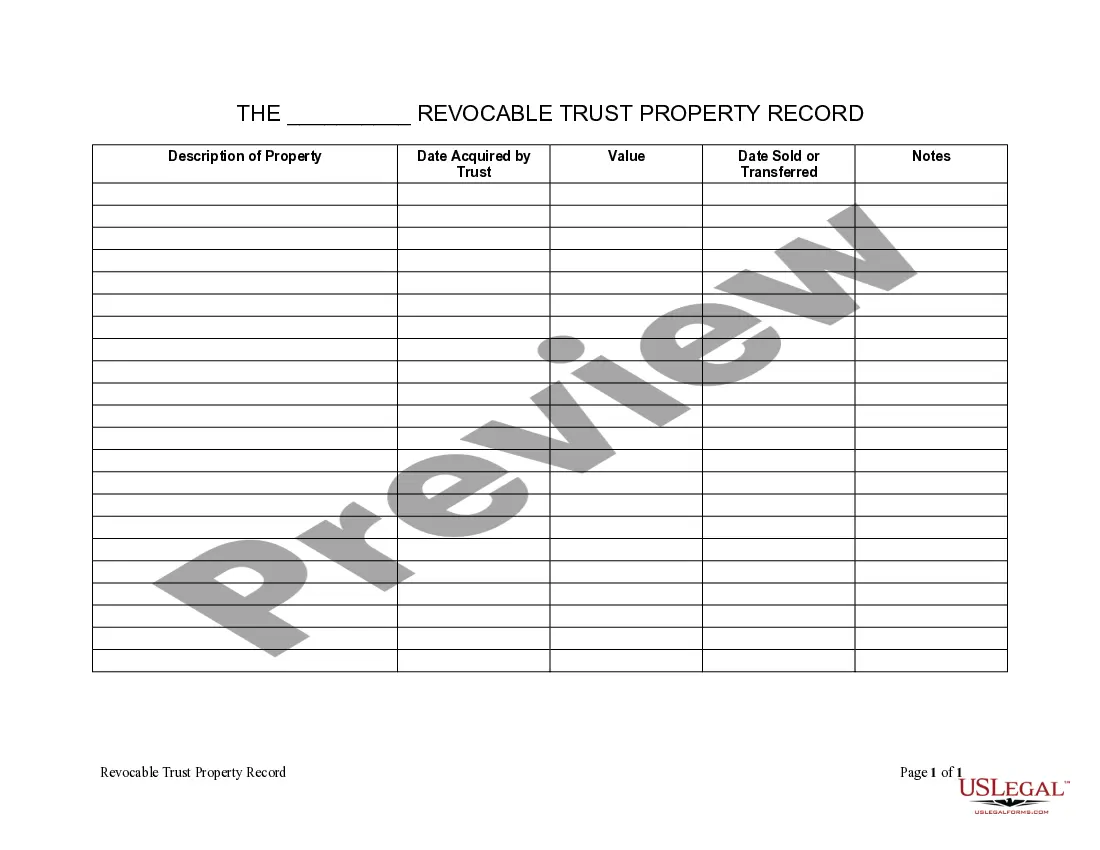

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Iowa Living Trust Property Record

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Living Trust Property Record?

Access one of the most extensive collections of legal templates.

US Legal Forms is a platform where you can locate any state-specific document in just a few clicks, such as Iowa Living Trust Property Record examples.

No need to waste time searching for a legally acceptable sample.

Use the Preview option, if it's offered, to view the document's content. If everything is correct, click Buy Now. After choosing a payment plan, create your account. Pay using a card or PayPal. Download the document by clicking the Download button. That's it! You need to fill out the Iowa Living Trust Property Record form and verify it. To ensure accuracy, consult with your local legal advisor for assistance. Register and easily find about 85,000 useful templates.

- To utilize the forms collection, select a subscription and create an account.

- If you have registered, simply Log In and click Download.

- The Iowa Living Trust Property Record template will be immediately saved in the My documents section (a section for all documents you store on US Legal Forms).

- To establish a new account, follow the simple guidelines below.

- If you need to use a state-specific document, ensure you specify the correct state.

- If available, check the description to understand all the details of the form.

Form popularity

FAQ

The owner of a trust is typically the person who created it, known as the grantor or settlor. They have the authority to determine how the assets in the Iowa Living Trust Property Record should be managed and distributed. Once the grantor passes away, the assets transfer to the beneficiaries as specified in the trust. To gain clarity on ownership aspects, using resources from uslegalforms can be beneficial.

Identifying the owner of a trust can be complex, as trusts are designed to protect privacy. In many cases, you will find the trustee's name rather than the grantor listed on public records available in the Iowa Living Trust Property Record. To uncover this information, you may consult legal platforms like uslegalforms, which can provide guidance on navigating trust ownership inquiries.

Yes, beneficiaries have the right to request a copy of the trust. This transparency is crucial for beneficiaries to understand their rights regarding the assets outlined in the Iowa Living Trust Property Record. The trustee typically provides access to the trust document following the grantor’s death. Engaging with uslegalforms can help you comprehend the legal obligations trustees have towards beneficiaries.

You cannot directly look up someone's trust online due to privacy laws. However, you can access certain public records that may offer insight into the Iowa Living Trust Property Record. Often, estate planning documents become part of public records when a trust is funded or property is transferred. You might want to consider using platforms like uslegalforms to help guide you through the process of obtaining necessary documents.

In Iowa, living trusts are generally not recorded like wills. Instead, they are private documents, and the details typically remain confidential unless a specific action triggers public disclosure. However, it is important to maintain an accurate and updated Iowa Living Trust Property Record, especially when managing assets or dealing with beneficiaries. This documentation helps clarify the status and ownership of various properties held in trust.

The best way to put your house in trust involves several key steps. First, create a detailed living trust document that specifies how you want your property managed. Next, prepare a new deed transferring ownership of the house to the trust and record it with the appropriate county. Finally, regularly review your Iowa Living Trust Property Record to ensure all aspects remain aligned with your wishes.

If you don’t file taxes on your trust when required, you may face penalties and interest charges from the IRS. Failure to file can also lead to legal complications, as it signals a lack of compliance with tax regulations. To protect your Iowa Living Trust Property Record and ensure smooth asset management, it is crucial to stay informed about your tax responsibilities. Consulting with a tax advisor can help you avoid these pitfalls.

Depending on the type of trust you have, it may need to file a tax return. A revocable living trust, for example, does not require a separate tax return as its income is reported on your individual tax return. If your Iowa Living Trust Property Record generates income, it is essential to understand your tax obligations clearly. Consulting with a tax professional can provide clarity on your specific situation.

In Iowa, you typically do not need to record a certificate of trust. However, many institutions may require a certificate of trust to verify the authority of the trustee before allowing transactions. A well-structured Iowa Living Trust Property Record can make these transactions smoother, ensuring that property transfers or asset management occur without unnecessary delays.

Generally, you do not need to file your living trust with the court in Iowa. Living trusts are private documents, and there is no requirement to register them unless you are dealing with property that needs to be transferred to a trust. However, it's essential to keep your Iowa Living Trust Property Record updated and organized to reflect any changes or additions to your assets.