Personal Representative Deed Example With Will

Description

How to fill out New Mexico Quitclaim Deed For Personal Representative's Deed?

Utilizing legal document exemplars that adhere to federal and local regulations is essential, and the web provides numerous selections to choose from.

However, what’s the advantage of spending time searching for the precisely drafted Personal Representative Deed Example With Will template online if the US Legal Forms digital library already consolidates such resources in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 editable templates created by lawyers for various business and personal scenarios.

Review the template using the Preview option or through the text description to ensure it fulfills your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our specialists stay updated with legal changes, ensuring your form is current and compliant when acquiring a Personal Representative Deed Example With Will from our platform.

- Acquiring a Personal Representative Deed Example With Will is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you need in the appropriate format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

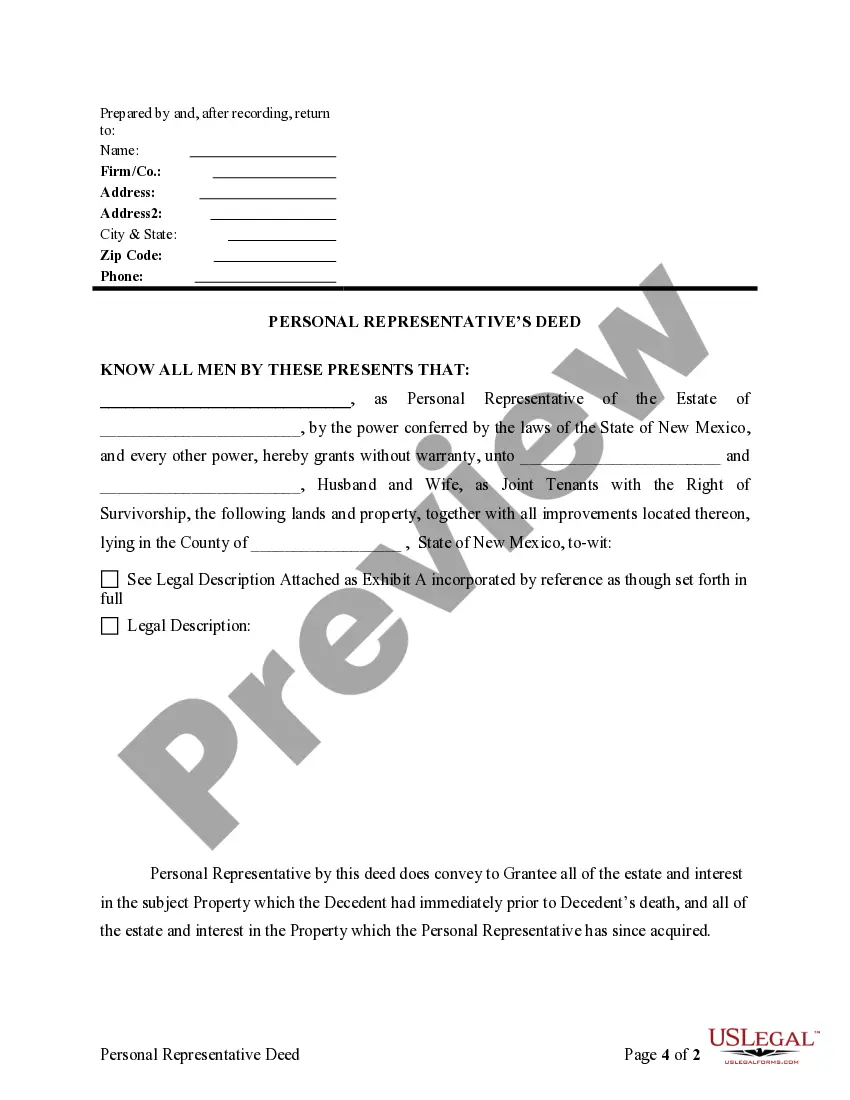

To secure a personal representative deed, you first need to be appointed by the court as the personal representative of the estate. After your appointment, you can draft and execute the deed, ensuring it aligns with the stipulations outlined in the will. A personal representative deed example with will can serve as a valuable resource to guide you through the drafting process.

You can obtain personal representative papers by initiating the probate process in your local court. This often involves submitting a petition for probate along with the deceased's will and other required documents. Resources like US Legal Forms can provide templates and guidance to help you navigate this process effectively.

To obtain a personal representative deed, you typically need to file the appropriate legal documents with the court. First, you must be appointed as the personal representative through the probate process. Once appointed, you can prepare the deed, using a personal representative deed example with will as a guide to ensure compliance with legal requirements.

In general, a property deed does not override a will; however, it can dictate how property is transferred upon death. If a property has a deed with a right of survivorship, that deed may take precedence over the will. Thus, it is essential to consider all documents, including a personal representative deed example with will, to understand the complete picture of asset distribution.

