Fixed Promissory Note Without Interest

Description

How to fill out New Jersey Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Bureaucracy demands exactness and correctness.

If you do not manage the completion of documents like the Fixed Promissory Note Without Interest on a daily basis, it may result in certain confusions.

Choosing the appropriate sample from the outset will guarantee that your document submission proceeds smoothly and avert any hassles of resending a document or starting the entire process afresh.

Finding the correct and updated samples for your paperwork is a simple task of a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and enhance your efficiency with forms.

- Find the template using the search function.

- Verify that the Fixed Promissory Note Without Interest you’ve found is applicable for your state or county.

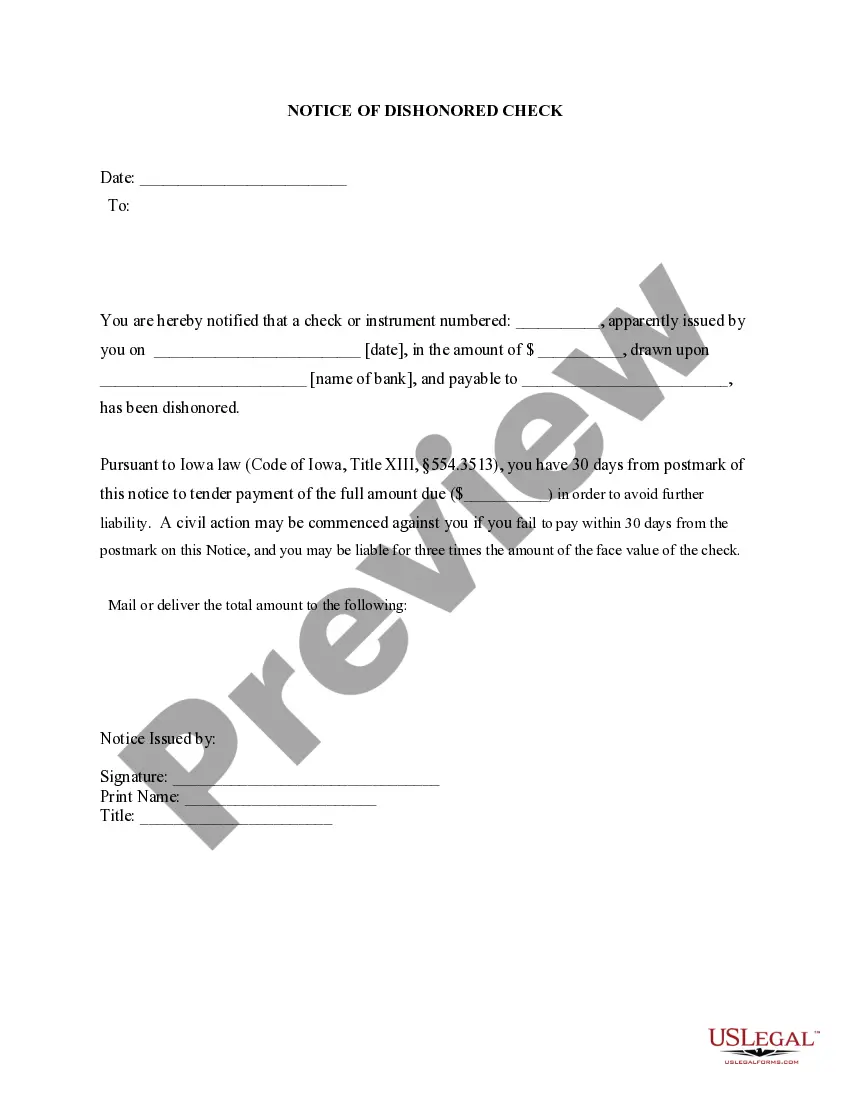

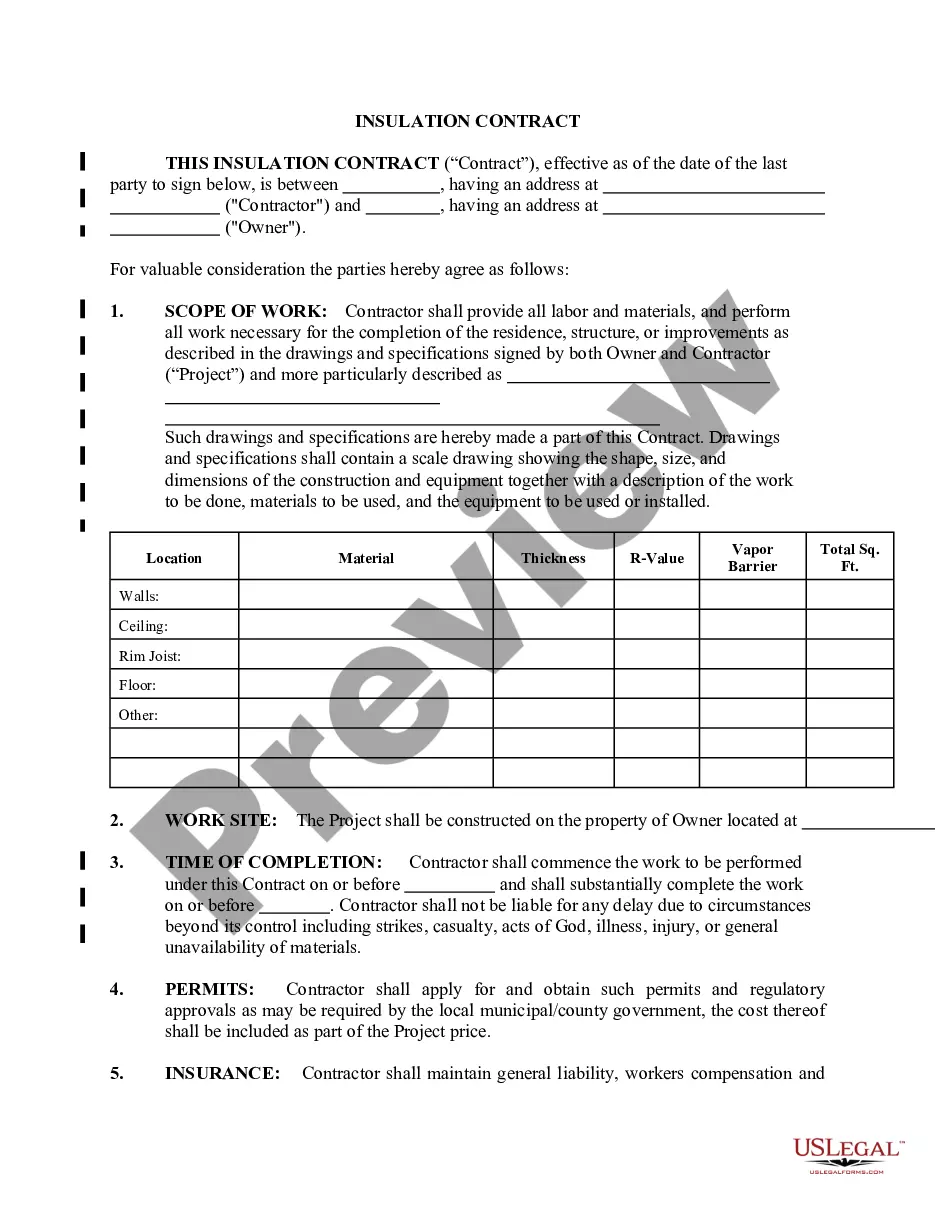

- Review the preview or read the description providing the details on the use of the template.

- If the outcome aligns with your search, click the Buy Now button.

- Select the suitable option from the offered pricing plans.

- Log In to your account or sign up for a new one.

- Finalize the purchase using a credit card or PayPal account.

- Receive the form in your preferred format.

Form popularity

FAQ

Principal and interest are payable in lawful money of the United States of America. Maker may prepay this Note in full or in part at any time without a prepayment charge. DEFAULT/ACCELERATION.

Promissory notes legally bind the borrower and lender in an agreement where the borrower is responsible for paying back a loan or debt. They lay out the conditions of the loan and detail the time frame for paying back the loan as well as any interest that might accrue over the life of the loan.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.