New Jersey Foreign Corporation Withdrawal

Description

How to fill out New Jersey Business Incorporation Package To Incorporate Corporation?

Individuals generally link legal documentation with something intricate that only an expert can manage.

In a certain sense, this is accurate, as creating a New Jersey Foreign Corporation Withdrawal requires considerable expertise in subject matters, including state and county statutes.

Nonetheless, with US Legal Forms, things have become easier: ready-made legal documents for any personal and business circumstances adhering to state regulations are gathered in a single online directory and are now accessible to all.

All templates in our collection are reusable: once bought, they remain stored in your profile. You can access them at any time as needed through the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and area of application, so searching for New Jersey Foreign Corporation Withdrawal or any specific template only takes a few minutes.

- Previously registered users with an active membership must Log In to their account and click Download to receive the form.

- New users to the service must first create an account and subscribe before they can download any files.

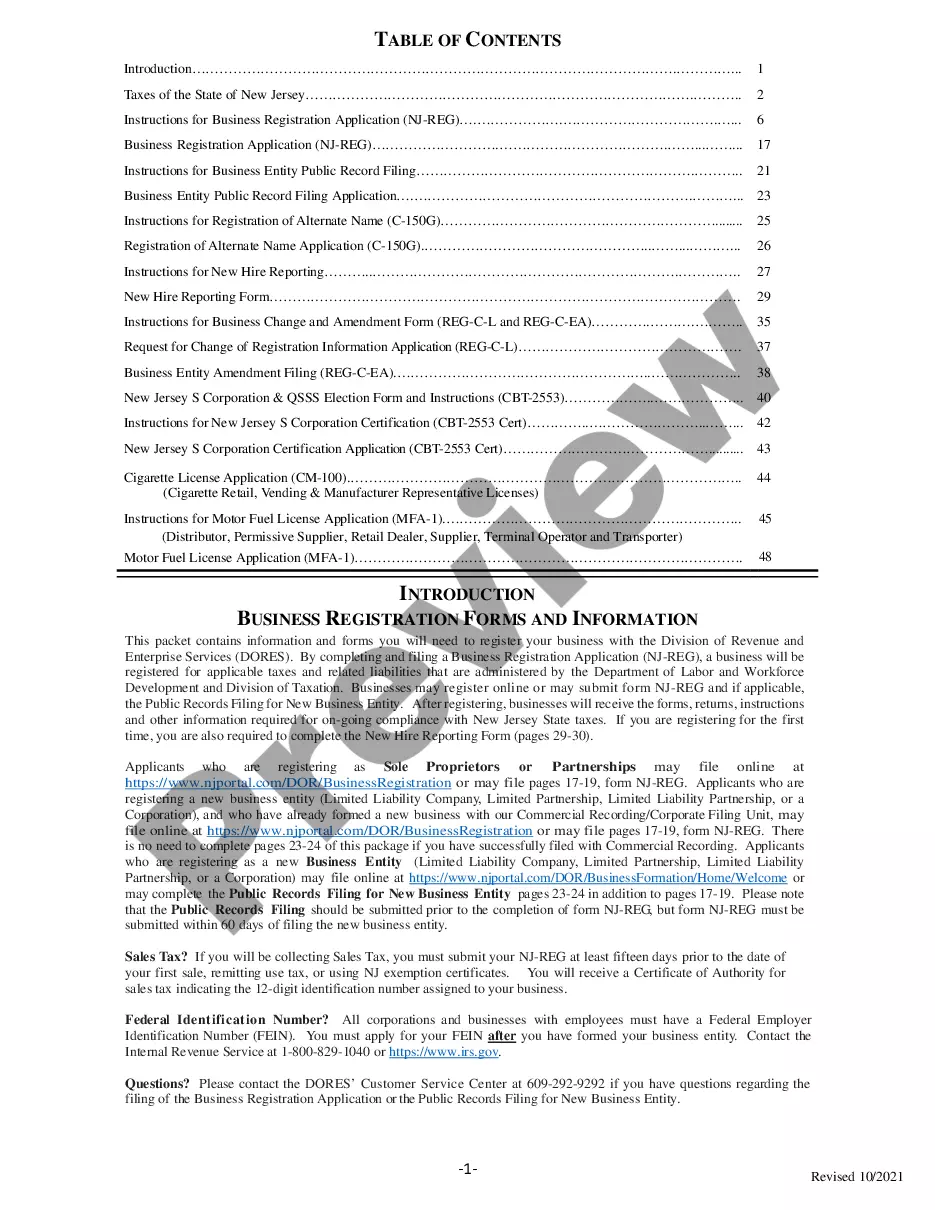

- Here is the procedure on how to obtain the New Jersey Foreign Corporation Withdrawal.

- Carefully review the page content to ensure it meets your requirements.

- Examine the form description or confirm it through the Preview option.

- Utilize the Search field above to find another sample if the previous one does not fit your needs.

- Click Buy Now when you locate the suitable New Jersey Foreign Corporation Withdrawal.

- Choose a pricing plan that aligns with your needs and budget.

- Register an account or Log In to advance to the payment page.

- Complete your payment via PayPal or with your credit card.

- Select the format for your document and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

To close your New Jersey withholding tax account, you need to first ensure that all withholding tax liabilities are settled. You can file the final return and indicate that it is your last submission. Additionally, you can contact the New Jersey Division of Taxation for specific guidance on your account. This process is essential to avoid complications related to New Jersey foreign corporation withdrawal, ensuring a smooth transition.

Failing to file an annual report for your LLC in New Jersey can lead to penalties and the potential forfeiture of the LLC's status. This could limit your ability to conduct business legally in the state. Hence, to facilitate a New Jersey foreign corporation withdrawal, it is important to stay compliant with filing obligations.

