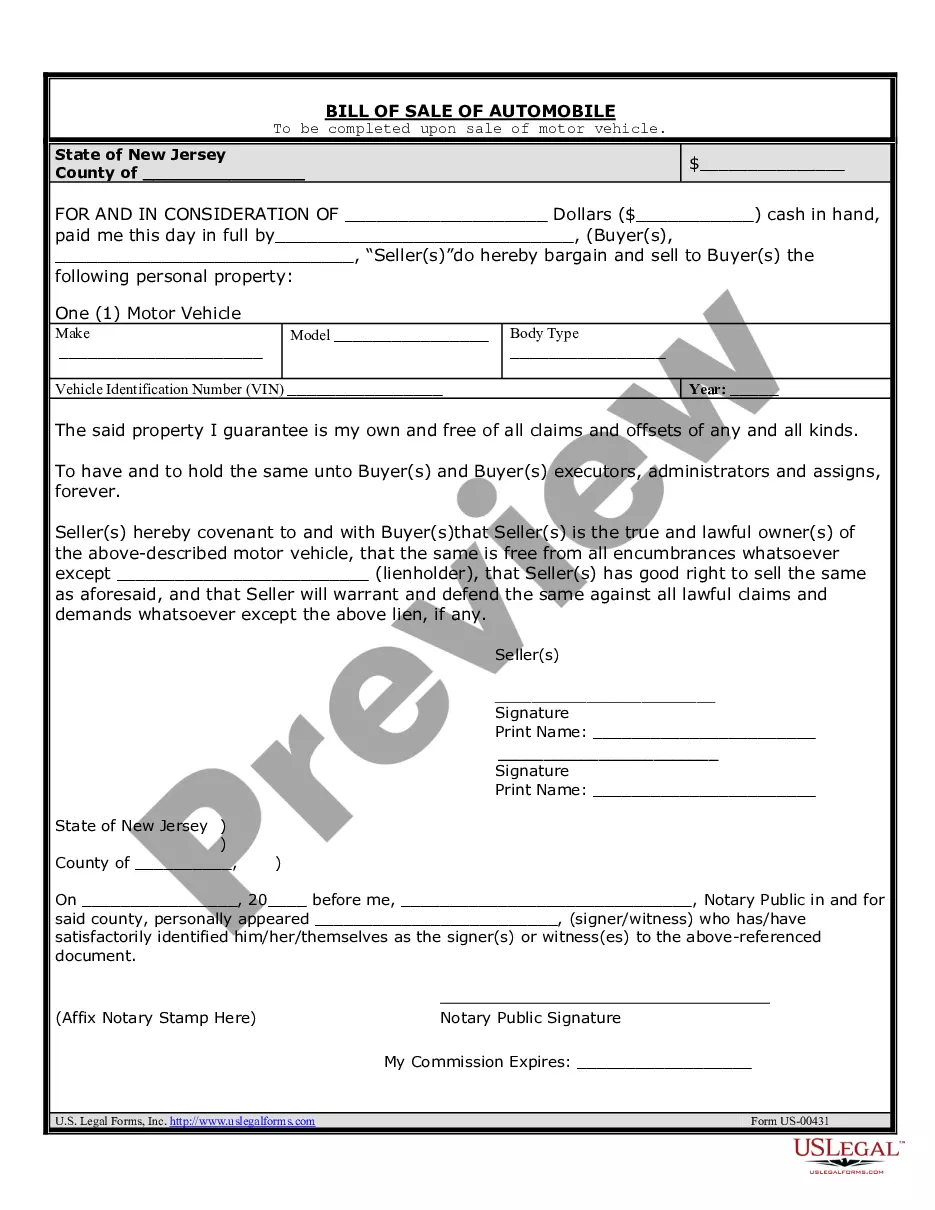

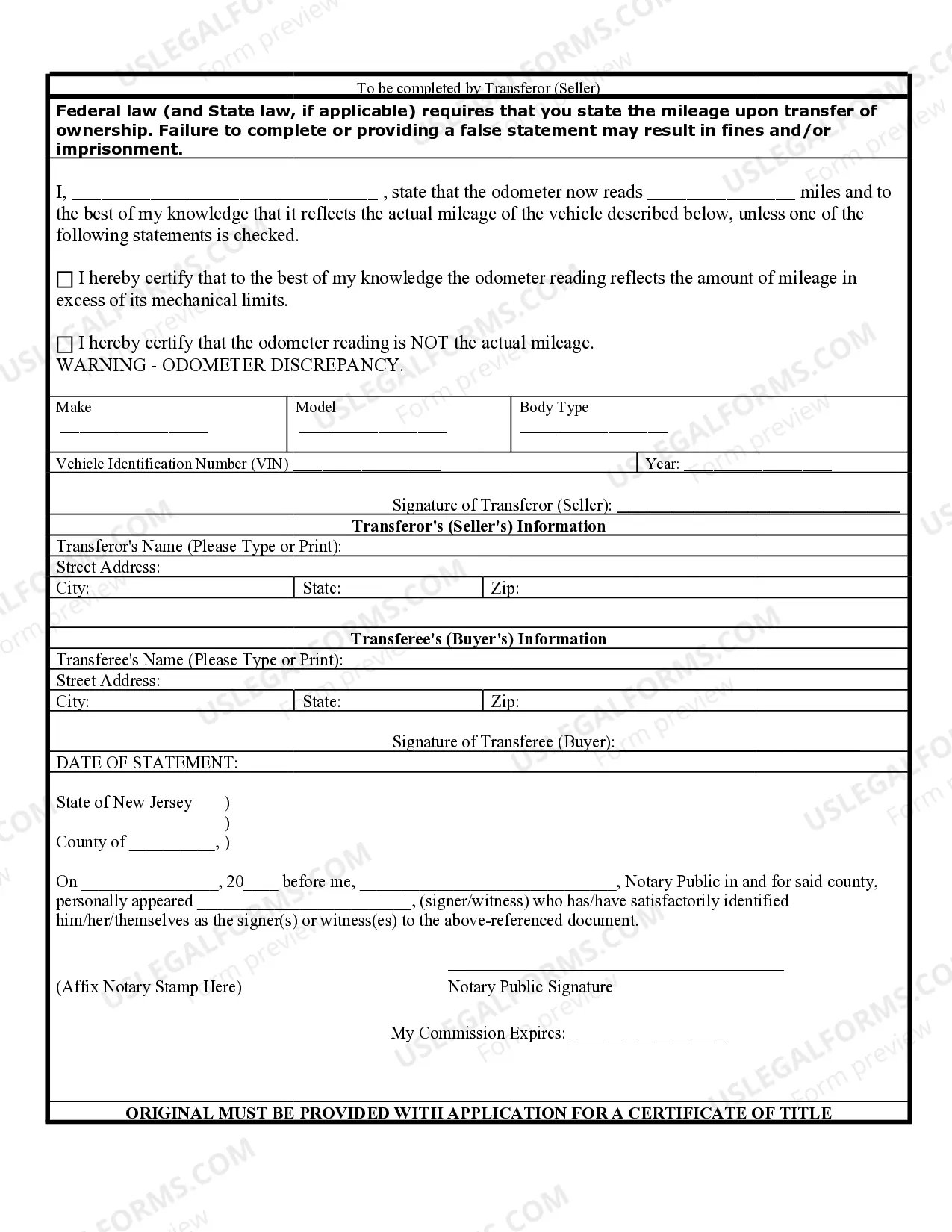

Nj Odometer Statement With Name

Description

How to fill out New Jersey Bill Of Sale Of Automobile And Odometer Statement?

The Nj Odometer Statement With Name displayed on this webpage is a reusable official template crafted by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners access to more than 85,000 authenticated, state-specific documents for various business and personal needs. It’s the fastest, most direct, and most dependable method to acquire the necessary paperwork, as the service provides the utmost level of data protection and anti-malware security.

Re-download your paperwork anytime needed. Access the My documents tab in your account to retrieve any forms you have previously downloaded. Register with US Legal Forms to access validated legal templates for every aspect of life.

- Explore the document you require and review it.

- Examine the example you searched for and either preview it or check the form description to verify it meets your requirements. If it does not, utilize the search bar to find the correct one. Click Buy Now once you’ve identified the template you need.

- Select a subscription plan and create an account. Choose PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template. Select the file type you prefer for your Nj Odometer Statement With Name (PDF, Word, RTF) and download the sample to your device.

- Complete and sign the document. Print the template to fill it out manually. Alternatively, use a versatile online PDF editor to quickly and accurately fill out and sign your form digitally.

