Personal Representative Deed New Mexico Withholding

Description

How to fill out New Mexico Quitclaim Deed For Personal Representative's Deed?

Identifying a reliable location to acquire the most up-to-date and suitable legal templates is a significant portion of managing red tape.

Selecting the correct legal paperwork necessitates precision and meticulousness, which illustrates the importance of obtaining samples of Personal Representative Deed New Mexico Withholding exclusively from trustworthy sources, such as US Legal Forms.

Eliminate the complications related to your legal documentation. Explore the vast US Legal Forms directory where you can locate legal samples, verify their applicability to your situation, and download them instantly.

- Utilize the library navigation or search function to find your template.

- Access the details of the form to confirm it satisfies the requirements of your state and locality.

- Preview the form, if possible, to verify that it is the template you seek.

- Continue your search for the correct document if the Personal Representative Deed New Mexico Withholding does not meet your criteria.

- If you are confident regarding the form’s applicability, proceed to download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not possess an account yet, click Buy now to purchase the form.

- Select the pricing option that fits your needs.

- Proceed with the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Personal Representative Deed New Mexico Withholding.

- After obtaining the form on your device, you can modify it using the editor or print it for manual completion.

Form popularity

FAQ

Yes, New Mexico requires nonresident withholding for certain payments made to nonresidents. If you are involved in managing a personal representative deed in New Mexico, it is vital to understand and comply with these withholding requirements. This ensures you properly handle any tax liabilities and meet legal obligations.

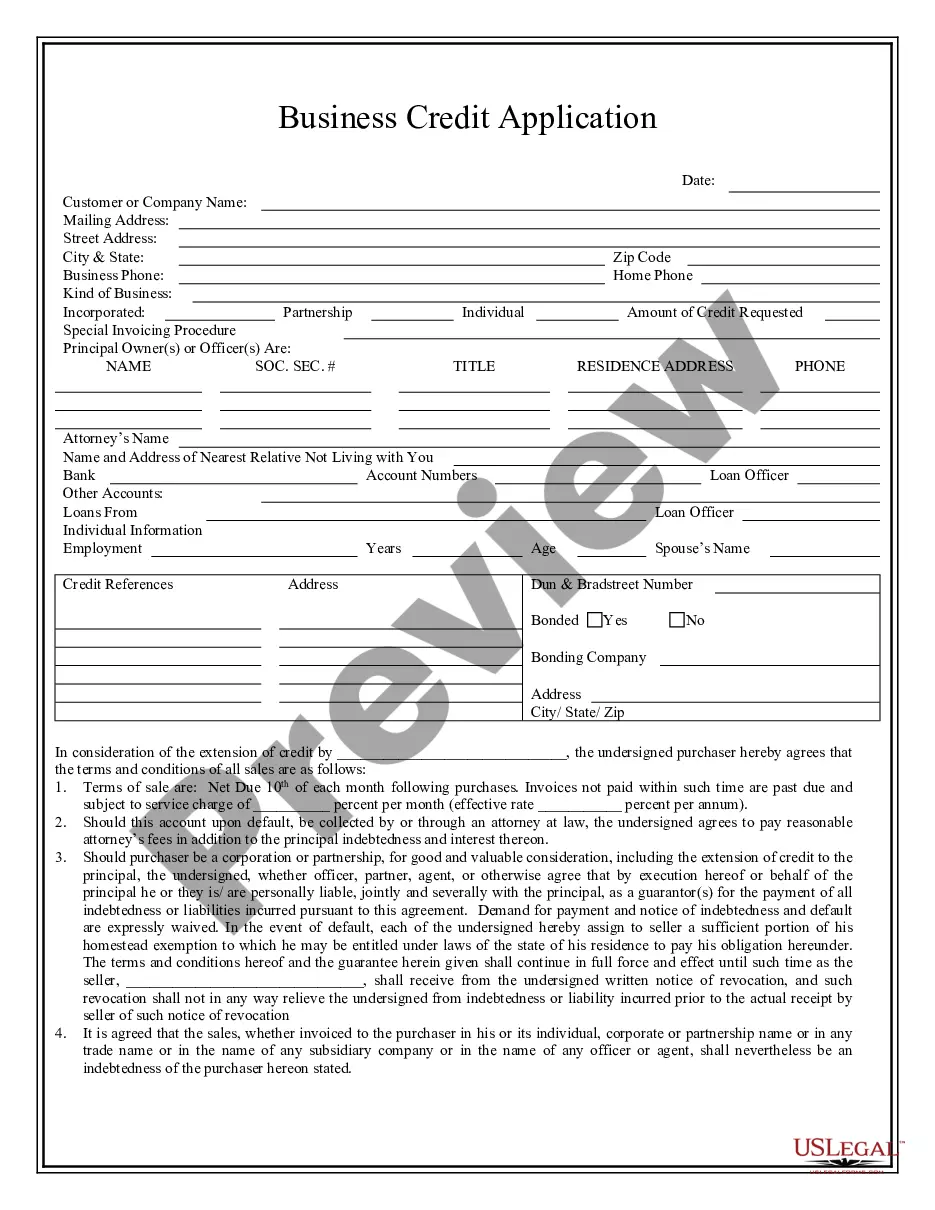

To register for withholding tax in New Mexico, you must complete the appropriate forms with the New Mexico Taxation and Revenue Department. This is especially important for those handling a personal representative deed in New Mexico. Make sure you keep accurate records to stay compliant with state regulations.

