Nj Covenants Grantors Acts With A Minor

Description

How to fill out New Jersey Bargain And Sale Deed - With Covenants As To Grantor's Acts?

Finding a reliable location to acquire the most up-to-date and suitable legal templates is half the challenge of managing bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it is essential to obtain Nj Covenants Grantors Acts With A Minor samples solely from trustworthy sources, like US Legal Forms.

Eliminate the complications associated with your legal documentation. Explore the extensive US Legal Forms collection where you can find legal samples, verify their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to locate your template.

- Review the document’s details to ensure it meets your state and local requirements.

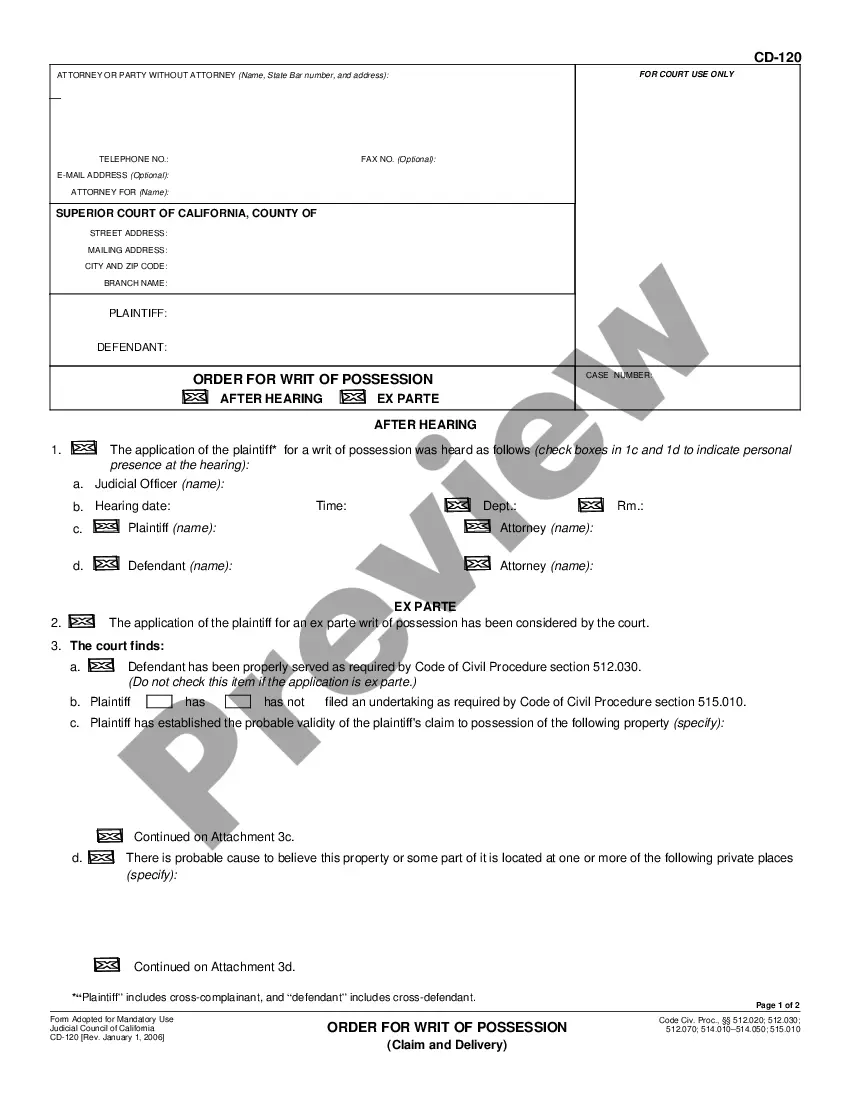

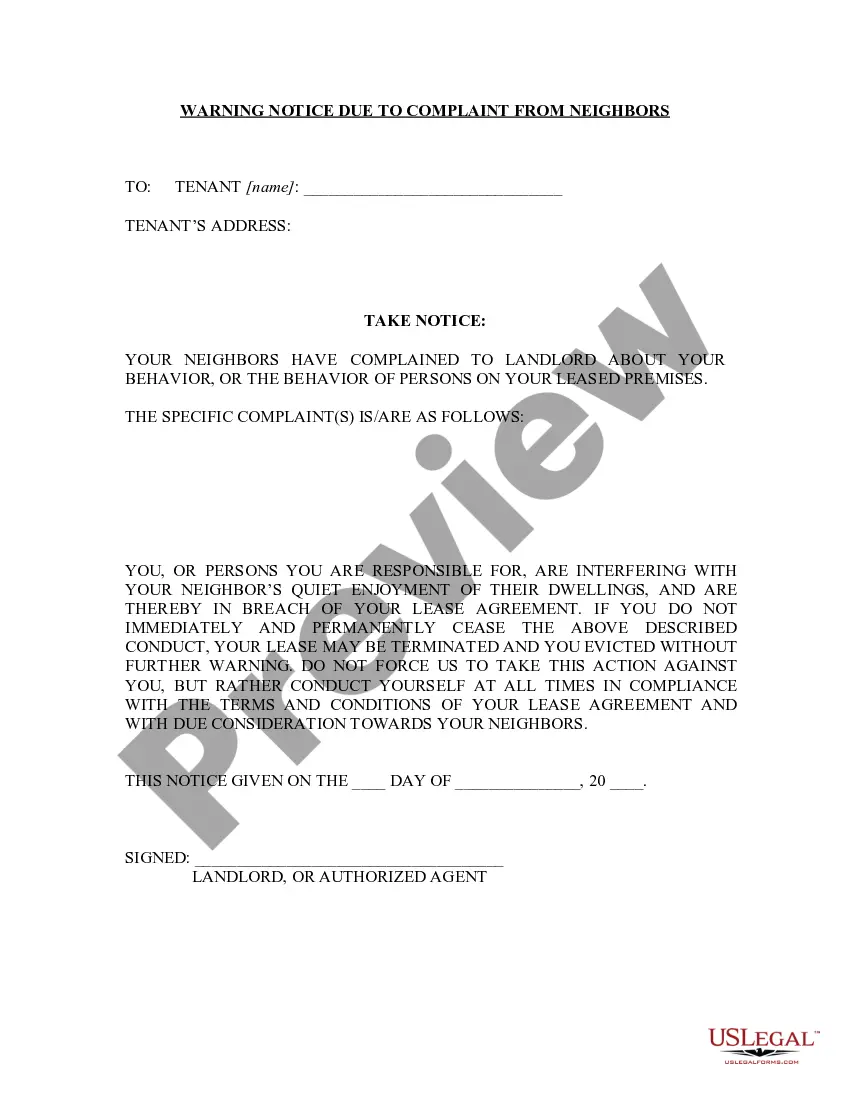

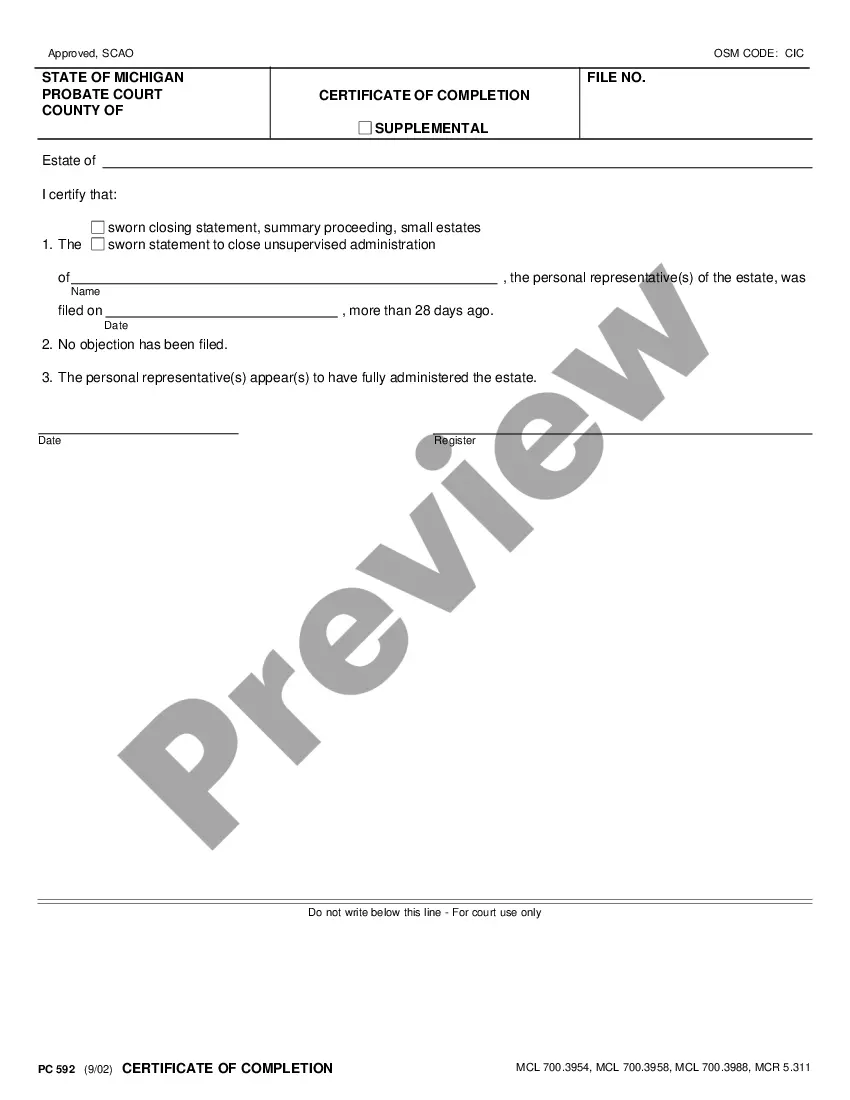

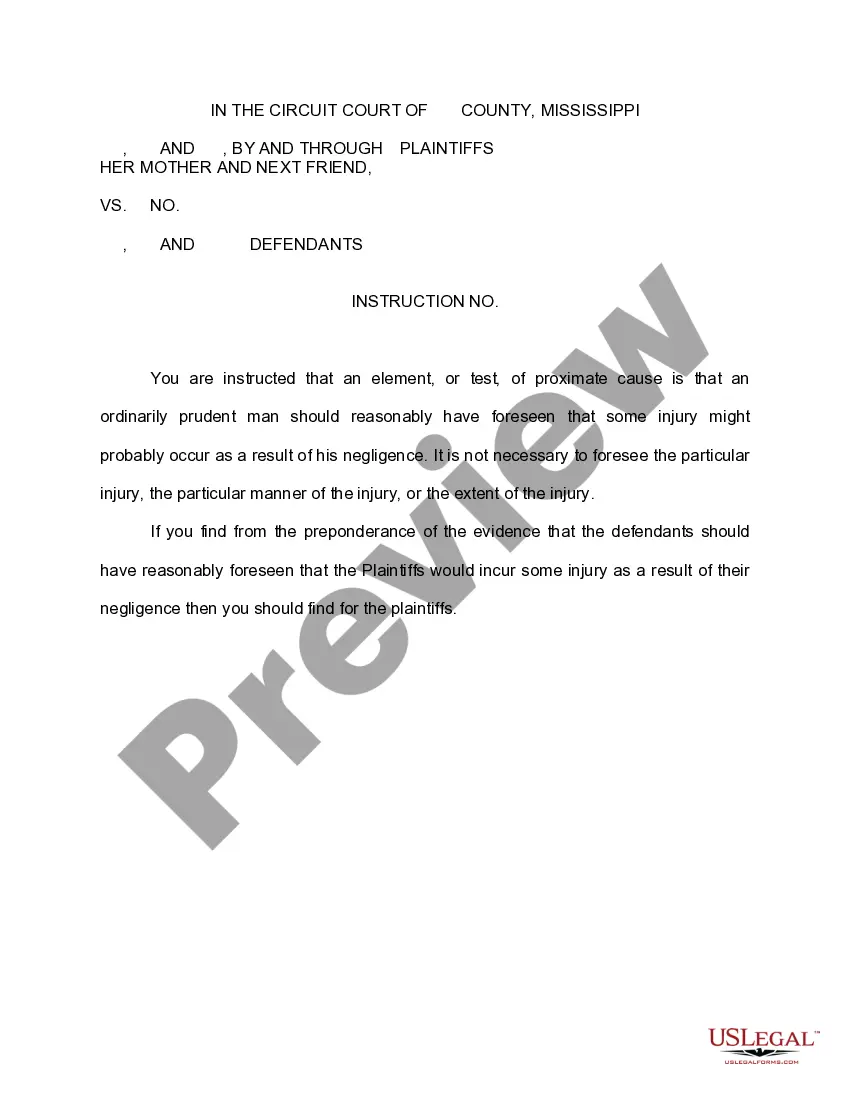

