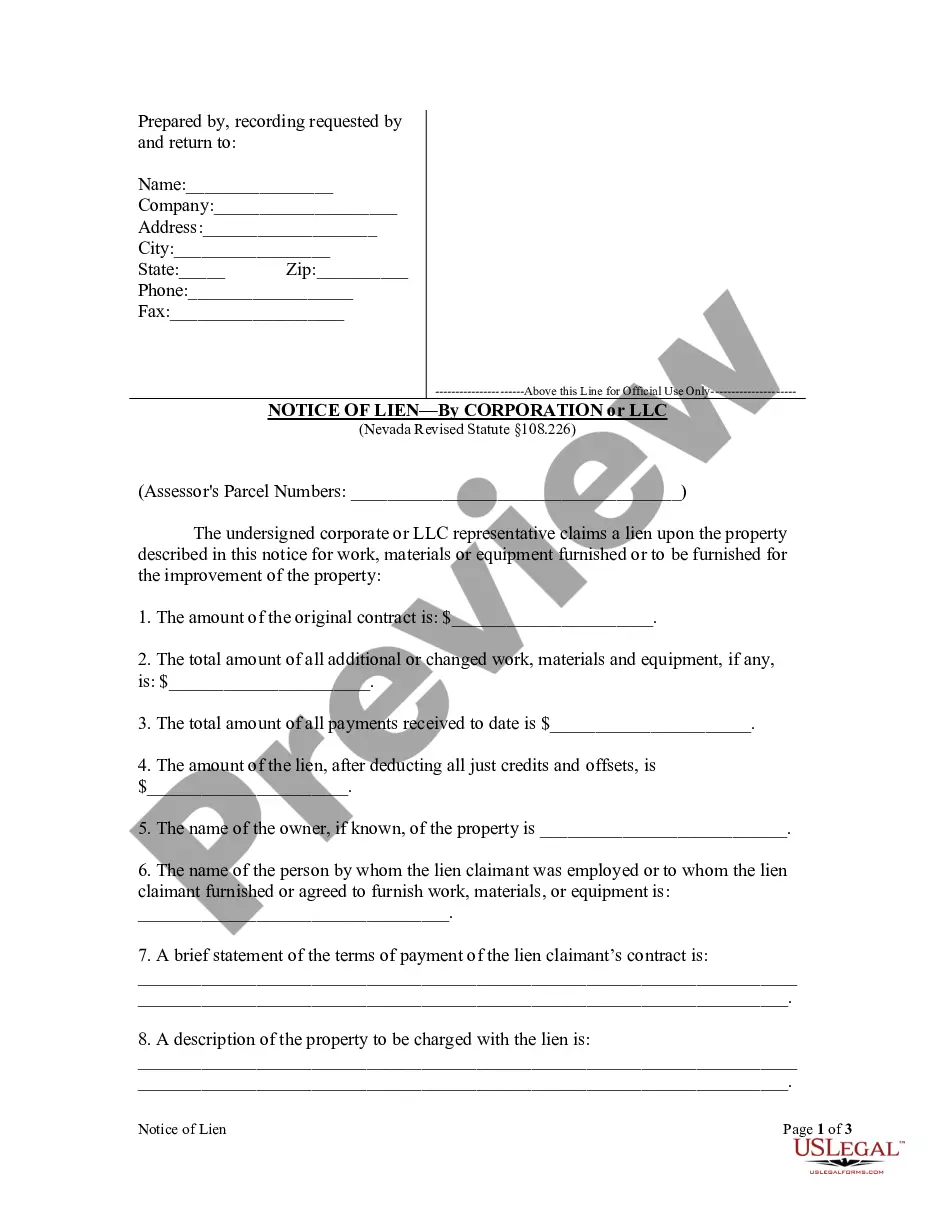

This notice, properly filed, serves to put all parties with an interest in a piece of property that has been improved on notice that the corporate lien claimant has a claim for the value of labor or materials expended in the improvement.

Notice Lien Form With Notary

Description

Form popularity

FAQ

To conduct a lien search in Missouri, start by visiting the local county recorder's office or online databases. You can also use a Notice lien form with notary to formally request access to lien records. Make sure to have the necessary details, such as property addresses or names, to streamline your search. This process ensures you remain informed about any existing liens on your property.

In Missouri, a lien is typically valid for five years, unless it is renewed properly. After this period, if no action is taken, the lien may become unenforceable. If you are unsure about the status of a lien, utilizing a Notice lien form with notary can help clarify your position and protect your rights. Staying proactive with your liens is crucial for effective management.

To successfully process a lien release in Missouri, you need a completed Notice lien form with notary. This form should include details such as the lienholder's name, the property description, and signatures. Additionally, ensure you have the original lien documents and any required identification. It is advisable to check with local authorities for specific requirements.

In New York, a notice of intent to lien serves a similar purpose, alerting property owners that a lien may be placed on their property due to unpaid debts, commonly related to construction work. This notice must be filed with the appropriate county clerk’s office as part of a legal process to protect contractors and financial stakeholders. Ensuring that you send a notice of intent to lien form with notary, as needed, safeguards your legal rights and can positively affect your debt recovery efforts.

In Florida, a notice of intent to lien form is a legal document that notifies a property owner of impending claims against their property for unpaid debts. This notice is typically used in construction and service contracts, where contractors want to secure their right to place a lien for unpaid services. By using this form, you ensure that you follow the legal protocols, which protects your interests and clarifies obligations. Submitting this form properly can enhance your claims significantly.

The primary reason for a lien is to secure a creditor's interest in a debtor's property, ensuring that they can recover funds if necessary. Liens protect lenders by providing them a method to claim assets in the event of non-payment. They play a critical role in financial transactions, especially in real estate and business loans. Implementing a notice lien form with notary provides additional legal protection for these claims.

A lien letter is a formal document that informs a property owner of the existence of a lien and its terms. This letter usually outlines the amount owed and the actions required to resolve the debt. Lien letters serve as a warning to the property owner, urging them to take action to avoid further legal consequences. Utilizing a notice lien form with notary helps in properly documenting this communication.

Having a lien against your property signifies that someone has a legal claim over it, often due to an unpaid debt. This can limit your ability to sell or refinance the property, as the lien must be resolved first. Understanding the implications of a lien is vital for managing your finances and protecting your investments. You can use a notice lien form with notary to communicate this claim formally.

The term 'lien' refers to a legal right that a creditor has over a debtor's property until the debt obligation is satisfied. Essentially, a lien gives the creditor security, ensuring that they can make a claim against the asset if needed. This concept protects lenders and allows them to recover funds in case of default. Understanding lien terms is crucial when dealing with contracts and obligations.

A lien is a legal claim that allows a lender to take possession of an asset if the borrower fails to meet their repayment obligations. For example, if you take out a mortgage to buy a home, the bank holds a lien on the property. This means that if you don’t make your mortgage payments, the bank can take ownership of your house through foreclosure. Using a notice lien form with notary can formalize this process.