New Jersey Mechanics Lien Withholding

Description

Form popularity

FAQ

A no lien contract is an agreement between parties that prevents contractors or subcontractors from placing a mechanic's lien on the property. Often found in commercial agreements, these contracts ensure that all parties understand their rights and obligations upfront. It's crucial for property owners to review such contracts carefully to avoid surprises related to New Jersey mechanics lien withholding. Consider consulting US Legal Forms for expert guidance on navigating these contracts.

To put a lien on a house, contractors must file a mechanic's lien with the local county clerk in New Jersey. This legal document must detail the work performed, the amount owed, and the property address. It's essential to follow the proper procedures and deadlines to uphold your claim. US Legal Forms offers templates and services to help contractors effectively manage the New Jersey mechanics lien withholding process.

A mechanic's lien in New Jersey provides a contractor or subcontractor a legal claim against a property for unpaid services or materials. This lien secures the debt owed and can affect the property's title until the debt is satisfied. Filing a lien initiates a formal legal process, which can lead to a forced sale of the property if payments are not made. Make sure to consider using US Legal Forms for step-by-step assistance with New Jersey mechanics lien withholding.

In New Jersey, a contractor can file a mechanic's lien without a formal written contract, provided that they can demonstrate that they have delivered materials or performed services. However, the absence of a contract can complicate the process. It's essential to document everything to support your claim. Utilizing resources such as US Legal Forms can help you properly navigate the New Jersey mechanics lien withholding process.

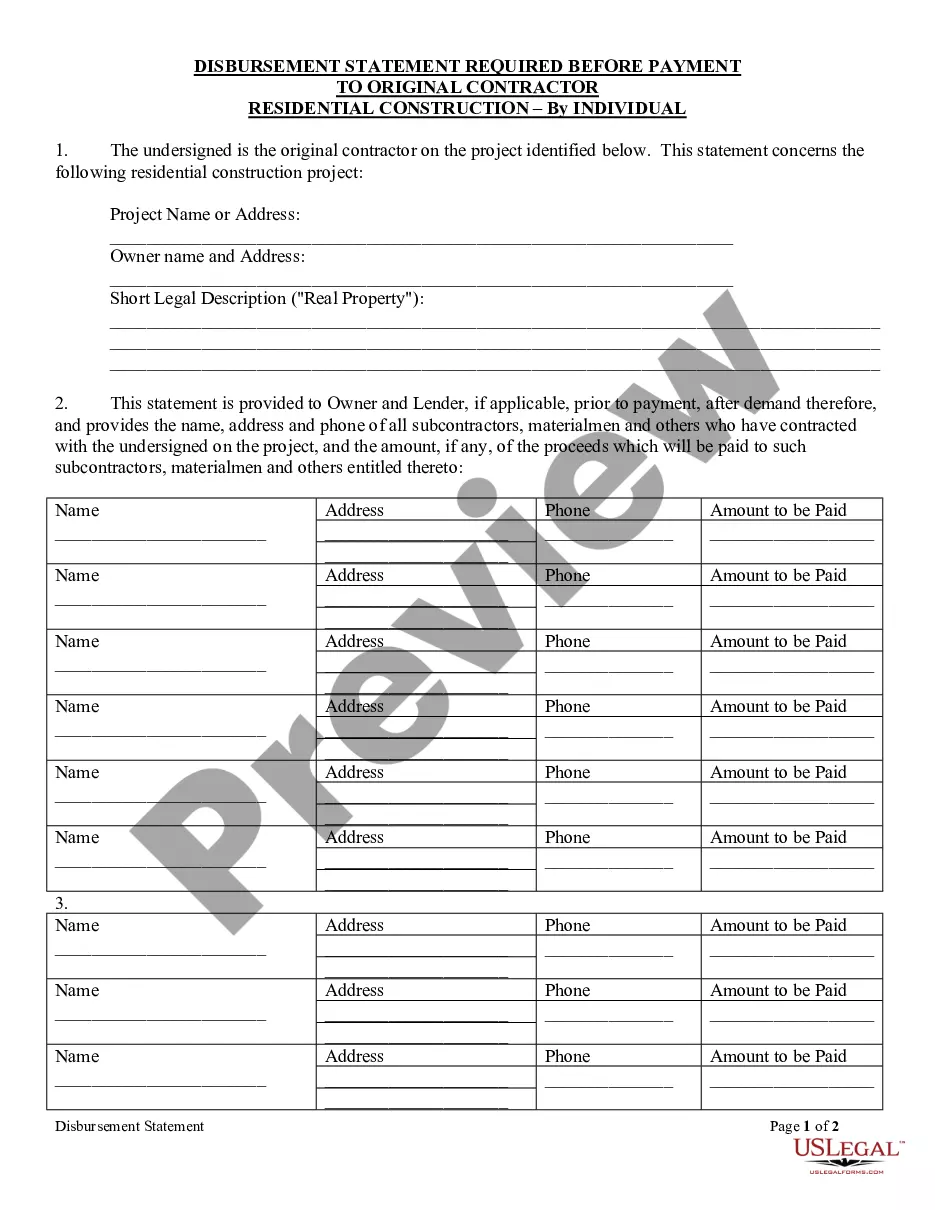

Filing a mechanics lien in New Jersey involves several important steps. Begin by preparing the lien claim form and gathering all necessary documents, such as proof of work completion and payments owed. After that, you must file the claim with the appropriate county clerk’s office. Consider using platforms like USLegalForms to streamline the filing process and ensure compliance with New Jersey mechanics lien withholding regulations.

To navigate around a mechanic's lien, you should first understand the laws behind it. You might need to provide proof of payment or negotiate with the party who filed the lien. Additionally, ensuring that you comply with all contractual obligations can help prevent any withholding related to New Jersey mechanics lien issues. Always consult a legal expert for guidance tailored to your situation.

To file a construction lien in New Jersey, first gather necessary documents, such as proof of work completed and details of the involved parties. File your lien with the county clerk's office where the property is located, ensuring you meet the filing deadline of 90 days after the last service or materials were provided. For a smoother process, consider using platforms like US Legal Forms, which can help guide you through the necessary paperwork. It's vital to understand the implications of New Jersey mechanics lien withholding during this process.

When creating a contractor's contract in New Jersey, include clear descriptions of the project scope, timelines, payment schedules, and both parties' obligations. It's also wise to stipulate provisions for changes and disputes. Along with a contract, consider the importance of documented communication to avoid misunderstandings. And remember, dealing with New Jersey mechanics lien withholding can be simpler with a well-structured agreement.

Yes, in New Jersey, contractors can file a mechanics lien even without a formal contract in certain situations. However, it's advisable to have some agreement, written or verbal, to support your claim. If you find yourself in such a position, gather any evidence of work performed or materials supplied. Understanding the implications of New Jersey mechanics lien withholding can help clarify your rights.

In New Jersey, the statute of limitations for enforcing a construction lien is typically one year from the date of the last provision of services or materials. This timeframe can impact your ability to file a lien, so it is essential to act promptly. If you need help understanding the legal timelines, consider consulting a specialist. Be aware that New Jersey mechanics lien withholding can lead to extended periods of uncertainty.