New Jersey Liability For Team India

Description

How to fill out New Jersey Limited Liability Company LLC Operating Agreement?

It's clear that you can't transform into a legal expert overnight, nor can you swiftly acquire the ability to formulate New Jersey Liability For Team India without possessing a unique array of skills.

Compiling legal documents is a labor-intensive procedure that necessitates specific training and expertise. Therefore, why not entrust the formulation of the New Jersey Liability For Team India to the experts.

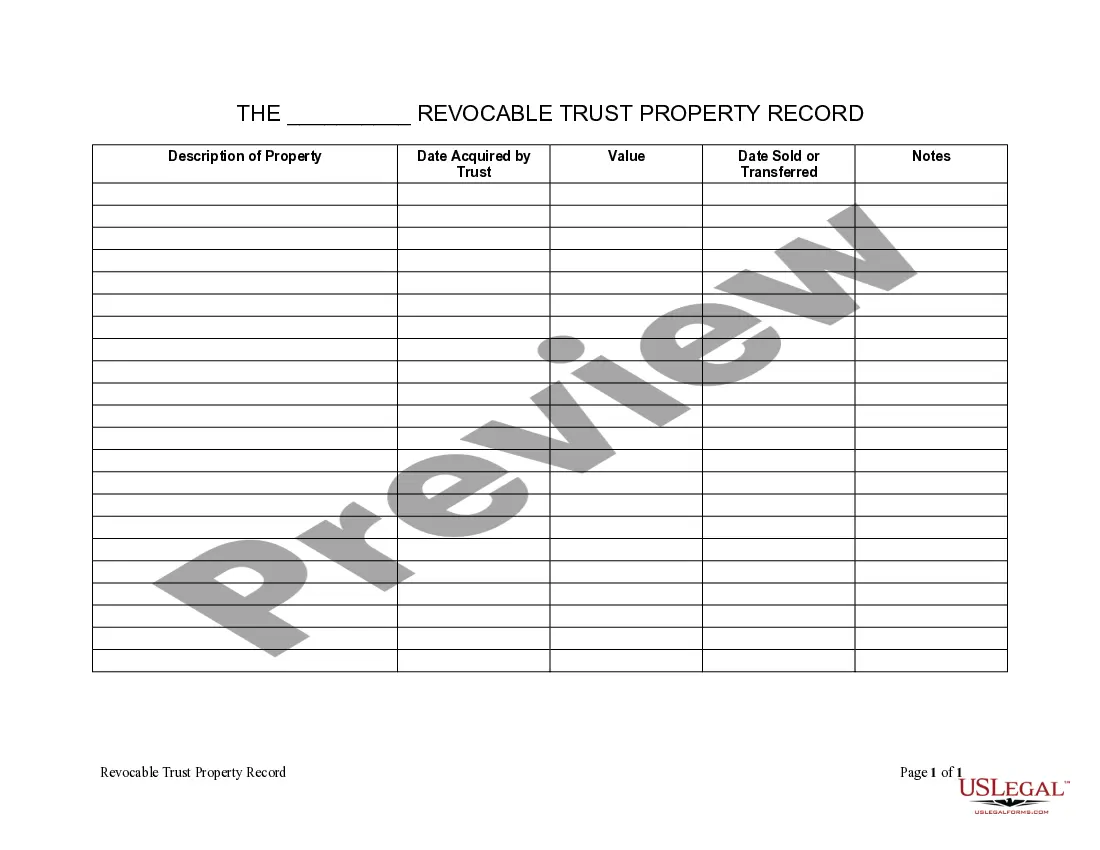

With US Legal Forms, one of the most extensive legal template repositories, you can access everything from court filings to templates for in-office correspondence. We understand the significance of compliance and adherence to federal and local statutes and regulations. Hence, on our platform, all forms are tailored to locations and are current.

You can retrieve your files from the My documents section at any moment. If you're a returning customer, you can simply Log In and find and download the template from the same section.

Regardless of the nature of your documents—be it financial, legal, or personal—our website has you covered. Experience US Legal Forms today!

- Find the form you require using the search bar at the top of the webpage.

- Review it (if this feature is offered) and read the accompanying description to ascertain whether New Jersey Liability For Team India is what you're looking for.

- Start your search anew if you need a different document.

- Create a complimentary account and select a subscription plan to purchase the form.

- Click Buy now. Once the payment is processed, you can download the New Jersey Liability For Team India, complete it, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

The 33 jersey in India has been famously worn by renowned cricketer MS Dhoni, known for his exceptional leadership and skills on the field. His connection to this number has made it iconic among fans. If you're interested in jersey numbers and their significance, knowing the implications surrounding New Jersey's liability for Team India can enhance your understanding of the sport's cultural elements. This knowledge may be beneficial if you are considering purchasing memorabilia.

If you are the only owner and begin conducting business, you automatically become a sole proprietorship. There is no need to formally file paperwork or submit anything at the federal, state, or local level to be recognized as such.

Sole proprietorships and general partnerships registered to do business in Maryland MUST file an Annual Report (Form 2, no fee). For general assistance with the Annual Report, contact the Maryland State Department of Assessments & Taxations office at 410-767-1330 or sdat.cscc@maryland.gov.

A business license is required for most businesses, including retailers and wholesalers. A trader's license is required for buying and re-selling goods. And you, or the professionals you hire, may need individual occupational and professional licenses.

Traders License Fees - All Counties Excluding Baltimore City Inventory AmountFee30,001 - 40,000$12540,001 - 50,000$15050,001 - 75,000$20075,001 - 100,000$25017 more rows

Sole proprietorships or general partnerships require no legal entry formalities except compliance with state and local licensing and taxation requirements.

A person or business organization other than a grower, maker or manufacturer may not offer for sale, sell or otherwise dispose of any goods within Maryland, without first obtaining a license from the Clerk of the Circuit Court.

How much does it cost to apply for a sales tax permit in Maryland? It is free to register for a sales tax permit in Maryland. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business.

When it comes to being a sole proprietor in the state of Maryland, there is no formal setup process. There are also no fees involved with forming or maintaining this business type. If you want to operate a Maryland sole proprietorship, all you need to do is start working.