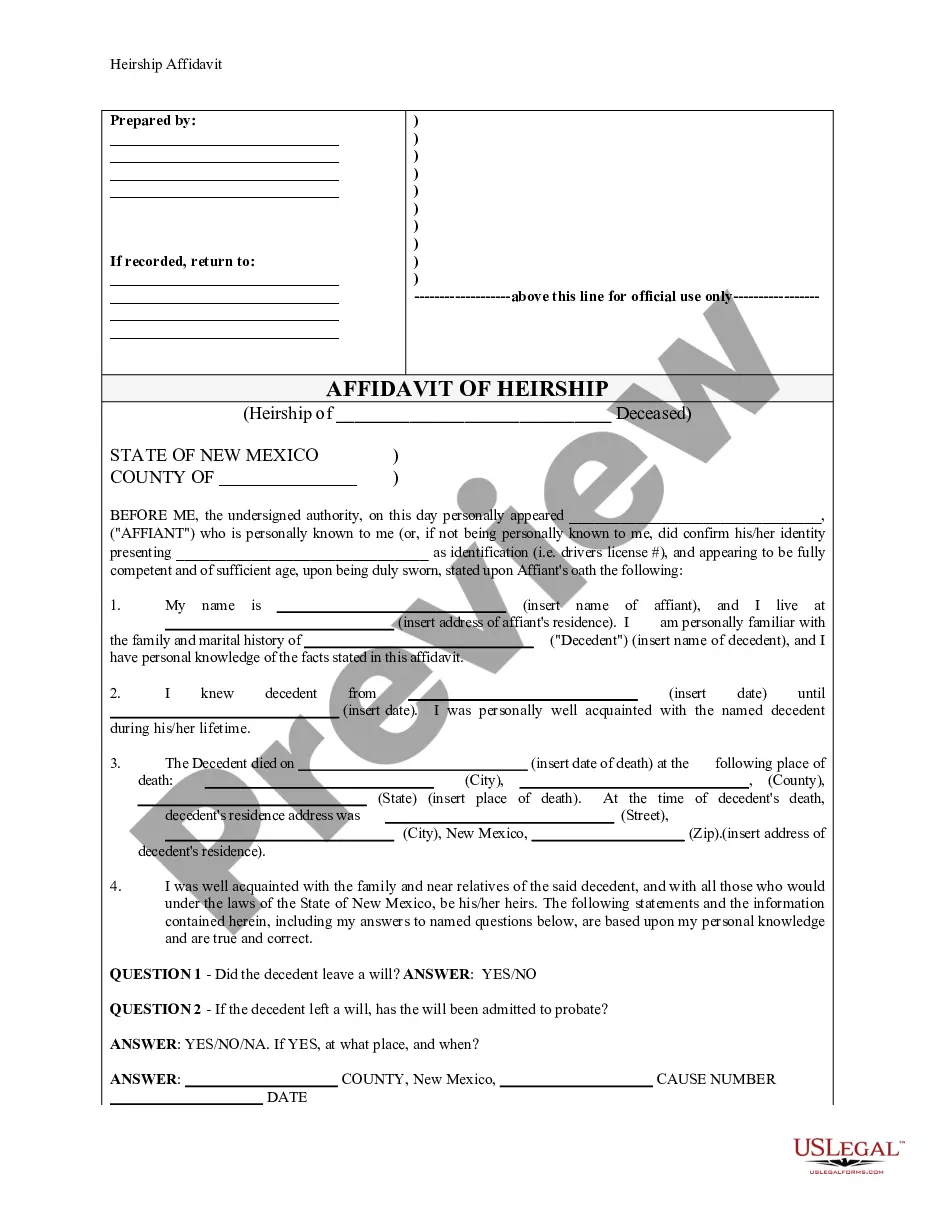

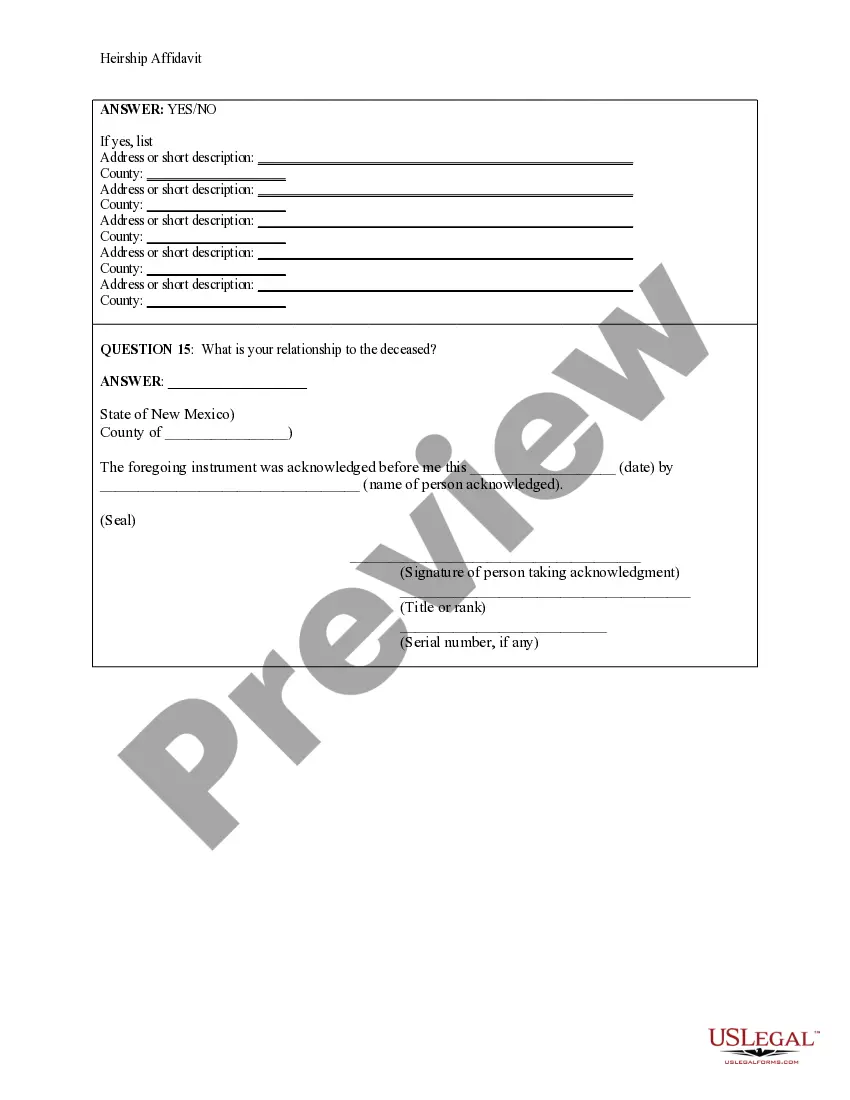

