Transfer On Death Property Deed Without Will

Description

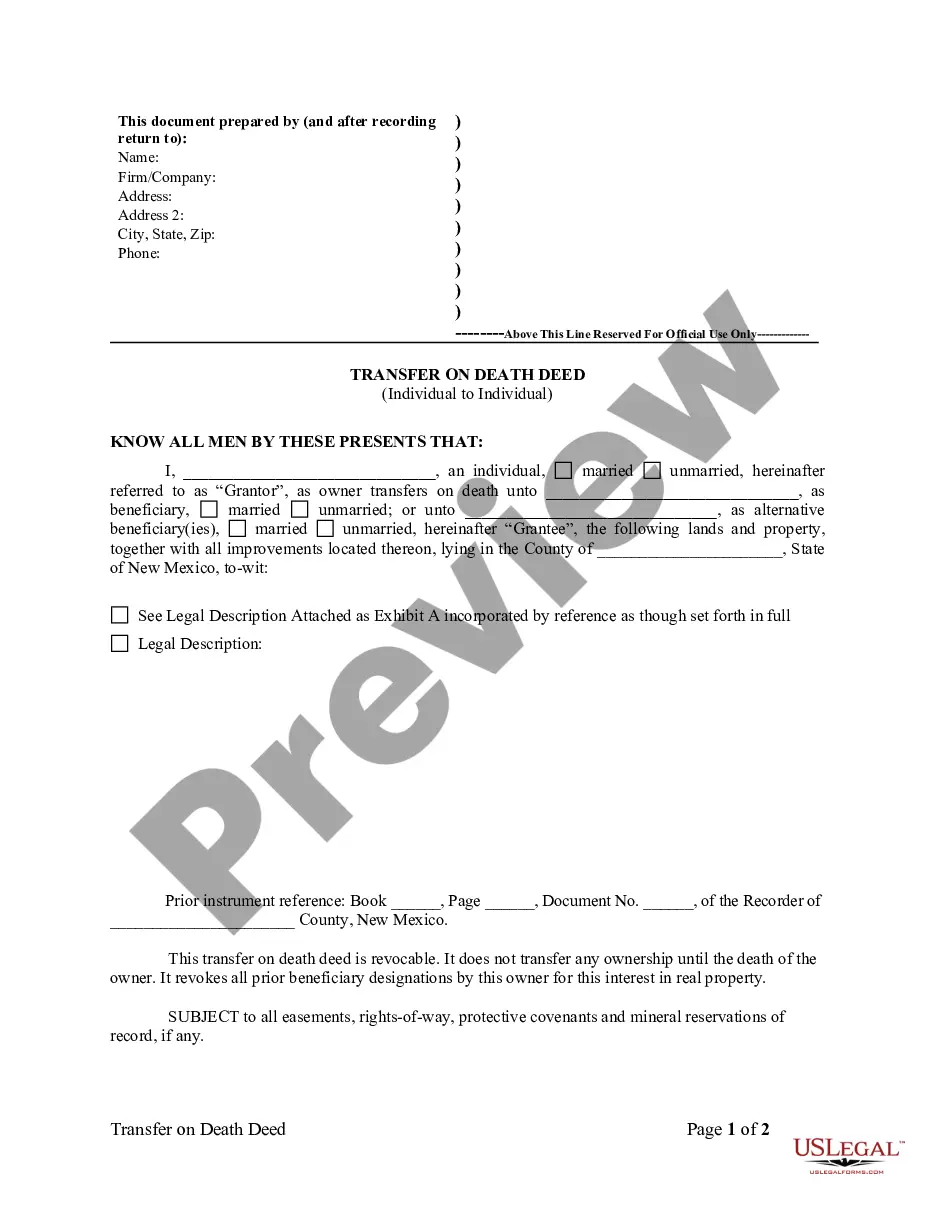

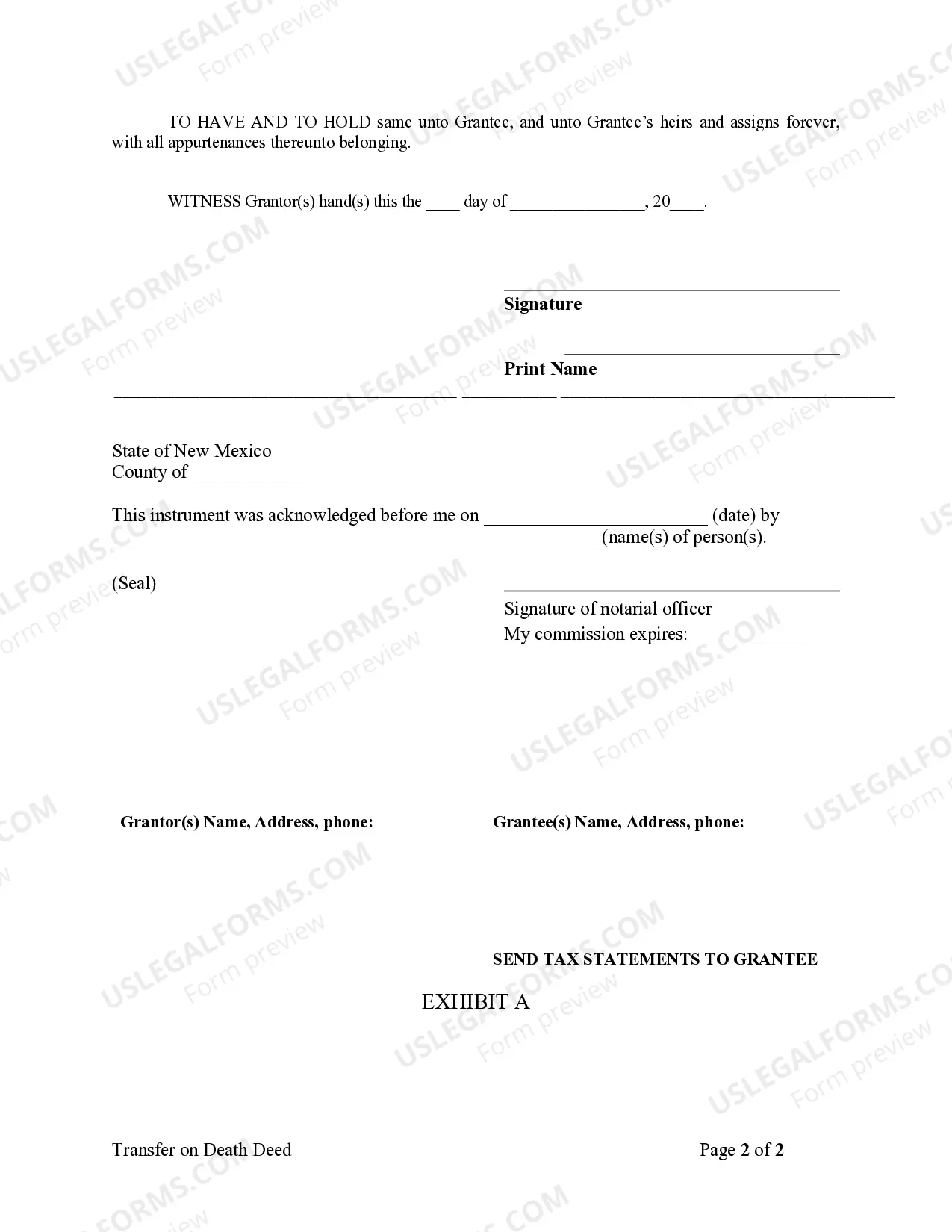

How to fill out New Mexico Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

Utilizing legal documents that adhere to federal and state regulations is a crucial requirement, and the web provides numerous alternatives to select from.

However, what is the advantage of squandering time hunting for the properly composed Transfer On Death Property Deed Without Will example online when the US Legal Forms online library conveniently compiles such templates in one location.

US Legal Forms stands as the premier online legal repository with over 85,000 editable templates crafted by legal professionals for various professional and personal situations.

All templates you discover through US Legal Forms are reusable. To re-download and complete previously acquired documents, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- They are straightforward to navigate with all documents categorized by state and intended use.

- Our experts keep pace with legislative changes, ensuring that your form is always current and compliant when obtaining a Transfer On Death Property Deed Without Will from our site.

- Acquiring a Transfer On Death Property Deed Without Will is simple and rapid for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in your desired format.

- If you are new to our platform, adhere to the instructions below.

Form popularity

FAQ

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

How to Minimize Capital Gains Tax on Inherited Property Sell the inherited property quickly. ... Make the inherited property your primary residence. ... Rent the inherited property. ... Qualify for a partial exclusion. ... Disclaim the inherited property. ... Deduct Selling Expenses from Capital Gains.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.