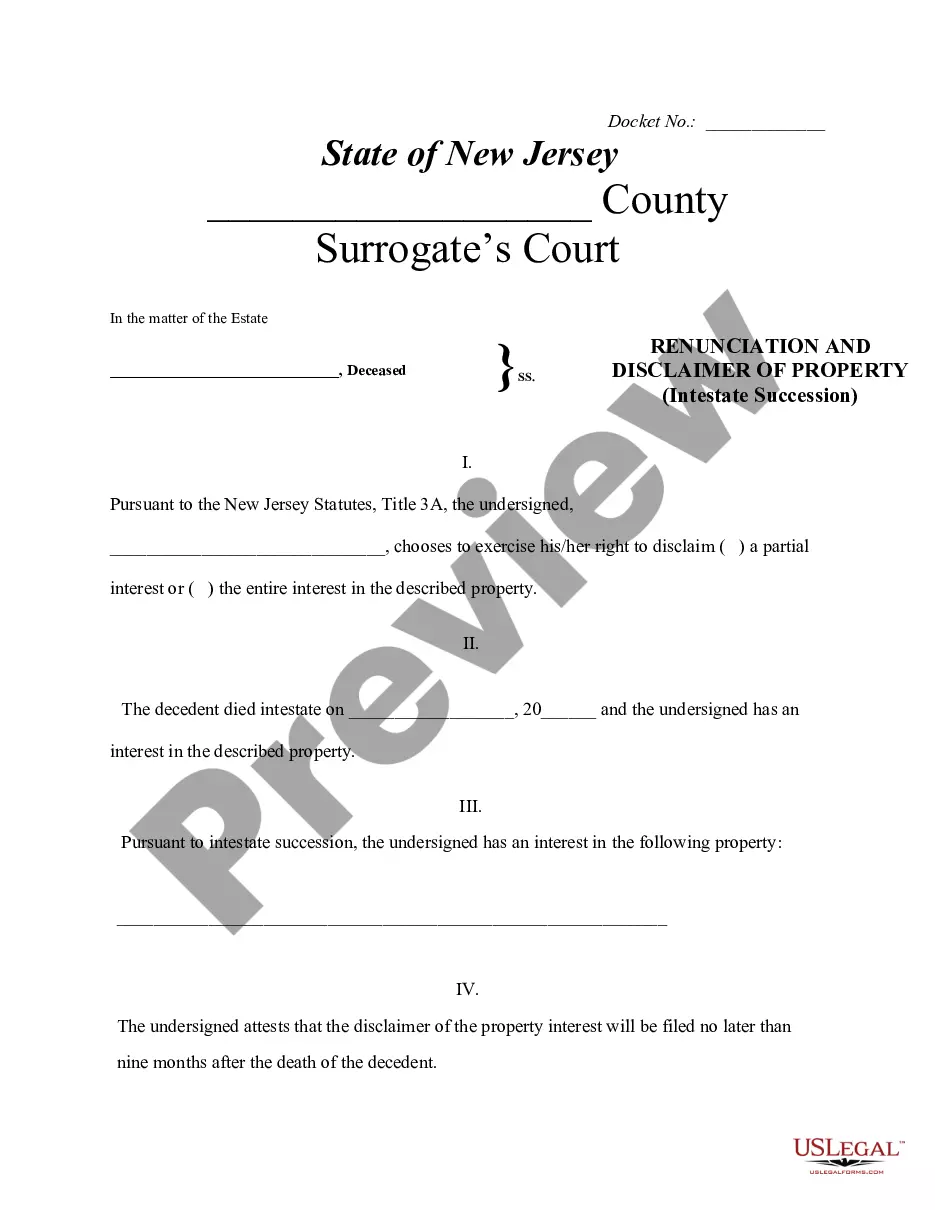

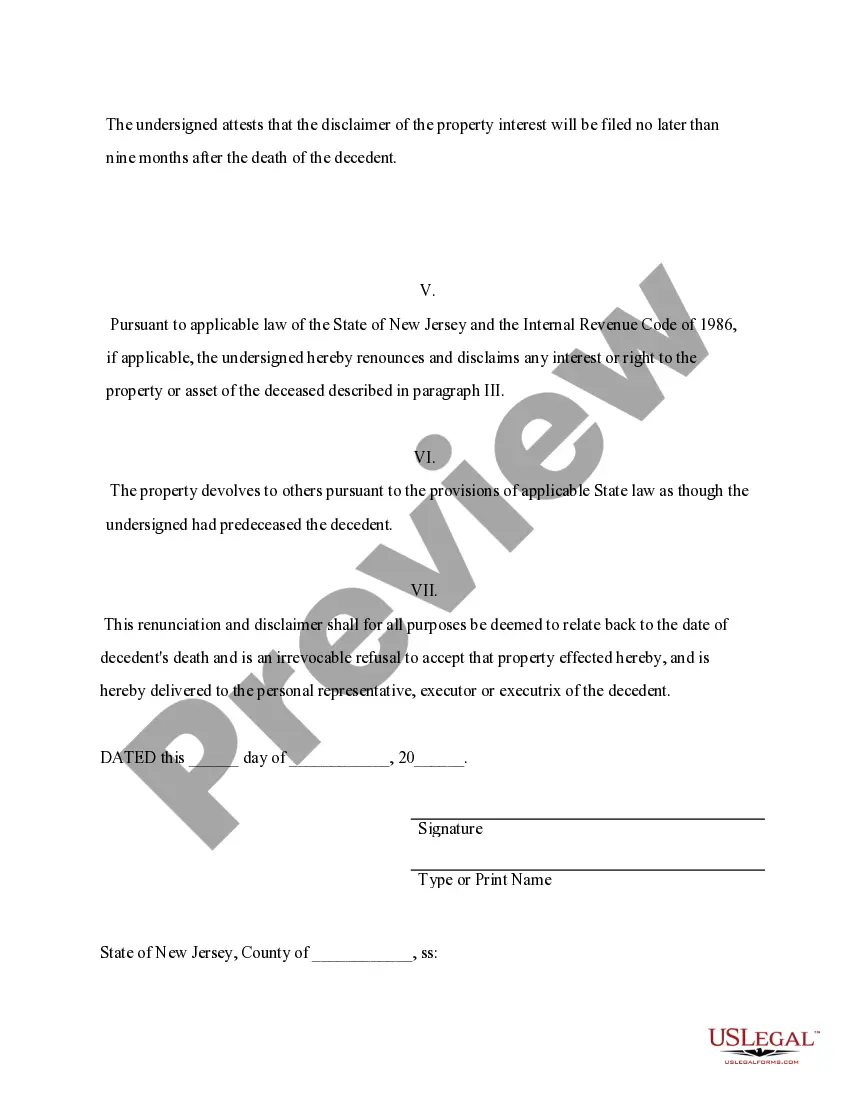

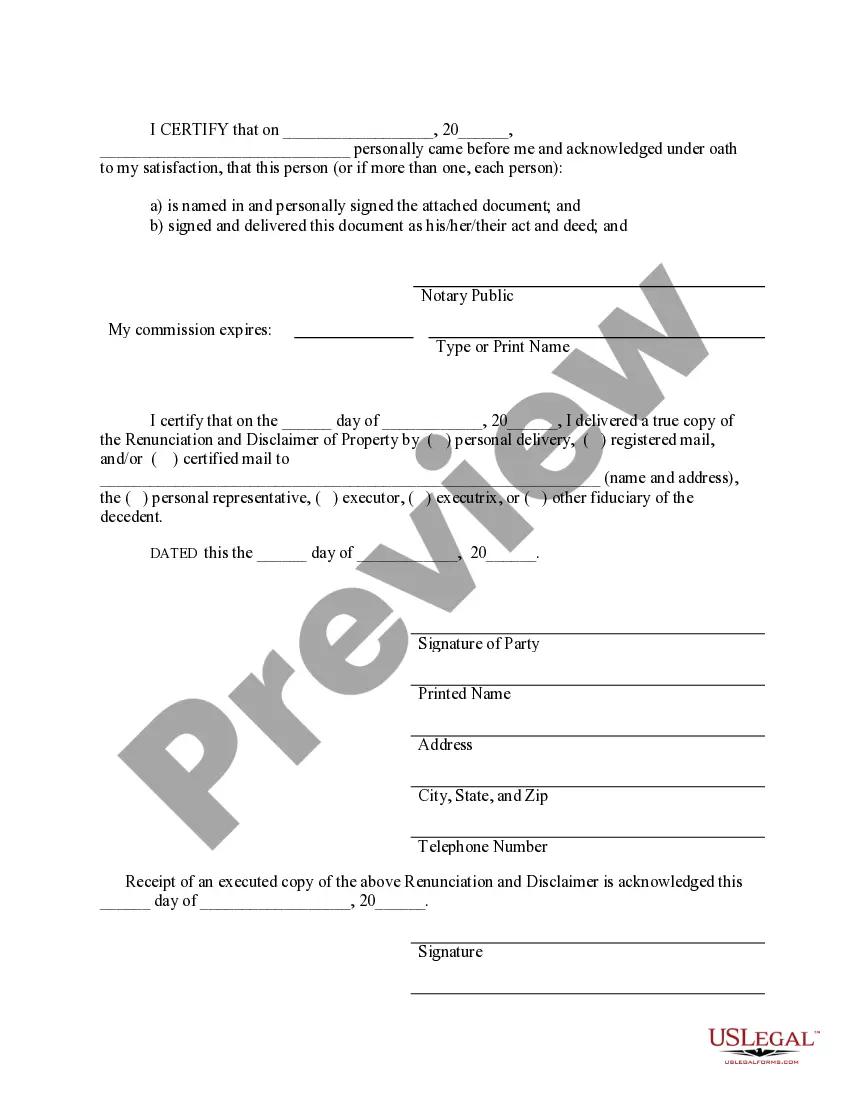

Intestate succession refers to the legal process that determines how a person's assets will be distributed when they die without a valid will. In New Jersey, intestate succession follows a set of rules established by the state's probate laws. The primary purpose of intestate succession is to allocate the deceased person's property and assets to their surviving family members according to a predetermined order of priority. The hierarchy of distribution is based on the degree of familial relationship, ensuring that close relatives receive the inheritance. In New Jersey, there are different types of intestate succession, which are based on the deceased person's surviving family members. The following are the scenarios that can arise: 1. Spouse and