Nj Property Testate Withdrawal

Description

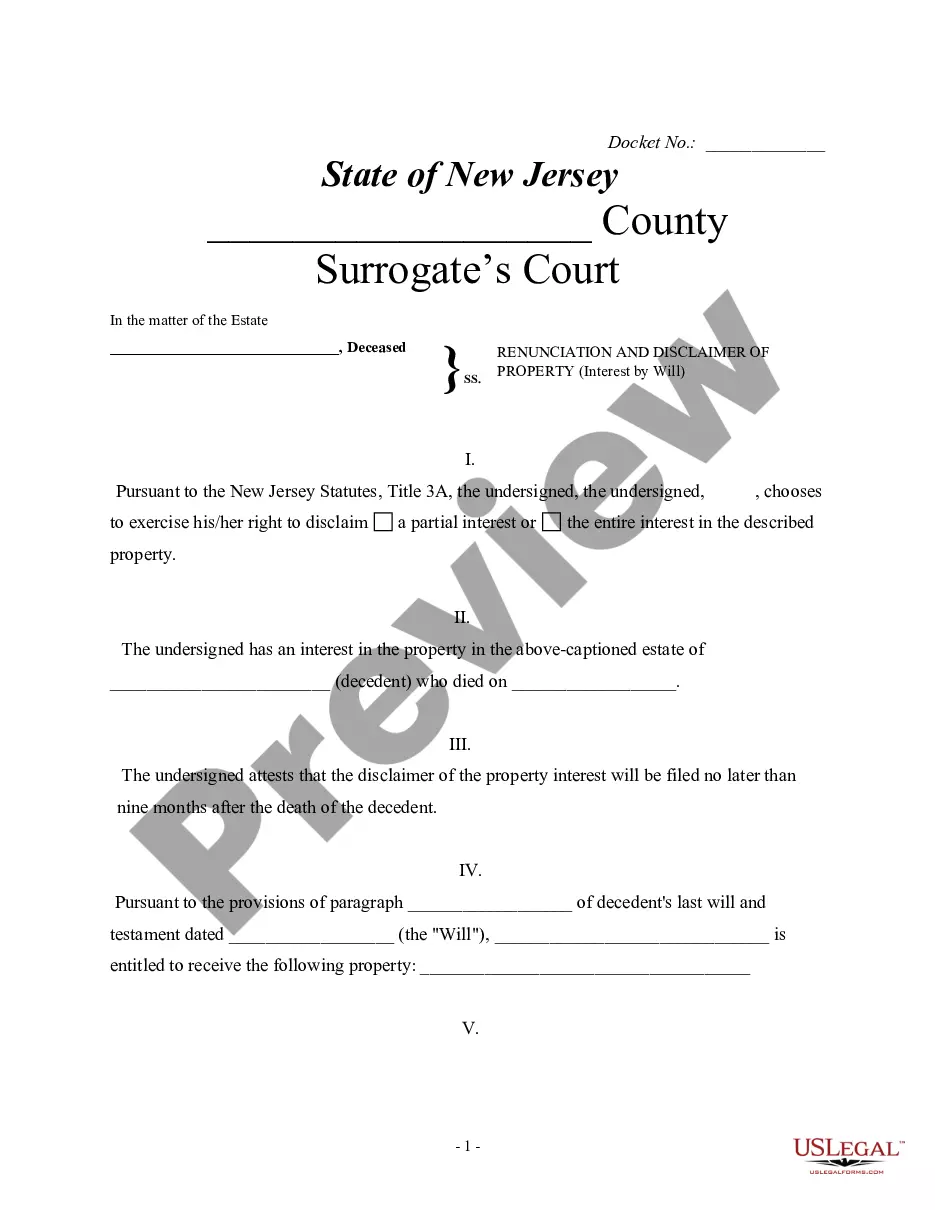

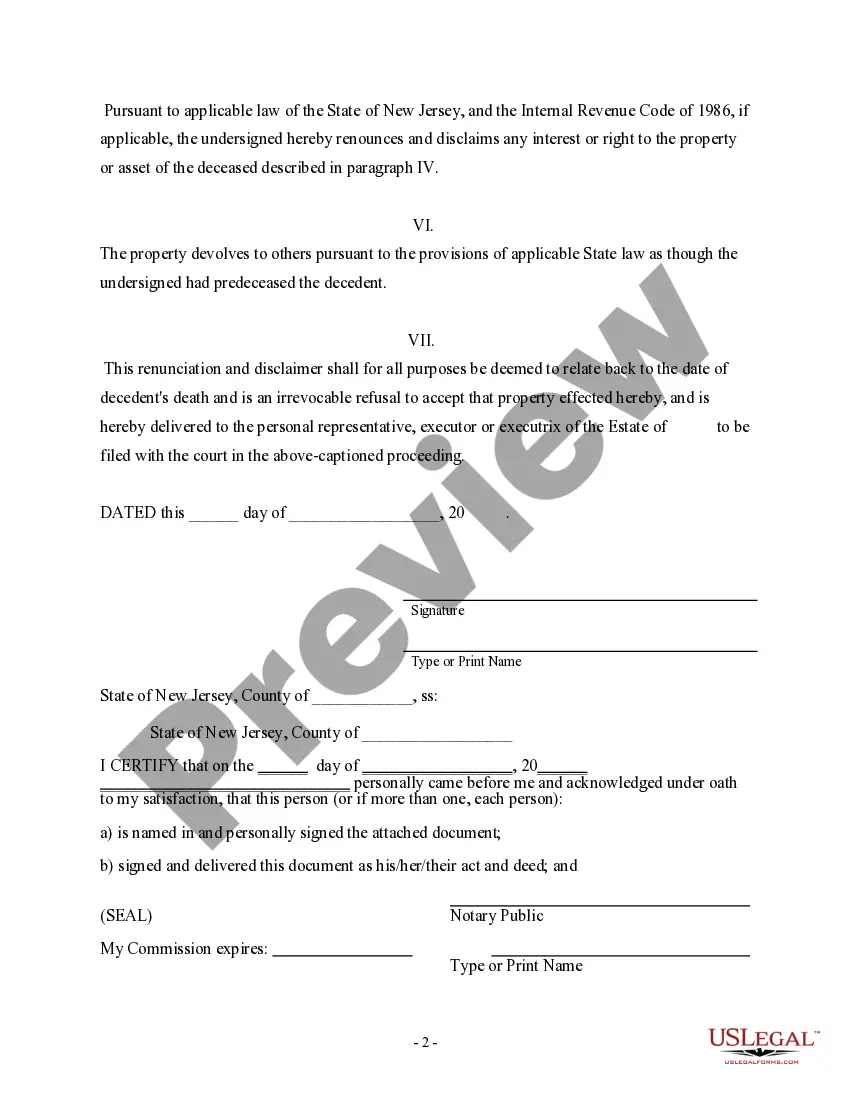

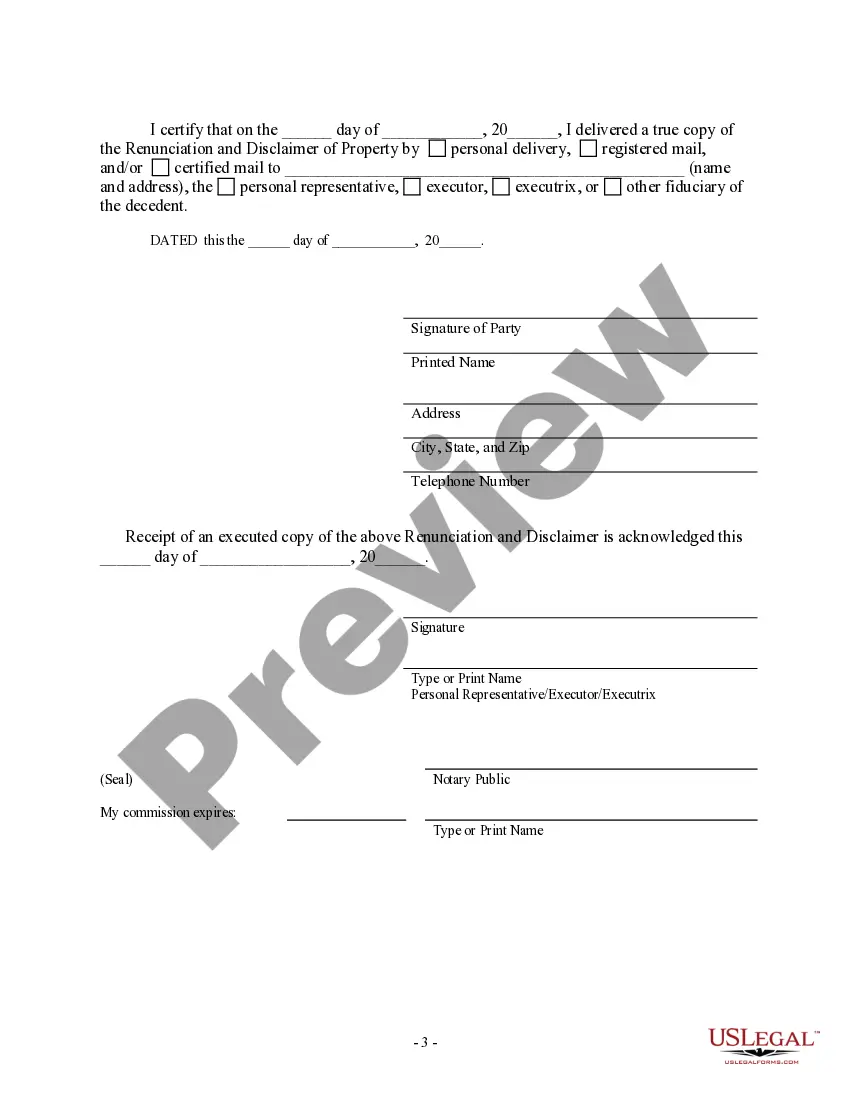

How to fill out New Jersey Renunciation And Disclaimer Of Property From Will By Testate?

Legal administration can be daunting, even for the most adept professionals.

When seeking a Nj Property Testate Withdrawal and lacking the time to locate the correct and current version, the procedures can be anxiety-inducing.

US Legal Forms caters to all your needs, from individual to corporate documentation, all in one location.

Utilize cutting-edge tools to complete and manage your Nj Property Testate Withdrawal.

Here are the steps to follow after acquiring the form you need: Validate that this is the correct form by previewing it and reviewing its details. Ensure that the sample is recognized in your state or county. Click Buy Now when you are prepared. Choose a monthly subscription plan. Select the file format you prefer, and Download, complete, sign, print, and dispatch your document. Enjoy the US Legal