New Mexico non-resident withholding refers to the tax that is withheld from payments made to nonresidents earning income in the state. This includes income related to personal representative deeds in New Mexico. Understanding this aspect of tax law is essential for anyone managing estate-related transactions.

New Mexico does not impose an inheritance tax. However, when dealing with a personal representative deed in New Mexico, it is important to consider any applicable estate tax in the case of larger estates. This means you should plan accordingly and consult with a tax advisor to ensure you understand any financial implications.

Nonresidents who earn income from New Mexico sources need to file a New Mexico nonresident tax return. This includes anyone involved in managing a personal representative deed in New Mexico. Understanding your obligations can help ensure compliance and avoid potential penalties.

Several states, including New Mexico, require nonresident withholding to ensure that taxes are collected from individuals who are not residents but receive income sourced from the state. This means that if you are managing a personal representative deed in New Mexico, it's crucial to understand the withholding obligations. Staying informed about each state's requirements can save you from unexpected tax issues.

No, a personal representative does not inherently have power of attorney. While both roles involve decision-making, power of attorney is designated to act during a person's lifetime, whereas a personal representative manages an estate after death. However, if the designated person had granted power of attorney to the personal representative prior to passing, then they could carry out those specified duties temporarily. Understanding these distinctions is vital in estate management.

The power of a personal representative can be significant yet varies by the scope of the estate. They can manage, sell, or transfer assets and have the authority to make decisions on behalf of the estate. As they handle tax responsibilities, including personal representative deed New Mexico withholding, it is crucial for them to act prudently and transparently. Their role is essential in carrying out the deceased’s final wishes and fulfilling legal obligations.

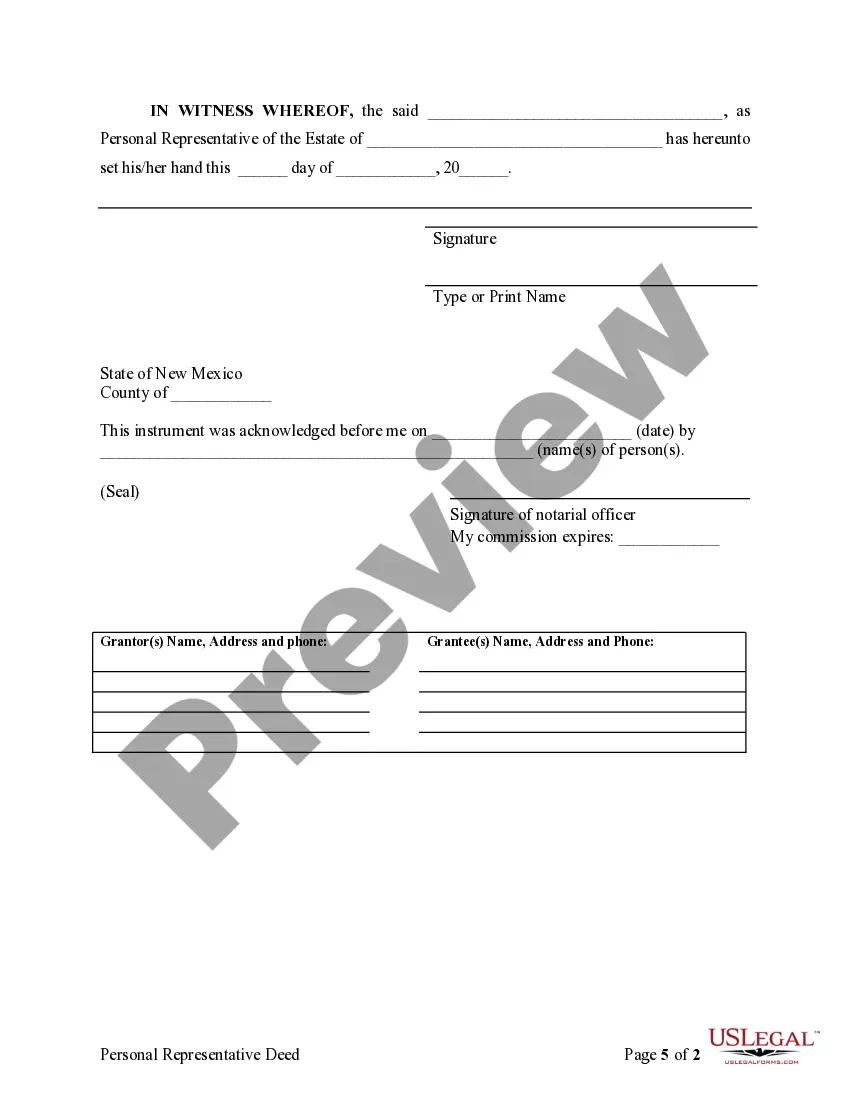

Filling out a personal representative deed in New Mexico involves several steps to ensure compliance with state requirements. First, gather necessary documents, such as the will and letters of administration. Next, use clear and precise language to describe the property and the actions being taken. You may also find it helpful to utilize resources from USLegalForms, which can guide you through the process with templates designed for personal representative deeds.

Yes, a personal representative must follow the instructions outlined in the will as part of their duties. This includes distributing the assets in accordance with the deceased person's wishes. If the will is valid, the representative has the legal obligation to honor those terms. However, when no will exists, they must follow New Mexico state laws instead.