New Jersey Bargain Download With Tax

Description

How to fill out New Jersey Bargain And Sale Deed - With Covenants As To Grantor's Acts?

Dealing with legal documents and operations could be a time-consuming addition to your entire day. New Jersey Bargain Download With Tax and forms like it often require that you look for them and understand the best way to complete them correctly. For that reason, whether you are taking care of economic, legal, or individual matters, using a thorough and practical web catalogue of forms at your fingertips will help a lot.

US Legal Forms is the best web platform of legal templates, boasting over 85,000 state-specific forms and numerous resources to help you complete your documents quickly. Discover the catalogue of relevant papers available to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered at any moment for downloading. Shield your papers management processes with a top-notch support that lets you put together any form within a few minutes without any additional or hidden cost. Simply log in to the profile, locate New Jersey Bargain Download With Tax and acquire it right away within the My Forms tab. You may also access formerly downloaded forms.

Could it be your first time making use of US Legal Forms? Sign up and set up a free account in a few minutes and you’ll gain access to the form catalogue and New Jersey Bargain Download With Tax. Then, stick to the steps below to complete your form:

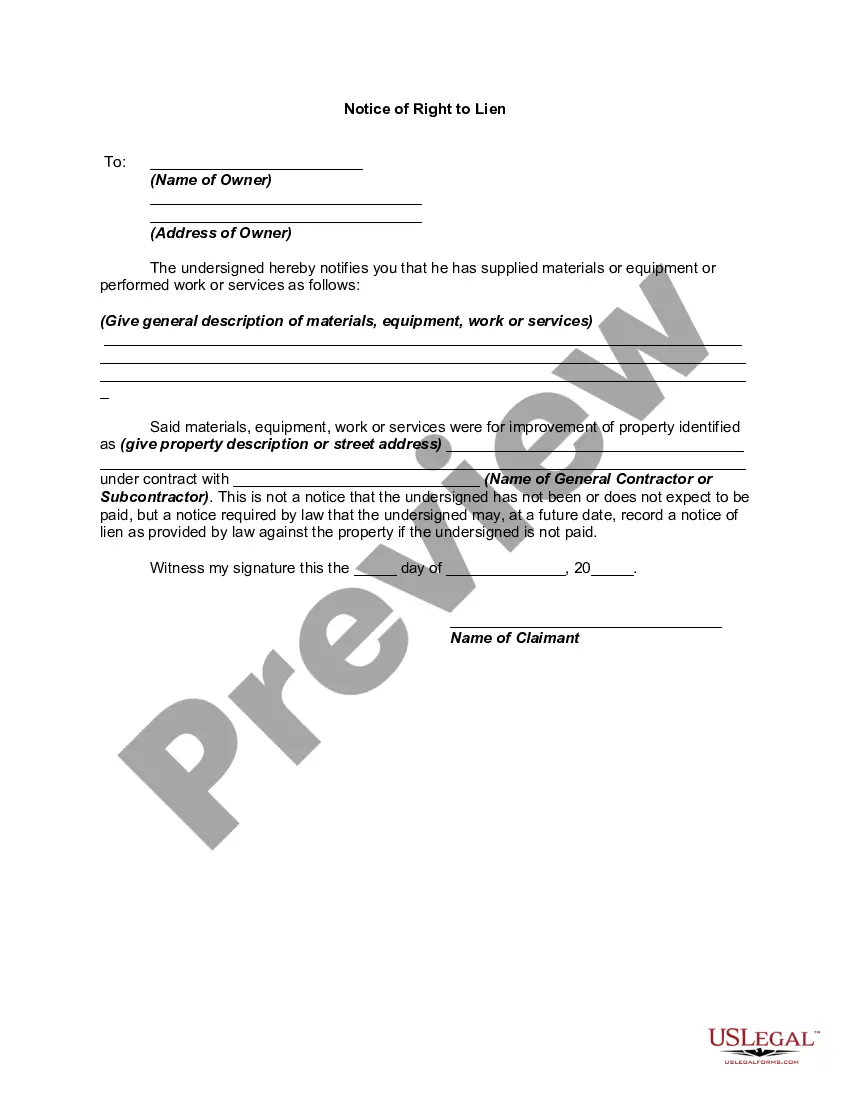