To dissolve a company in New Jersey, you must file necessary documents with the Division of Revenue, including the appropriate dissolution forms. You should also address any liabilities or obligations before finalizing the process. For a smooth New Jersey foreign corporation withdrawal, consider using professional services offered by platforms like uslegalforms.

If you don't dissolve an LLC in New Jersey, it may continue to incur fees and penalties for not filing required reports. Additionally, the LLC could lose its good standing, leading to potential legal complications. It's crucial to manage a New Jersey foreign corporation withdrawal properly to avoid these issues.

To dissolve a corporation in New Jersey, you must file a Certificate of Dissolution with the state. You should also settle any outstanding debts and obligations the corporation has. This process is essential to complete a New Jersey foreign corporation withdrawal efficiently, ensuring all legal requirements are met.

A New Jersey foreign corporation refers to a business entity that is incorporated in another state or country but conducts business in New Jersey. This means it must register with the New Jersey Division of Revenue to legally operate. Understanding this status is crucial, especially when considering a New Jersey foreign corporation withdrawal.

To close a corporation in New Jersey, you must vote to approve the closure, settle any outstanding debts, and file a Certificate of Dissolution with the state. Additionally, ensure that you have handled all tax obligations to avoid future complications. Taking these steps will aid in your New Jersey foreign corporation withdrawal and secure your personal interests.

Closing a business in New Jersey involves several key steps: resolving any debts, notifying employees, and filing dissolution paperwork with the state. It’s also important to cancel any permits or licenses associated with the business. For a smooth New Jersey foreign corporation withdrawal, consider using resources like USLegalForms to navigate the required forms and processes effectively.

To close a corporation, the owners must follow several steps, including voting on the closure, settling outstanding debts, and filing the necessary documentation with state authorities. Additionally, obtaining a tax clearance is advisable to confirm all obligations have been met. Properly handling this process will facilitate your New Jersey foreign corporation withdrawal and protect you from future liabilities.

Failing to dissolve your LLC in New Jersey can lead to ongoing tax obligations, penalties, and potential legal complications. Unresolved liabilities might continue to accumulate, impacting your business credibility and financial standing. Therefore, if you're considering a New Jersey foreign corporation withdrawal, ensure you follow through with dissolution to prevent these issues.