Demand For Rent Nh With Utilities Included

Description

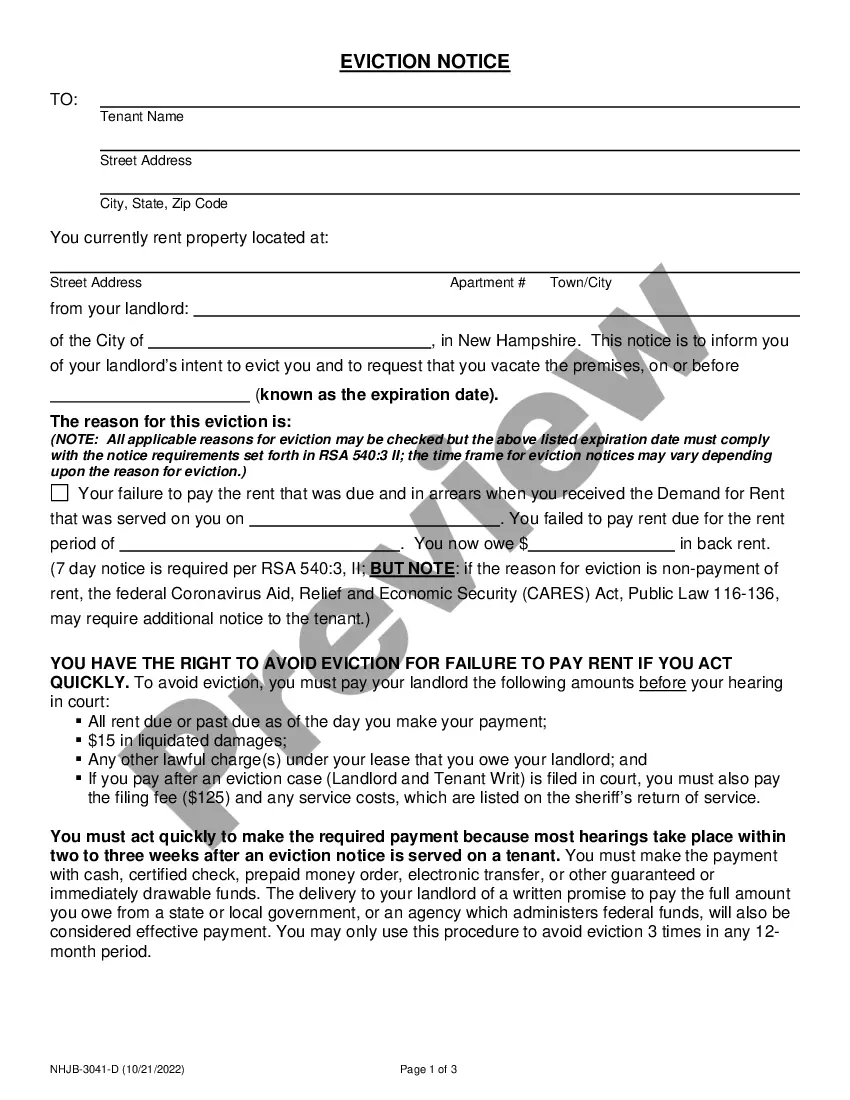

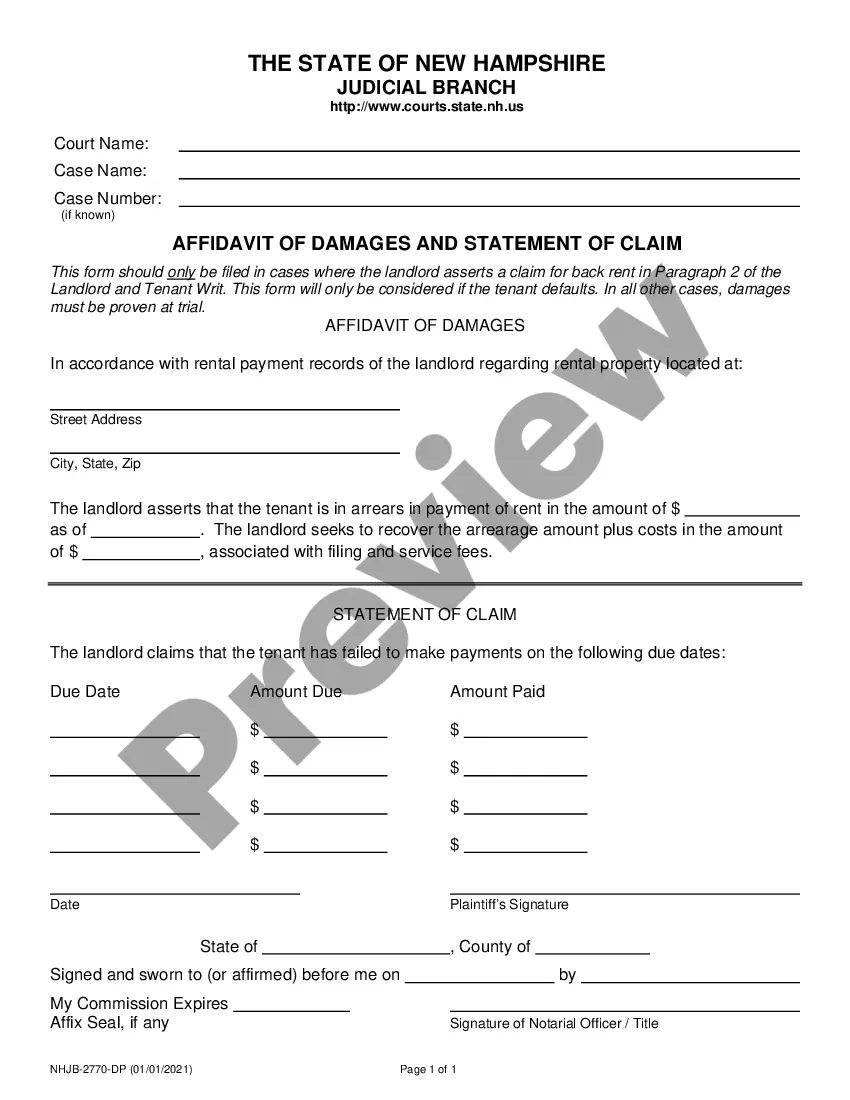

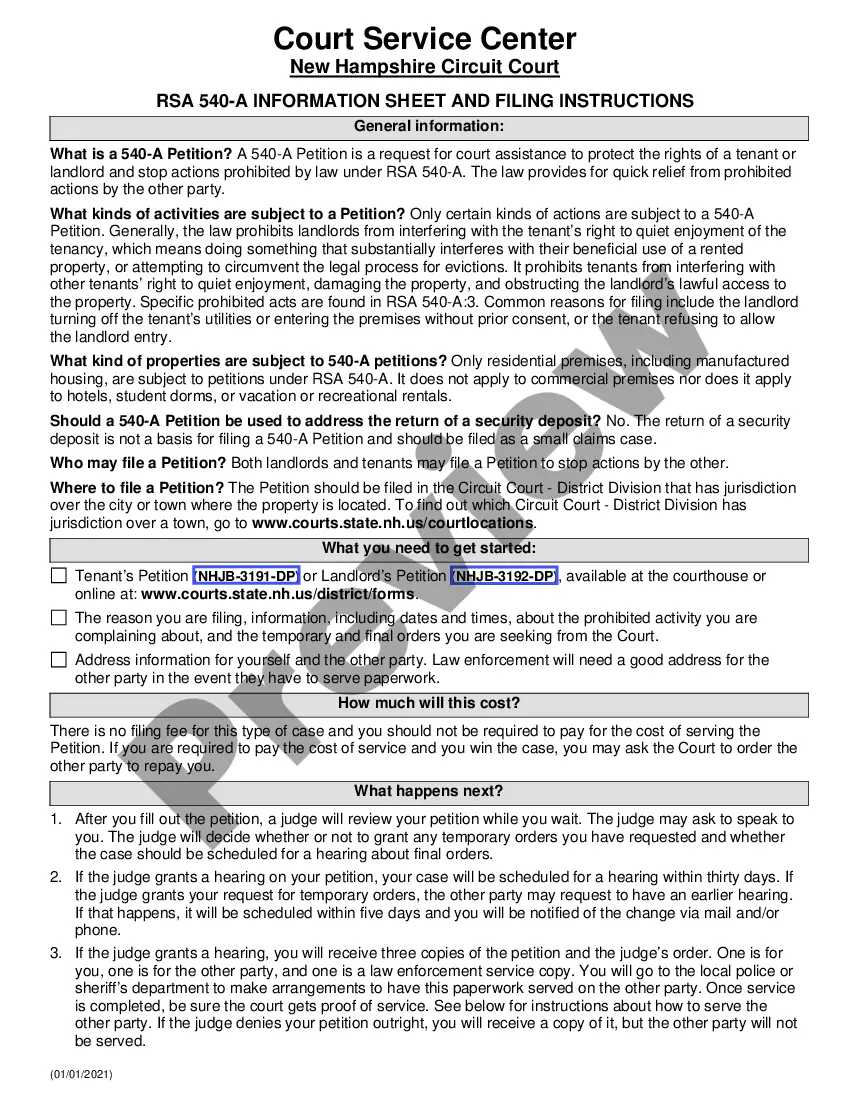

How to fill out New Hampshire Demand For Rent?

Creating legal documents from square one can frequently be somewhat daunting.

Certain situations may require numerous hours of investigation and significant financial expenditure.

If you’re searching for a more uncomplicated and budget-friendly method of generating Demand For Rent Nh With Utilities Included or other documentation without the hassle, US Legal Forms is always available.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters.

US Legal Forms has a flawless reputation and over 25 years of experience. Join us now and make document processing a straightforward and efficient task!

- With just a few clicks, you can quickly obtain state- and county-compliant templates meticulously prepared by our legal professionals.

