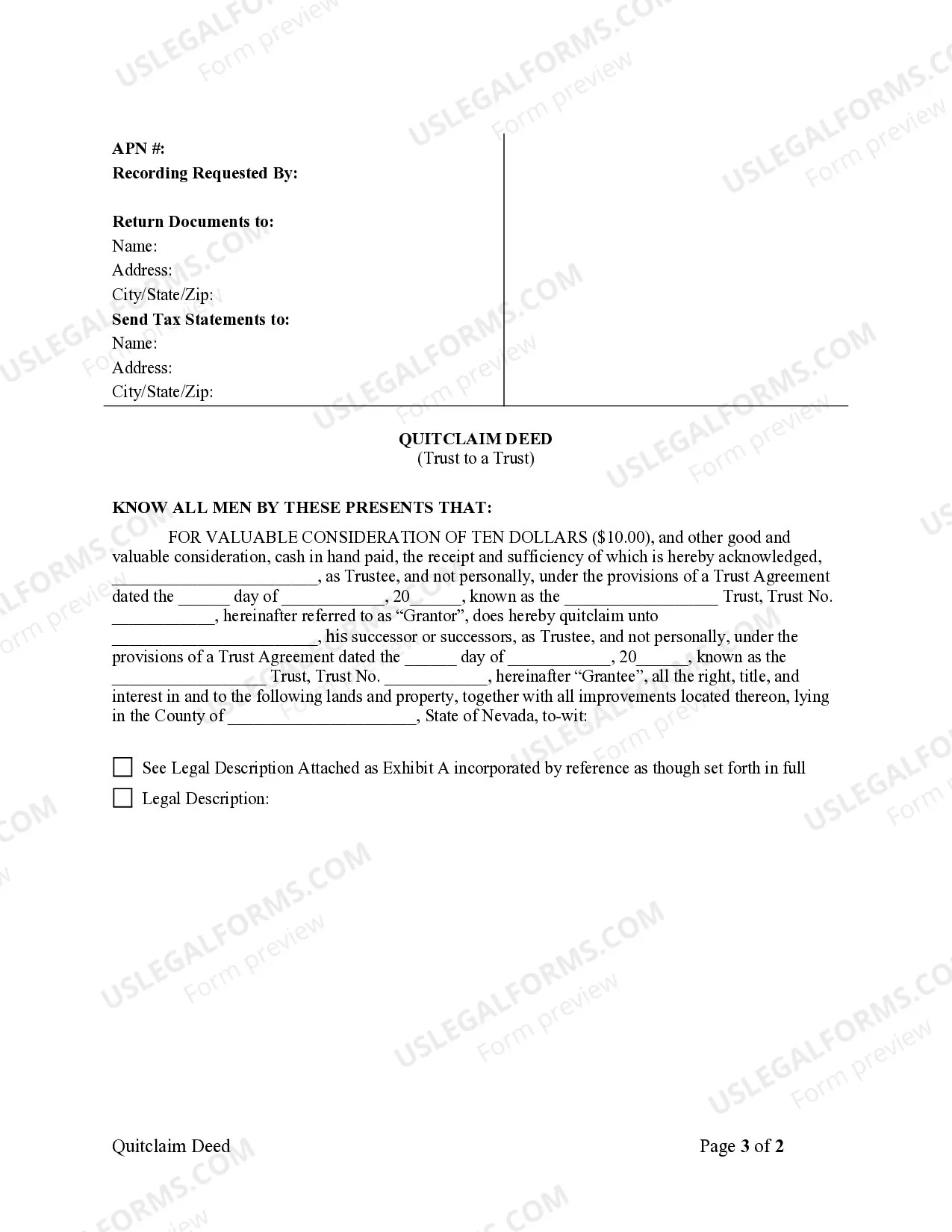

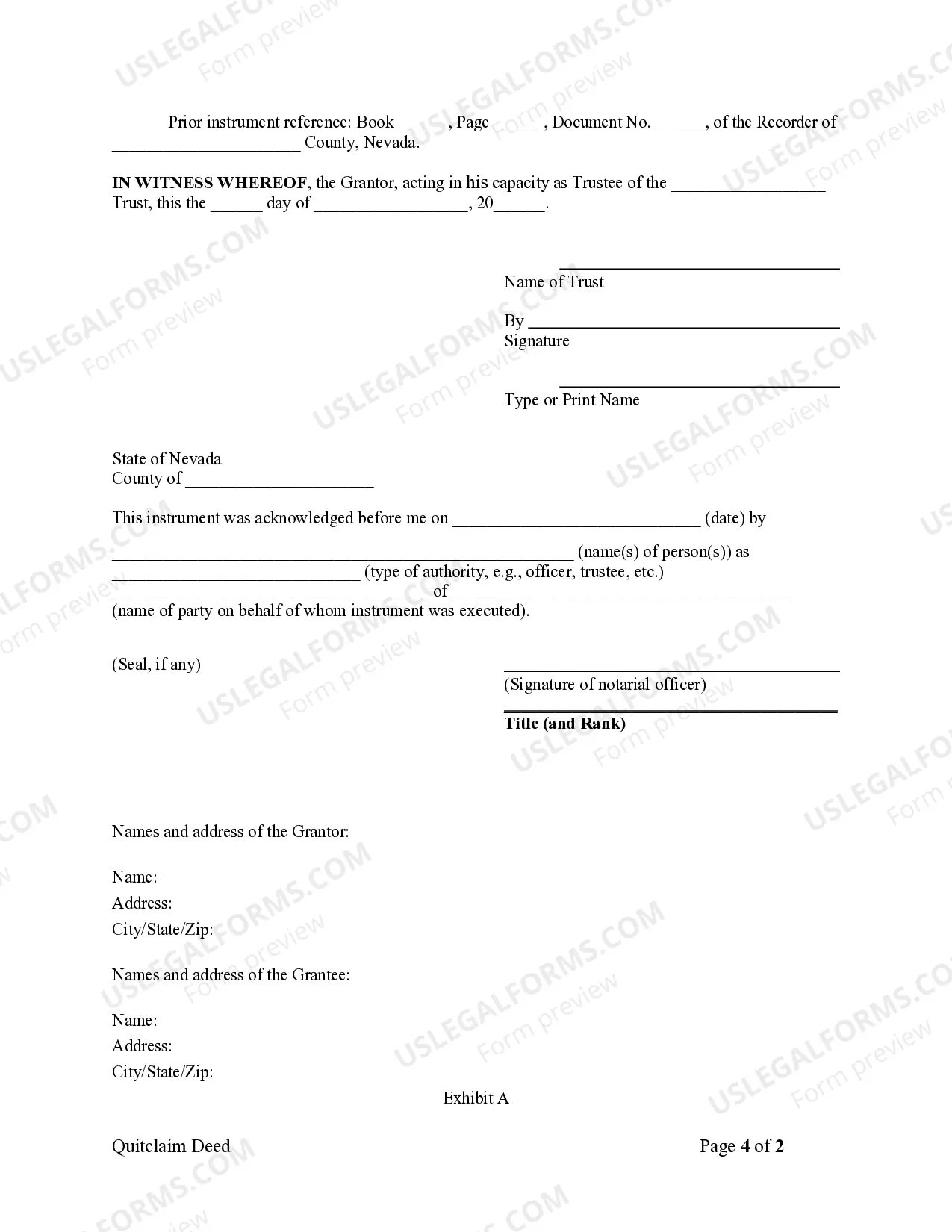

This form is a Quitclaim Deed where the grantor is a trust and the grantee is a trust. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Trust Legal Nevada For 202

Description

How to fill out Nevada Quitclaim Deed - Trust To A Trust?

- Begin by reviewing the form you need. Enter the US Legal Forms website and use the search bar to find your desired document. Preview the options that match your requirements.

- If you don't find what you need immediately, explore additional templates. The advanced search feature will help you pinpoint the exact form that meets local jurisdiction criteria.

