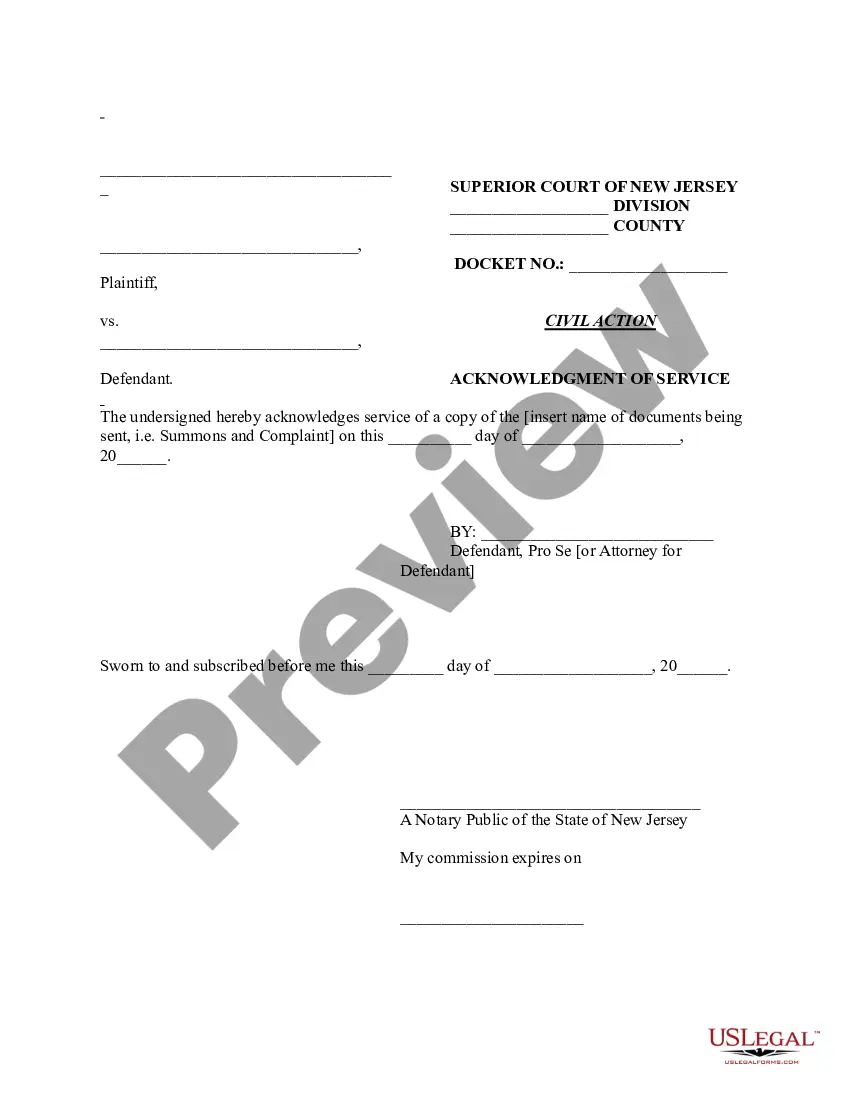

Acknowledgement Of Service Form Divorce Nj For Fill Out

Description

How to fill out New Jersey Acknowledgment Of Service?

Regardless of whether for commercial objectives or personal concerns, every individual will eventually have to handle legal circumstances in their life.

Filling out legal documents requires meticulous care, starting with selecting the appropriate form template.

With an extensive US Legal Forms library available, you do not need to waste time searching for the correct template online. Utilize the library’s user-friendly navigation to find the suitable form for any circumstance.

- For instance, if you choose an incorrect version of the Acknowledgement Of Service Form Divorce Nj For Fill Out, it will be rejected once you submit it.

- Thus, it is vital to have a trustworthy source of legal documents like US Legal Forms.

- To obtain a Acknowledgement Of Service Form Divorce Nj For Fill Out template, follow these straightforward steps.

- 1. Locate the template you need by utilizing the search bar or catalog navigation.

- 2. Review the form’s details to ensure it corresponds to your situation, state, and locale.

- 3. Click on the form’s preview to examine it.

- 4. If it is the incorrect form, return to the search feature to find the Acknowledgement Of Service Form Divorce Nj For Fill Out sample you require.

- 5. Download the template when it satisfies your needs.

- 6. If you have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- 7. If you do not have an account yet, you can acquire the form by clicking Buy now.

- 8. Select the appropriate pricing option.

- 9. Complete the profile registration form.

- 10. Choose your payment method: you can utilize a credit card or PayPal account.

- 11. Select the document format you desire and download the Acknowledgement Of Service Form Divorce Nj For Fill Out.

- 12. Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

The fee to record a Hawaii deed depends on the system in which the deed is recorded. Land Court System deeds require a $36.00 recording fee?increased to $101.00 for deeds exceeding 50 pages. Regular System deeds require a $41.00 recording fee?increased to $106.00 for deeds exceeding 50 pages.

Recording Fee ? Documents up to and including 50 pages ? $36.00 per document. Recording Fee ? Documents 51 pages or more ? $101.00 per document.

Recorded documents, which include deeds and mortgages, tax and assessment records are managed by each county. The State of Hawaii Bureau of Conveyances maintains a statewide recorder's directory.

The Bureau of Conveyances is responsible for recording instruments of property transactions between grantors and grantees in the Regular System, and for registering in the Land Court system the "Certificate of Title" of ownership for property that is decided on in the Hawai?i Land Court.

Copies of documents recorded at the BOC since January 1, 1976 can be purchased online and downloaded at . Documents recorded prior to 1976 can be ordered can be ordered by submitting a written request.

Documents recorded from 1976 are available online, if you need documents prior to 1976, visit dlnr.hawaii.gov/boc/general-public for instructions. Once registered you may search the system without cost and only pay when purchasing a document via credit card or through your subscription.

Contact the filing entity directly for detailed information regarding the lien. (For example, contact the Internal Revenue Service and/or Hawaii Department of Taxation for unpaid tax liens.)