Landlord Deposit Laws

Description

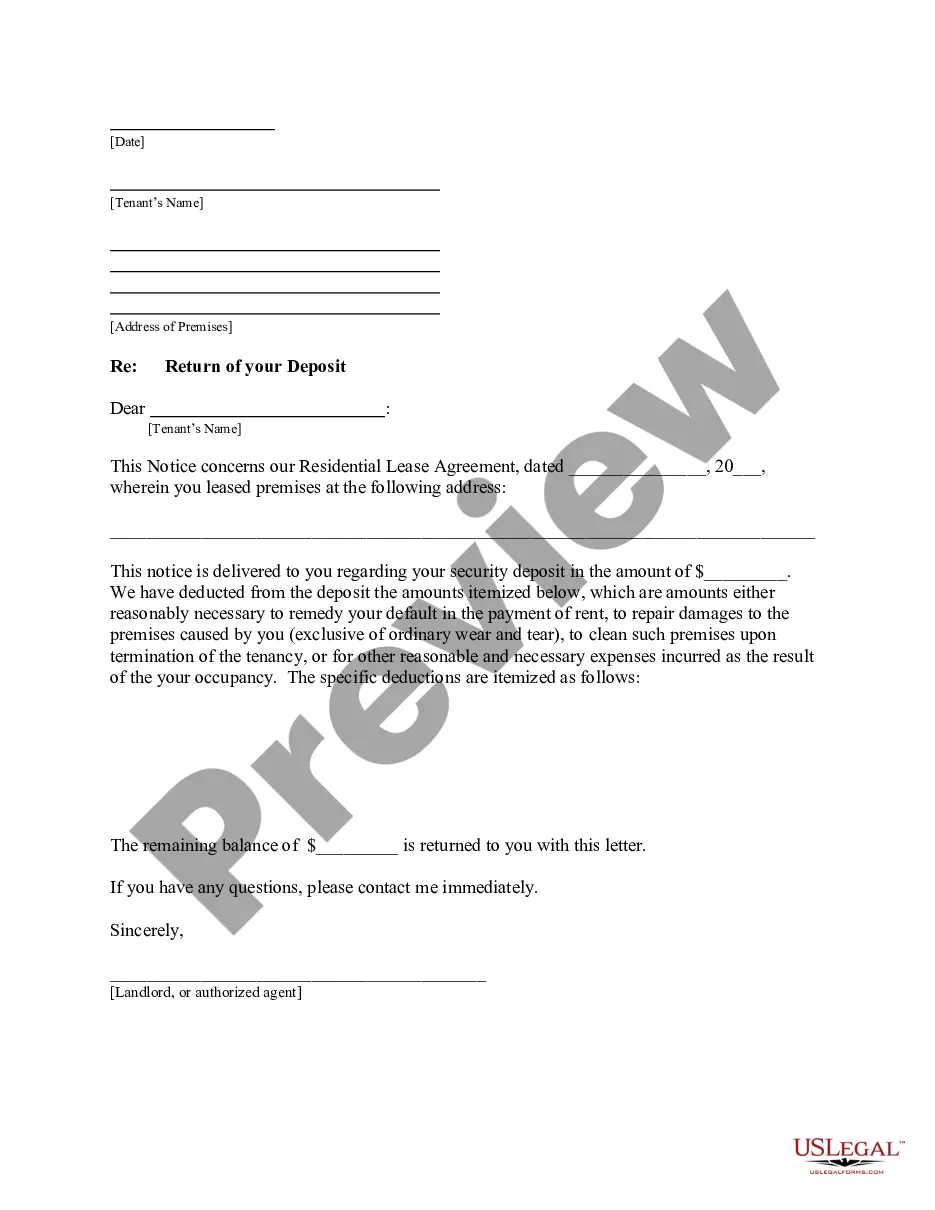

How to fill out New Jersey Letter From Landlord To Tenant Returning Security Deposit Less Deductions?

Managing legal documents can be daunting, even for seasoned professionals.

When searching for Landlord Deposit Regulations and lacking the time to dedicate to locating the correct and current version, the procedures can be tense.

Utilize a collection of articles, guides, manuals, and resources pertinent to your circumstances and needs.

Conserve time and effort searching for the documents you require, and use US Legal Forms’ sophisticated search and Review feature to find Landlord Deposit Regulations and download it.

Benefit from the US Legal Forms online library, supported by 25 years of experience and trustworthiness. Transform your daily document management into a simple and user-friendly experience today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you have previously saved and to manage your folders as you see fit.

- If it is your inaugural experience with US Legal Forms, create an account and gain unlimited access to all platform benefits.

- Here are the actions to take after locating the form you need.

- Confirm that this is the correct form by previewing it and reviewing its details.

- Access location- or jurisdiction-specific legal and business forms.

- US Legal Forms addresses any needs you may have, from personal to corporate documentation, all in one location.

- Leverage cutting-edge tools to complete and manage your Landlord Deposit Regulations.

Form popularity

FAQ

Use this form to report any change in filing status, business activity, or to change your identification information such as identification number, business and/or trade name, business address, mailing address, etc. DO NOT use this form for a change in ownership or an incorporation of a busi- ness.

NJ Taxation Charges for the service of storing all tangible personal property not held for sale in the regular course of business and the rental of safe deposit boxes or similar space remains subject to tax.

Collecting sales tax in New Jersey is fairly easy because New Jersey doesn't have local sales tax rates. If you have sales tax nexus in New Jersey and sell to buyers in New Jersey just charge the 6.625% state and use tax rate.

A Certificate of Formation/Authority Forming your Entity within New Jersey requires you to complete New Jersey's Online Business Formation Service1 application. A NJ based (domestic) business is then issued a Certificate of Formation.

If you do not have a FEIN, your New Jersey tax ID number is usually the Social Security Number of the primary business owner followed by three zeroes.

The Division of Revenue and Enterprise Services (DORES) adopted this registration procedure to assist you in becoming aware of and understanding all of the taxes and related liabilities to which a new business or applicant for a license may be subject.

You can obtain records by submitting a request online, through the mail, or by stopping by in person at 140 E. Front Street in Trenton. You can also use the new VitalCheck site or call 877-622-7549 to place an order.

All businesses must complete the registration application (NJ-REG, pages 17-19) in order to receive the forms, returns, instructions, and other information needed to comply with New Jersey laws.