- Select your preferred subscription plan. Hit the 'Buy Now' button once you’ve identified the right document, and create your account to gain full access to the extensive library.

- Proceed with your payment. Enter your credit card information or opt for PayPal to finalize your subscription. Ensure that all details are correct for a smooth transaction.

- Download your legal form directly to your device. Access it anytime through the 'My Forms' section on your account for easy completion and retrieval.

US Legal Forms provides a robust collection, boasting over 85,000 editable legal forms, empowering users with reliable resources for their legal needs.

Ready to simplify your legal document process? Start your journey with US Legal Forms today and ensure your paperwork is in expert hands!

Form popularity

FAQ

In Nevada, a trust does not necessarily need to be filed with the court unless it becomes a probate asset. However, proper documentation and record-keeping are crucial to maintain the trust's validity and protect your assets. You should consider consulting legal professionals or using platforms like US Legal Forms for tools that facilitate understanding trust legal Nevada for 202. This can help you ensure compliance with all local laws.

To file a trust in Nevada, you must first create the trust document, outlining the terms and conditions. You will then need to sign the document before a notary public, ensuring its legitimacy. Once that is complete, the trust can be funded with your assets. If you are looking for guidance throughout this process, consider using US Legal Forms for reliable templates and professional assistance focused on trust legal Nevada for 202.

The trust laws in Nevada are designed to promote flexibility and protect settlors' privacy. Key provisions include allowing for spendthrift trusts and language that favors the autonomy of the trust creator. This creates a secure environment for estate planning and asset management. For comprehensive insights into these laws, you can rely on Trust legal Nevada for 202 solutions available through US Legal Forms.

One significant benefit of establishing a trust in Nevada is the strong asset protection it offers. Residents can safeguard their assets from creditors and minimize estate taxes effectively. Additionally, trusts provide a way to manage your assets for your beneficiaries, ensuring your wishes are honored. To explore these advantages further, Trust legal Nevada for 202 can help you by providing essential documentation via US Legal Forms.

Trust law in Nevada encompasses regulations and statutes that govern the creation and management of trusts. Nevada is known for having favorable trust laws that enhance privacy and minimize taxation. This includes the ability to establish asset protection trusts and ease of online trust formation. To navigate these laws effectively, Trust legal Nevada for 202 provides valuable resources through US Legal Forms.

The 5 year rule for trusts refers to a specific timeframe during which assets placed in a trust may be subject to certain tax implications. In Nevada, if you establish a trust and change its terms or beneficiaries within five years, this could trigger tax liabilities. Understanding this rule is crucial for effective estate planning. For detailed guidance, consider utilizing the Trust legal Nevada for 202 services offered by US Legal Forms.

One significant mistake parents often make is failing to clearly define the terms and beneficiaries of the trust. This oversight can lead to confusion and disputes down the line. To avoid these pitfalls, consider consulting with experts or using tools like Trust Legal Nevada for 202, which provides clarity on how to structure your trust. Clear definitions help ensure your wishes are honored and your loved ones are taken care of.

Absolutely, you can write your own trust in Nevada. It is crucial to clearly outline your goals and the terms of the trust. Many people find it beneficial to utilize platforms like uslegalforms to ensure all legal language is accurate and the document meets state requirements. This approach allows you to fully engage with trust legal nevada for 202 and protect your interests.

In Nevada, while a trust does not need to be notarized to be valid, having it notarized can enhance its credibility. A notarized trust may offer additional protection should disputes arise. To make the best choice for your situation, consider consulting resources like uslegalforms, which provide clarity on notarization requirements. This way, you can confidently trust legal nevada for 202.

In Nevada, a trust is considered valid if it meets specific criteria such as having a clear intent by the grantor, identifiable beneficiaries, and a trustee to manage the trust’s assets. Additionally, the trust must comply with Nevada state laws regarding estate planning. To simplify this process, many individuals turn to experts or services like uslegalforms, ensuring their trust is legally sound. Therefore, you can trust legal nevada for 202 to secure your assets.