New Jersey Deed Online Withholding Tax

Description

How to fill out New Jersey Bargain And Sale Deed - With Covenants As To Grantor's Acts?

Getting a go-to place to access the most recent and appropriate legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal papers demands accuracy and attention to detail, which explains why it is crucial to take samples of New Jersey Deed Online Withholding Tax only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and check all the information regarding the document’s use and relevance for your situation and in your state or county.

Take the listed steps to finish your New Jersey Deed Online Withholding Tax:

- Utilize the library navigation or search field to find your template.

- Open the form’s description to check if it fits the requirements of your state and region.

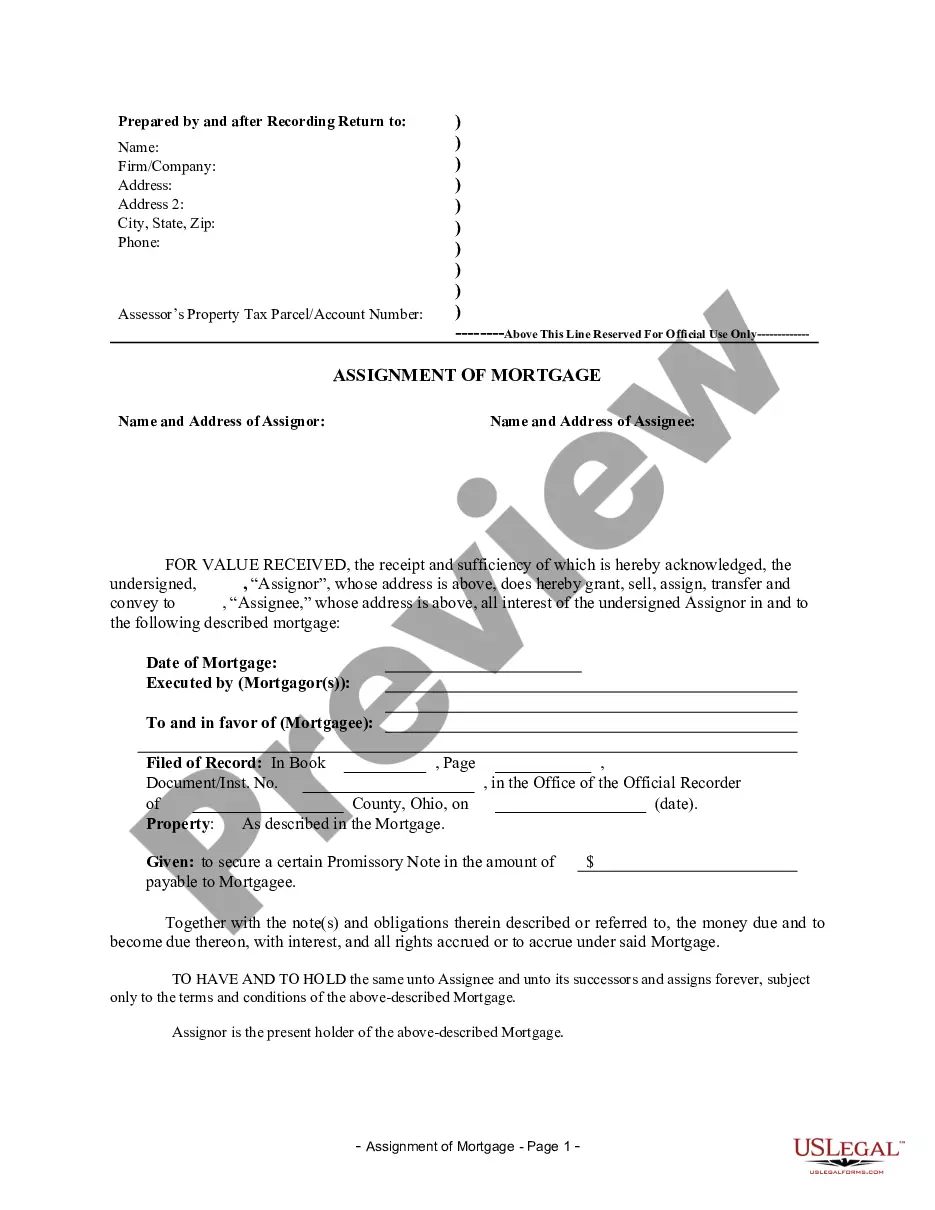

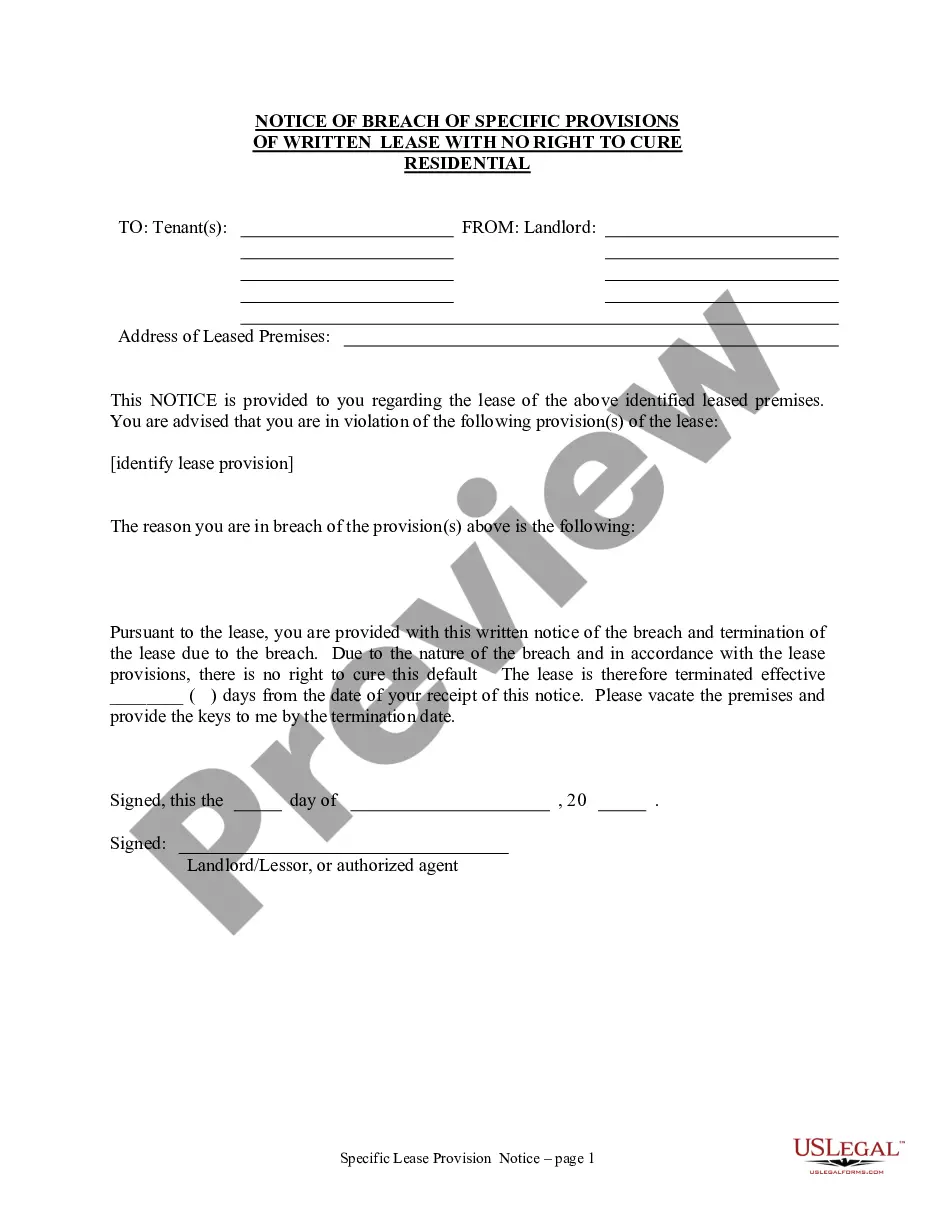