- Access the document preview, if available, to verify it is the correct form you need.

- Continue searching for a suitable template if the Nj Covenants Grantors Acts With A Minor does not satisfy your needs.

- If you are confident about the document’s appropriateness, download it.

- If you are an authorized user, click Log in to verify and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to purchase the form.

- Select the pricing plan that suits your needs.

- Proceed to registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Nj Covenants Grantors Acts With A Minor.

- Once the form is on your device, you can edit it using the editor or print it and fill it out manually.

Form popularity

FAQ

Promises by Grantor. This promise is called a "covenant as to grantor's acts" (N.J.S.A. -6). This promise means that the Grantor has not allowed anyone else to obtain any legal rights which affect the property (such as by making a mortgage or allowing a judgment to be entered against the Grantor).

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.

Under a special warranty deed, the grantor only warrants and covenants to defend the title against claims and demands as against the grantor only, and not otherwise. The net effect of this limitation is to relieve the grantor from any liability for claims that do not arise through him.

A new deed has to be recorded to add or delete anyone from the official record of ownership. We recommend that you seek legal assistance from an attorney or title company specializing in property transactions. If you are listed as a Joint Tenant, no change is required but is recommended.

A bargain and sale deed with covenant against grantor's acts provides the grantee with a covenant that the grantor has not committed any act that would encumber title to the real property being conveyed. This is the most common type of deed used in New Jersey.