No Children: If the deceased person is survived by their spouse but has no children or descendants, their spouse will inherit the entire estate. 2. Spouse and Children: If the deceased person is survived by their spouse and children, the distribution of assets depends on whether the children are their shared descendants or from a previous relationship. If there are shared children, the spouse will inherit the first 25% of the estate plus an additional $50,000. The remaining assets will be distributed equally among the spouse and children. However, if the deceased person has children from a previous relationship, the spouse will receive 50% of the estate, and the children will split the remaining 50% equally. 3. Parents and No Spouse or Children: If the deceased person has no spouse or children, their parents will inherit the entire estate in equal shares, or the surviving parent will inherit if only one is alive. 4. Siblings: If the deceased person is not survived by a spouse, children, or parents, the estate will be divided equally among their siblings. If a sibling has predeceased the deceased person, their share will be passed on to their children, if any. 5. Distant Relatives: If the deceased person has no immediate family members, including parents, children, siblings, or nieces/nephews, the estate may pass to more distant relatives, such as aunts, uncles, cousins, or even more remote connections, depending on the specific circumstances. It is important to note that intestate succession laws can be complex, and it is advisable to consult with an experienced probate attorney to navigate the intricacies of estate distribution in New Jersey.

Intestate Succession In Nj

Description

How to fill out Intestate Succession In Nj?

