Asset Protection For Dummies

Description

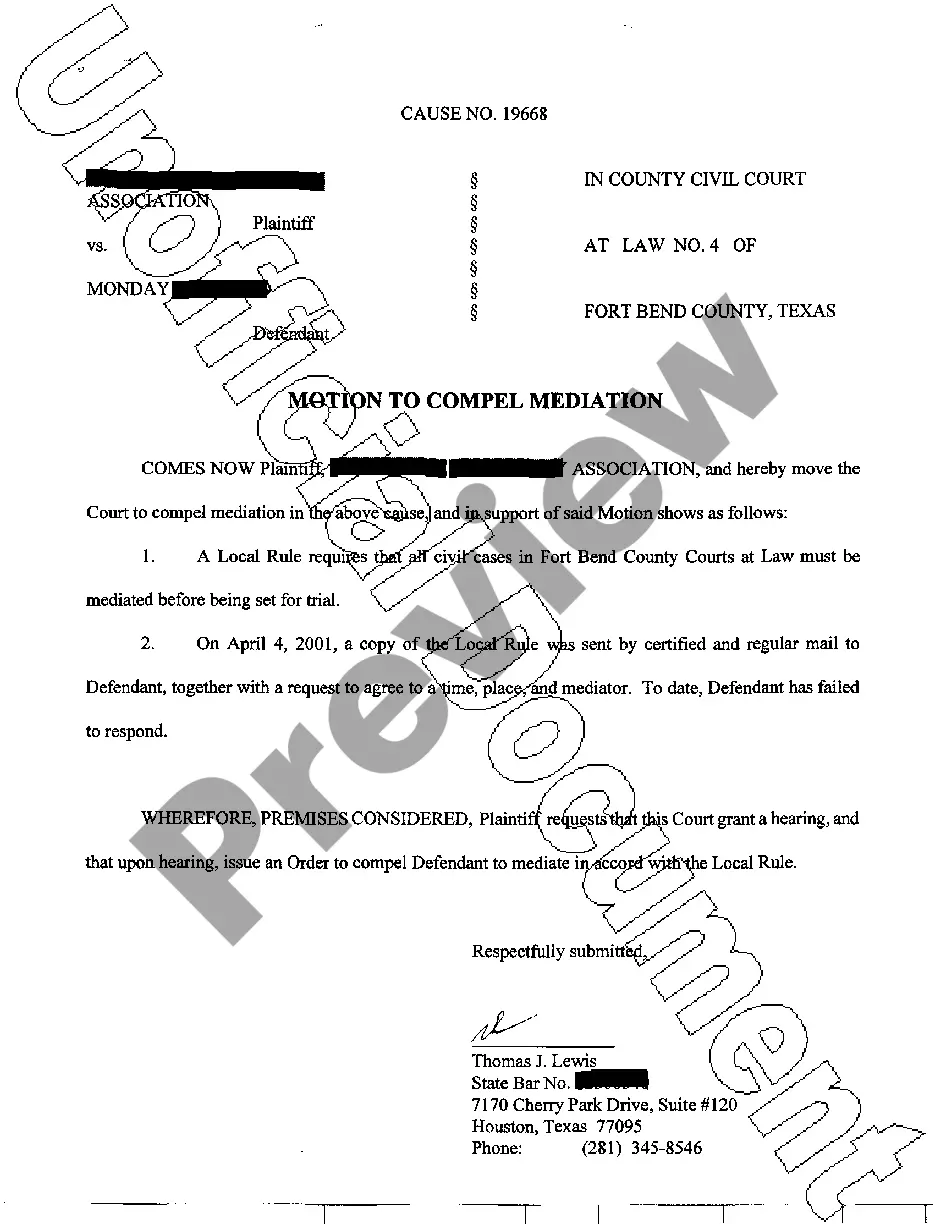

How to fill out Nevada Asset Protection Trust?

- If you are a returning user, log in to your account and verify your subscription status. Click the Download button for the necessary form template.

- For first-time users, start by browsing the extensive library. Check the preview mode and the description of forms to ensure they meet your specific needs and align with your local laws.

- If you encounter discrepancies, utilize the Search tab to find a more suitable template.

- Once you've found your document, click on the Buy Now button and select your preferred subscription plan, ensuring that you create an account for full access.

- Proceed to payment by inputting your credit card details or using your PayPal account.

- After completing your purchase, download your legally sound template to your device and find it later in the My Forms section.

Using US Legal Forms not only gives you access to a vast library of over 85,000 legal forms but also connects you with premium experts who can assist in form completion, ensuring the documents are accurate and compliant.

Protect your assets today by leveraging US Legal Forms. Start your journey to efficient legal documentation and take control of your financial security!

Form popularity

FAQ

Asset backed securities are financial instruments backed by a pool of assets, like loans or mortgages. Understanding these securities is essential for anyone exploring investment opportunities, as they offer a way to invest in a diversified asset base. For those interested in asset protection for dummies, knowledge of these securities can enhance overall financial strategy.

Asset protection works by creating legal structures that limit exposure to creditors and lawsuits. Strategies like forming an LLC or transferring assets into a trust can help secure your wealth. By employing these techniques, you protect your assets while remaining compliant with the law, ensuring your financial safety.

The basics of asset protection focus on understanding various legal structures that can shield your assets. Key elements include proper planning and the use of legal entities to separate personal and business finances. Familiarizing yourself with these foundational concepts is crucial, especially for anyone interested in asset protection for dummies.

Examples of asset protection can include the establishment of trusts, limited liability companies (LLCs), and off-shore accounts. These tools work together to create legal barriers that can shield your assets from claims. By understanding and implementing these strategies, you can effectively protect your financial wellbeing.

Investing in asset protection is often worthwhile, especially if you have significant assets or face potential risks. It provides financial security and peace of mind, knowing your wealth is shielded from unexpected legal troubles. For individuals aiming to preserve their financial legacy, the benefits of asset protection for dummies can far outweigh the costs.

Asset protection for dummies involves strategies designed to safeguard your wealth from creditors, lawsuits, and unforeseen financial troubles. By utilizing various legal tools, individuals can create barriers that protect their assets from potential claims. This ensures that your hard-earned resources remain secure, allowing you to manage your finances with greater peace of mind.

Writing an asset protection trust involves several steps, including defining your goals and selecting the right trust type. You should outline the trust terms clearly and ensure compliance with relevant state laws. It’s advisable to consult legal experts or utilize platforms like US Legal Forms to simplify the process of creating an asset protection trust for dummies.

Experience in finance, law, or risk management is often valuable for a career in asset protection. Many employers prefer candidates with a background in these areas as they provide insight into asset management and legal considerations. Engaging in practical experiences, such as internships, can also enhance your understanding of asset protection for dummies.

The ideal structure for asset protection varies depending on individual circumstances, but common options include limited liability companies (LLCs) and irrevocable trusts. These structures can help shield your assets from creditors and lawsuits. Utilizing resources like US Legal Forms can simplify the process of setting up the best structure for asset protection for dummies.

As an asset protection specialist, you should have strong analytical skills to assess risks and develop effective strategies. Communication skills are also crucial, as you will often explain complex concepts to clients. Familiarity with legal regulations and financial principles is important for understanding asset protection for dummies.