New Jersey Business Nj Form Nj-reg

Description

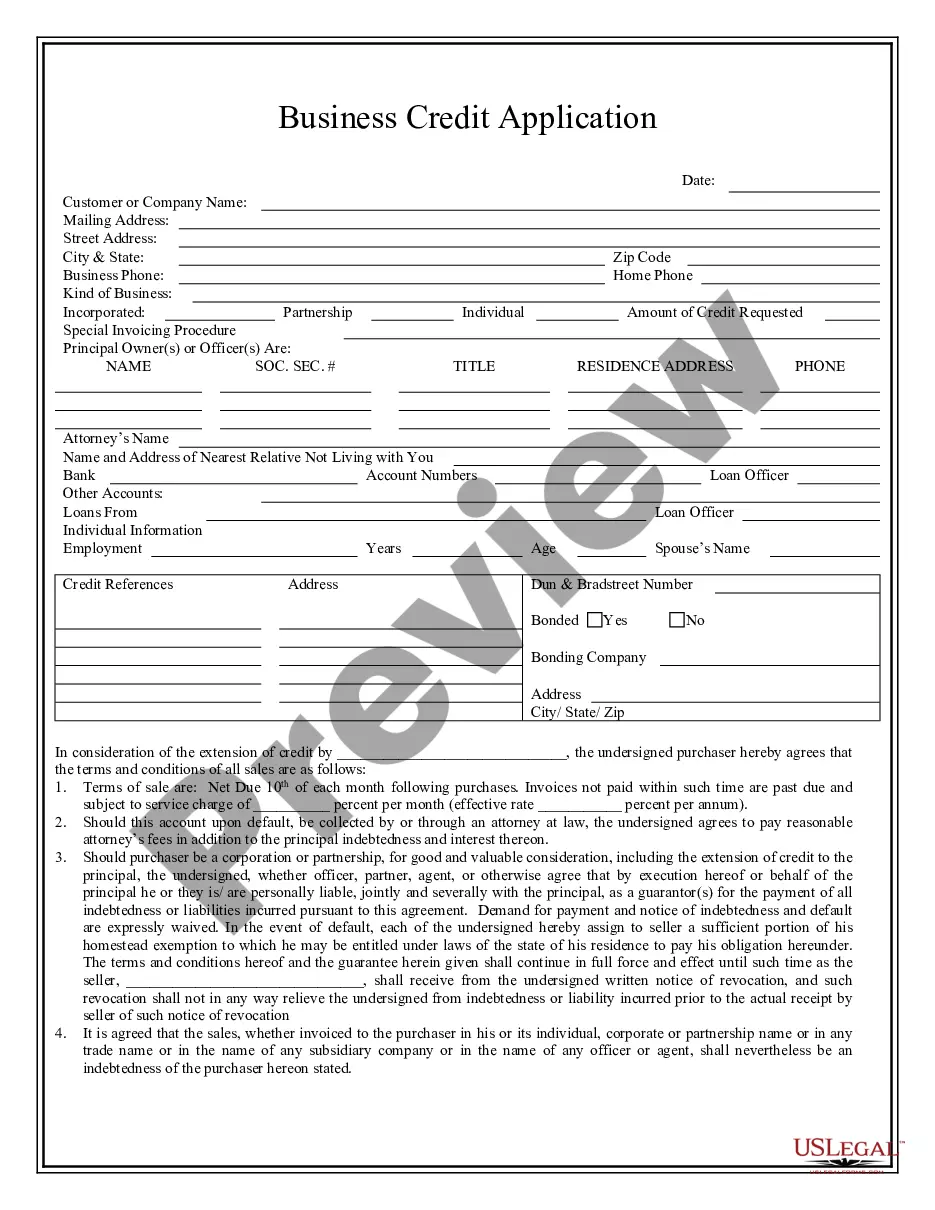

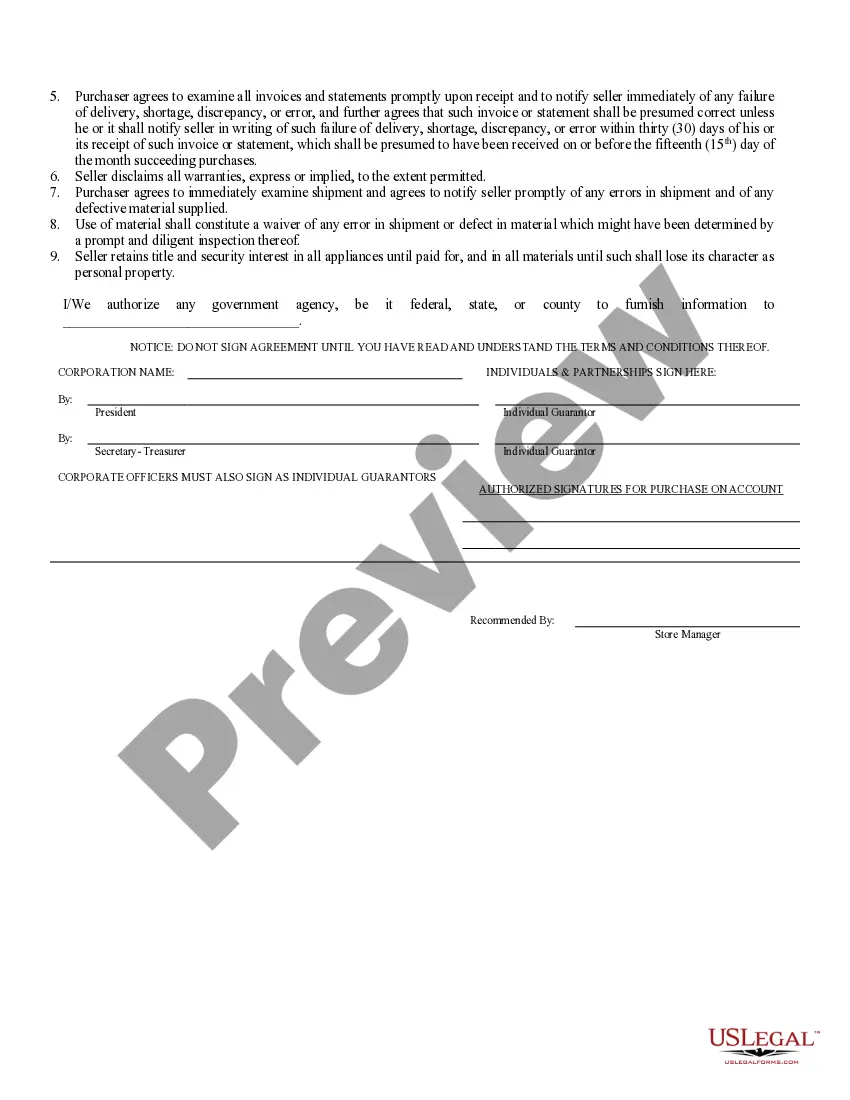

How to fill out New Jersey Business Credit Application?

Working with legal documents and operations could be a time-consuming addition to the day. New Jersey Business Nj Form Nj-reg and forms like it usually require you to look for them and navigate the best way to complete them properly. As a result, regardless if you are taking care of financial, legal, or individual matters, having a comprehensive and practical web library of forms at your fingertips will go a long way.

US Legal Forms is the top web platform of legal templates, offering over 85,000 state-specific forms and a number of resources that will help you complete your documents effortlessly. Discover the library of relevant papers available with just one click.

US Legal Forms gives you state- and county-specific forms offered at any moment for downloading. Safeguard your document managing procedures having a high quality support that lets you make any form in minutes without any additional or hidden charges. Just log in in your profile, find New Jersey Business Nj Form Nj-reg and download it right away in the My Forms tab. You may also gain access to formerly downloaded forms.

Would it be your first time using US Legal Forms? Sign up and set up up an account in a few minutes and you’ll gain access to the form library and New Jersey Business Nj Form Nj-reg. Then, follow the steps below to complete your form:

