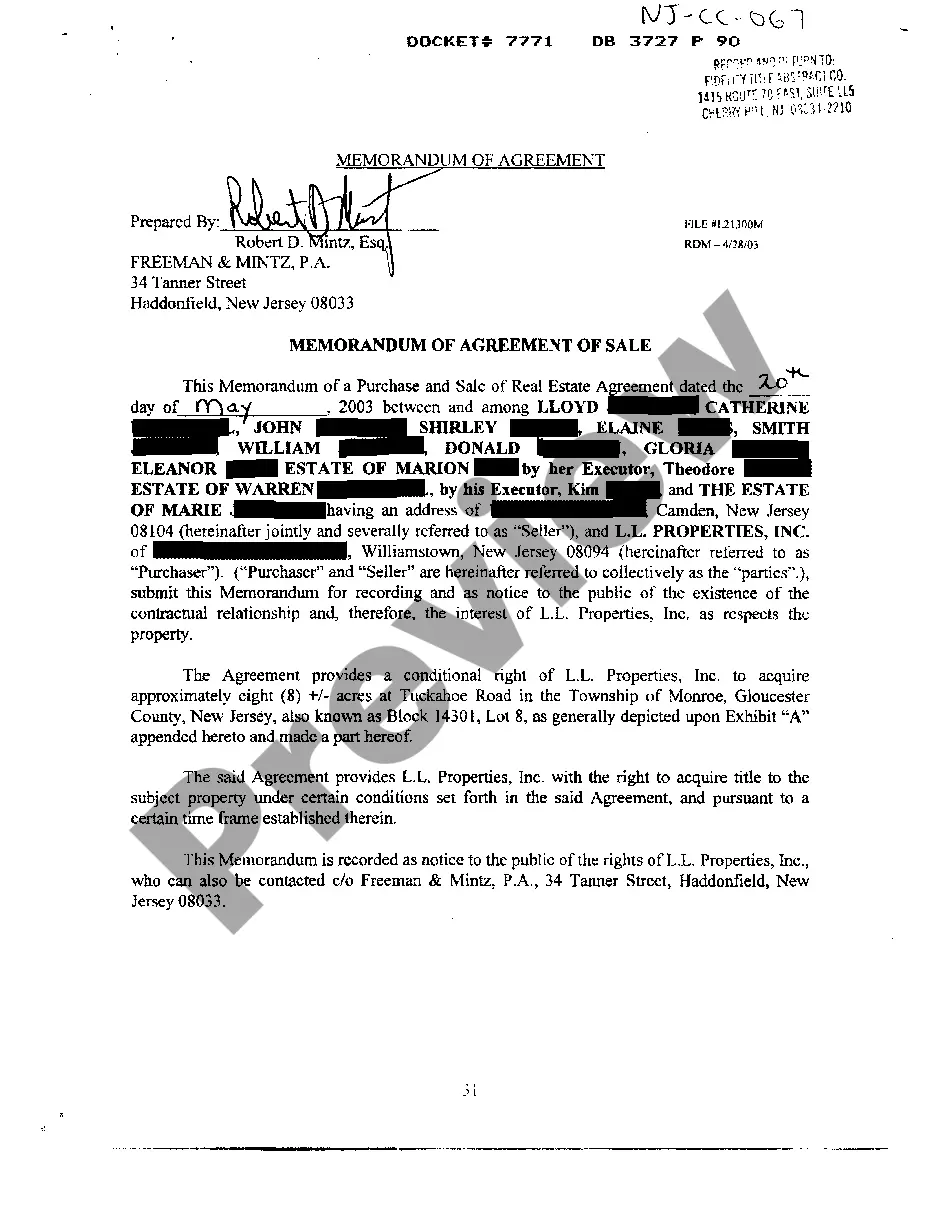

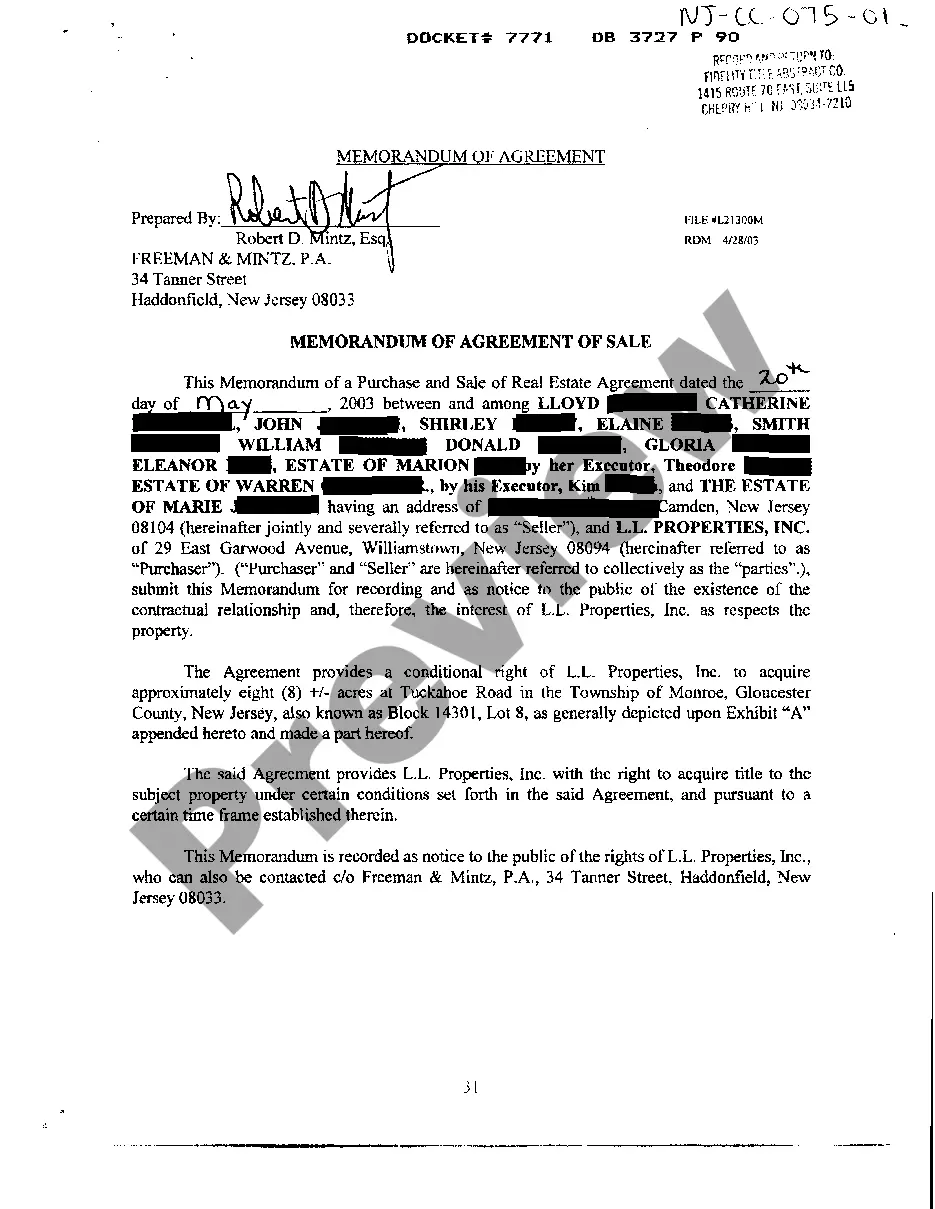

New Jersey Real Estate Sales Contracts Memorandums Form

Description

How to fill out New Jersey Memorandum Of Agreement Of Sale Of Property?

Bureaucracy requires meticulousness and exactitude.

If you do not manage completing documentation like New Jersey Real Estate Sales Contracts Memorandums Form regularly, it may lead to some confusions.

Selecting the correct template from the outset will guarantee that your document submission proceeds without a hitch and avert any troubles of resending a document or repeating the same effort from the beginning.

Obtaining the correct and current samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate the concerns of bureaucracy and simplify your paperwork process.

- Locate the template using the search function.

- Ensure the New Jersey Real Estate Sales Contracts Memorandums Form you’ve found is applicable to your state or county.

- View the preview or examine the description providing the details on the application of the template.

- If the result meets your requirements, click the Buy Now button.

- Choose the appropriate option among the available pricing plans.

- Log In to your account or sign up for a new one.

- Complete the transaction using a credit card or PayPal payment method.

- Download the form in your preferred format.

