For A Lease

Description

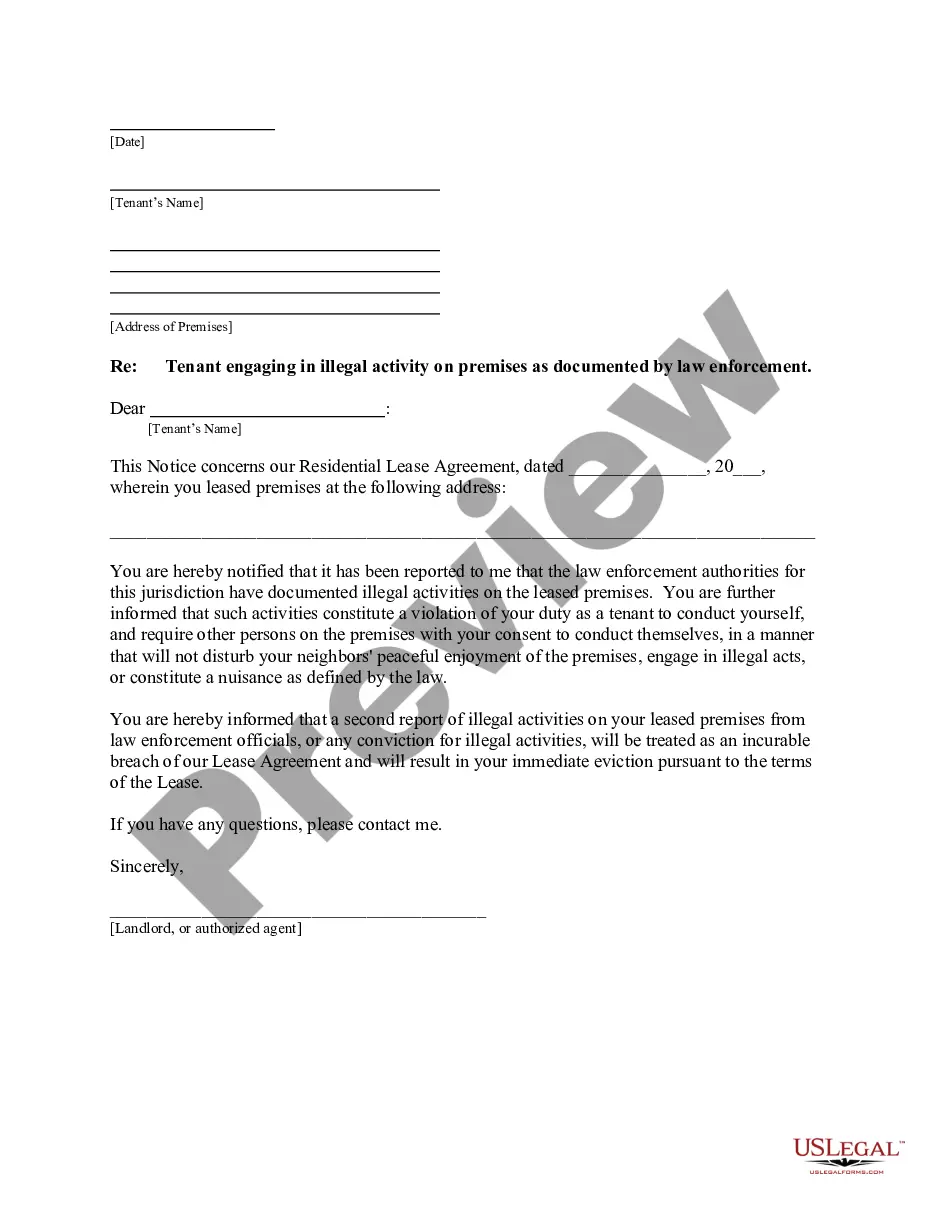

How to fill out New Mexico Letter From Landlord To Tenant About Tenant Engaging In Illegal Activity In Premises As Documented By Law Enforcement And If Repeated, Lease Terminates?

- If you have used US Legal Forms before, please log in to your account and download the necessary lease template. Ensure your subscription is current; renew it as required.

- For new users, start by browsing through the Preview mode and form descriptions to find a lease that meets your local jurisdiction requirements.

- Should you need a different template, use the Search feature at the top of the page to locate the right lease form.

- Once you've selected the appropriate document, click on the Buy Now button and select a preferred subscription plan. Create an account to access the full library.

- Complete your purchase by entering your payment details using a credit card or PayPal, then proceed to download your lease form.

- Save the completed template on your device, and you can access it at any time through the My documents section.

By following these steps, you can efficiently obtain and complete your lease using the extensive resources available at US Legal Forms.

Start today and benefit from our vast collection of over 85,000 legal forms to ensure your documents are precise and comply with legal standards.

Form popularity

FAQ

Writing a good lease involves clarity and specificity. Start with pertinent details like tenant and landlord names, rental amount, and lease duration. Include rules about property use, maintenance responsibilities, and termination procedures. To streamline the process for a lease, leverage uslegalforms, where you can find pre-made templates that guide you in creating a comprehensive agreement.

A lease agreement should be clear, organized, and detailed. It generally includes sections for tenant and landlord information, terms of the lease, payment details, and rules for the property. You want to ensure all parties can easily understand their rights and responsibilities. For a lease, uslegalforms can provide you with templates that incorporate all essential elements.

Filling an agreement form involves several steps. Start by reviewing the entire document to understand its purpose. Next, input the necessary information accurately, such as names and agreement details. Lastly, if you prefer ease and guidance, consider using uslegalforms for a lease, as they provide templates that simplify the process.

Yes, you can write your own lease agreement. Begin by outlining the essential terms, such as rent amount, payment schedule, and lease duration. Make sure to include necessary clauses that protect both parties' rights. Uslegalforms provides templates and guidance that can help you draft a legally sound document for a lease.

To fill a lease agreement form in PDF format, first, download the document from a reliable source. You can open it using a PDF editor, or print it out to fill it manually. Ensure you provide accurate details such as names, property address, and leasing terms. If you prefer, uslegalforms offers customizable templates that simplify this process for a lease.

To qualify for a lease, you'll need a stable income, a decent credit score, and identification. Dealerships may also ask for a down payment or trade-in vehicle to reduce monthly payments. Additionally, understanding your needs in a car can significantly influence which lease is right for you. By preparing these elements, you can streamline your leasing experience.

Creating your own lease agreement is possible, but it comes with challenges. You must ensure that the document complies with legal requirements in your state. A well-structured lease protects both parties involved and addresses essential terms. Consider leveraging platforms like USLegalForms to draft a legally sound lease agreement.

Signing a lease involves several steps to ensure you understand your commitments. First, you’ll negotiate the terms, including monthly payments and mileage limits. After that, you'll need to review the lease agreement thoroughly. Finally, signing the lease will confirm your agreement and set the framework for your responsibilities.

The minimum credit score required for a lease typically starts around 620. However, some dealerships may offer leases to individuals with lower scores under certain conditions. It's advisable to check with multiple dealerships for their specific requirements. Understanding your credit score will help you in the leasing process.

Getting approved for a lease may not be as hard as you think. While credit scores and income play essential roles, dealerships often consider other factors. If you have a steady income and a reasonable credit score, you might find that securing a lease is quite feasible. Always explore various leasing options to fit your situation.