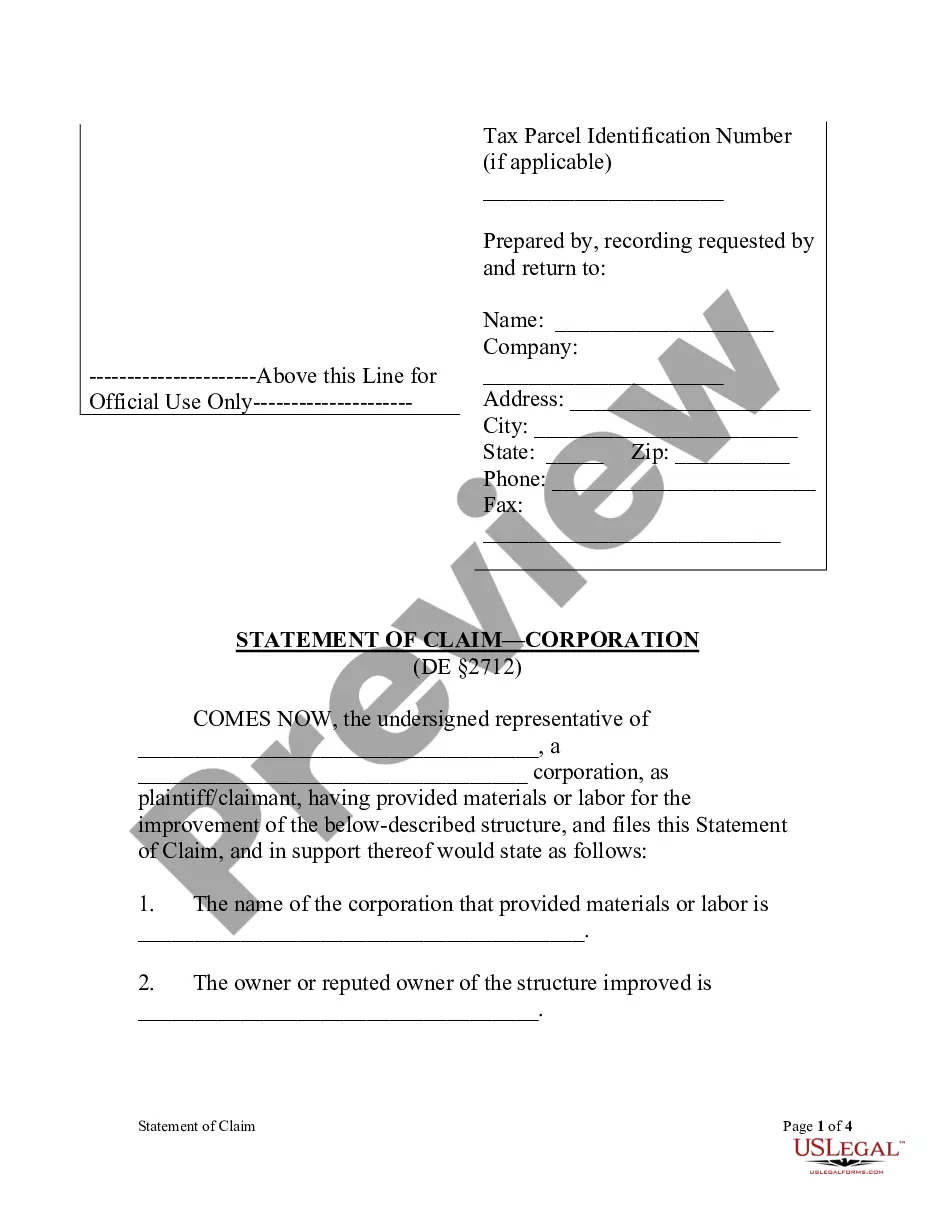

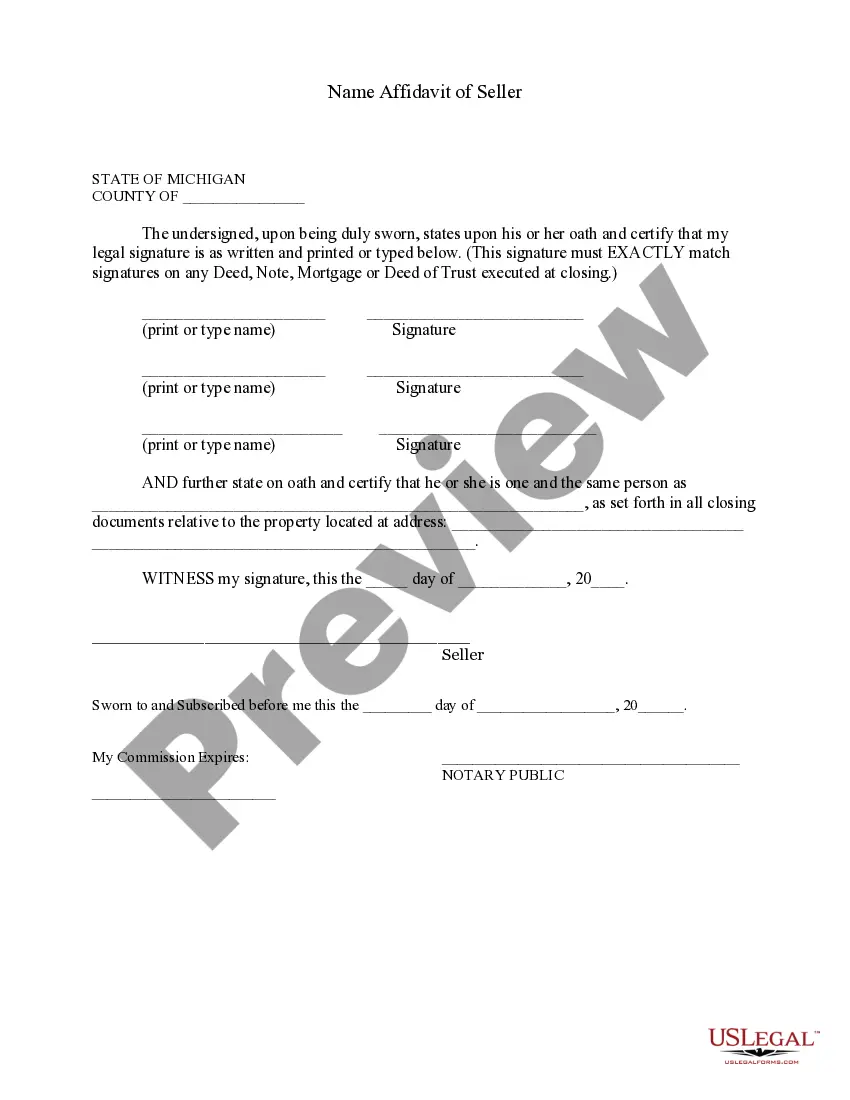

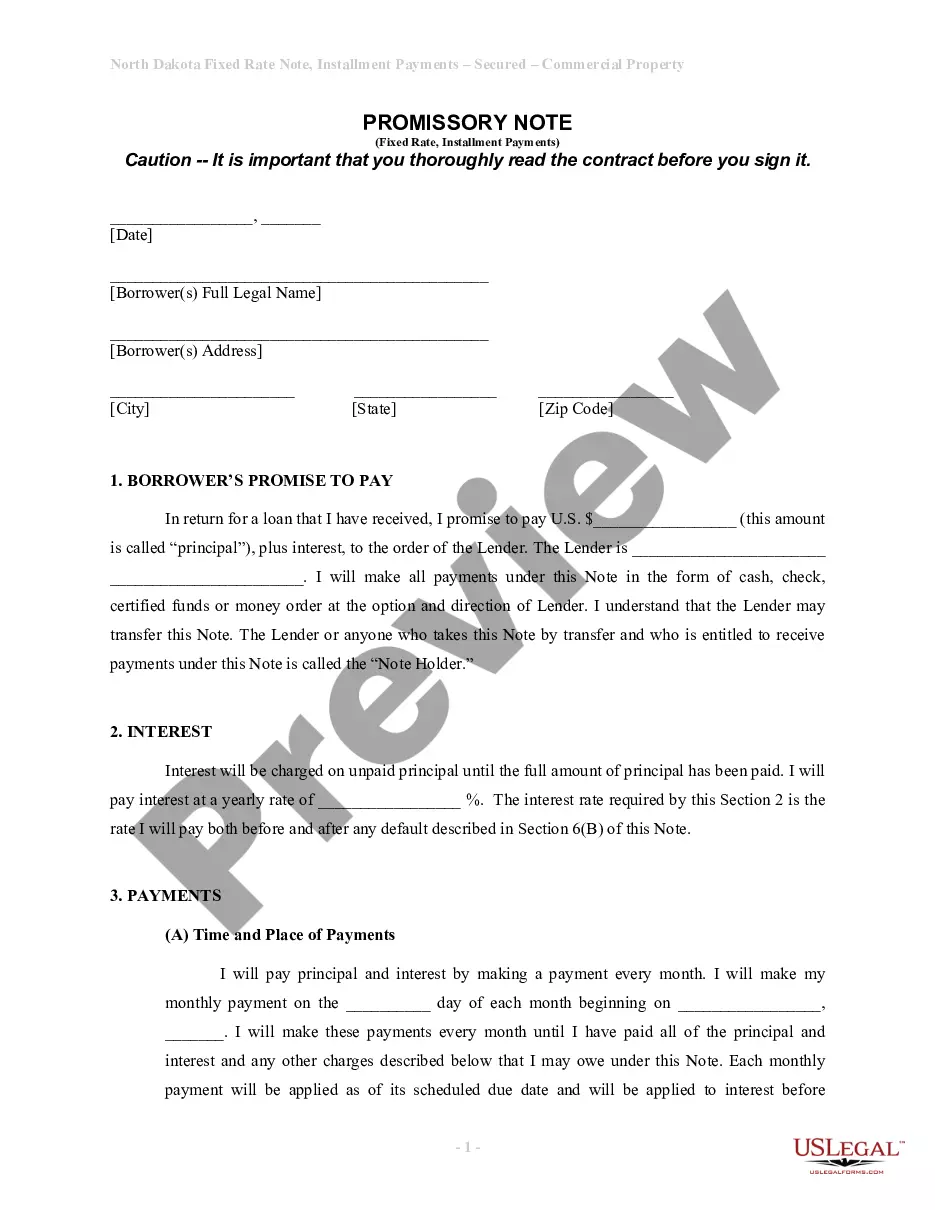

- Ensure you have found the right form by using the Review option and reading the form information.

- Select Buy Now as soon as all set, and select the monthly subscription plan that is right for you.

- Press Download then complete, sign, and print the form.

US Legal Forms has 25 years of experience supporting consumers manage their legal documents. Obtain the form you require right now and streamline any operation without breaking a sweat.

Form popularity

FAQ

Are software downloads taxable in New Jersey? Yes. You owe tax for the sale of software downloads to customers in New Jersey.

The Use Tax rate is the same as the Sales Tax rate, which is 6.625%. 6.625% Use Tax to New Jersey. company based in another state.

NJ Taxation As a seller, you have the option of calculating Sales Tax due using either the tax bracket (See Sales Tax Collection Schedule, Form ST-75) or by multiplying the taxable receipts by the applicable tax rate. If you are not using the tax bracket, you must: Calculate the tax to the third decimal point.

Make a note of the purchase amount (add shipping cost, if applicable). Get the applicable sales tax rate; in the present case, the New Jersey state sales tax is 6.625%. Check if special sales tax applies in your case. Multiply the purchase amount by the sum of applicable rates.

The State of New Jersey has a flat sales tax rate of 6.625% with no local or municipal taxes.