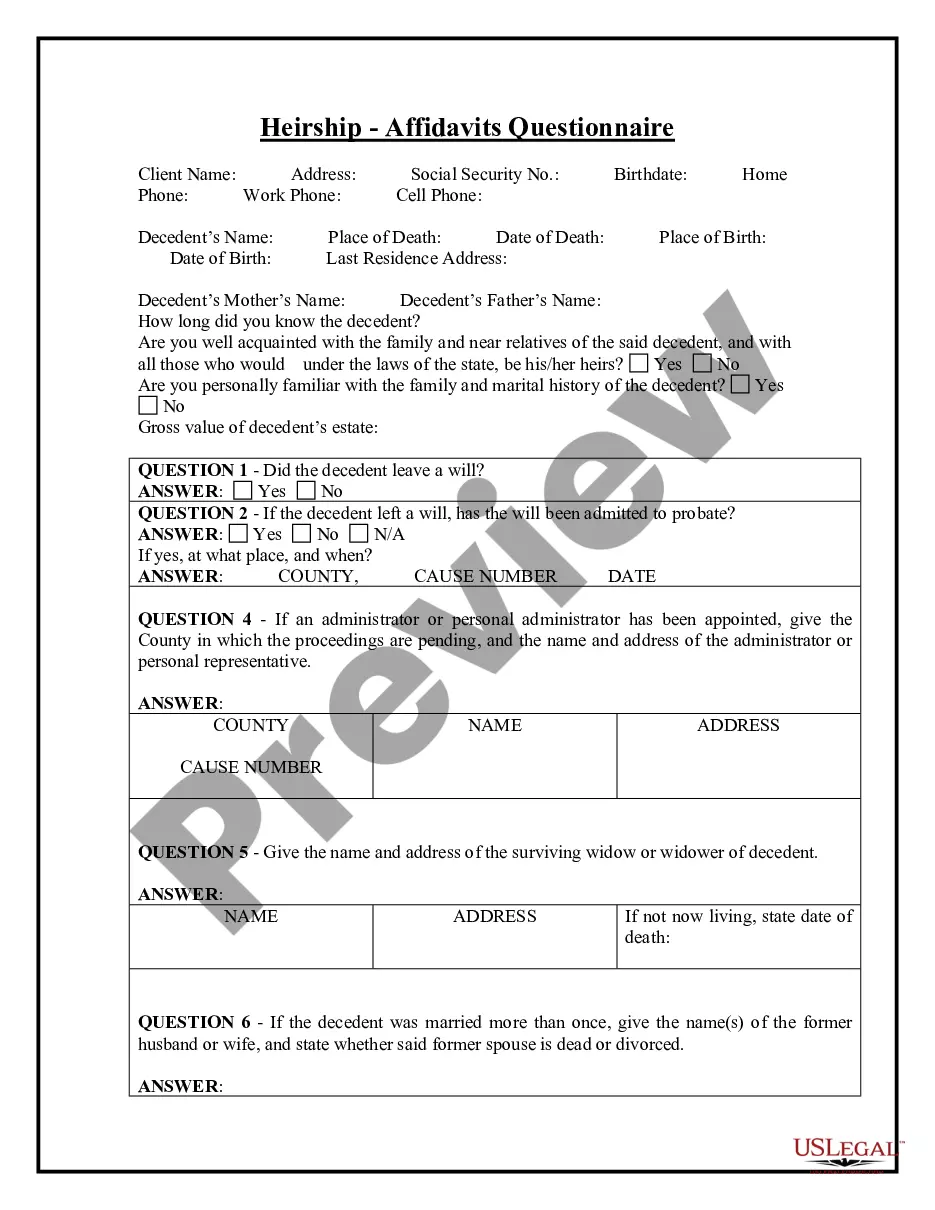

New Mexico Affidavit Of Heirship Format

Description

How to fill out New Mexico Heirship Affidavit - Descent?

