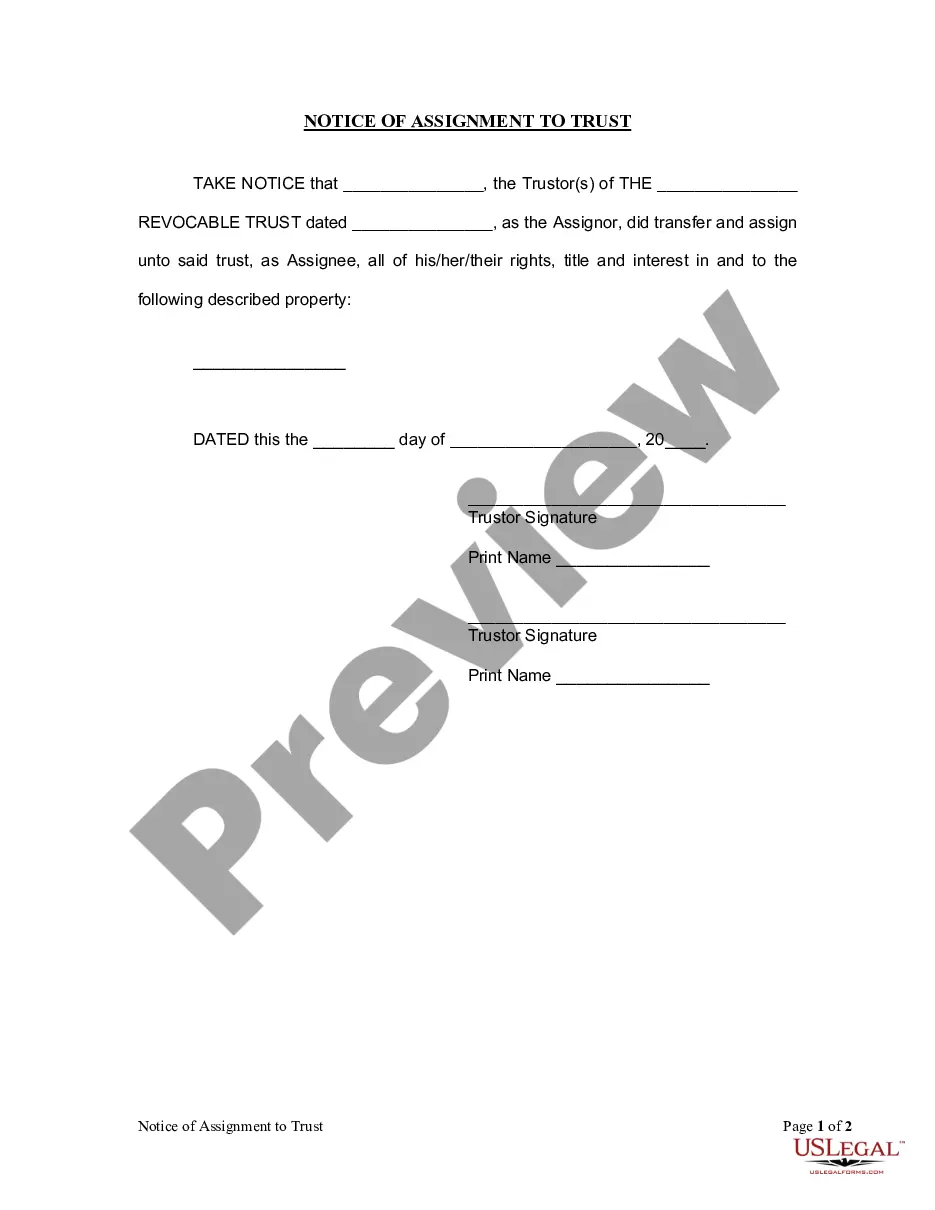

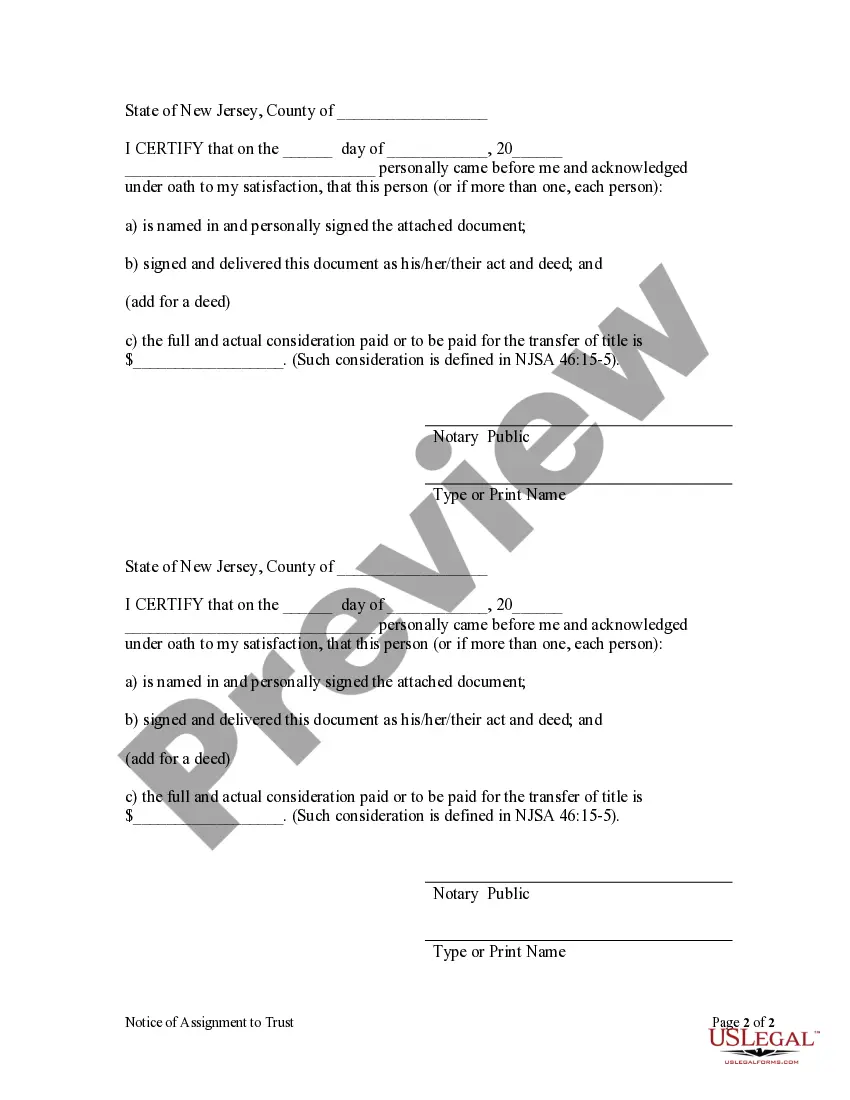

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

New Jersey Trust Withholding Tax Registration

Description

Form popularity

FAQ

Yes, if you conduct business in New Jersey, you typically need to file for a state tax registration. This step is essential for fulfilling your tax obligations, especially concerning trust withholdings. To simplify this process, consider using US Legal Forms, which offers resources and guidance to help you complete your New Jersey trust withholding tax registration effectively.

To obtain a tax ID number in New Jersey, you can apply through the New Jersey Division of Taxation. You may complete the application process online, or you can file it by mail. Having this tax ID number is vital for managing tax-related responsibilities, particularly if you are dealing with New Jersey trust withholding tax registration.

No, a tax registration number and an Employer Identification Number (EIN) are not the same, although both serve important functions. The EIN is specifically used for federal tax purposes and is obtained from the IRS. In contrast, a tax registration number pertains to state-level tax obligations, including New Jersey trust withholding tax registration. Both numbers are crucial for businesses operating in New Jersey.

A state tax registration number is a number assigned to businesses and individuals for the purpose of collecting and remitting state taxes. Each state has its process for issuing these numbers, and they are essential for maintaining compliance with state tax laws. If you are processing trust withholdings, ensure that you have your New Jersey trust withholding tax registration in place.