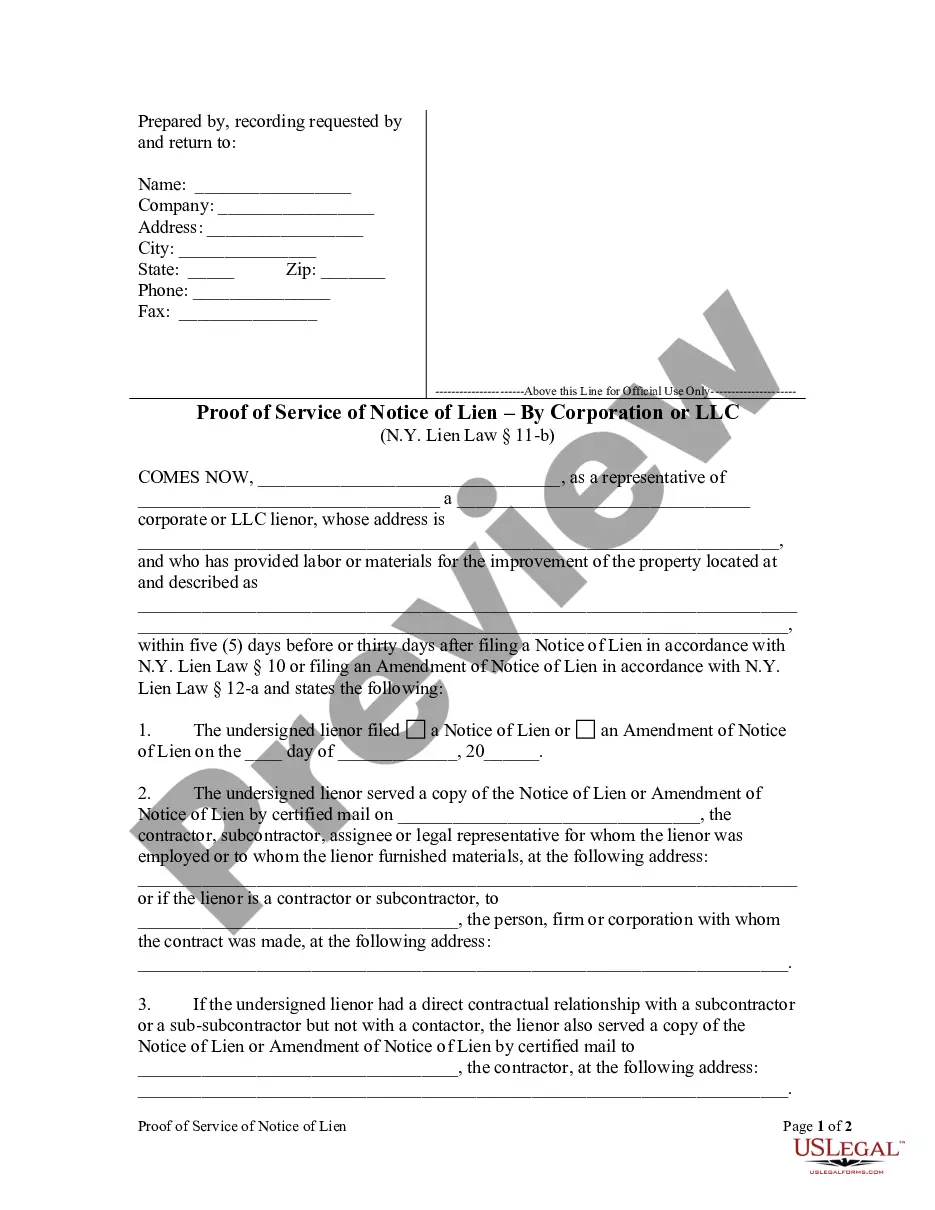

- Be sure you have found the proper form using the Review option and looking at the form information.

- Select Buy Now as soon as all set, and select the subscription plan that suits you.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of experience supporting consumers manage their legal documents. Find the form you require today and enhance any operation without breaking a sweat.

Form popularity

FAQ

Filing your Public Records Filing for New Business Entity (the New Jersey equivalent of Articles of Organization) carries a fee of $125. You can submit the filing in person, through the mail or by fax, or you can do it online through New Jersey's Online Business Formation portal.

All businesses must complete the registration application (NJ-REG, pages 17-19) in order to receive the forms, returns, instructions, and other information needed to comply with New Jersey laws.

Two Ways to Start A New Business in New Jersey Define your business concept. Draft a business plan. Choose a business name. Fund your startup costs. Choose a business structure. Register your business with the New Jersey Secretary of State. Get your business licenses. Set up a business bank account.

Your New Jersey tax identification (ID) number has 12 digits. If you have a Federal Employer Identification Number (FEIN) assigned by the Internal Revenue Service (IRS), your New Jersey tax ID number is your FEIN followed by a 3 digit suffix. If you do not have a suffix, enter three zeroes.

After you form your business, you will obtain a Certificate of Formation or Certificate of Authority which will display your Entity ID. An Entity ID is a 10-digit number used to identify your corporate business records. Your corporate records are public and kept separate from your tax records, which are confidential.