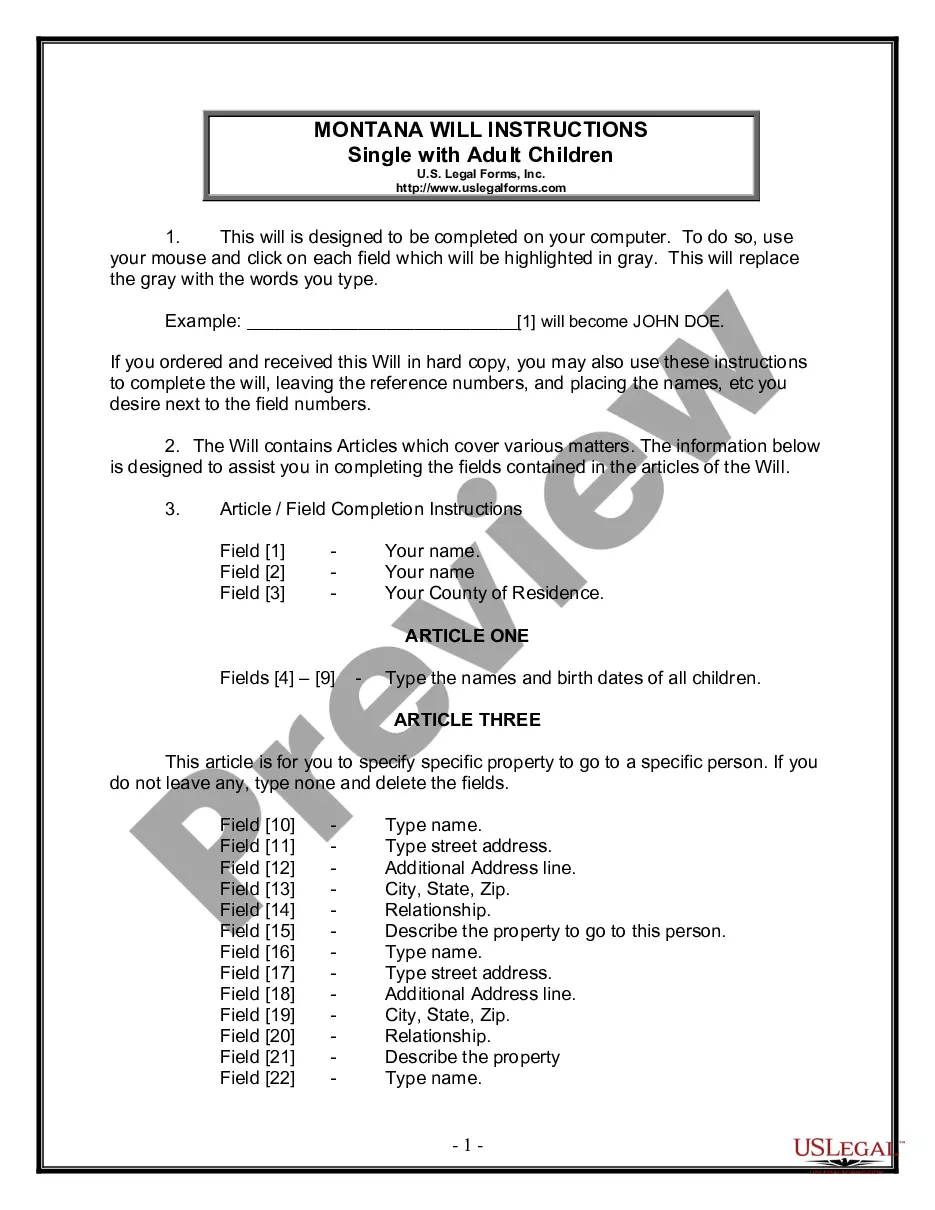

Accessing legal document samples that comply with federal and regional laws is crucial, and the internet offers many options to choose from. But what’s the point in wasting time looking for the appropriate Intestate Succession In Nj sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are easy to browse with all files arranged by state and purpose of use. Our specialists stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when getting a Intestate Succession In Nj from our website.

Getting a Intestate Succession In Nj is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the instructions below:

- Take a look at the template using the Preview option or via the text description to make certain it meets your requirements.

- Browse for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Intestate Succession In Nj and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

If you die with no surviving spouse, your children will inherit everything. If you have a surviving spouse, but no children or parents, your spouse inherits everything. If there is a surviving spouse and children from that spouse, the spouse inherits everything.

If a person dies with assets but no will or trust, an administrator for his/her estate must be appointed by a court. If a person owns assets or property jointly with another person or in trust, then probate and estate administration is not necessary because ownership automatically goes to the surviving owner.

Children in New Jersey Inheritance Law Intestate Succession: Spouses and ChildrenChildren, but no spouse? Children inherit everythingSpouse, but no children or parents? Spouse inherits everythingSpouse and children from you and that spouse; the spouse has no other children? Spouse inherits everything6 more rows ?

The law of intestate succession in New Jersey states that: If you die leaving a spouse, a registered domestic partner, or civil union partner and children who are also the children of the spouse or legal partner, the spouse/legal partner receives 100% of the estate and no bond is required to be posted.

New Jersey law determines who inherits the estate of a person dying without a will. It is determined ing to kinship, meaning bloodline. When there are no known relatives, the estate is in escheat and all property goes to the State of New Jersey.