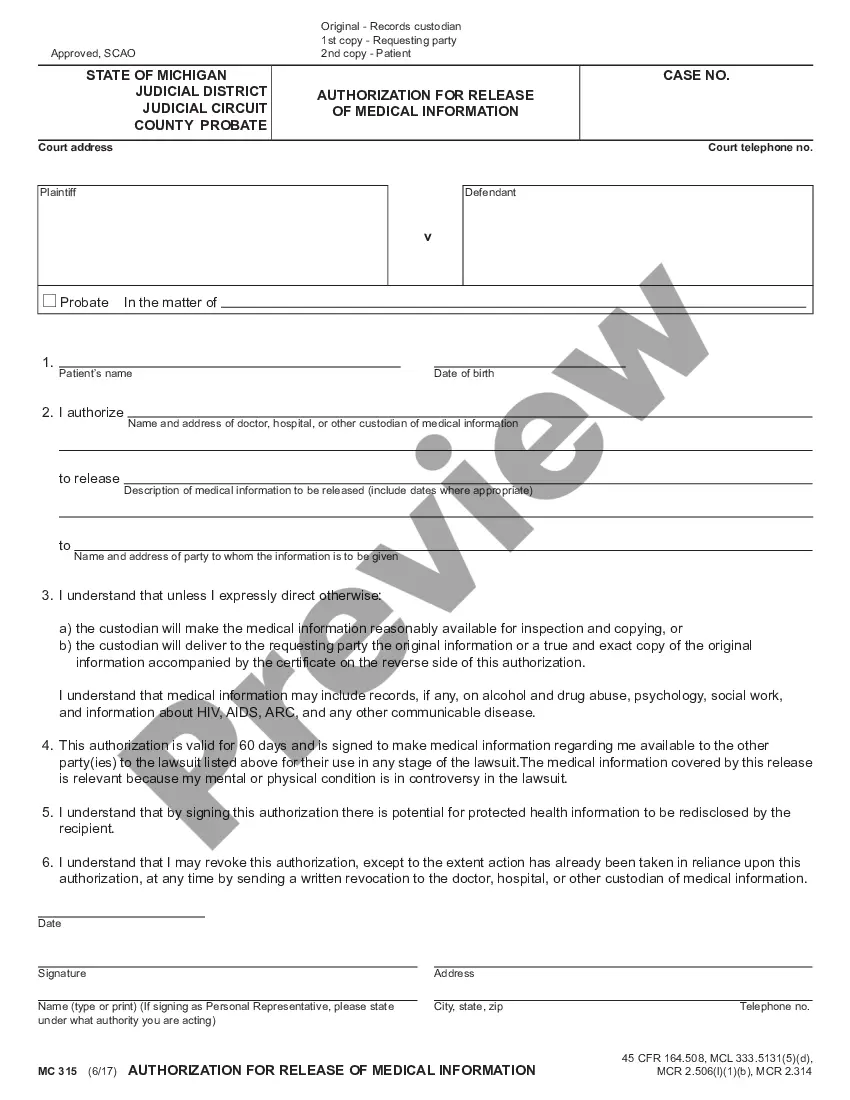

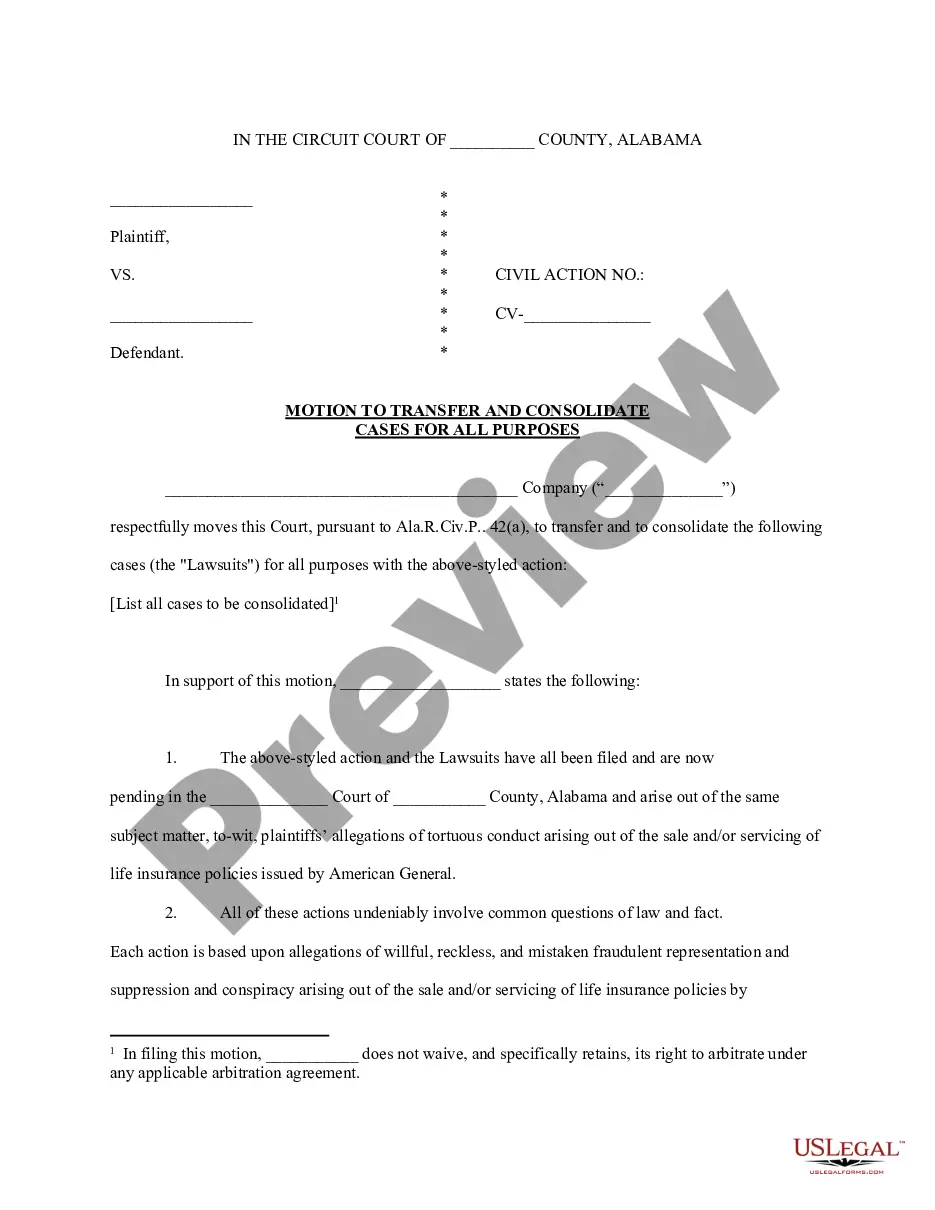

Whether for corporate objectives or for individual matters, everyone must deal with legal circumstances at some stage in their life.

Completing legal documentation requires meticulous care, beginning with selecting the appropriate form template.

With a comprehensive US Legal Forms catalog available, there is no need to waste time searching for the correct sample online. Utilize the library’s user-friendly navigation to find the suitable form for any occasion.

- Locate the template you require by using the search box or catalog navigation.

- Review the form’s description to confirm it fits your situation, state, and region.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to find the New Mexico Affidavit Of Heirship Format sample you require.

- Download the template if it aligns with your needs.

- If you already have a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not possess an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the file format you desire and download the New Mexico Affidavit Of Heirship Format.

- Once it is downloaded, you are able to fill out the form using editing software or print it to complete manually.