A personal representative's deed is a legal document that transfers property ownership from the deceased's estate to the beneficiaries. This deed is crucial when the personal representative executes the will, ensuring that the property is conveyed according to the deceased’s wishes. Understanding a personal representative deed example with will can help clarify how the asset distribution process works.

A personal representative of an estate is typically an individual appointed by a court to administer the estate of a deceased person. This role may involve managing assets, paying debts, and distributing property according to the will or state laws. An example of a personal representative is an executor named in a will, who is responsible for carrying out the wishes of the deceased, including any personal representative deed example with will.

A Personal Representative's deed, or PR deed, is a tool used to transfer title of real estate out of an estate. It is very similar to a quitclaim deed, only the person transferring the ownership of the property is the executor of an estate instead of the actual owner.

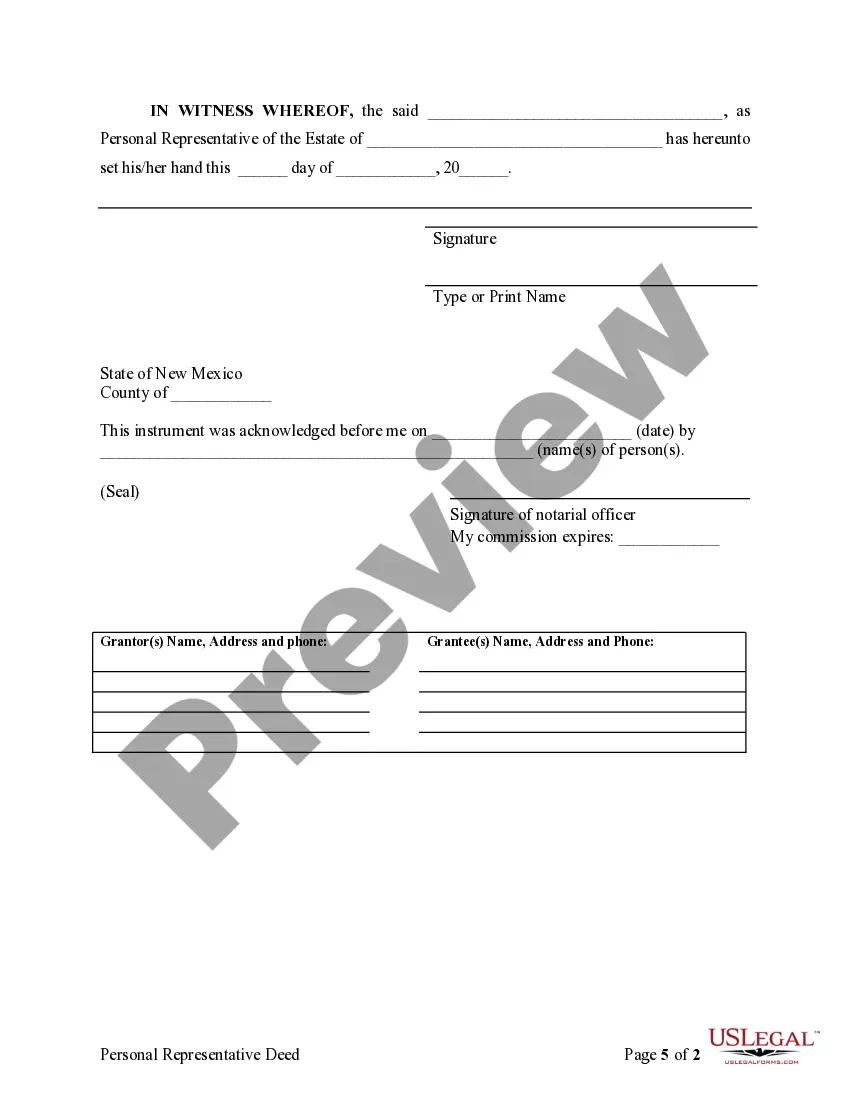

A PR appointed informally by the Probate or District Court has legal authority to sell real property and to transfer title to it via a ?Personal Representative's Deed? from the estate to the new owner(s). It is the PR's job to have this deed prepared, signed, acknowledged before a notary public, and properly recorded.

The probate court appoints legally qualified persons, called personal representatives, to manage and settle the decedent's affairs. personal representatives distribute the assets decedent's estate to the rightful recipients. These might include heirs, devisees named in a valid and current will, or creditors.

Personal Representative's Deed / Trustee's Deed ? refers to the type of person executing the deed. A personal representative is named in a Will to dispose of an estate after an owner has died. The Will legally conveys title, but a Personal Representative's deed is used to formalize and record transfer of title.