New Jersey Modification Withdrawal Of Foreign Corporation

Description

How to fill out New Jersey Modification Withdrawal Of Foreign Corporation?

There’s no longer a need to waste time searching for legal documents to adhere to your local state laws. US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our platform provides over 85,000 templates for any business and personal legal situations categorized by state and area of use. All forms are properly drafted and affirmed for accuracy, ensuring you receive a current New Jersey Modification Withdrawal Of Foreign Corporation.

If you are acquainted with our service and already possess an account, be sure your subscription is active before acquiring any templates. Log In to your account, choose the document, and click Download. You can also revisit all obtained documents at any time by accessing the My documents tab in your profile.

Select the file format for your New Jersey Modification Withdrawal Of Foreign Corporation and download it to your device. Print your form for manual completion or upload the template if you prefer to work in an online editor. Creating official documents under federal and state laws and regulations is quick and simple with our library. Try out US Legal Forms now to maintain your documentation organized!

- If you’ve never utilized our service before, the procedure will require additional steps to finish.

- Here’s how new users can discover the New Jersey Modification Withdrawal Of Foreign Corporation in our catalog.

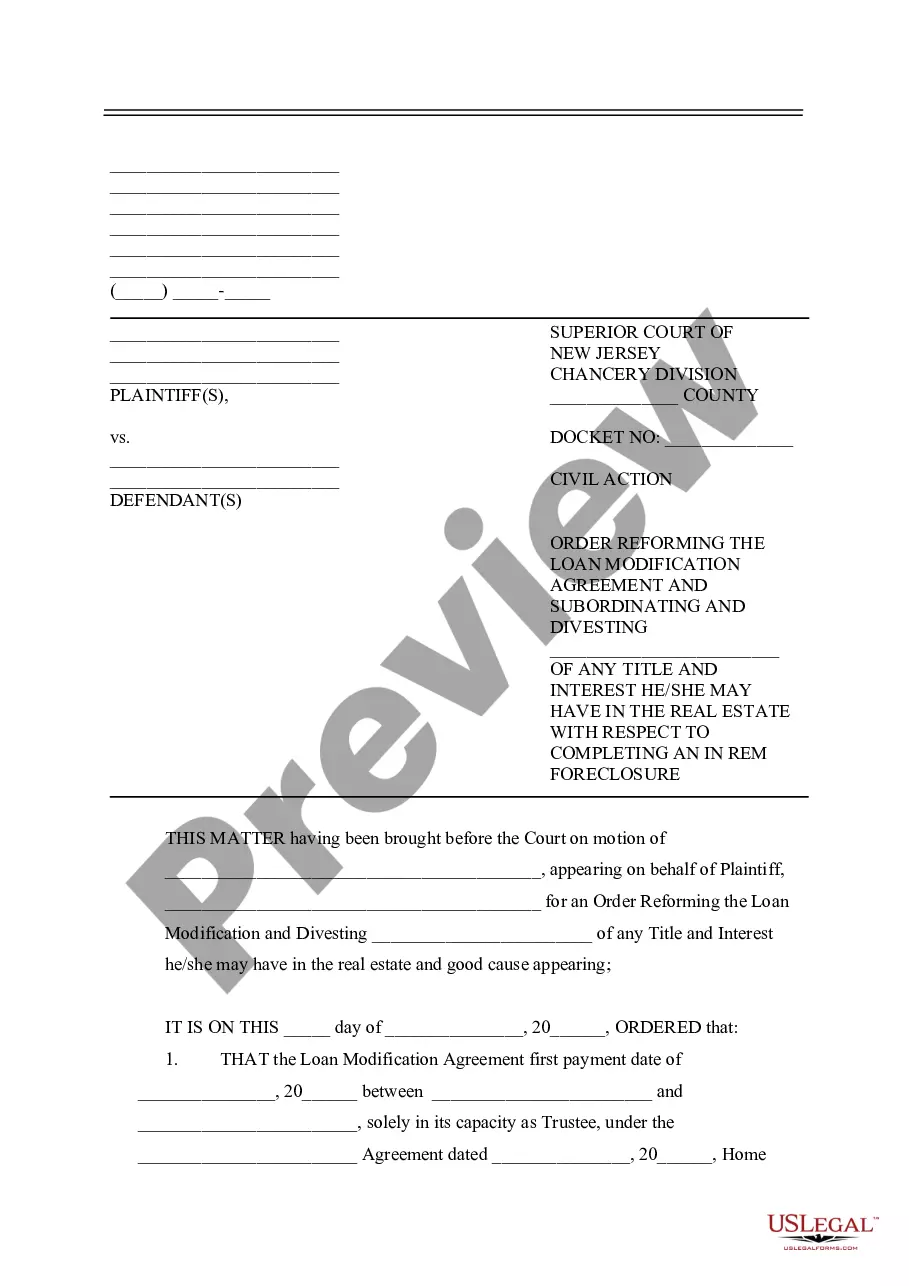

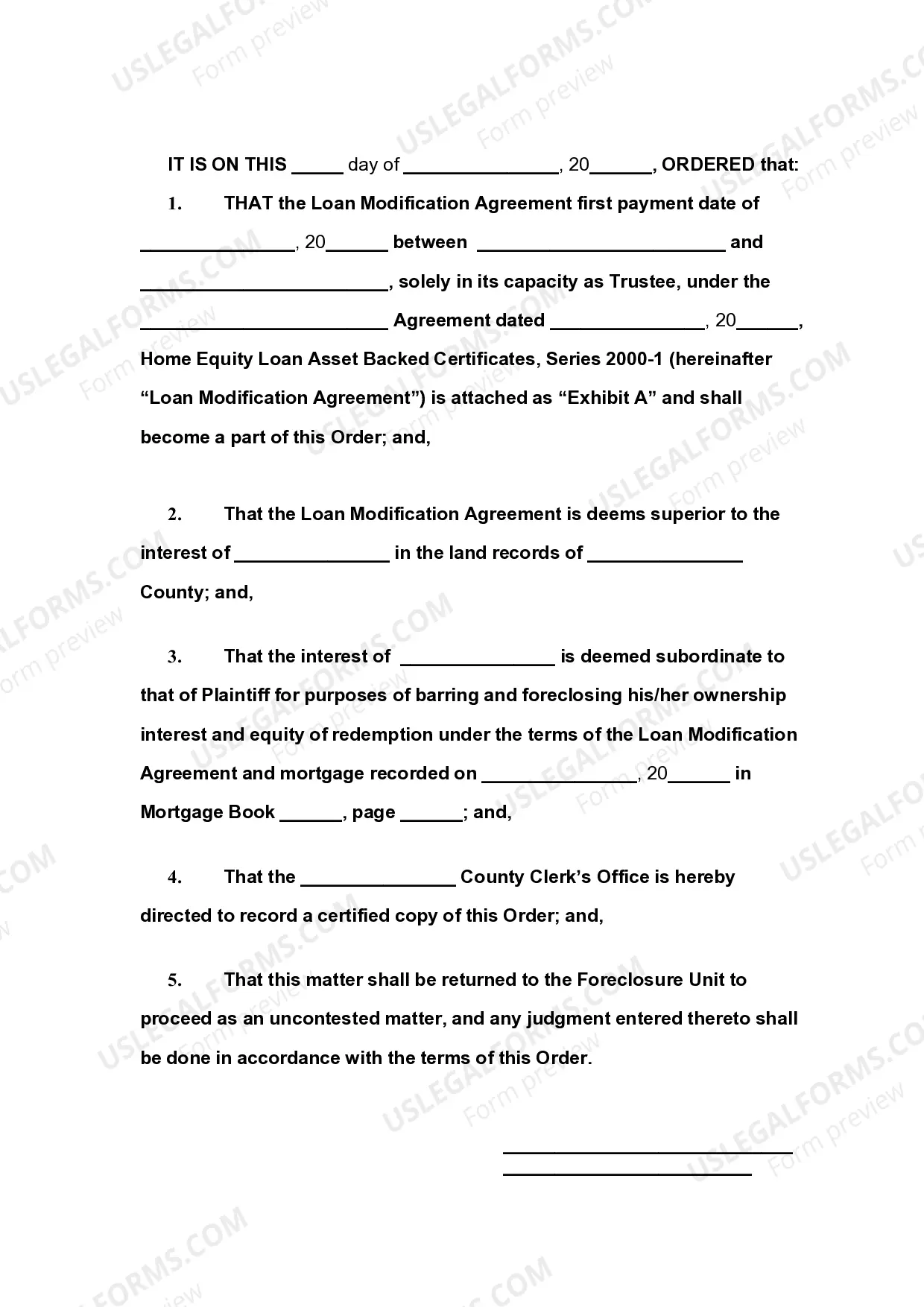

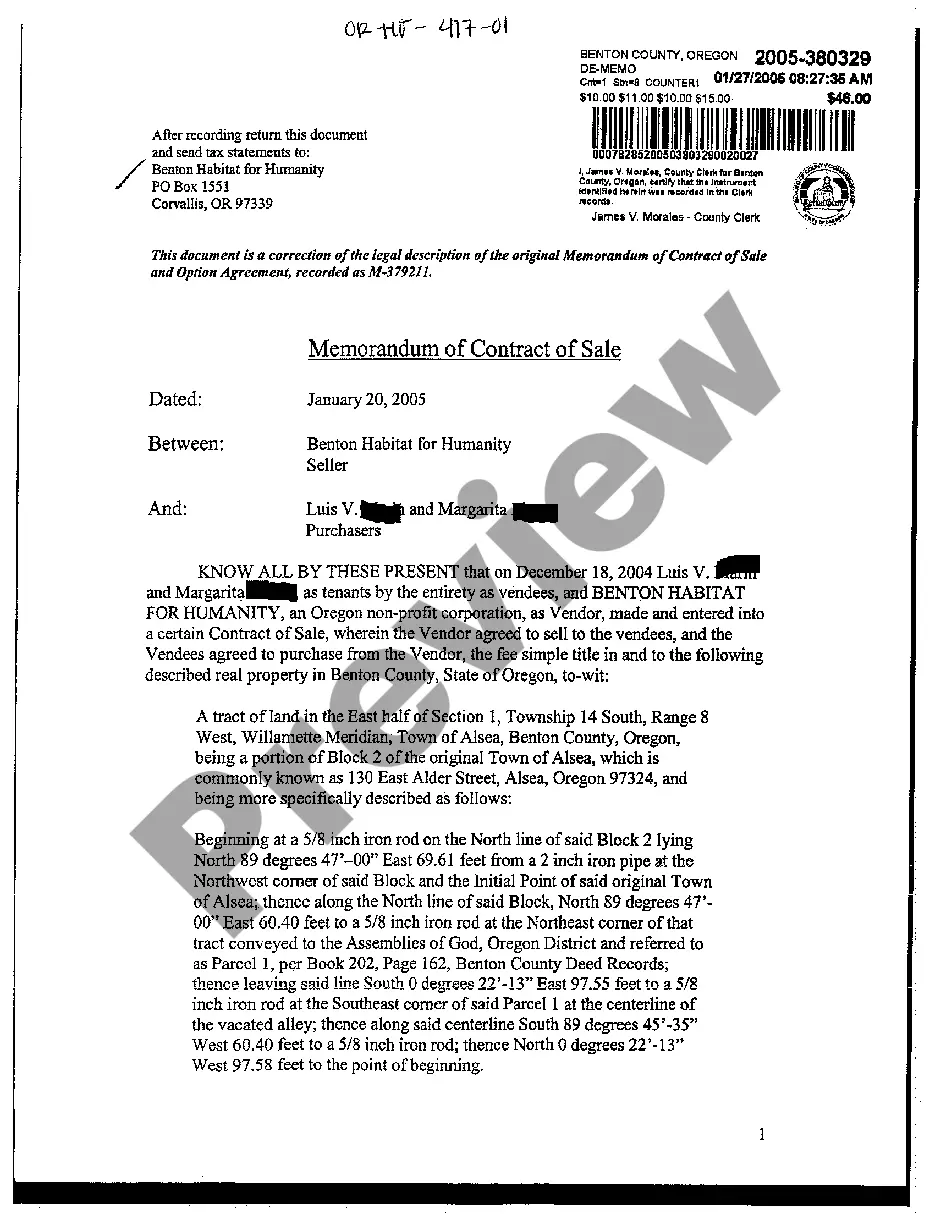

- Carefully examine the page content to verify it includes the sample you need.