Form popularity

FAQ

Permanent structures like storage sheds are generally considered taxable real estate, so they may result in an increase in taxes due each year, depending upon their size and use.

Self storage (a shorthand for "self-service storage," and also known as "device storage") is an industry that rents storage space (such as rooms, lockers, containers, and/or outdoor space), also known as "storage units," to tenants, usually on a short-term basis (often month-to-month).

Are shed taxes deductible? An outdoor structure such as a shed can be a deductible business expense. It is possible to take a write-off for an independent shed structure on your property that you use exclusively and regularly for business. The deduction will include any expenses connected to the shed structure.

Transitional Rules: All charges for space for storage for periods on and after October 1, 2002, are subject to 6% sales and use taxes, and charges for periods before October 1, 2002, are not taxable.

What is the cost of a storage unit in Connecticut? SizeLowestAverage5x5$24$735x10$34$11510x10$59$18010x15$63$2421 more row

Common Exemptions from Connecticut Sales and Use Tax: Bicycle Helmets. Booster seats and child car seats for use in motor vehicles are exempt. ... Sales of college textbooks to full-time and part-time students. ... Current United States and Connecticut flags. Firearm (gun) safety devices. Food products for human consumption.

Taxable personal property is tangible property other than real estate, as described in Sections 12-41 & 71 of the Connecticut General Statutes.