New Jersey Liability Company With The Most Employees

Description

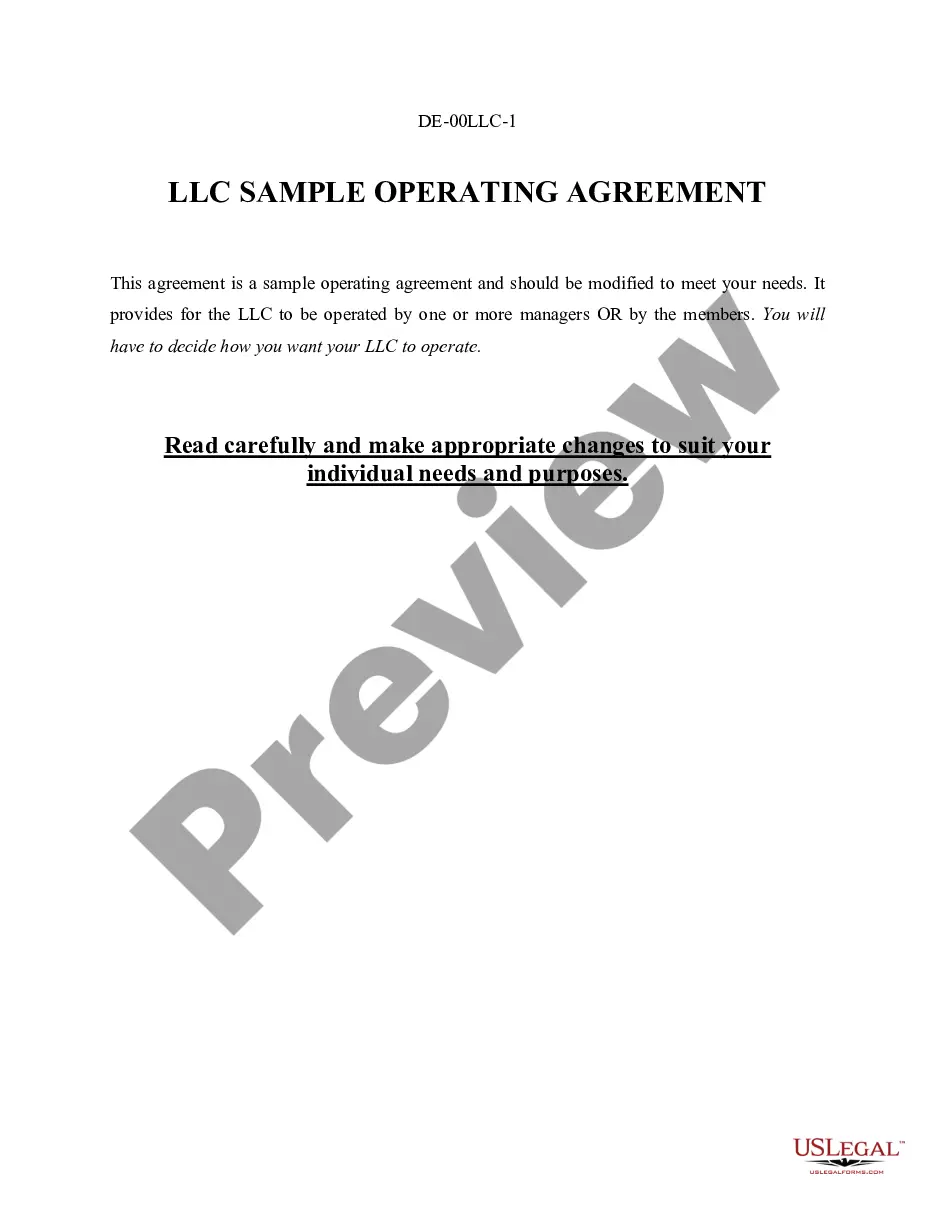

How to fill out New Jersey Limited Liability Company LLC Operating Agreement?

It’s no secret that you can’t become a legal professional immediately, nor can you grasp how to quickly draft New Jersey Liability Company With The Most Employees without the need of a specialized set of skills. Putting together legal forms is a long venture requiring a specific education and skills. So why not leave the creation of the New Jersey Liability Company With The Most Employees to the professionals?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court documents to templates for in-office communication. We understand how important compliance and adherence to federal and local laws are. That’s why, on our website, all forms are location specific and up to date.

