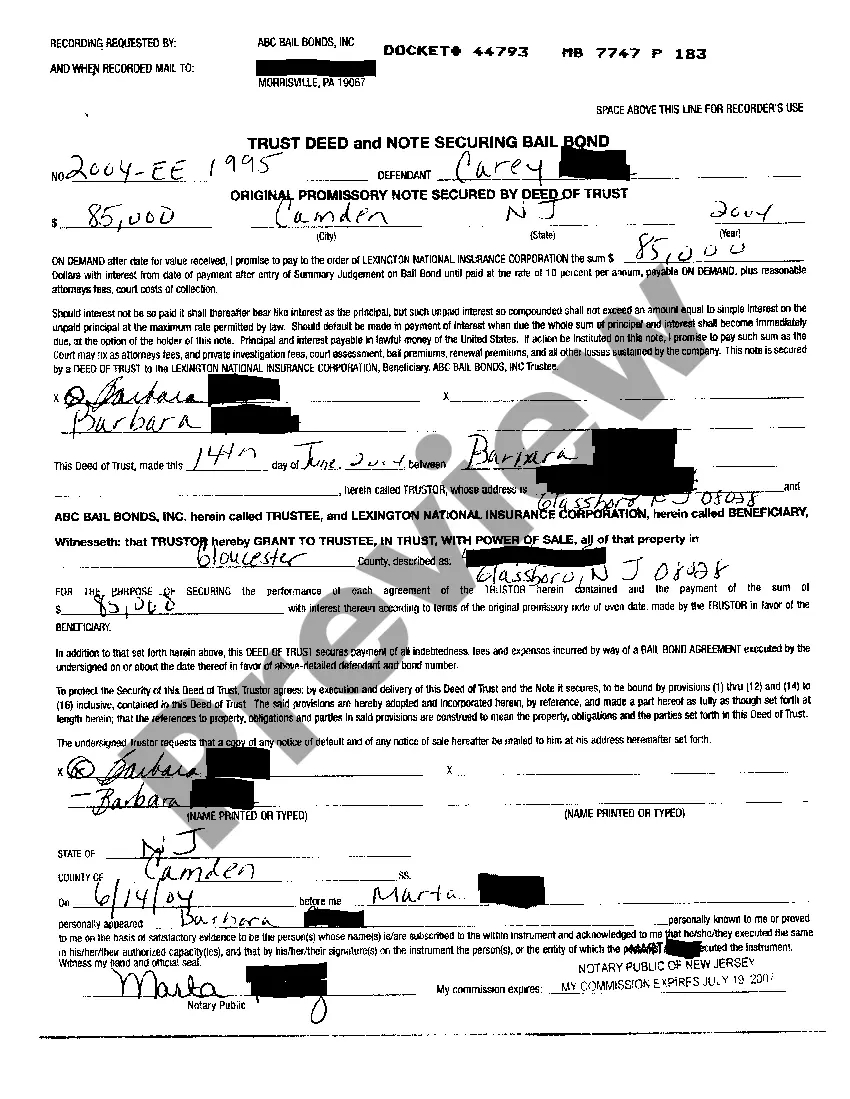

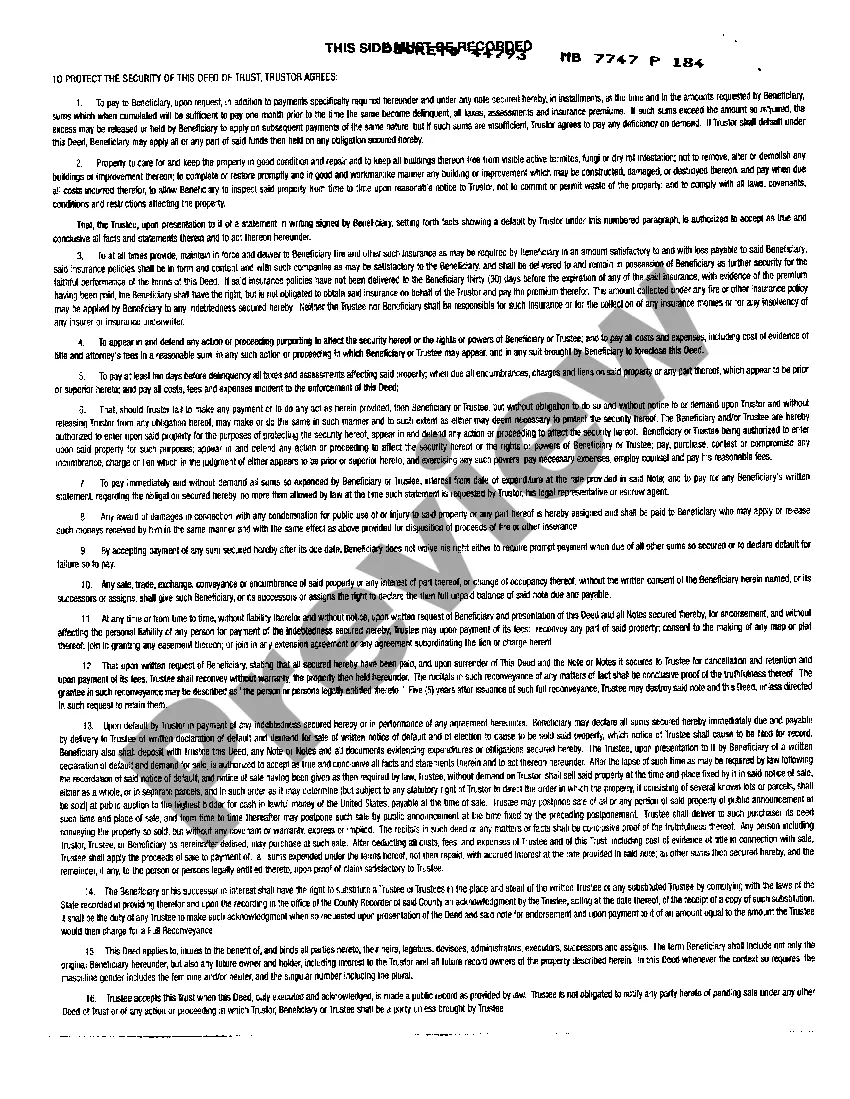

Bond Trust Deed Withdrawal

Description

How to fill out Bond Trust Deed Withdrawal?

Maneuvering through the red tape of official documents and formats can be challenging, particularly when one is not accustomed to doing so professionally.

Selecting the appropriate template for a Bond Trust Deed Withdrawal can be labor-intensive, as it must be valid and precise down to the last digit.

However, you will substantially reduce the time spent sourcing a suitable template from a trustworthy resource.

Obtain the correct form in a few straightforward steps: Enter the document title in the search field, locate the relevant Bond Trust Deed Withdrawal from the result list, review the outline of the sample or view its preview, click Buy Now when the template meets your requirements, select your subscription plan, register an account at US Legal Forms using your email and a password, choose a payment method via credit card or PayPal, and save the template file on your device in your preferred format. US Legal Forms can save you considerable time verifying if the form you found online is suitable for your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the task of finding the correct forms online.

- US Legal Forms is a single source you need to access the latest examples of documents, learn about their usage, and download these samples for completion.

- It comprises over 85K forms that are relevant across various fields.

- When searching for a Bond Trust Deed Withdrawal, there will be no doubt regarding its validity, as all forms are authenticated.

- Creating an account at US Legal Forms will guarantee that you have all the essential samples at your disposal.

- You can store them in your history or add them to the My documents catalog.

- Your saved forms can be retrieved from any device by simply clicking Log In at the library website.

- If you do not yet have an account, you can always search again for the template you require.

Form popularity

FAQ

The 5 tax deferred allowance allows you to withdraw up to 5 percent of your investment without incurring tax penalties for a certain period. This feature is beneficial for maintaining the tax-deferred status of your bond. Understanding this allowance can make planning your bond trust deed withdrawal smoother, helping you use your investment wisely.