- To do this, use the form description and preview options if available.

- Employ the Search bar above to find an alternative template if the prior one didn’t meet your needs.

- Click Buy Now next to the template title when you identify the correct one.

- Choose your preferred subscription plan and register for an account or Log In.

- Complete payment for your subscription using a credit card or PayPal to proceed.

Form popularity

FAQ

Closing a sole proprietorship in New Jersey requires a few clear steps. You need to cancel any business licenses and permits, settle any debts, and file your final tax returns. Additionally, if you have registered your business name, you should take steps for its cancellation. In situations involving foreign entities, consider a New Jersey modification withdrawal of foreign corporation to ensure all records are properly managed.

If you do not file an annual report for your LLC in New Jersey, the state may impose penalties. These can include fines and ultimately the administrative dissolution of your LLC. This affects your business's legal standing and can complicate the process if you need to perform a New Jersey modification withdrawal of foreign corporation. Always stay compliant to avoid disruptions in your business operations.

A certificate of dissolution and termination in New Jersey serves as official documentation that your corporation or LLC has legally ended its operations. This certificate confirms that you have met all requirements, including settling any outstanding obligations. Utilizing platforms like USLegalForms can streamline the process, especially when dealing with the New Jersey modification withdrawal of foreign corporation.

Dissolution refers to the process of legally ending a corporation or LLC, while termination specifically applies to the conclusion of a foreign corporation’s business activities in New Jersey. During dissolution, the entity files necessary paperwork and settles debts, whereas termination deals with withdrawing from the state. Understanding these distinctions is crucial when navigating the New Jersey modification withdrawal of foreign corporation.

If you don't dissolve an LLC in New Jersey, your business may still incur annual fees and taxes even if it is inactive. This can lead to penalties and complications if you attempt to re-establish your LLC later. It's important to formally dissolve your LLC to avoid these issues, especially concerning the New Jersey modification withdrawal of foreign corporation process.

To dissolve a corporation in New Jersey, you need to file the appropriate documents with the New Jersey Division of Revenue and Enterprise Services. Typically, this involves submitting a Certificate of Dissolution and settling any business debts and taxes. After your application is approved, your corporation will officially cease to exist, ensuring compliance with the New Jersey modification withdrawal of foreign corporation guidelines.

To close an entity in New Jersey, submit the appropriate dissolution paperwork to the New Jersey Division of Revenue. If you are dissolving a foreign corporation, ensure you follow all steps related to New Jersey modification withdrawal of foreign corporation. This often includes final filings and payment of any due taxes. Performing these actions properly will help you secure confirmation of your entity's closing.

To amend your CBT-100, file Form CBT-100-A with the New Jersey Division of Taxation. This form allows you to report changes and correct any inaccuracies on your original return. By doing this, you can ensure your compliance with tax regulations while navigating your New Jersey modification withdrawal of foreign corporation. Consulting accounting professionals may help clarify any complex situations.

Removing tax withholding requires you to submit a new W-4 form to your employer, requesting adjustment or elimination of the withholding. This action should reflect your designated tax preferences and align with your financial situation. For those engaged in New Jersey modification withdrawal of foreign corporation, it's essential to maintain accurate tax statuses. Regularly updating your withholding ensures adherence to state tax regulations.

Closing a New Jersey withholding tax account involves submitting a final tax return to the New Jersey Division of Taxation. You should indicate that it is your final return. This is crucial for ensuring a proper closure of your New Jersey modification withdrawal of foreign corporation. It is also important to verify that all employer taxes are settled before closing the account.