Special Power Of Attorney For Banking Purposes

Description

How to fill out New Jersey Special Durable Power Of Attorney For Bank Account Matters?

What is the most reliable service to obtain the Special Power Of Attorney For Banking Purposes and other up-to-date editions of legal documents.

US Legal Forms is the answer! It boasts the largest assortment of legal forms for any situation.

If you don't yet have an account in our library, here are the steps to create one: Confirm form compliance. Before acquiring any template, ensure it meets your intended use and complies with your state or county statutes. Review the form description and utilize the Preview option if available.

- Each template is expertly crafted and validated for adherence to federal and local laws.

- They are categorized by field and jurisdiction, making it simple to locate what you require.

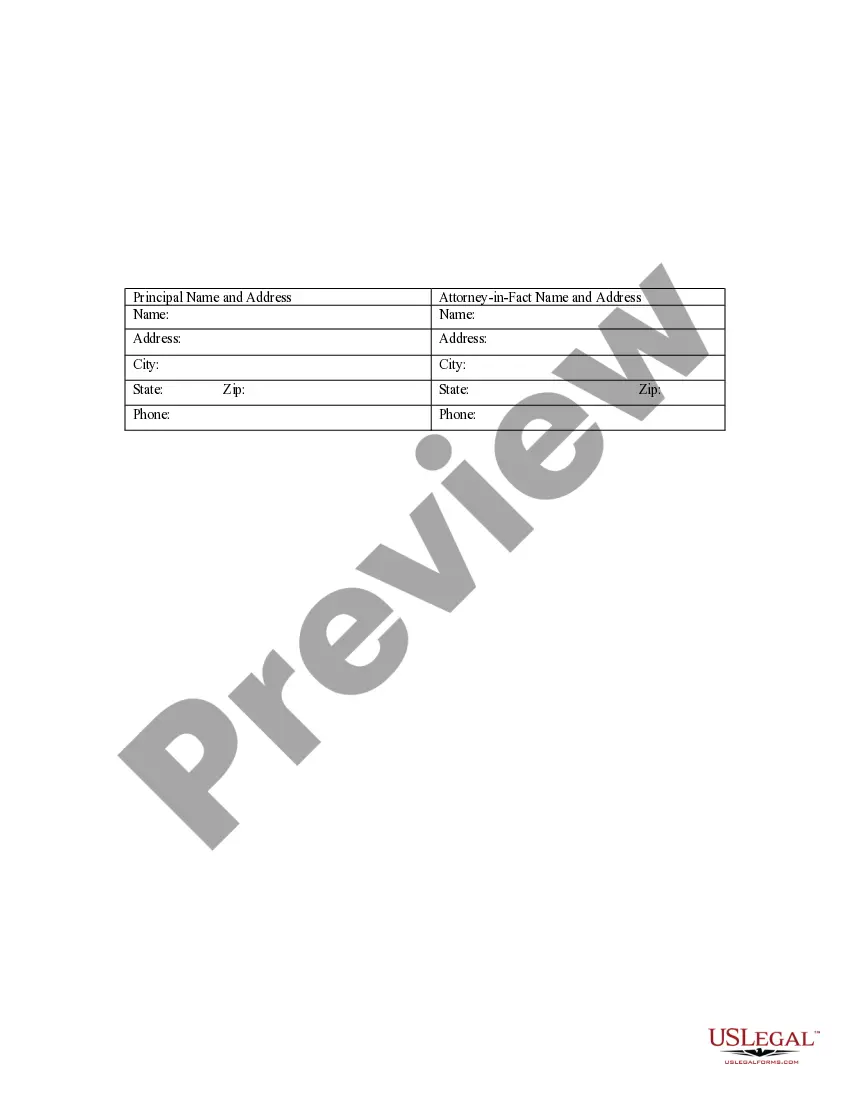

- Experienced users of the site simply need to Log In to the platform, verify their subscription status, and click the Download button next to the Special Power Of Attorney For Banking Purposes to retrieve it.

- Once saved, the document is accessible for future use within the My documents section of your account.

Form popularity

FAQ

Bank of America does not charge a fee to add a power of attorney agent to your account (if you're a Merrill Lynch or Private Bank client and have questions regarding power of attorney and your accounts, please contact your Advisor for assistance). Is there a fee to obtain a power of attorney document?

Through the use of a valid Power of Attorney, an Agent can sign checks for the Principal, withdraw and deposit funds from the Principal's financial accounts, change or create beneficiary designations for financial assets, and perform many other financial transactions.

If you need help, contact our Client Service Center at (800) 392-5749 or submit your question by Secure Message on chase.com. Establish power of attorney on a brokerage account. Along with this form, you will also need to submit a durable Power of Attorney agreement.

Common Reasons Why Banks Won't Accept a Power of Attorney A financial institution might raise objections such as these: Your POA isn't durable. If the person who made the POA is now incapacitated, the agent can't use the POA unless it's durablethat is, made to last even during incapacitation.