Forms online catalog, supported by 25 years of experience and reliability. Simplify your everyday document management into a seamless and user-friendly process today.

- Access a valuable repository of articles, guides, and materials applicable to your needs and situation.

- Conserve time and energy searching for the documents you require, and leverage US Legal Forms’ sophisticated search and Review tool to locate Nj Property Testate Withdrawal and obtain it.

- If you possess a monthly subscription, Log Into your US Legal Forms account, search for the form, and procure it.

- Check your My documents tab to view the documents you’ve previously saved and to organize your folders as desired.

- If this is your initial experience with US Legal Forms, create an account to gain unlimited access to all the platform's advantages.

- A comprehensive online form directory can be a transformative tool for anyone looking to effectively manage these matters.

- US Legal Forms is a frontrunner in online legal documents, offering over 85,000 state-specific legal forms available at any time.

- With US Legal Forms, you can access legal and business forms tailored to your state or county.

Form popularity

FAQ

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Affidavit Requesting Preliminary Waivers: Resident Decedents, Form L-4. Page 1. This form may be used when: ? A complete Inheritance or Estate Tax return cannot be completed yet; or ? All beneficiaries are Class A, but estate does not qualify to use Form L-8; or ? All beneficiaries are Class E, or Class E and Class A.

If you are not satisfied with the decision made at your County Tax Board hearing, you can file an appeal with the Tax Court of New Jersey. File your appeal with Tax Court within 45 days of the date of the County Board of Taxations judgment.

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

The New Jersey Gross Income amount from your 2021 return can be found on line 29 of your 2021 NJ-1040 return. Please note, if the Division of Taxation has made adjustments to your return for the previous year, the amount on the . pdf of your return may not match what is on file.