Release Of Lien Form New Mexico Withholding

Description

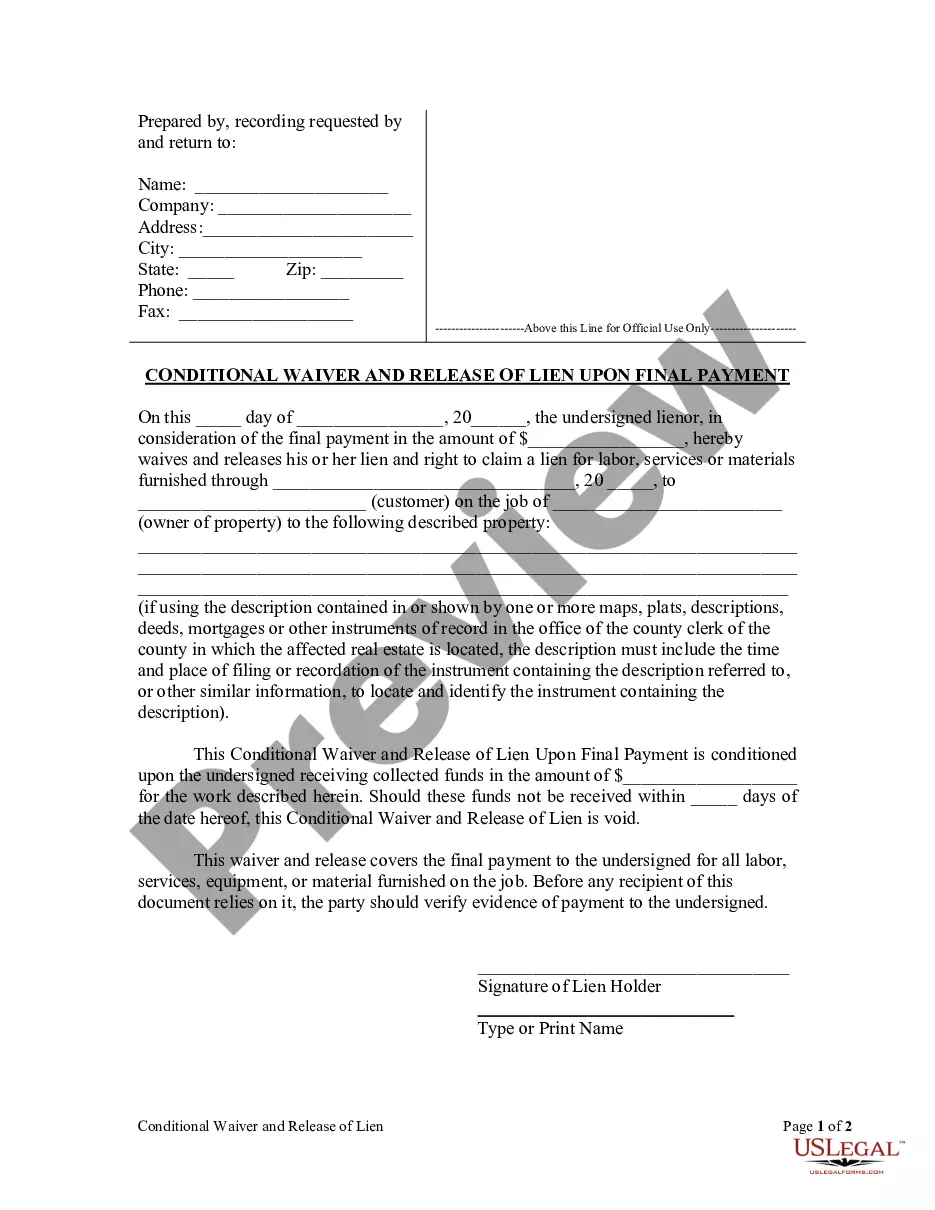

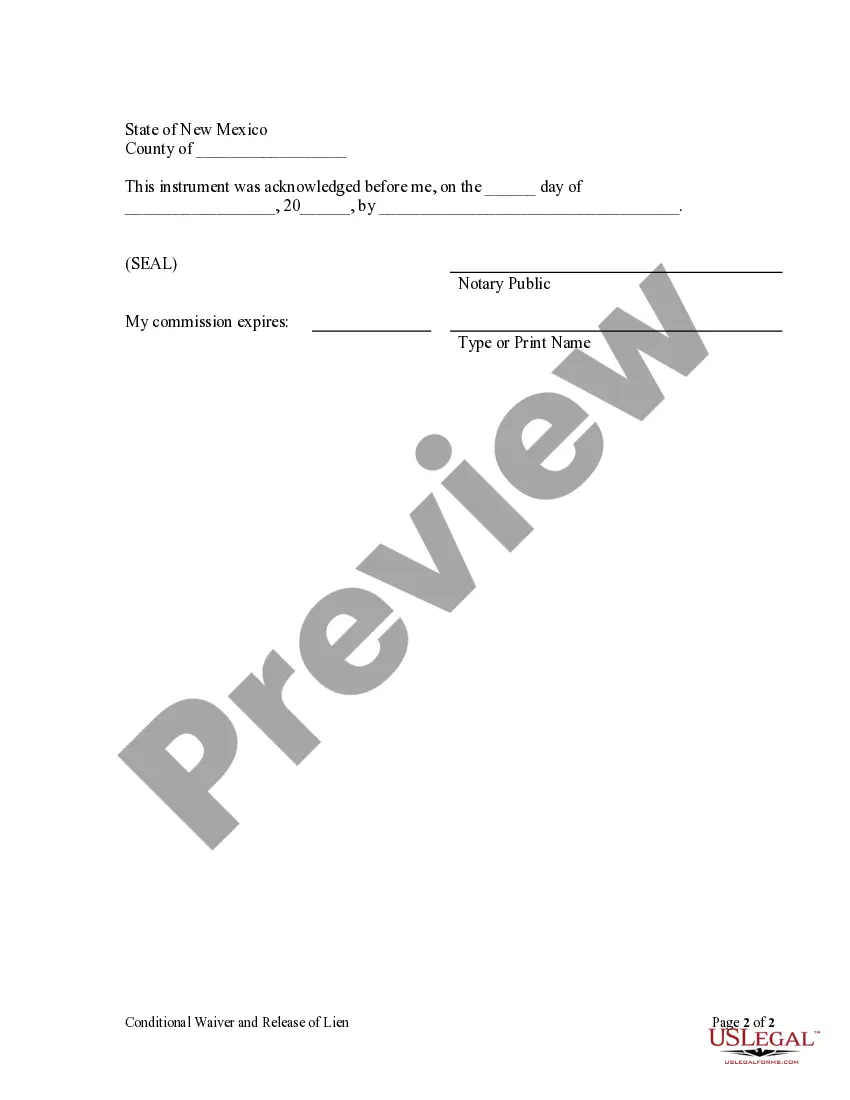

How to fill out New Mexico Conditional Waiver And Release Of Lien Upon Final Payment?

Securing legal document samples that conform to federal and state regulations is vital, and the internet provides numerous options to select from.

However, what is the purpose of spending time looking for the properly structured Release Of Lien Form New Mexico Withholding sample online if the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by legal experts for any professional and personal situation. They are easy to navigate with all documents categorized by state and intended use. Our experts keep up with legal updates, so you can be confident that your form is current and compliant when obtaining a Release Of Lien Form New Mexico Withholding from our site.

All templates you discover through US Legal Forms are reusable. To re-download and finalize previously saved forms, access the My documents tab in your account. Experience the most comprehensive and user-friendly legal paperwork service!

- Acquiring a Release Of Lien Form New Mexico Withholding is straightforward and fast for both existing and new users.

- If you already possess an account with a valid subscription, Log In and download the document sample you require in your desired format.

- If you are new to our site, follow these steps.

- Review the template using the Preview function or through the text outline to ensure it meets your needs.

- Search for another sample using the search feature at the top of the page if needed.

- Click Buy Now when you find the appropriate form and choose a subscription plan.

- Create an account or Log In and complete the payment using PayPal or a credit card.

- Choose the most suitable format for your Release Of Lien Form New Mexico Withholding and download it.

Form popularity

FAQ

To remove a lien on your property in Alabama, start by paying off the debt that caused the lien. After the debt is settled, request a Release of Lien Form New Mexico withholding to remove the lien from public records. Remember to confirm that the lien has been officially released after submission. If questions arise during this process, services like US Legal Forms can provide assistance.

