Sale To Idgt Vs Grat

Description

How to fill out New Jersey Bargain And Sale Deed - With Covenants As To Grantor's Acts?

Legal papers managing can be overpowering, even for skilled professionals. When you are searching for a Sale To Idgt Vs Grat and do not have the time to devote looking for the right and updated version, the procedures can be stress filled. A robust online form library can be a gamechanger for everyone who wants to take care of these situations successfully. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms handles any demands you may have, from personal to business papers, all-in-one spot.

- Use advanced resources to accomplish and deal with your Sale To Idgt Vs Grat

- Access a useful resource base of articles, tutorials and handbooks and resources related to your situation and needs

Save effort and time looking for the papers you will need, and employ US Legal Forms’ advanced search and Review tool to locate Sale To Idgt Vs Grat and get it. In case you have a subscription, log in in your US Legal Forms account, search for the form, and get it. Review your My Forms tab to find out the papers you previously saved and also to deal with your folders as you can see fit.

Should it be your first time with US Legal Forms, create a free account and acquire unrestricted use of all advantages of the library. Listed below are the steps to take after downloading the form you want:

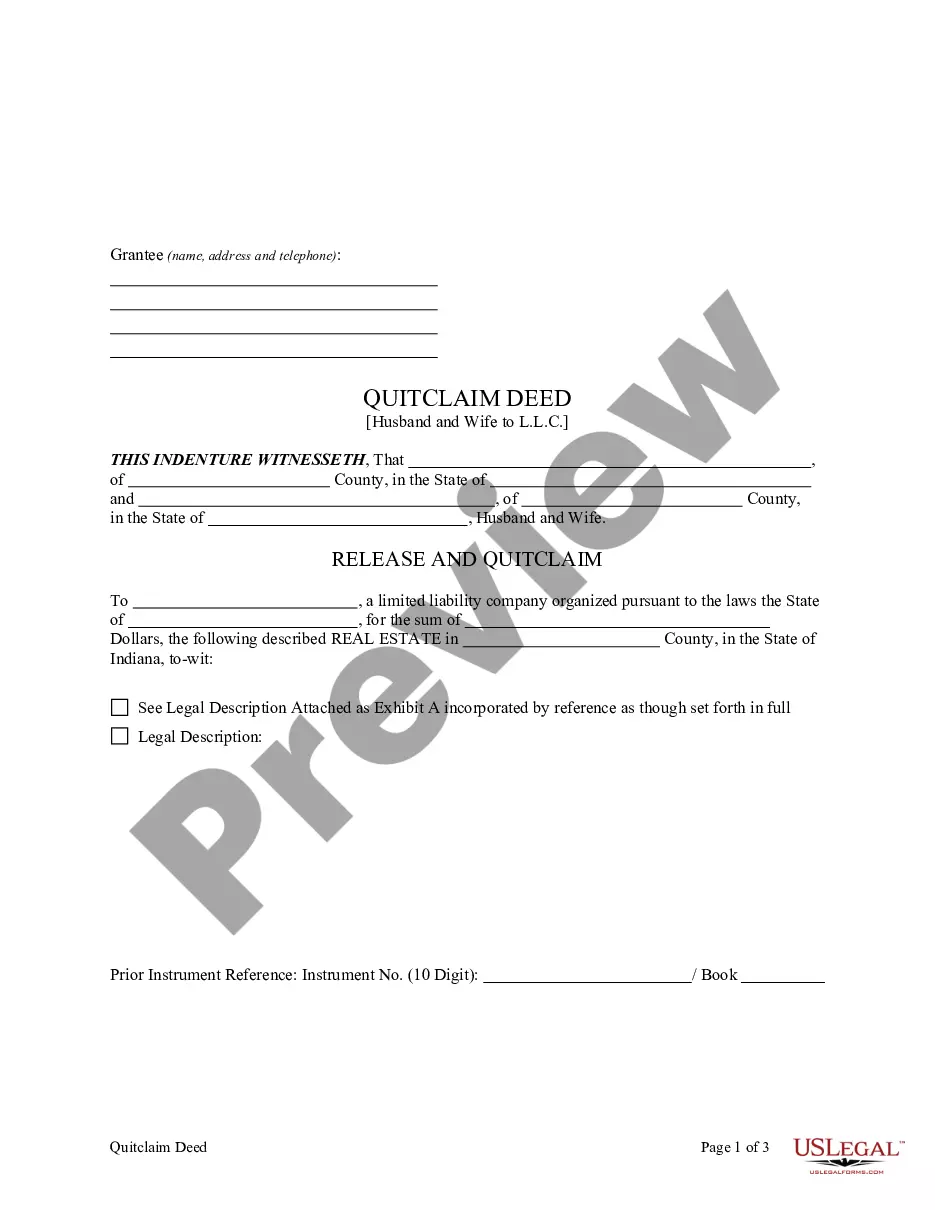

- Confirm this is the right form by previewing it and looking at its information.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now when you are all set.

- Choose a monthly subscription plan.

- Find the formatting you want, and Download, complete, eSign, print and send your papers.

Benefit from the US Legal Forms online library, backed with 25 years of experience and stability. Change your everyday papers managing in to a smooth and user-friendly process today.

Form popularity

FAQ

One of the primary uses of a Grantor Retained Annuity Trust (GRAT) is to move asset appreciation from the grantor to remainder beneficiaries, reducing the value of the grantor's assets that will ultimately be subject to estate tax.

Benefits of an IDGT This has 2 additional benefits: Reducing the grantor's taxable estate in an amount equal to the income taxes paid by the grantor. Helping to preserve the trust by not reducing it with the trust's payment of the income taxes.

A quick definition of completed gift: A completed gift is when someone gives something to another person without expecting anything in return. It's like giving a present to a friend just because you want to make them happy. Once the gift is given, the giver no longer has control over it.

Payments ? IDGTs offer the option of paying interest only on the loan balance for the term of the loan followed by a lump sum payment. From a cash flow perspective, this is highly favorable for a business that may need reinvested capital to grow. The GRAT requires an annual annuity payment.

Generally, assets transferred to the trust are treated as completed gifts and, therefore, are not included in the grantor's estate upon death. While not included in the grantor's estate, assets transferred to an IDGT could trigger gift tax.