Form popularity

FAQ

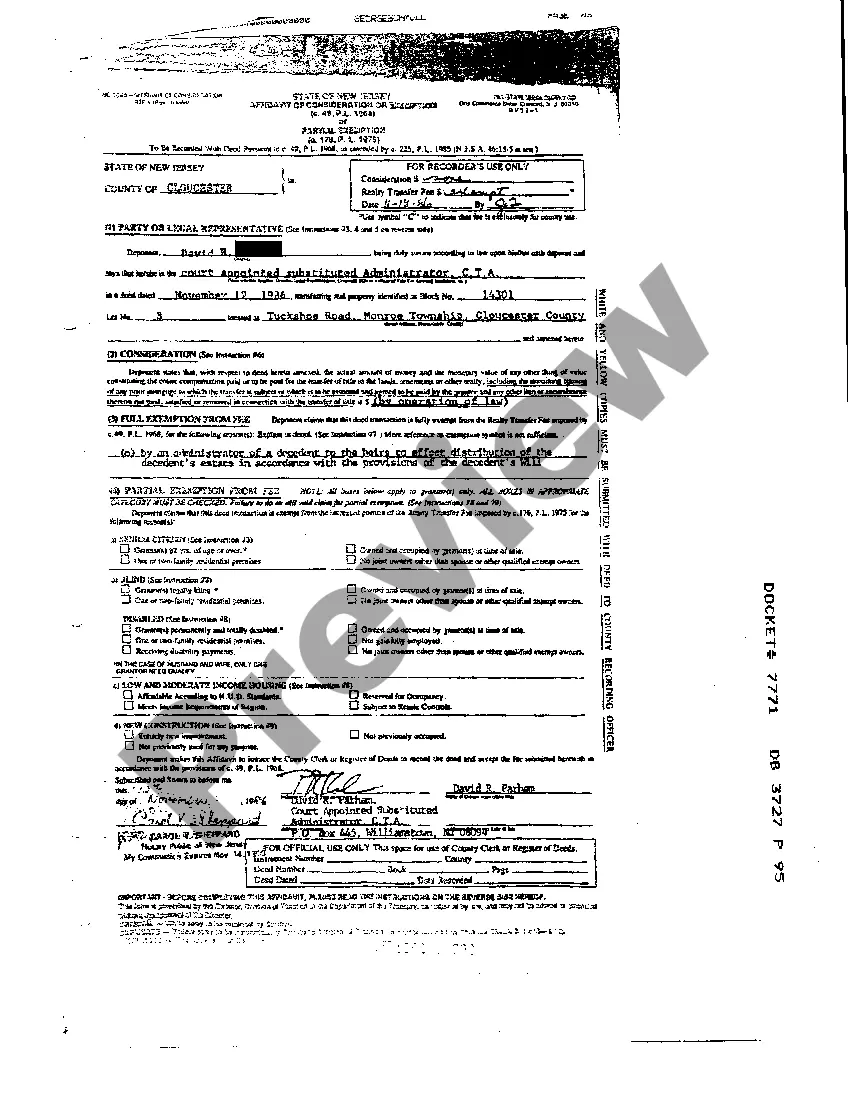

Generally, in New Jersey, the Seller pays the Transfer Tax. If you qualify for an exemption, you are entitled to pay a reduced amount. Consult your attorney to see if any of these exemptions apply to you. Note:If purchase price is over 1 million dollars, a 1% mansion tax may be due.

How to write a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

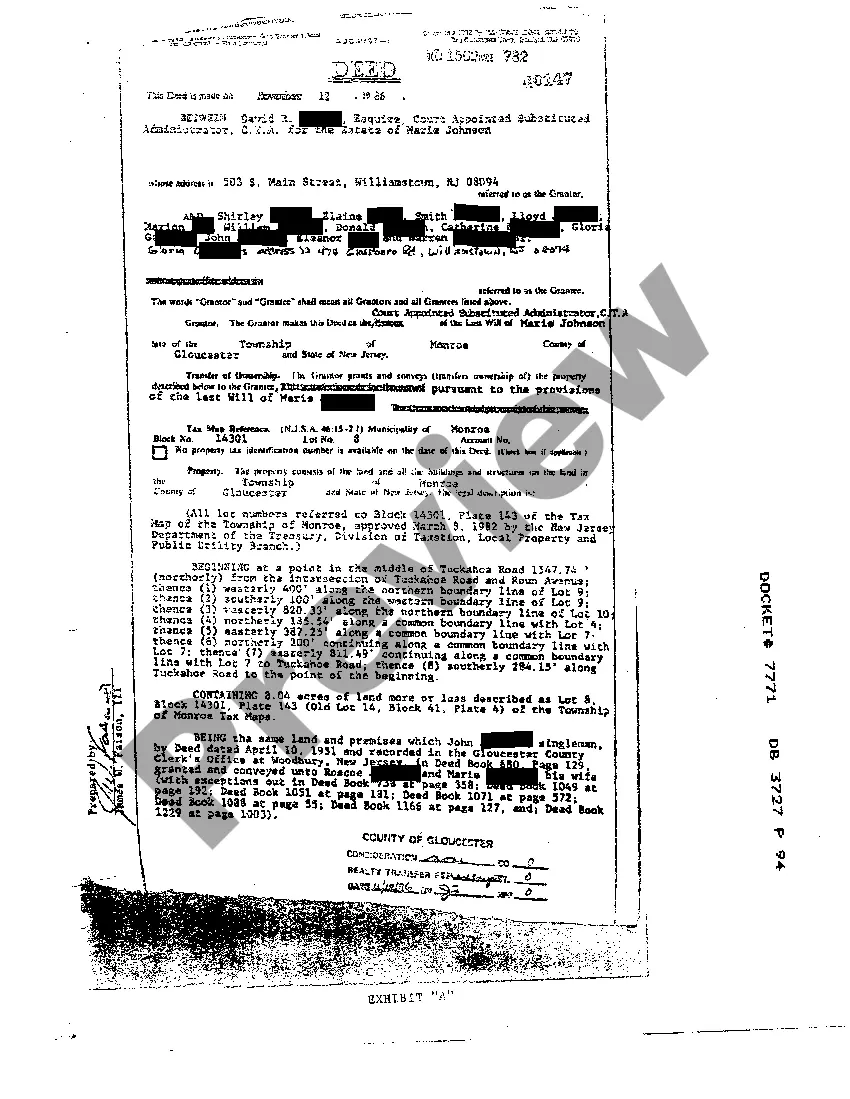

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

Writing a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...