For Sale Veículos

Description

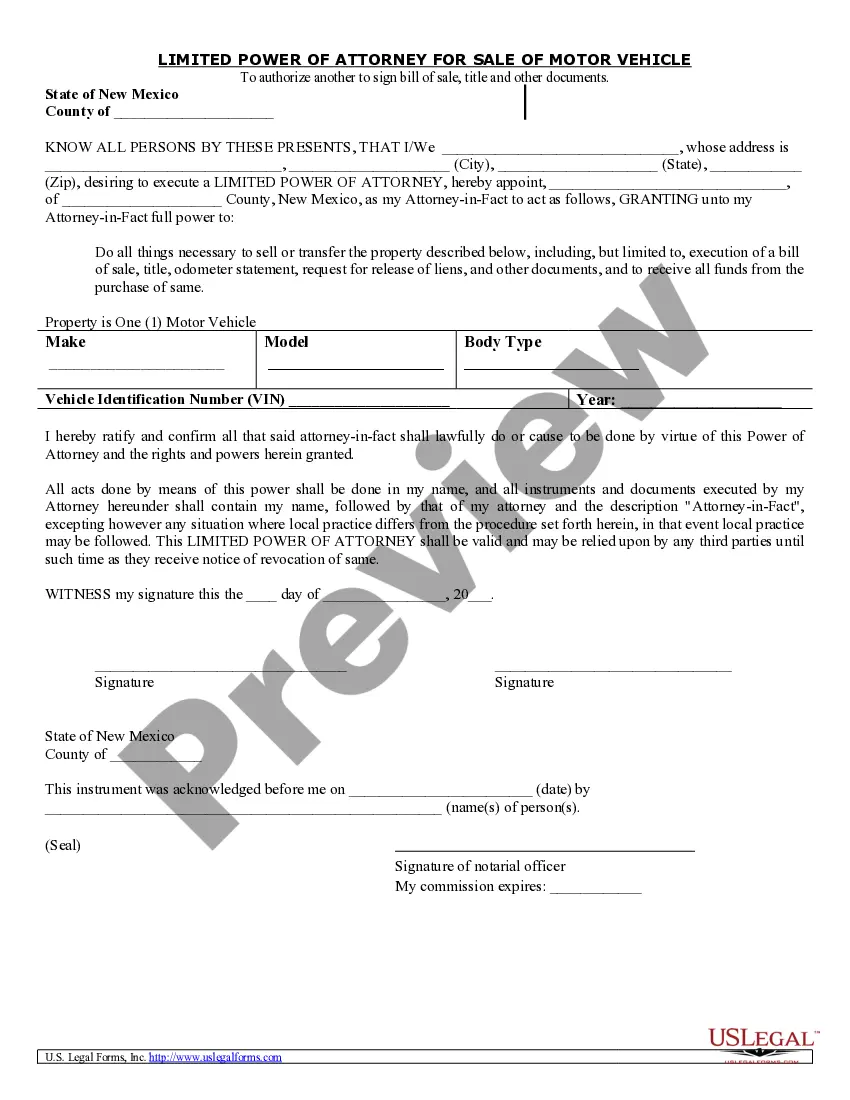

How to fill out New Mexico Power Of Attorney For Sale Of Motor Vehicle?

- Log in to your account if you're a returning user. Verify your subscription status and renew it if needed.

- Preview the form's description to confirm that it aligns with your legal needs and meet local requirements.

- Utilize the Search tab to browse for other templates if the current one doesn't suit your needs.

- Select the desired template by clicking the Buy Now button and opt for your preferred subscription plan. You'll need to create an account for full access.

- Complete your transaction by entering your payment information via credit card or PayPal.

- Download the form to your device. You can access it any time from the My Forms menu in your profile.

By following these steps, you can simplify the process of obtaining necessary legal documents without hassle. US Legal Forms not only offers a comprehensive directory but also provides access to premium experts for assistance, ensuring that your documents are accurate and legally sound.

Start exploring your options today and take the first step toward effortless legal compliance!

Form popularity

FAQ

Utilizing deductions effectively can lower your taxes substantially. Common deductions include mortgage interest, property taxes, and, of course, sales tax on purchases like vehicles. For sale veículos, keeping track of such expenses can significantly reduce your taxable income. Working with a tax professional can uncover additional strategies to minimize your taxes.

Yes, if you sell your home, you may need to file Form 1099-S, especially if the sale meets certain thresholds. This form documents the sale and helps ensure accurate tax reporting for both the seller and the IRS. If you’ve sold a vehicle along with real estate, consider how the procedures may differ. Always consult a tax professional for clarity on your filing requirements.

Refunding sales tax can be necessary if a transaction is canceled or reversed. For example, if you return a vehicle purchased for sale, it may be pertinent to refund the applicable sales tax. In some cases, this can protect your business and maintain good customer relations. It's important to check local laws to ensure compliance when handling refunds.

When selling rental property, you typically need to use IRS Form 4797, which allows you to report the sale and any gains. This form helps identify the income from the sale and calculate taxes owed. For sales of vehicles tied to rental property operations, precise reporting is crucial. Always ensure you keep accurate records to support your filing.

Claiming sales tax on your federal tax return can be beneficial if you make significant purchases. For sale veículos, you may be able to deduct a portion of the sales tax, which can lower your tax burden. This opportunity can result in a worthwhile refund, making it a smart decision for many taxpayers. Always consult with a tax professional to maximize your potential benefits.

Sales tax provides essential funding for public services such as education, transportation, and infrastructure. When people engage in transactions, like purchasing a vehicle, the sales tax contributes to local communities. As a result, your purchases for sale veículos help improve the area where you live. Understanding this benefit can enhance your appreciation for the sales tax system.