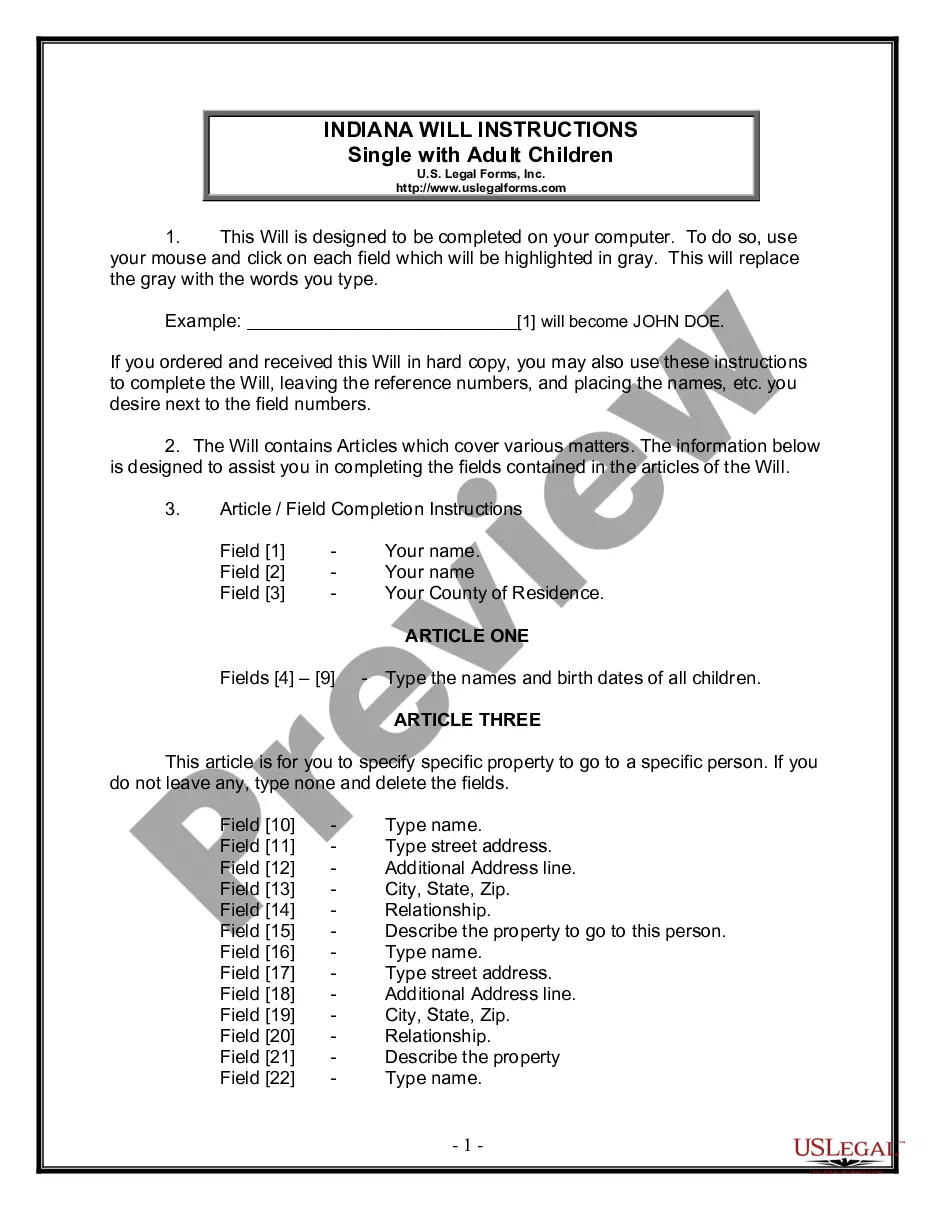

Here’s how you can get started with our website and obtain the document you require in mere minutes:

- Find the document you need with the search bar at the top of the page.

