Dissolve Nevada Corporation Without Filing

Description

How to fill out Nevada Dissolution Package To Dissolve Limited Liability Company LLC?

Legal managing might be overpowering, even for the most knowledgeable experts. When you are interested in a Dissolve Nevada Corporation Without Filing and do not have the a chance to spend in search of the right and updated version, the processes might be stressful. A robust web form library could be a gamechanger for anybody who wants to manage these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms handles any requirements you could have, from personal to organization documents, all-in-one spot.

- Employ innovative resources to complete and manage your Dissolve Nevada Corporation Without Filing

- Access a resource base of articles, tutorials and handbooks and resources highly relevant to your situation and requirements

Save time and effort in search of the documents you will need, and make use of US Legal Forms’ advanced search and Preview feature to get Dissolve Nevada Corporation Without Filing and acquire it. For those who have a subscription, log in to your US Legal Forms account, look for the form, and acquire it. Review your My Forms tab to find out the documents you previously downloaded as well as manage your folders as you see fit.

If it is your first time with US Legal Forms, make an account and get unrestricted usage of all advantages of the platform. Here are the steps for taking after getting the form you want:

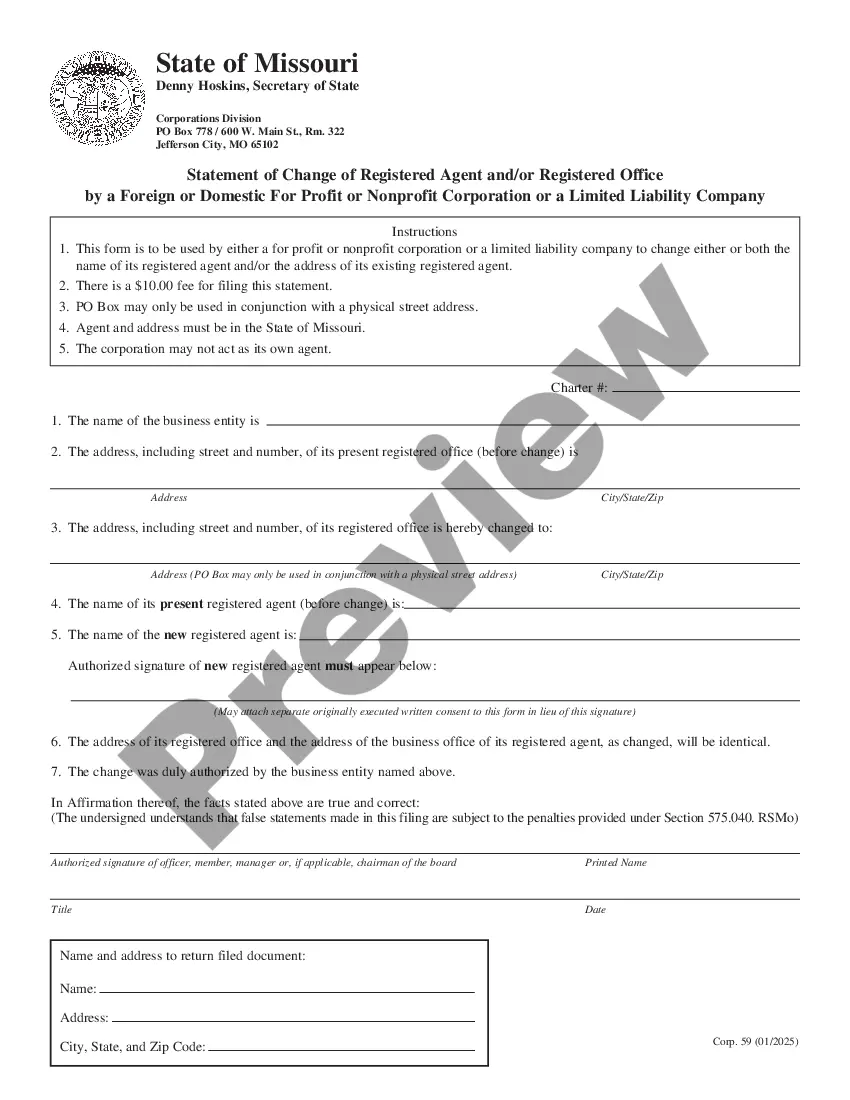

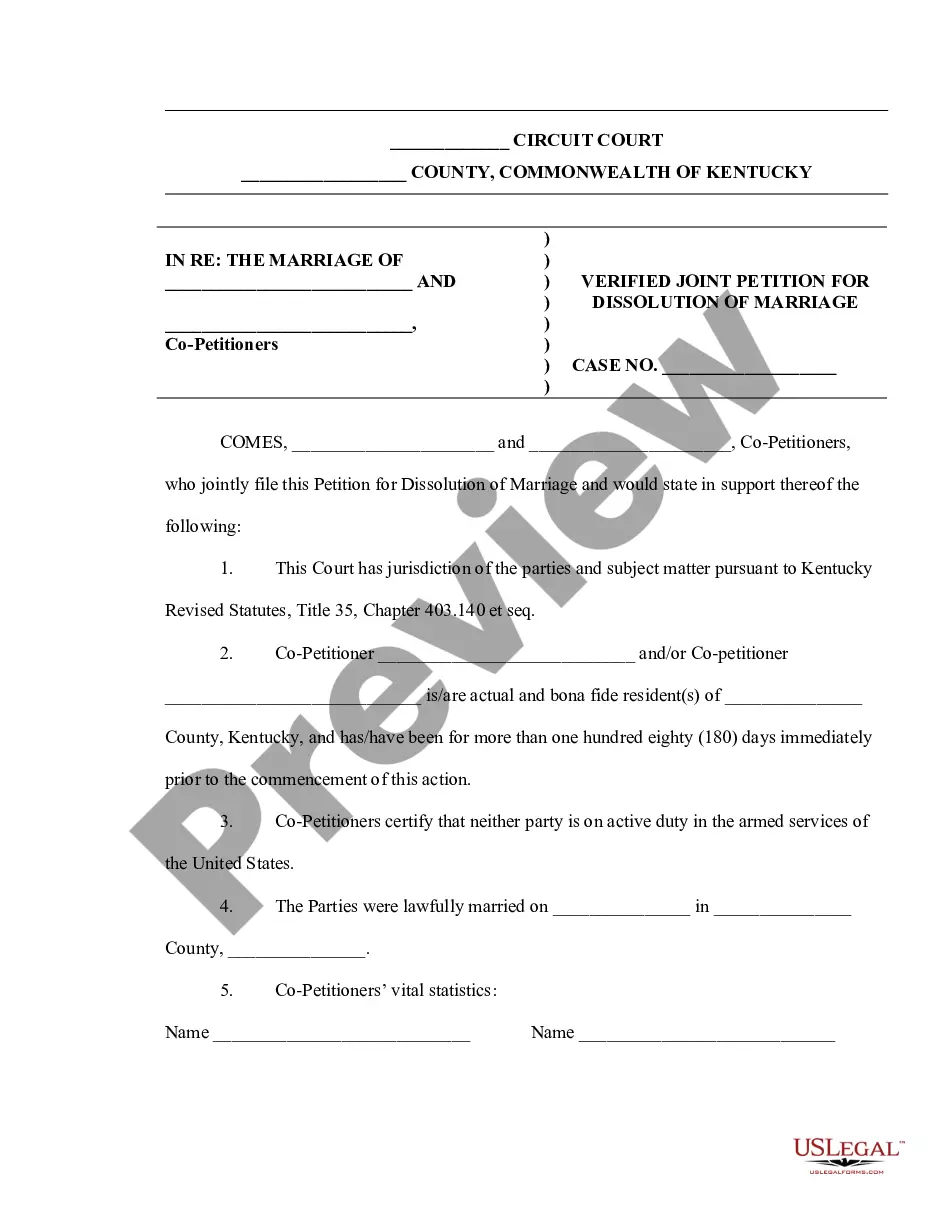

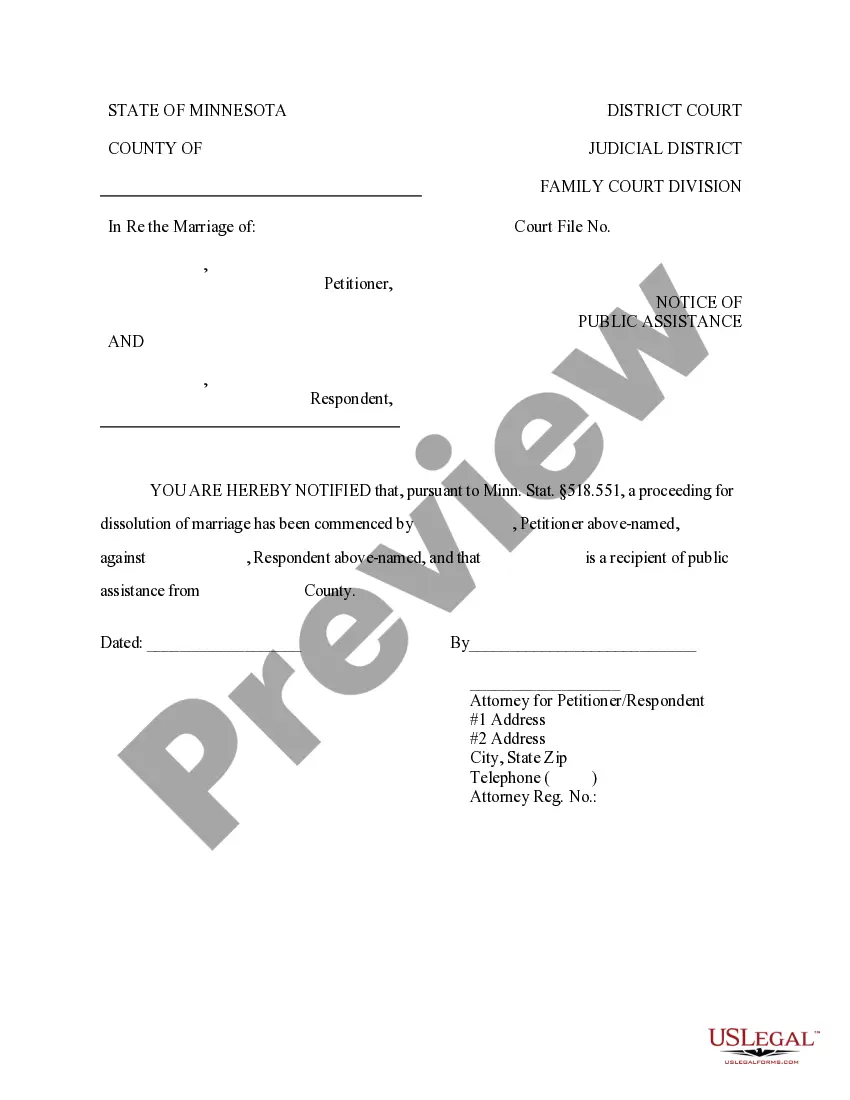

- Confirm this is the correct form by previewing it and reading its description.

- Be sure that the sample is approved in your state or county.

- Pick Buy Now once you are all set.

- Choose a monthly subscription plan.

- Pick the format you want, and Download, complete, eSign, print and send your document.

Take advantage of the US Legal Forms web library, supported with 25 years of expertise and trustworthiness. Transform your day-to-day document managing into a smooth and user-friendly process today.

Form popularity

FAQ

To dissolve your limited liability company in Nevada, there is a $100 filing fee required. Expedited service within 24 working hours is available for an additional $125 fee.

How do you dissolve a Nevada corporation? To dissolve your domestic corporation in Nevada, you submit the completed Certificate of Dissolution and Customer Order Instructions forms to the Secretary of State by mail, fax, email or in person, along with the filing fee.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

Removing a member from an LLC To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail. The member in question of removal may need to get compensated for his share of membership interests.

To revive a Nevada LLC, you'll need to file a reinstatement packet with the Nevada Secretary of State. You'll also have to fix the issues that led to your Nevada LLC's dissolution.