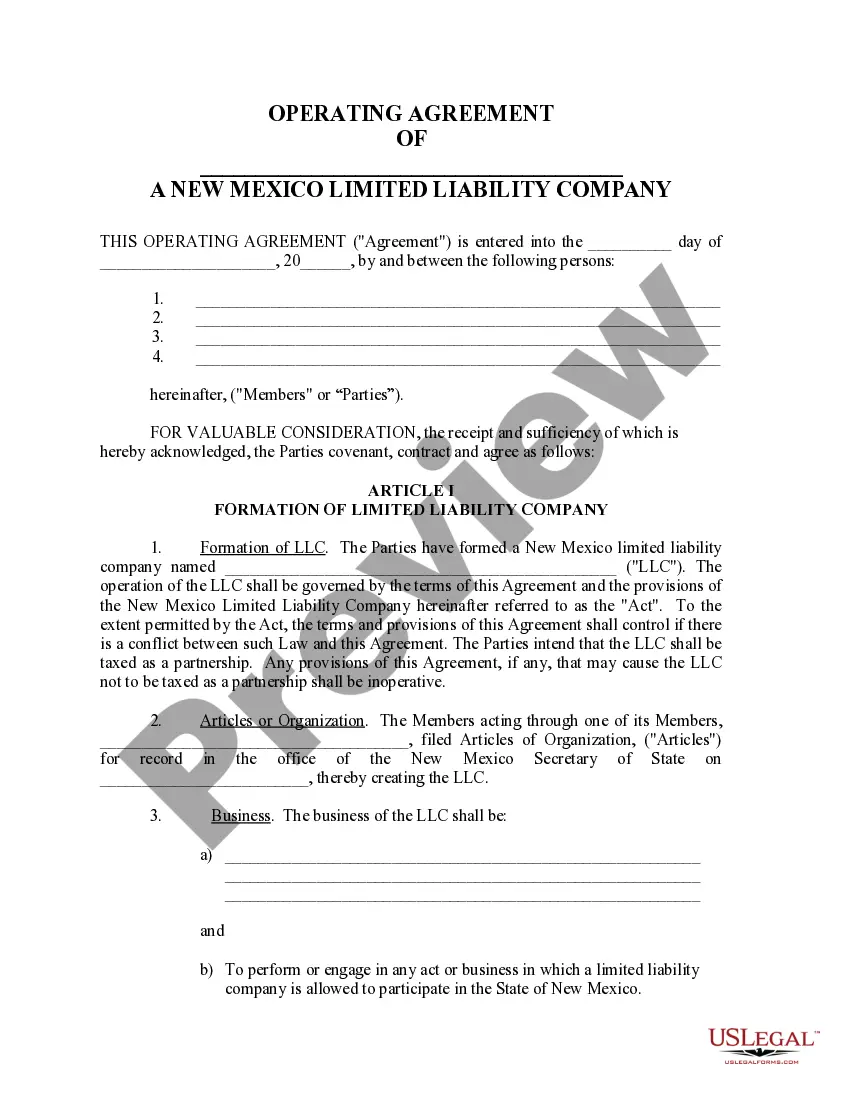

New Mexico Llc Operating Agreement Form With Signature

Description

How to fill out New Mexico Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for personal matters, everyone has to manage legal situations sooner or later in their life. Completing legal paperwork demands careful attention, starting with selecting the correct form template. For example, when you select a wrong edition of the New Mexico Llc Operating Agreement Form With Signature, it will be turned down when you submit it. It is therefore essential to get a dependable source of legal files like US Legal Forms.

If you need to get a New Mexico Llc Operating Agreement Form With Signature template, follow these easy steps:

- Find the sample you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it fits your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong form, go back to the search function to find the New Mexico Llc Operating Agreement Form With Signature sample you need.

- Get the file if it matches your needs.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Select the document format you want and download the New Mexico Llc Operating Agreement Form With Signature.

- When it is saved, you are able to complete the form with the help of editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time searching for the appropriate sample across the internet. Use the library’s easy navigation to get the right form for any situation.