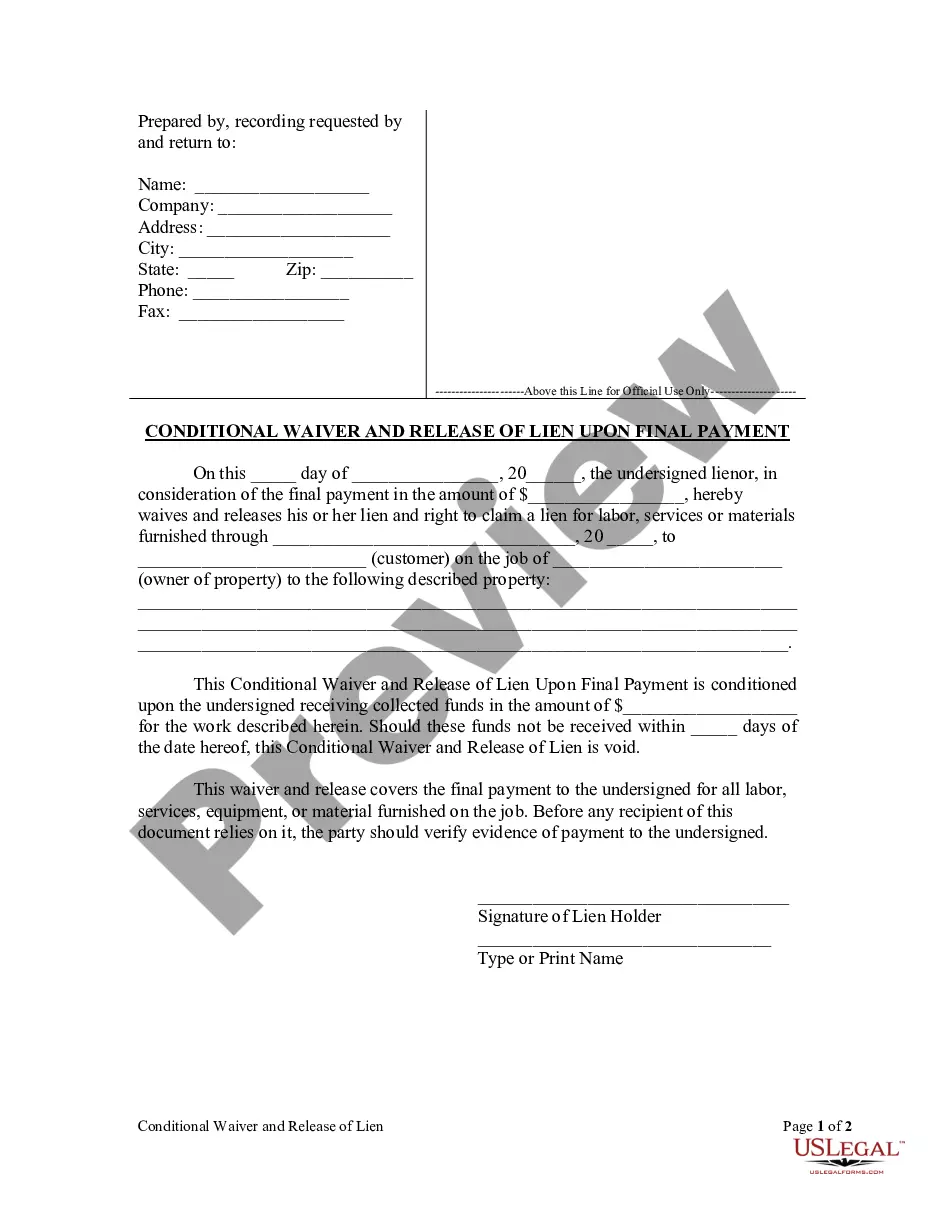

- Preview it (if this option provided) and check the supporting description to figure out whether New Jersey Liability Company With The Most Employees is what you’re looking for.

- Start your search again if you need a different template.

- Set up a free account and select a subscription plan to buy the template.

- Pick Buy now. Once the payment is through, you can download the New Jersey Liability Company With The Most Employees, complete it, print it, and send or send it by post to the necessary individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Your LLC must file an IRS Form 1065 and a New Jersey Partnership Return (Form NJ-1065). LLC taxed as a Corporation: Yes. Your LLC must file tax returns with the IRS and the New Jersey Division of Taxation to pay your New Jersey income tax. Check with your accountant to make sure you file all the correct documents.

Then the New Jersey Division of Taxation honors this and taxes your LLC the same way at the state level. An LLC with 1 owner (Single-Member LLC) is taxed like a Sole Proprietorship. An LLC with 2 or more owners (Multi-Member LLC) is taxed like a Partnership. The above are referred to as the ?default status?.

Every business in NJ must file an annual report. This includes simply ensuring that your registered agent and address are up to date, and submitting a $75 filing fee. The report is due every year on the last day of the month, in the month in which you completed your business formation (LLC, Corporation, etc).

New Jersey LLC Name Requirement The name of an LLC must end with "Limited Liability Company," "LLC" or "L.L.C." The name must not contain any word, phrase, abbreviation or derivative thereof indicating or implying it is organized for any purpose other than one or more purposes permitted by its Certificate of Formation.

Although they may have different classes of members, there is no requirement for a board of directors. Also, LLC's may have anywhere between one and an unlimited number of members, who may be people or other businesses.