Death On Transfer

Description

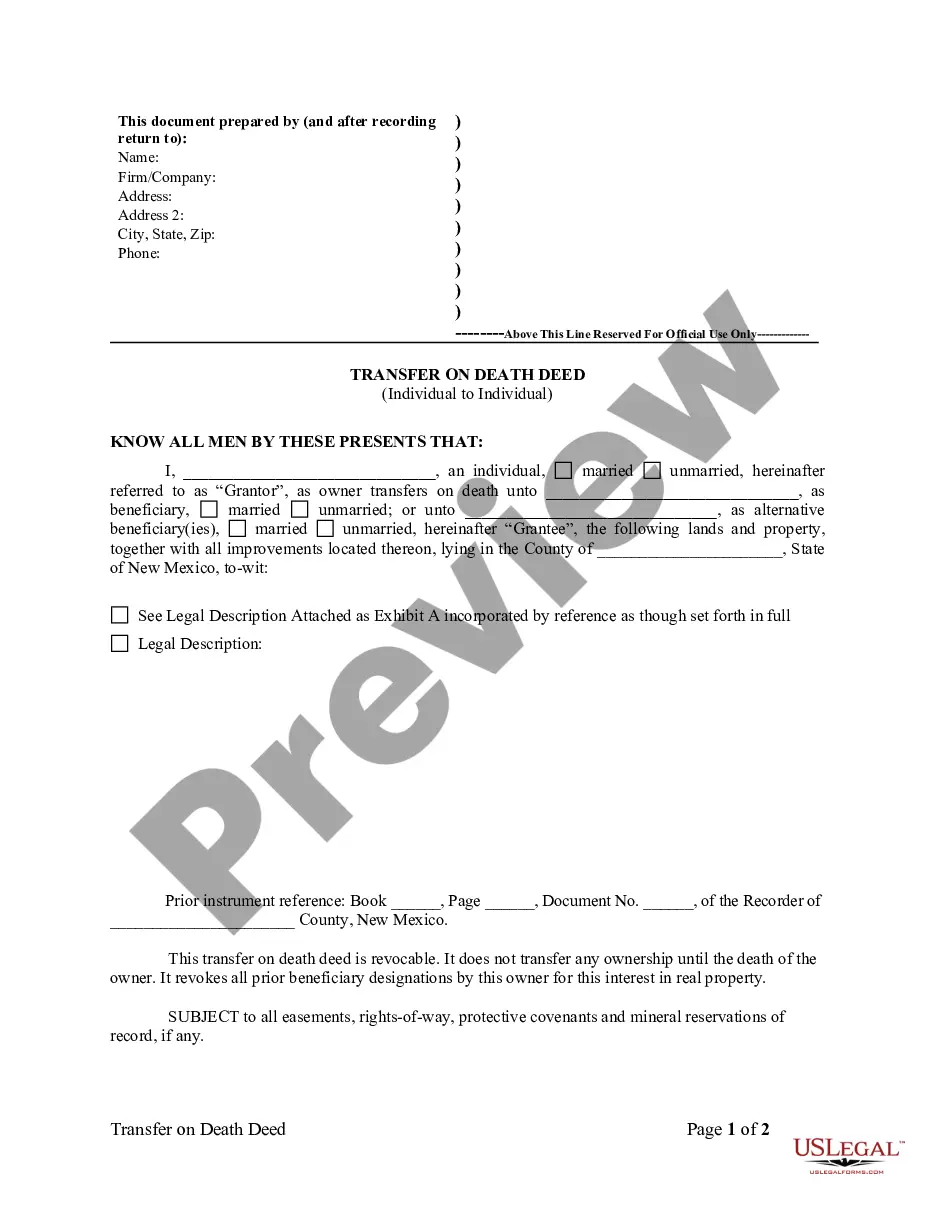

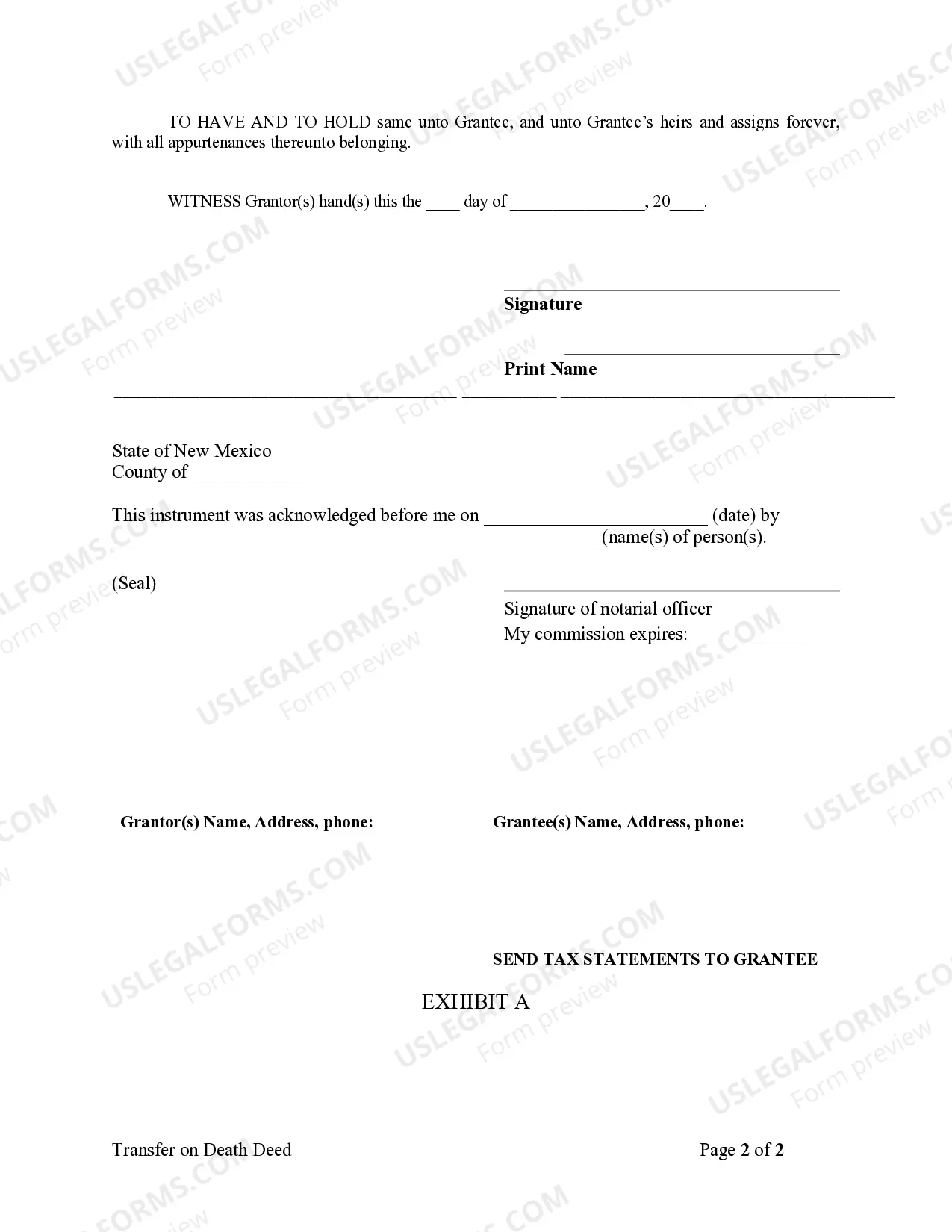

How to fill out New Mexico Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

The Death On Transfer you see on this page is a multi-usable legal template drafted by professional lawyers in compliance with federal and state regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Death On Transfer will take you just a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it fits your needs. If it does not, make use of the search bar to get the right one. Click Buy Now when you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Death On Transfer (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your papers one more time. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, like minimizing estate tax or creditor protection, for which you need a trust. In addition to a will or trust, you can also transfer property by making someone else a joint owner, or using a life estate deed.

?Typically, TOD accounts are investment accounts that will transfer to the beneficiary when the account owner dies." Transfer on death accounts are similar to ?payable on death" (POD) accounts, with both transferring assets to beneficiaries after the account owner dies.

And while the process may vary slightly from state to state, there are some general, basic steps to follow. Get Your State-Specific Deed Form. ... Decide on Your Beneficiary. ... Include a Description of the Property. ... Sign the New Deed. ... Record the Deed. ... Tax Implications of Transfer on Death Deeds.

Lack of Resources To Pay Final Expenses A significant downfall with relying upon TOD or POD account registration to administer your assets upon death is that there might not be remaining assets in your estate to cover such expenses.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.