Form popularity

FAQ

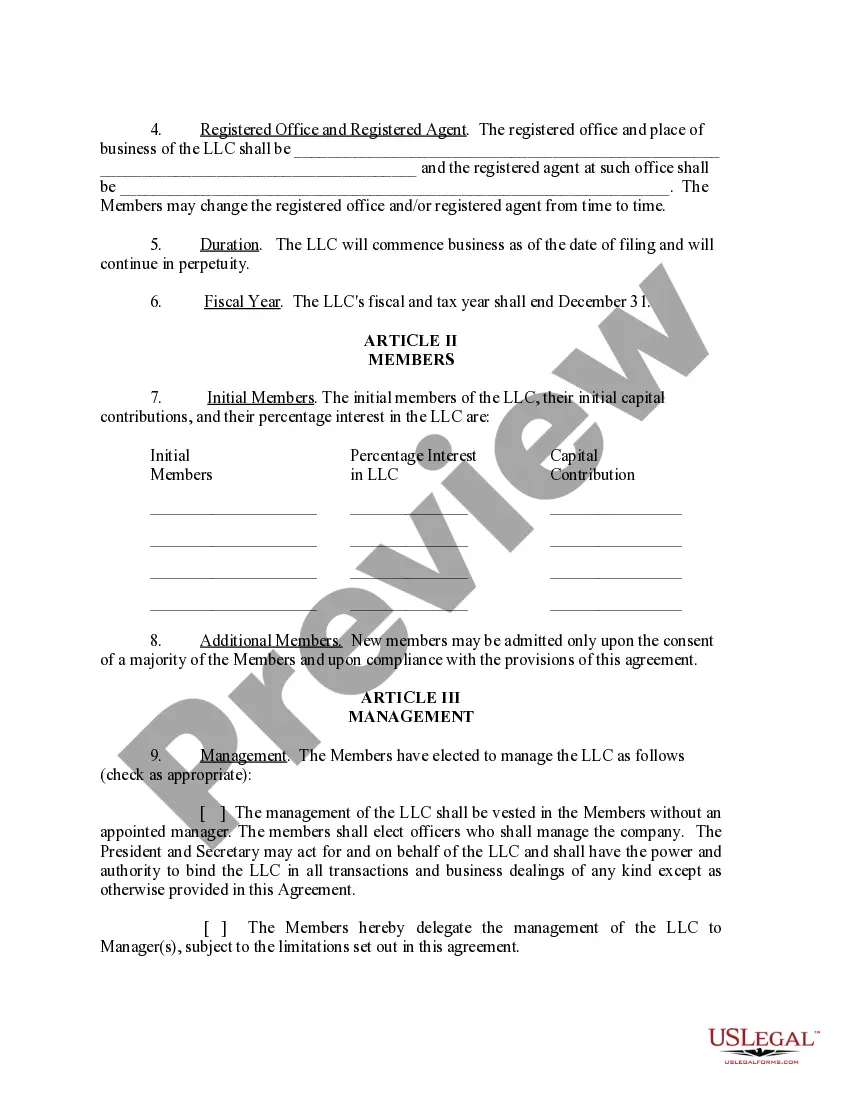

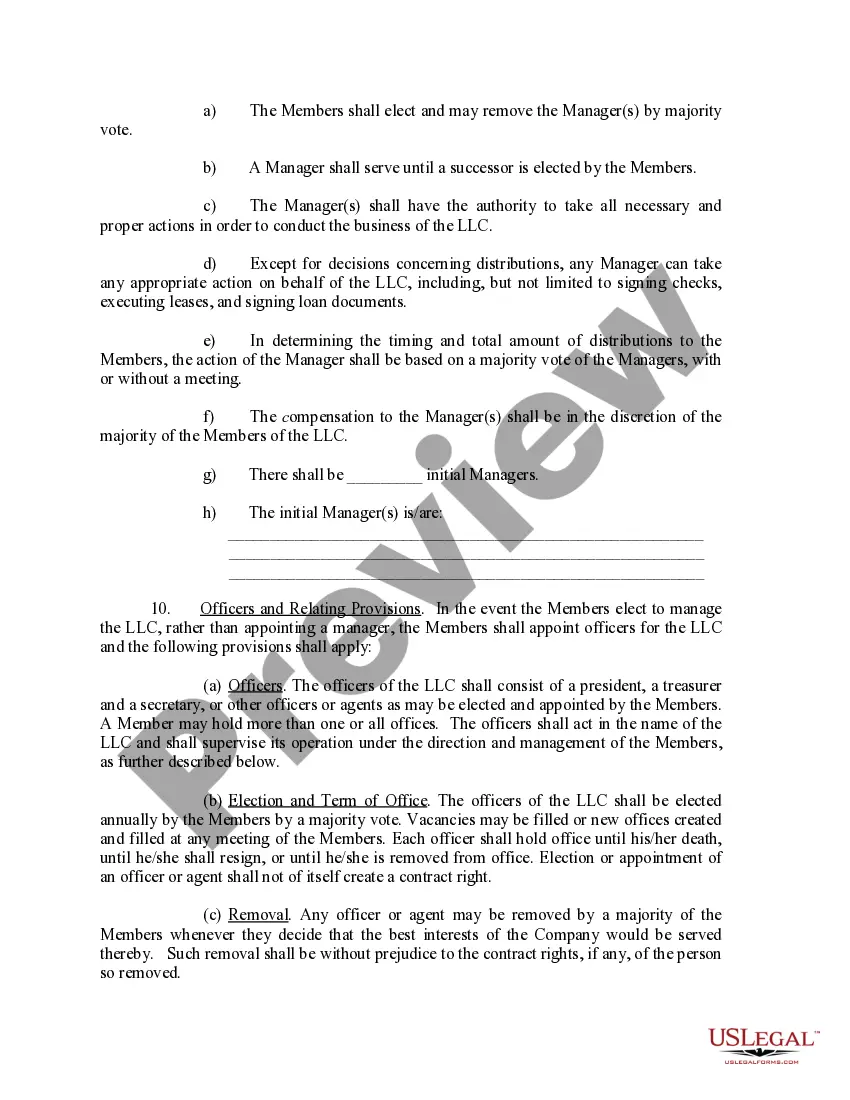

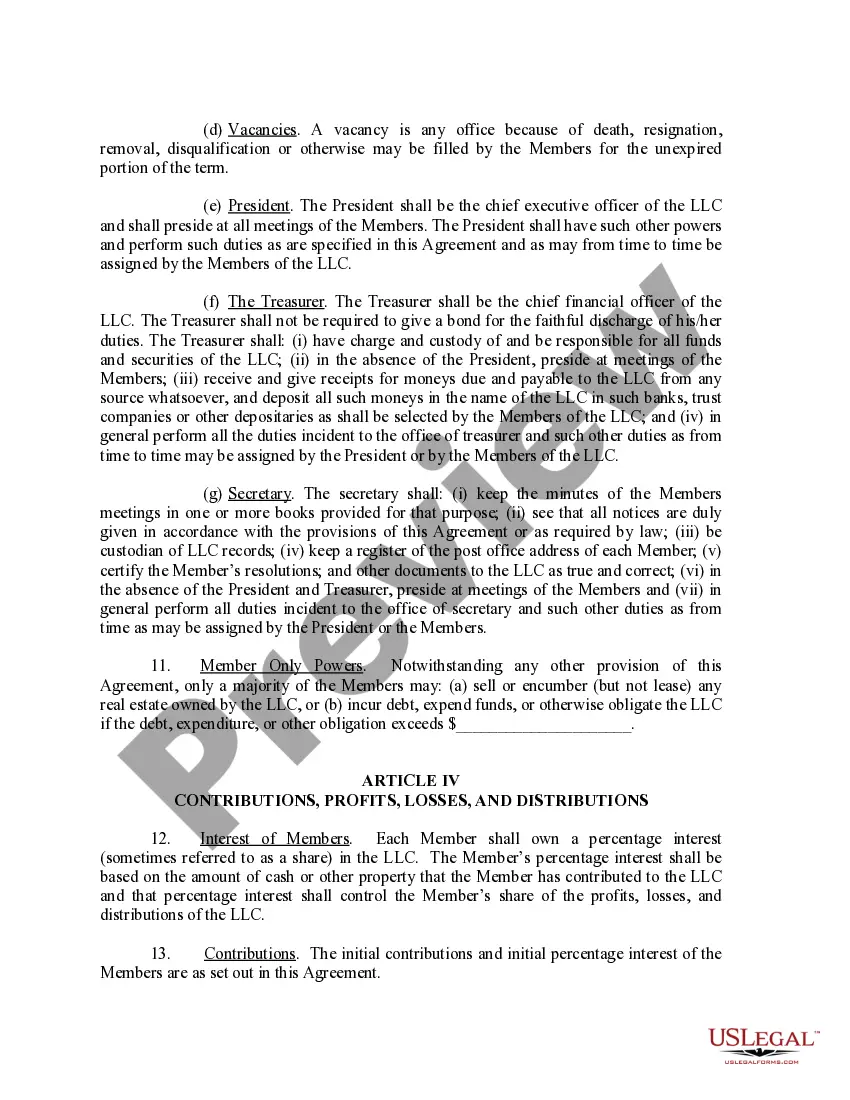

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.

As per the New Mexico LLC Act, an Operating Agreement isn't required for an LLC in New Mexico. But while it's not required in New Mexico to conduct business, we strongly recommend having an Operating Agreement for your LLC.

Any person or business entity in New Mexico can be a registered agent. The only necessary requirements are that they have a physical address in New Mexico and that they understand that their personal information will be made public once the business is formed.

All Corporations, LLCs, and Partnerships must first register with the Secretary of State. You can register LLCs online, but partnerships and corporations registration forms must be completed and submitted via mail or in person. Please visit the pages specific to the type of business you would like to register.

What Should be Included in an Operating Agreement? Names, addresses, and titles of each member. Ownership percentages. Member rights and responsibilities. Responsibility, liability, and powers of members and/or managers. Profit and loss distribution. Buying and selling rules. Dissolution instructions. Meeting guidelines.