Form popularity

FAQ

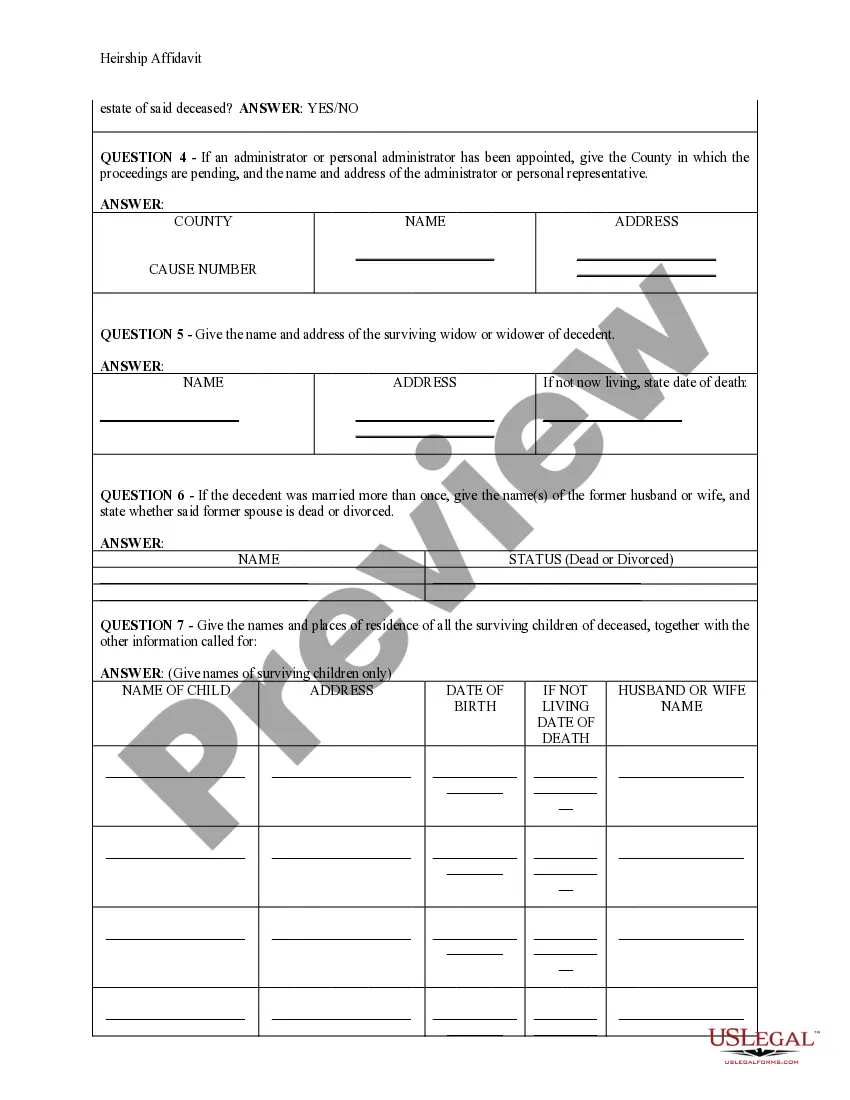

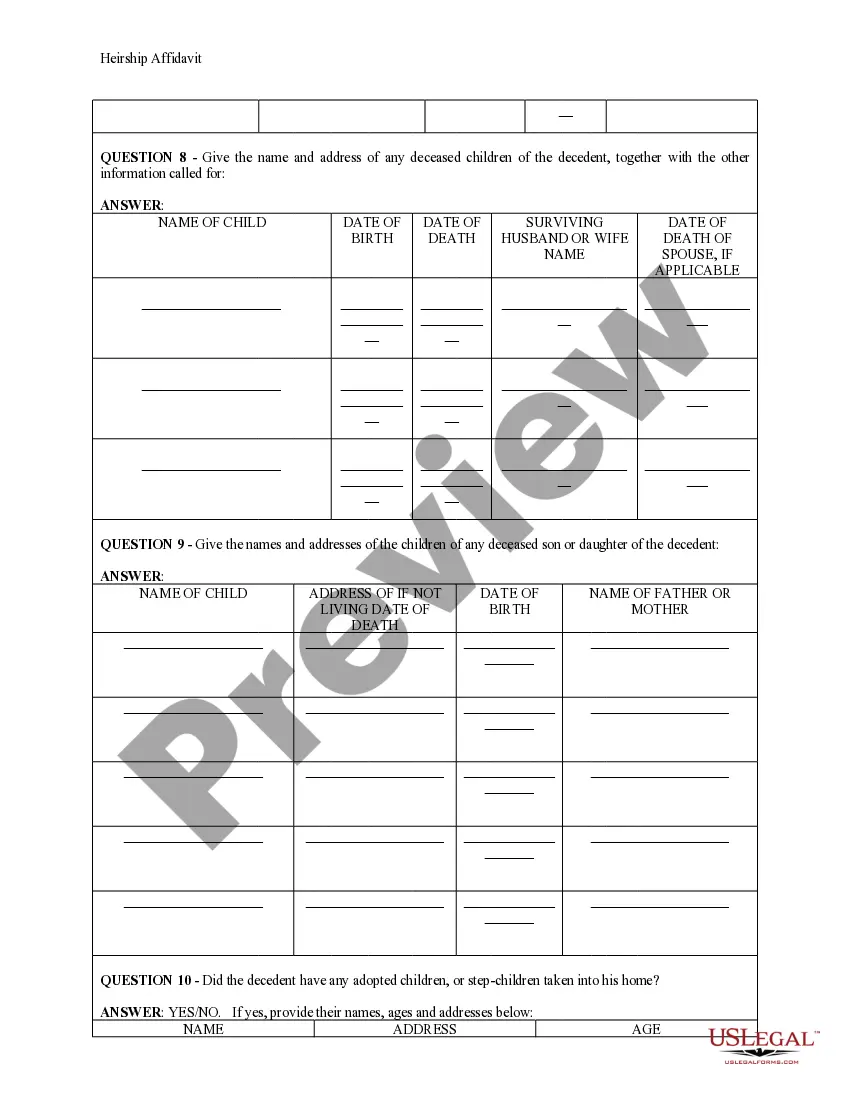

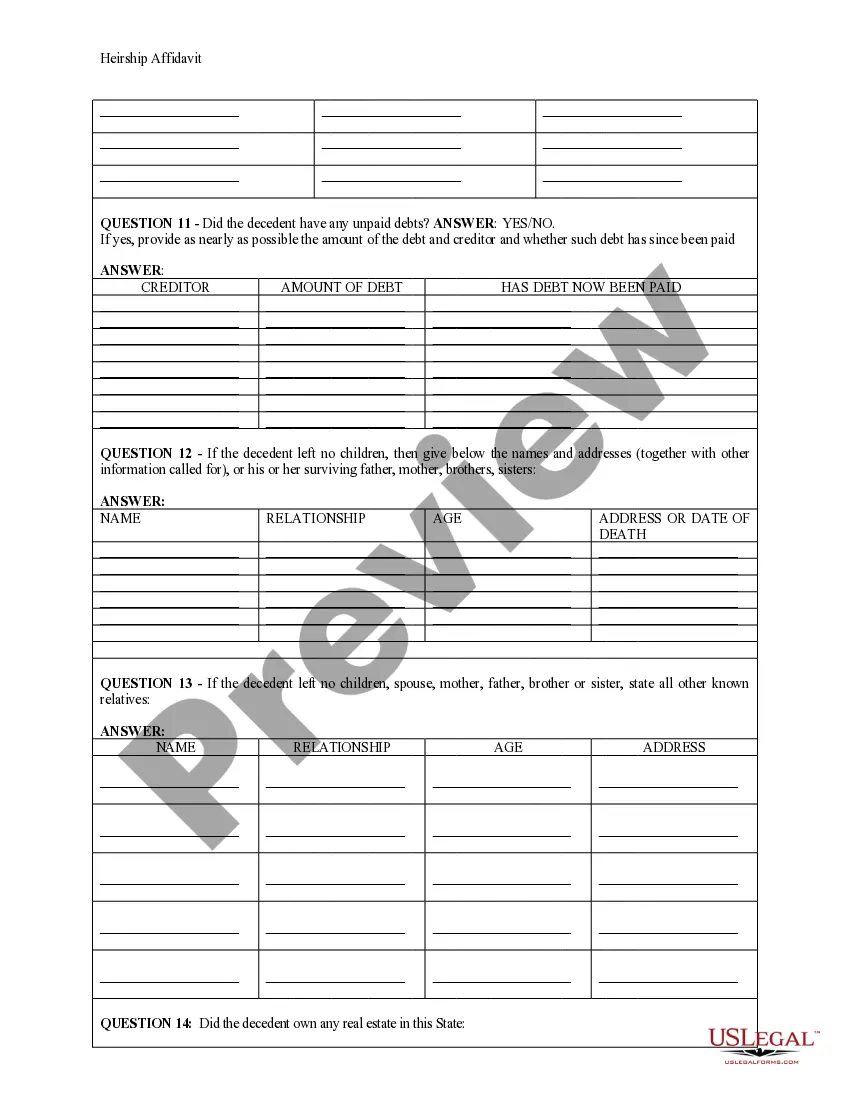

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

What is required for an affidavit of heirship in Texas? A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

What Is An Affidavit Of Heirship in Oklahoma. Under Oklahoma law, successors (usually children) can file an affidavit of heirship if the deceased individual's estate qualified as a ?small estate.? The affidavit of heirship must contain specific information if its to be used to avoid the probate process.