- Utilize our platform whenever you require a trustworthy and dependable service through which you can effortlessly locate and download the Demand For Rent Nh With Utilities Included.

- If you’re already familiar with our services and have previously registered, simply Log In to your account, find the form, and download it or access it again anytime in the My documents section.

- Not signed up yet? No problem. It takes little to no time to register and browse the library.

- Before directly downloading Demand For Rent Nh With Utilities Included, follow these suggestions.

Form popularity

FAQ

The letter/memo includes the following values for 2022 and 2023: No Tax Due Threshold - USD 1,230,000. Tax Rate (retail or wholesale) - 0.375% Tax Rate (other than retail or wholesale) - 0.75%

A passive entity is a partnership or trust that earns at least 90% of its income from certain passive sources. Passive entities are exempt from paying Texas franchise tax and can file a No Tax Due Report.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

Franchise tax is based on a taxable entity's margin. Unless a taxable entity qualifies and chooses to file using the EZ computation, the tax base is the taxable entity's margin and is computed in one of the following ways: total revenue times 70 percent; total revenue minus cost of goods sold (COGS);

EFileTexas.Gov. Official E-Filing System for Texas. applying technology that enables everyone access to our justice system.

The franchise tax rate for entities choosing to file using the EZ computation method is 0.331% (0.00331). No margin deduction (COGS, compensation, 70% of revenue or $1 million) is allowed when choosing the EZ computation method.

The minimum tax rate for 2023 is 0.23 percent. The maximum tax rate for 2023 is 6.23 percent. You pay unemployment tax on the first $9,000 that each employee earns during the calendar year. Your taxable wages are the sum of the wages you pay up to $9,000 per employee per year.

The EZ computation uses a reduced tax rate of 0.331% multi- plied by a business' revenue apportioned to Texas.