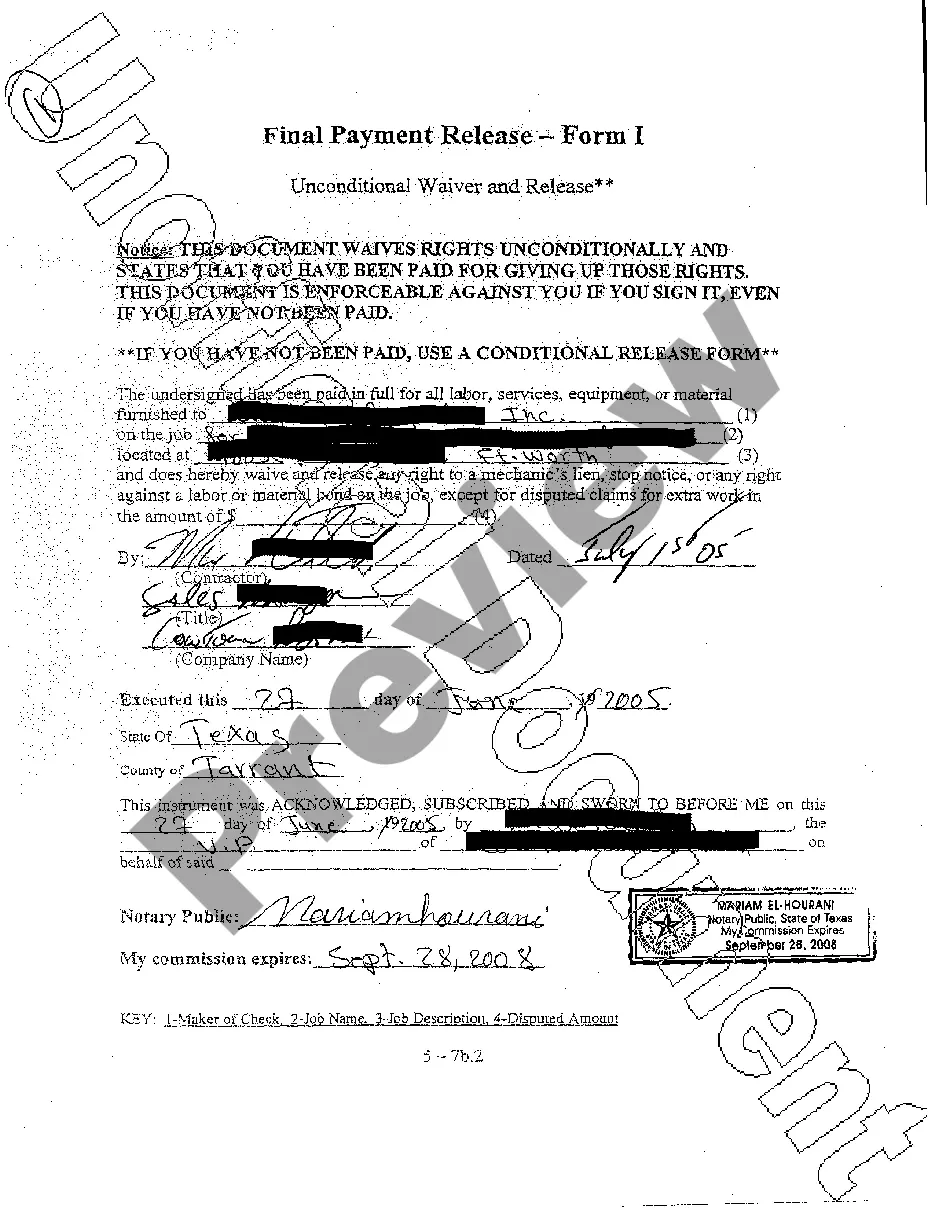

- Open the form preview, if there is one, to make sure the form is the one you are searching for.

- Resume the search and find the right template if the New Jersey Deed Online Withholding Tax does not suit your requirements.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Select the pricing plan that suits your preferences.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by picking a transaction method (credit card or PayPal).

- Select the document format for downloading New Jersey Deed Online Withholding Tax.

- When you have the form on your device, you may modify it using the editor or print it and complete it manually.

Eliminate the hassle that comes with your legal documentation. Check out the comprehensive US Legal Forms collection where you can find legal templates, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

The State of New Jersey imposes a Realty Transfer Fee (RTF) on the seller whenever there is a transfer of title by deed. The fee is based on the sales price of the property, and the seller is required to pay the fee at the time of closing.

New Jersey exit tax particulars The New Jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: whichever is higher.

If your New Jersey taxable income is over:But not over:Your tax is:$0$20,0001.4% of your income$20,000$50,0001.75% of the excess over $20,000, minus $70.00$50,000$70,0002.45% of the excess over $50,000, minus $420.00$70,000$80,0003.5% of the excess over $70,000, minus $1,154.504 more rows

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Your federal income tax withholdings are based on your income and filing status. For 2022, the federal income tax brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Regardless of your situation, you'll need to complete a W-4 and submit it to your employer.