Yes, you can withdraw from an investment bond at any time, but there are rules governing how much you can withdraw without incurring tax penalties. Bond trust deed withdrawal can be a flexible option, giving you access to funds as needed, but it’s important to understand the regulations surrounding your specific bond.

The 125% rule applies to additional contributions to your investment bond, allowing you to add to your investment without affecting tax benefits. You can contribute up to 125 percent of the previous year’s contributions while maintaining the tax advantages. This is particularly beneficial when considering future bond trust deed withdrawal needs.

The 5 withdrawal rule allows you to take out a specific portion of your investment bond annually, which generally equals 5 percent of the bond’s value. By following this rule, you can minimize tax impacts while accessing your funds. This strategy enhances your financial flexibility in relation to bond trust deed withdrawal.

The 5 percent rule establishes a guideline for withdrawals from onshore bonds without incurring a tax liability. Essentially, you can withdraw up to 5 percent of your investment each year without triggering any immediate tax implications. This helps you manage your investment while enjoying the benefits of a bond trust deed withdrawal.

When you withdraw from an investment bond, it can affect your taxable income. Generally, if the withdrawal exceeds the amount you invested, the excess may count as income. Understanding the implications of bond trust deed withdrawal is essential for tax planning.

Yes, you can withdraw from a bond, but be mindful of the rules that apply. Most notably, cashing out too early might result in penalties and loss of accrued interest. This aspect of bond trust deed withdrawal underlines the importance of evaluating your financial goals and options carefully.

While I bonds offer a safe investment with inflation protection, there are some downsides. They have restrictions on withdrawal timelines and penalties for early cashing. Understanding these nuances is crucial for managing your investments effectively, especially in the context of bond trust deed withdrawal.

Cashing out an I bond before it matures incurs a penalty. Specifically, you will lose the last three months of interest earned. Always keep in mind bond trust deed withdrawal choices, as this can affect your overall investment strategy.

Yes, you can withdraw a bond before it matures. However, be aware of potential penalties and lost interest. This type of situation often leads to bond trust deed withdrawal considerations, so weigh your options carefully before making a decision.