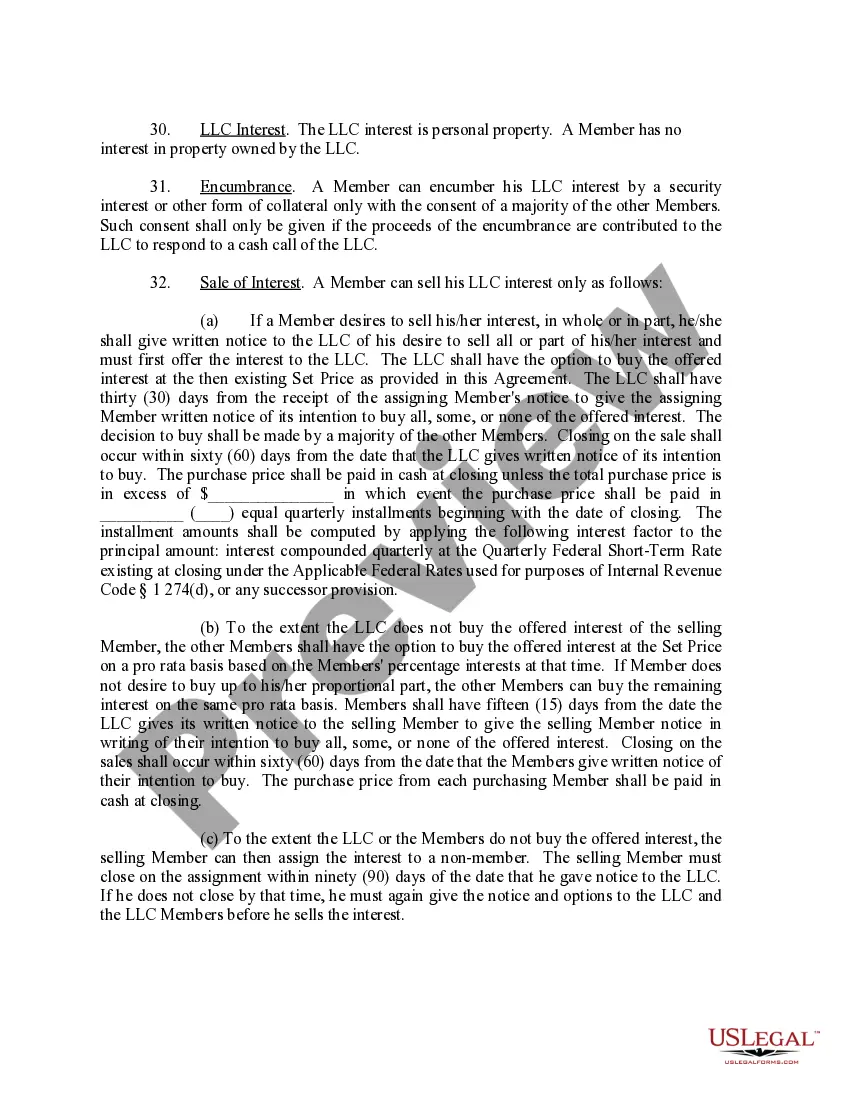

New Mexico Llc Operating Agreement With Owner

Description

How to fill out New Mexico Limited Liability Company LLC Operating Agreement?

Legal administration can be perplexing, even for seasoned experts.

When you are in search of a New Mexico LLC Operating Agreement With Owner and lack the time to seek out the correct and current version, the processes can be overwhelming.

Access state- or county-specific legal and business documents.

US Legal Forms addresses any requirements you may have, from personal to corporate paperwork, all in one location.

If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the advantages of the library. Below are the steps to follow after downloading the form you need: Confirm it is the correct form by previewing it and reading its description. Ensure that the template is accepted in your state or county. Select Buy Now when you are ready. Choose a subscription plan. Locate the format you need, and Download, complete, sign, print, and deliver your documents. Enjoy the US Legal Forms web repository, supported by 25 years of experience and reliability. Streamline your daily document management into a straightforward and user-friendly process today.

- Utilize advanced tools to fill out and oversee your New Mexico LLC Operating Agreement With Owner.

- Access a resource pool of articles, guides, and materials pertinent to your circumstances and requirements.

- Save time and effort searching for the documents you require, and use US Legal Forms’ sophisticated search and Preview tool to locate the New Mexico LLC Operating Agreement With Owner and obtain it.

- If you hold a membership, Log In to the US Legal Forms profile, search for the form, and acquire it.

- Check your My documents tab to review the documents you have previously downloaded and to manage your folders as needed.

- A robust web form repository could be a transformative solution for anyone who wishes to manage these scenarios effectively.

- US Legal Forms is a frontrunner in online legal documentation, with over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

Yes, you can write your own operating agreement for your LLC in New Mexico. Crafting a New Mexico LLC operating agreement with owner gives you the flexibility to tailor it to your specific needs and preferences. However, it's important to include essential elements such as ownership percentages, voting rights, and management responsibilities. If you need assistance, consider using US Legal Forms to access templates and guidance for creating an effective operating agreement.

In New Mexico, an operating agreement for an LLC is not legally required. However, having a New Mexico LLC operating agreement with owner is highly recommended. This document outlines the management structure and operational procedures of your LLC, which can help prevent disputes among owners. By creating an operating agreement, you ensure clarity and establish guidelines for your business.

Although fees vary by state when it comes to forming an LLC and keeping it in compliance, New Mexico is considered one of the best states to form an LLC in. This is because there is no annual fee.

New Mexico's LLC is highly sought after because there are no annual reports. No annual report also means no annual fee. The Secretary's only requirement is that you maintain a registered agent in New Mexico. So long as you have an agent your company will remain in good standing.

You can get an LLC in New Mexico in 1-3 business days if you file online (and 2-3 weeks if you file by mail).

As the owner of an LLC, you must pay self-employment tax and federal income tax, both of which are levied as ?pass-through taxation." Federal taxes can be complicated, so speak to your accountant or professional tax preparer to ensure that your New Mexico LLC is paying the correct amount.

As per the New Mexico LLC Act, an Operating Agreement isn't required for an LLC in New Mexico. But while it's not required in New Mexico to conduct business, we strongly recommend having an Operating Agreement for your LLC.