Fiduciary Deed Nh Withholding Tax

Description

How to fill out New Hampshire Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Legal administration can be daunting, even for the most seasoned experts.

When you are interested in a Fiduciary Deed Nh Withholding Tax and don’t have the opportunity to spend time searching for the accurate and current version, the procedures can be challenging.

For those with a monthly subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

Check out the My documents tab to view the documents you have previously saved and manage your folders as desired.

Enjoy the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your daily document management into a straightforward and user-friendly experience today.

- Ensure it is the correct document by previewing it and reviewing its description.

- Confirm that the template is validated in your state or county.

- Click Buy Now when you are prepared.

- Select a monthly subscription plan.

- Choose the file format required, and Download, complete, eSign, print, and send your documents.

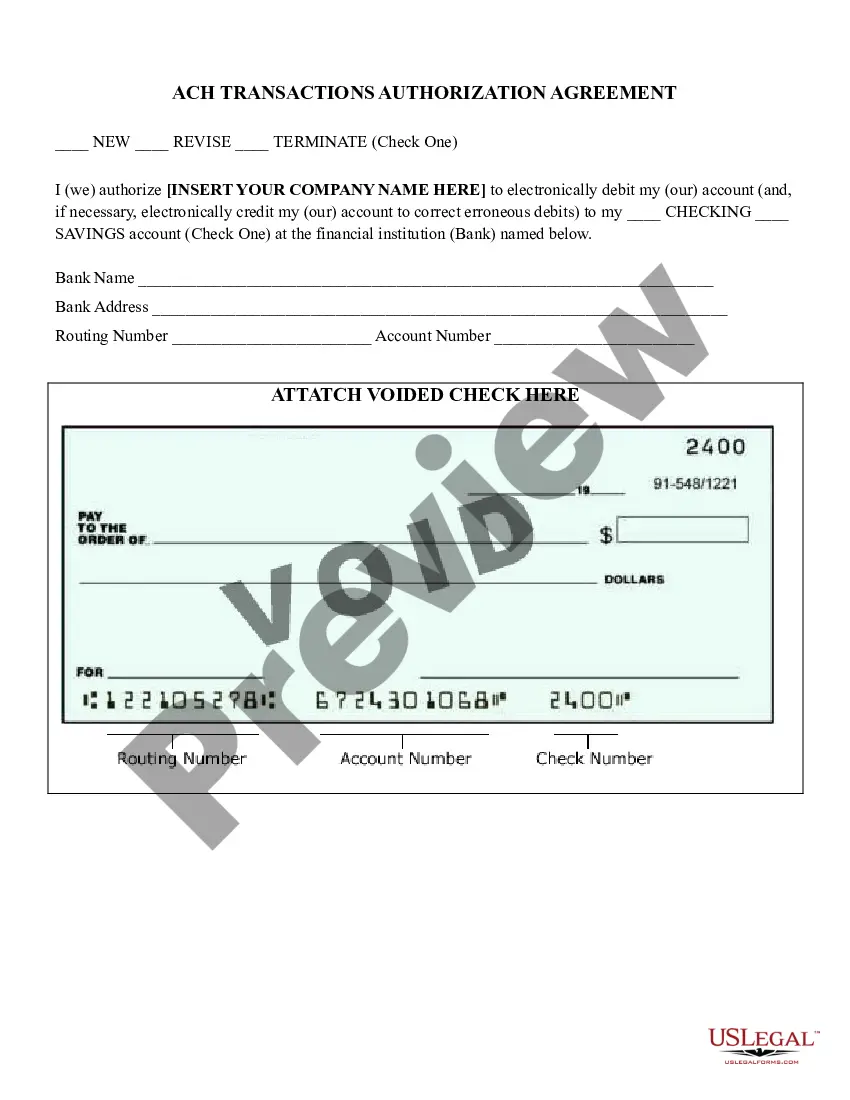

- Utilize external tools to complete and manage your Fiduciary Deed Nh Withholding Tax.

- Access a library of articles, guides, and resources pertinent to your situation and needs.

- Save time and effort locating the documents required, and use US Legal Forms’ advanced search and Review tool to locate Fiduciary Deed Nh Withholding Tax and obtain it.

Form popularity

FAQ

Enter the non-taxable amounts on Line 4, with the reason code and the payor's name and federal employer identification number. Use reason code 8 to reflect non- taxable interest and dividends allocated to non-New Hampshire residents interest holder.

The tax is imposed on both the buyer and the seller at the rate of $. 75 per $100 of the price or consideration for the sale, granting, or transfer. What types of transactions are taxable?

New Hampshire does not use a state withholding form because there is no personal income tax in New Hampshire.

New Hampshire uses Form DP-10 for full or part-year residents. The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. TaxAct® supports this form in the New Hampshire program.

Thus, the complete list of the federal payroll forms that you would need as an employer in New Hampshire are: W-4 Form: The W-4 Form will provide information on the employee withholdings so that you can properly calculate and withhold federal income taxes.