Account Transfer Trust With Standard Bank

Description

Form popularity

FAQ

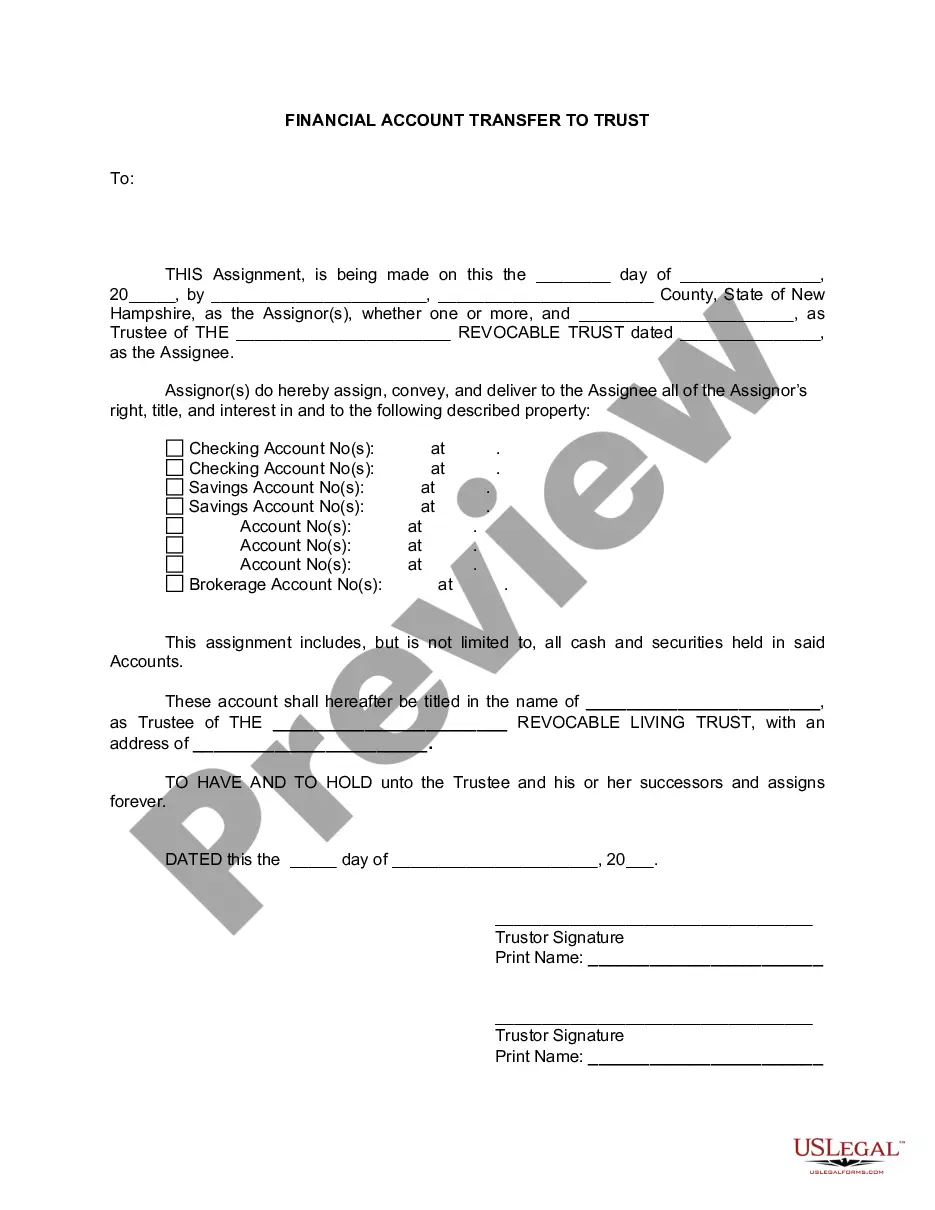

To transfer your bank account to your trust, you need to first set up your trust document. This document outlines the terms and details of the trust, including the trustee and beneficiaries. Next, contact your bank to inform them of your intention to perform an account transfer trust with standard bank. The bank may require you to provide the trust document and complete specific forms to facilitate the transfer, ensuring your assets are managed properly within the trust.

Transferring your bank account to a trust is a straightforward process. Begin by reaching out to your bank and requesting information on how to set up an account transfer trust with standard bank. After you provide the required documentation, such as your trust paperwork, the bank will facilitate the transfer, allowing your assets to be managed per your instructions.

To move bank accounts into a trust, contact your bank and inform them about your intention to create an account transfer trust with standard bank. You will likely need to provide a copy of the trust document and complete a change of ownership form. Once this is done, the bank will transfer the title of the account to the trust, ensuring that your funds are managed according to your wishes.

Yes, you can put your checking account into a trust. This is common for individuals looking to manage their assets efficiently. By doing this, you facilitate an account transfer trust with standard bank, simplifying the distribution of assets upon your passing. To execute this properly, you should consult with your bank and consider using UsLegalForms for guidance in preparing the necessary documentation.

One downside of putting assets in a trust is that it may involve legal fees for setting up the trust and possibly ongoing maintenance costs. Additionally, transferring assets can take time and effort, which some individuals may find inconvenient. If you need flexibility, accessing your assets can be more complex with a trust. However, the long-term estate planning benefits often outweigh these initial challenges.

To transfer your checking account to a trust, start by gathering necessary documents, including the trust agreement. Visit your bank branch to speak with a representative about the account transfer trust with standard bank. They will explain the necessary steps and forms required to complete the transfer. After submitting the required documents, ensure that the account is retitled under the trust's name.

Filling out a trust fund involves drafting a trust agreement that outlines your wishes for assets held in the trust. You can use resources like UsLegalForms to obtain a template tailored to your needs. It’s crucial to clearly define the assets, beneficiaries, and the fiduciary responsible for managing the trust. A well-prepared trust fund contributes to a smooth account transfer trust with standard bank.

To move a bank account into a trust, you need to contact your bank and request their process for an account transfer trust with standard bank. Generally, you will need to provide the trust document and possibly fill out some forms. The bank will guide you through any specific requirements they have. Once the bank approves the transfer, the account will be retitled in the name of the trust.

A Standard Bank trust account is a specialized account that holds assets on behalf of a trust. This type of account ensures that the assets are managed according to the terms of the trust agreement and are protected for the beneficiaries. When you choose an account transfer trust with Standard Bank, you benefit from their expertise in managing trust assets while enjoying peace of mind knowing your intentions are respected.

Transferring a trust account involves several steps, including contacting your bank and providing necessary documentation that outlines the details of the trust. You may need to provide the trust agreement and identification for the trustee and beneficiaries. When you initiate an account transfer trust with Standard Bank, their team assists you with a smooth transition, ensuring all legal requirements are met during the transfer process.