Asset Protection Trust Template With Irrevocable

Description

Form popularity

FAQ

The best trust structure for asset protection often depends on your specific financial situation, but an irrevocable trust is frequently recommended. This trust allows you to safeguard assets while also reducing estate taxes. Combining it with a comprehensive asset protection trust template with irrevocable options enhances your protection against creditors. Consulting professionals and using our templates can guide you to find the ideal structure for your needs.

You should think twice before placing highly appreciated assets, like stocks or real estate, in an irrevocable trust. These assets can trigger significant capital gains taxes when transferred into the trust. Additionally, it is wise to keep personal property or primary residences outside of such a trust to maintain access and control. Using our asset protection trust template with irrevocable features can help you navigate which assets are best suited for protection.

One downside of an irrevocable trust is that you cannot easily change its terms once it is established. This means that if your situation changes, you cannot simply adjust the trust to meet your new needs. Another concern is that you may lose certain tax benefits because assets in this trust may not be part of your estate. We recommend reviewing our asset protection trust template with irrevocable clauses to weigh these considerations carefully.

Yes, an irrevocable trust can protect your assets. When you transfer your assets into this trust, you relinquish control over them, which can shield them from creditors and lawsuits. Additionally, this type of trust helps in estate planning by removing assets from your taxable estate. For a streamlined approach, consider utilizing our asset protection trust template with irrevocable provisions.

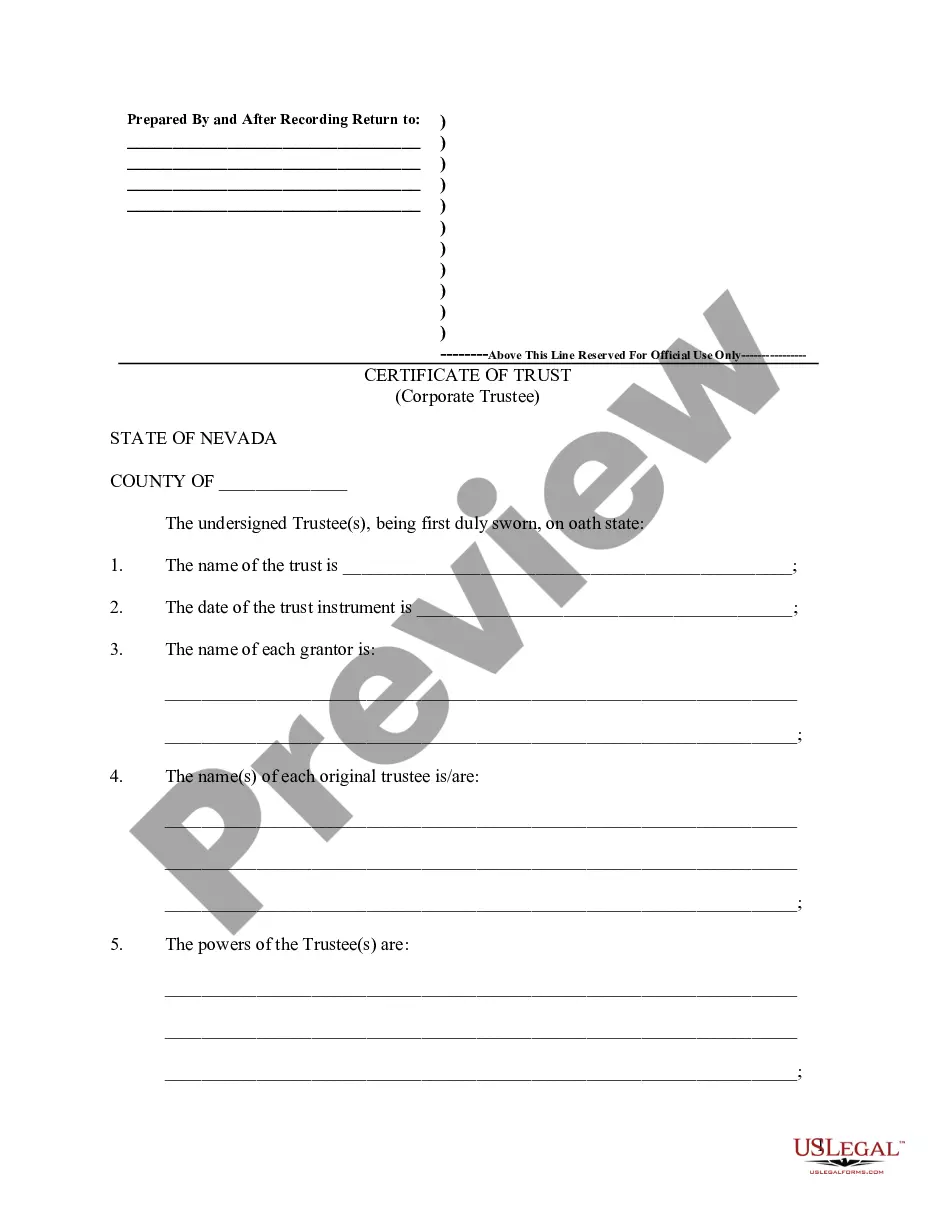

Setting up an asset protection trust begins with choosing an asset protection trust template with irrevocable terms that fits your needs. Next, gather your assets and decide which ones you want to place in the trust. After drafting the trust agreement, you should fund the trust by transferring the chosen assets and ensuring everything is legally sound. Utilizing a trusted provider like uslegalforms can guide you through this process efficiently and securely.

To file an asset protection trust, first, you need to create a valid trust document using an asset protection trust template with irrevocable provisions. After drafting, you must sign the document in accordance with your state’s laws. Next, it is essential to transfer ownership of your assets into the trust, ensuring all paperwork is in order. Consulting with a legal expert can simplify this process and ensure compliance.

A major disadvantage of an asset protection trust using an asset protection trust template with irrevocable clauses is the lack of control over your assets. Once you place your assets in this type of trust, you cannot easily access or reclaim them without potential penalties. This means you must commit to the trust long-term, which might not suit everyone’s financial goals. Understanding these limitations can help you make a more informed decision.

When creating an irrevocable trust, avoid placing assets that you may need to access frequently, such as personal savings accounts. It's also wise not to include assets with high liabilities, as they may complicate the trust's purpose. Create an asset protection trust template with irrevocable terms that clearly outlines what is included and excluded. This can help streamline the trust's function and protect your assets.

To write your own irrevocable trust, start by gathering necessary information about your assets and beneficiaries. You can then use an asset protection trust template with irrevocable provisions to guide you through the process. Be clear about how you want your assets managed and distributed. Remember, clarity minimizes potential disputes in the future.

You can indeed write your own irrevocable trust. Many people find that using an asset protection trust template with irrevocable options makes this task more manageable. While it's feasible to draft the trust yourself, make sure it complies with all applicable laws. This can help safeguard your assets effectively.