To find your New Jersey tax registration number, you can refer to your tax documents or account statements issued by the New Jersey Division of Taxation. Additionally, you can access your online account through the New Jersey Department of Treasury or contact their office directly for assistance. Keeping track of this number is particularly important for activities related to New Jersey trust withholding tax registration.

In New Jersey, a tax registration number is a unique identifier assigned to businesses for tax purposes. It helps the state track tax obligations and ensures compliance with tax laws. If you are involved in financial activities related to trust withholding, having this registration is crucial for proper reporting and payment.

In New Jersey, a TIN number is a unique identifier assigned to individuals and businesses for tax purposes. This number helps the state track tax obligations effectively. Knowing your TIN is important, especially when you're handling your New Jersey trust withholding tax registration.

The New Jersey registration form (often referred to as the NJ reg form) is a document used for various purposes, including tax registration. This form collects information about your business and its structure. Completing this form is necessary if you are preparing for your New Jersey trust withholding tax registration.

To obtain a TIN number in New Jersey, you can apply through the IRS by completing the appropriate forms online or via mail. The application process may require your personal and business information to ensure accuracy. This step is vital for anyone looking to complete their New Jersey trust withholding tax registration properly.

A TIN (Taxpayer Identification Number) and an EIN (Employer Identification Number) serve different purposes, but both are crucial for tax matters. A TIN is generally used for individuals, while an EIN is designated for businesses. Understanding the difference is important when navigating your New Jersey trust withholding tax registration.