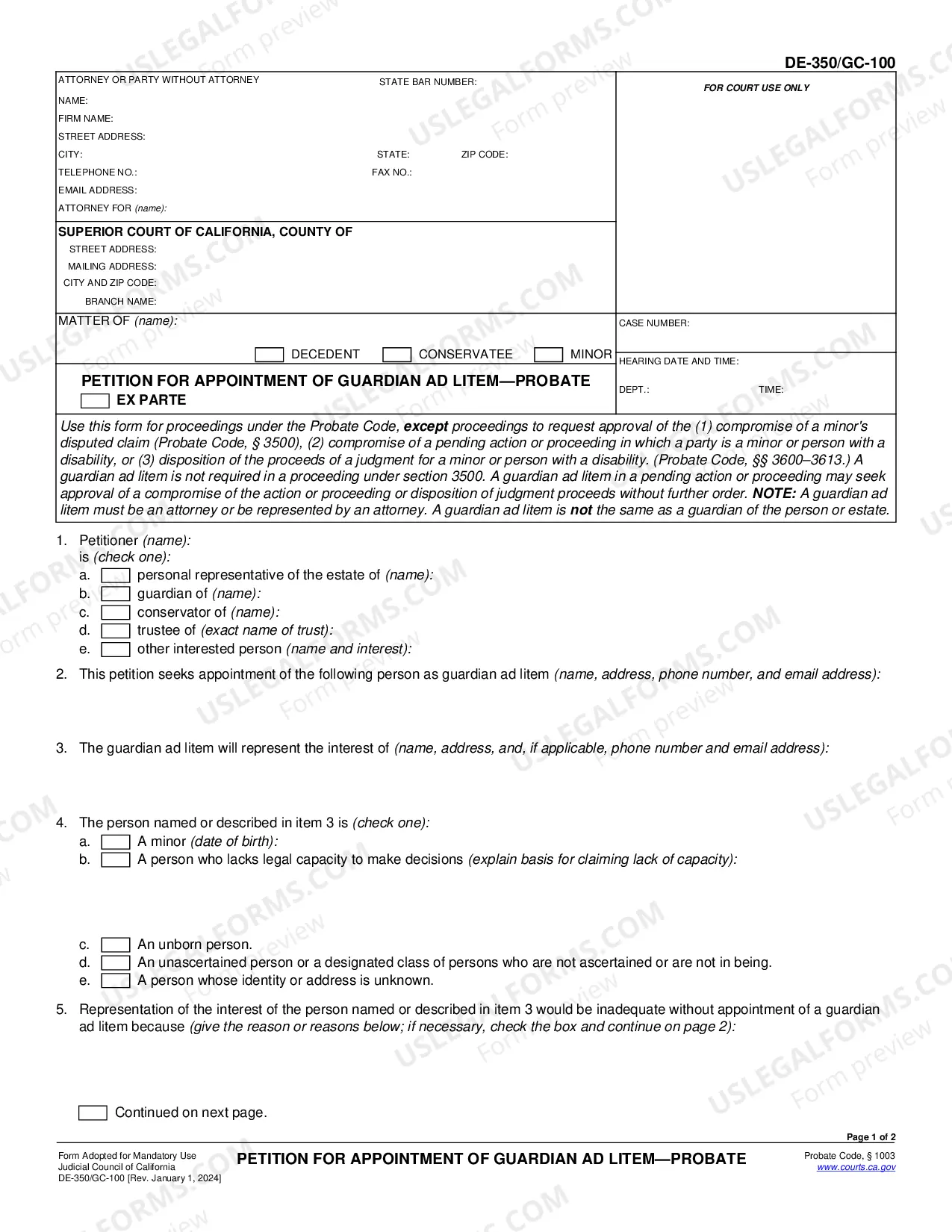

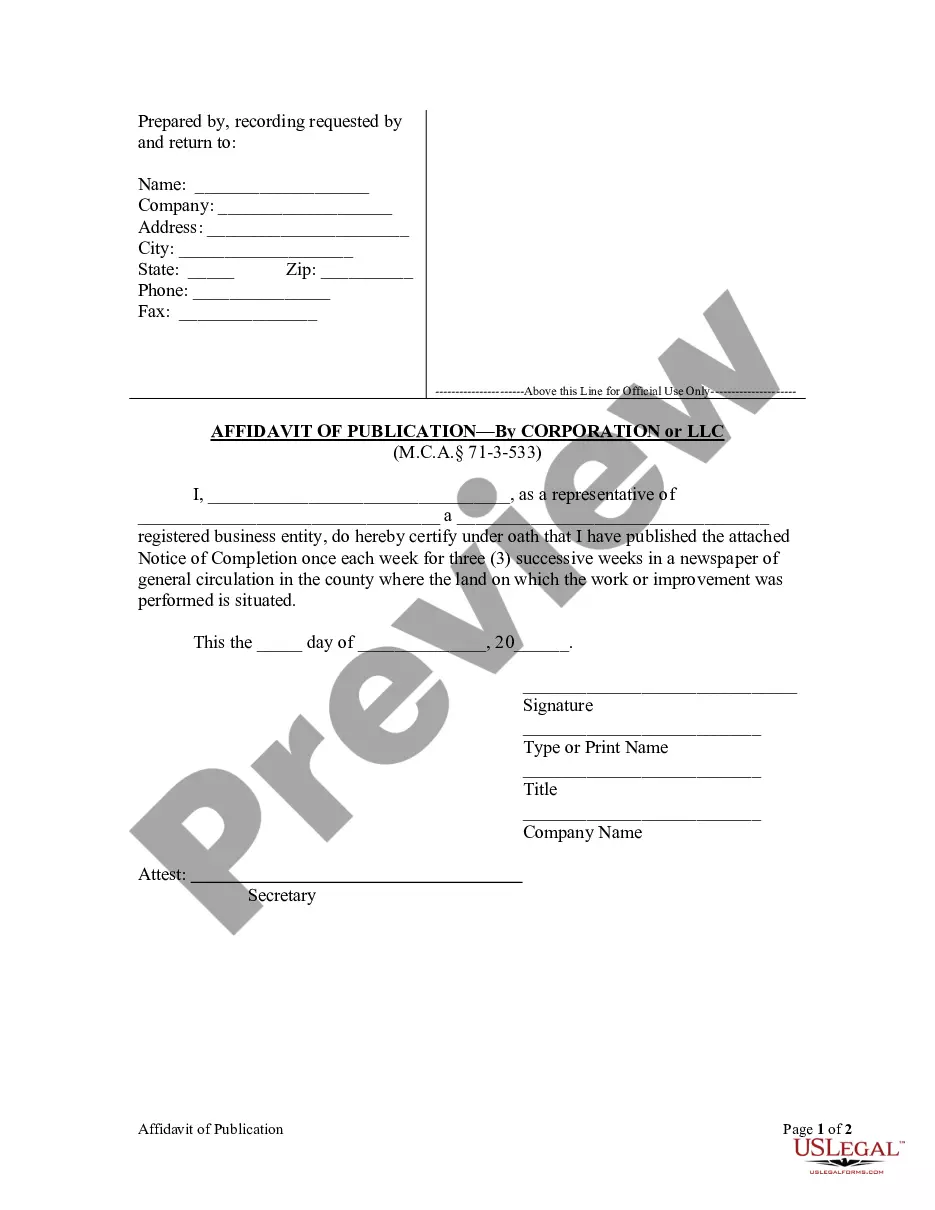

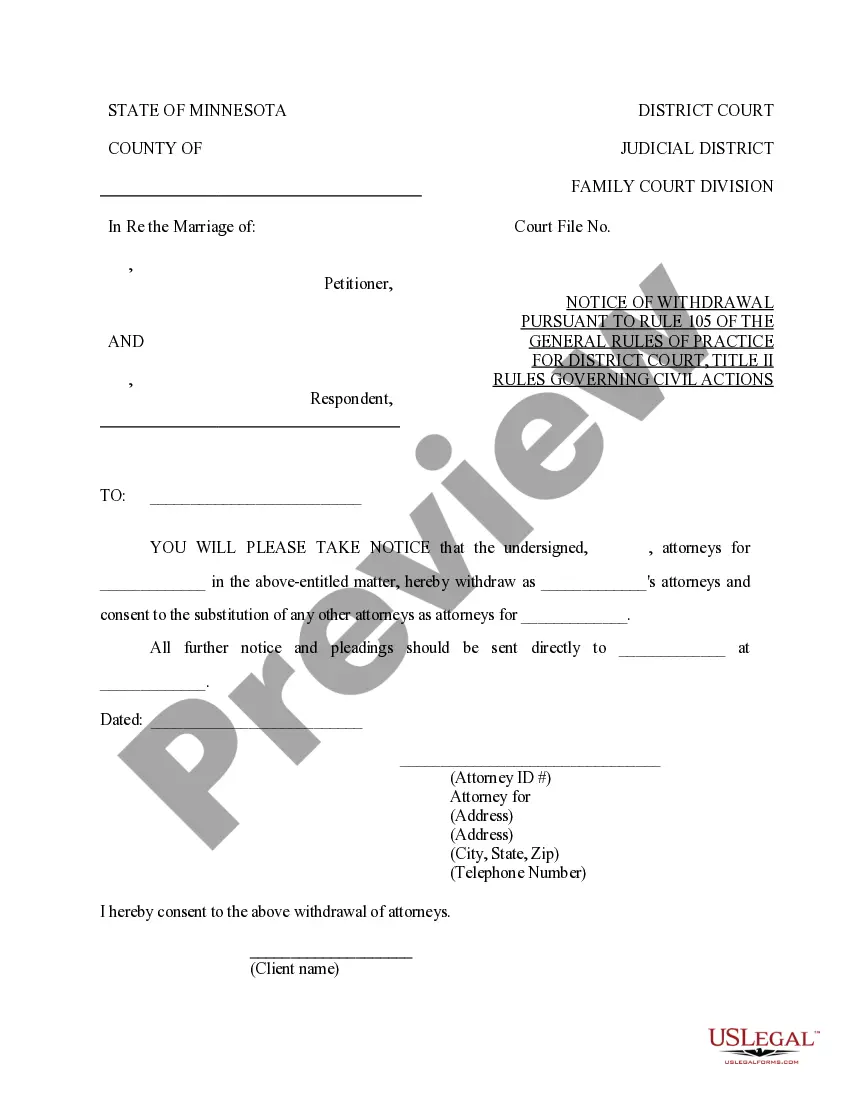

- Make sure you have discovered the proper form using the Preview option and looking at the form information.

- Choose Buy Now once all set, and choose the monthly subscription plan that suits you.

- Press Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise supporting consumers manage their legal documents. Get the form you need right now and streamline any operation without having to break a sweat.

Form popularity

FAQ

Usually this involves a vote by the board of directors and another by the shareholders, but more or less may be required depending on the local laws and the articles of incorporation. Second, one must satisfy the required filings and fees for the federal and state governments in which the business is registered.

Nevada Dissolution FAQs Dissolving a business entity in Nevada comes with a $100 filing fee. For expedited service, you have to pay an additional $125 for the 24-hour service, $500 for the two-hour service, and $1,000 for the one-hour processing.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

There are 3 main ways a company can be dissolved ? administratively, voluntarily, and judicially.

There are three main steps involved in a voluntary dissolution of a corporation: Filing the document to dissolve the corporation with the state. Wrapping up operations of the business. Liquidating and then distributing the assets of the corporation to the shareholders.