To get a lien release quickly, you should first contact the lienholder to understand their requirements. Often, you can obtain a Release of Lien Form New Mexico withholding directly from them. Make sure to gather all necessary documentation that supports your case. If you need assistance, consider using a legal forms service to expedite the process.

New Mexico withholding tax refers to the tax that employers deduct from an employee's wages. This tax is forwarded to the state to cover an individual’s income tax liability. It applies to various income types, including wages, pensions, and certain other payments. Knowing about the New Mexico withholding tax can help you manage your finances and ensure compliance with state tax laws.

To obtain a new lien release, you typically need to fill out a Release of Lien Form specific to New Mexico withholding. You can request this form from your creditor or download it online. Once you complete the form, submit it to the appropriate county clerk or office. This process helps clear your property title and ensures you have rightful ownership.

The process known as the release of a lien involves officially removing a lien from a property once the debtor fulfills their obligations. This process confirms the debt has been satisfied, allowing the debtor to enjoy clear title to their property. It’s critical for maintaining property values and securing financial transactions. Leverage the release of lien form New Mexico withholding for a smooth and efficient handling of this procedure.

The tax lien removal form is a document used to officially remove a lien that has been placed on your property due to unpaid taxes. Completing this form is essential in clearing your title and easing potential future transactions. Understanding this removal process is vital for homeowners and property investors alike. For efficient handling, consider integrating the release of lien form New Mexico withholding.

In New Mexico, you generally have four months to file a lien from the date the debt becomes due. It's crucial to act promptly to ensure your rights are protected. Delaying can result in complications, making it more challenging to enforce your lien. To streamline this process, you may want to use a release of lien form New Mexico withholding.