Property Exchange Agreement Form For Rental

Description

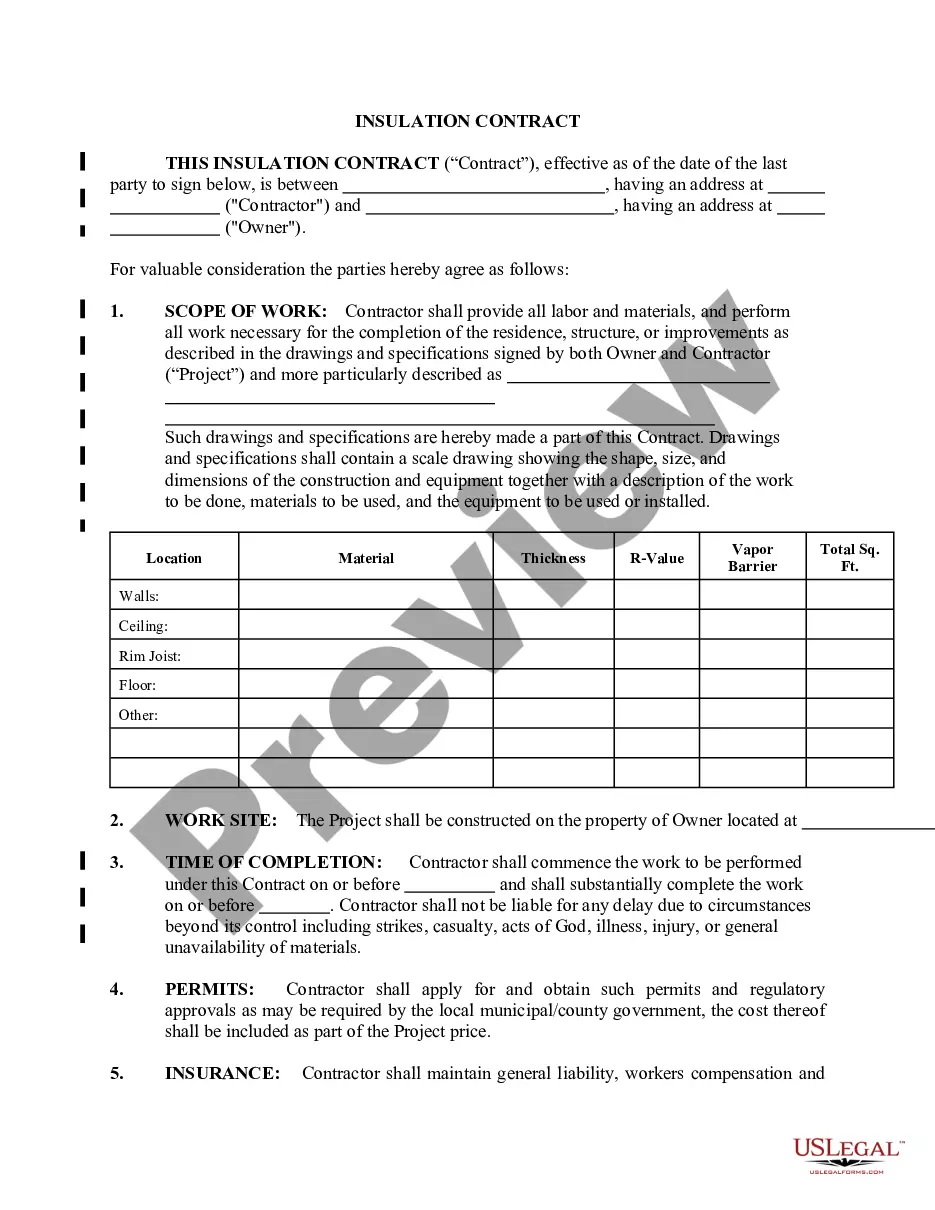

How to fill out New Jersey Property Exchange Agreement?

Navigating through the administration of official paperwork and templates can be difficult, particularly when one is not engaged in such tasks professionally.

Even locating the appropriate template to acquire a Property Exchange Agreement Form For Rental will be laborious, as it must be valid and accurate to the last detail.

Nonetheless, you will require considerably less time obtaining a suitable template if it originates from a source you can trust.

Obtain the correct form in a few straightforward steps: Enter the document title in the search box. Identify the appropriate Property Exchange Agreement Form For Rental on the result list. Review the description of the sample or open its preview. If the template meets your needs, click Buy Now. Continue to select your subscription plan. Use your email to create a password to set up an account at US Legal Forms. Choose a credit card or PayPal as your payment method. Save the template document on your device in your preferred format. US Legal Forms will save you considerable time in determining if the form you found online meets your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the procedure of finding the correct forms online.

- US Legal Forms serves as a singular location where one can access the most current samples of documents, verify their usage, and download these samples to complete them.

- This is a repository containing over 85K forms applicable across various industries.

- When searching for a Property Exchange Agreement Form For Rental, you won’t have to doubt its authenticity as every form is validated.

- Creating an account at US Legal Forms ensures you have all the necessary samples at your fingertips.

- You can store them in your history or add them to the My documents collection.

- Access your saved forms from any device simply by clicking Log In on the library website.

- If you still lack an account, you can always search for the template you seek.

Form popularity

FAQ

The IRS requires that if any party to a transaction wishes to do a 1031 Exchange, all parties to the closing are made aware.

An exchange agreement, also called the exchange contract, is a written agreement between the exchanger and the Qualified Intermediary (QI) defining the transfer of the relinquished property, the ensuing purchase of the replacement property, and the restrictions on the exchange proceeds during the exchange period.

Seller is aware and acknowledges that Buyer intends to perform an IRC Section 1031 tax deferred exchange. Buyer requests Seller's cooperation in such an exchange and agrees to hold Seller harmless from any and all claims, costs, liabilities, or delays in time resulting from such an exchange.

A property exchange agreement is a contract between two parties in which each party agrees to exchange specific assets. The purpose of a property exchange agreement is to simplify transferring ownership of assets.

Use Parts I, II, and III of Form 8824 to report each exchange of business or investment real property for real property of a like kind. Form 8824 figures the amount of gain deferred as a result of a like-kind exchange.