Account Transfer Trust With Fidelity

Description

Form popularity

FAQ

Yes, you can change your Fidelity account type to better suit your financial needs. If you're looking to establish an account transfer trust with Fidelity, this change can help align your investments with your specific goals. The process is straightforward, and Fidelity offers various options to assist you. To get started, you can visit the Fidelity website or contact their customer support for detailed guidance.

One of the biggest mistakes parents make is failing to clearly outline their intentions in the trust document. Without clear stipulations, beneficiaries may face confusion or disputes in the future. Effective communication and proper documentation are essential to prevent misunderstandings when your account transfer trust with Fidelity comes into play. Consider consulting with professionals to avoid common pitfalls and ensure your wishes are honored.

Transferring your Fidelity account to a trust is a straightforward procedure. Begin by contacting Fidelity's customer service to obtain the required forms for the transfer. They will guide you through the necessary steps and help ensure that your account transfer trust with Fidelity is executed smoothly, providing peace of mind as you manage your assets.

Setting up a trust account with Fidelity involves a few simple steps. First, gather necessary documentation, including trust agreements or legal paperwork. Next, you can either visit a Fidelity branch or use their online portal to apply. This streamlined process ensures that establishing your account transfer trust with Fidelity is both quick and efficient.

Yes, you can open a Fidelity account specifically designed for a trust. The process is straightforward, allowing you to manage trust assets effectively. With Fidelity, you gain access to a range of investment options while ensuring your trust's objectives are met. Utilizing an account transfer trust with Fidelity simplifies managing and tracking your trust’s finances.

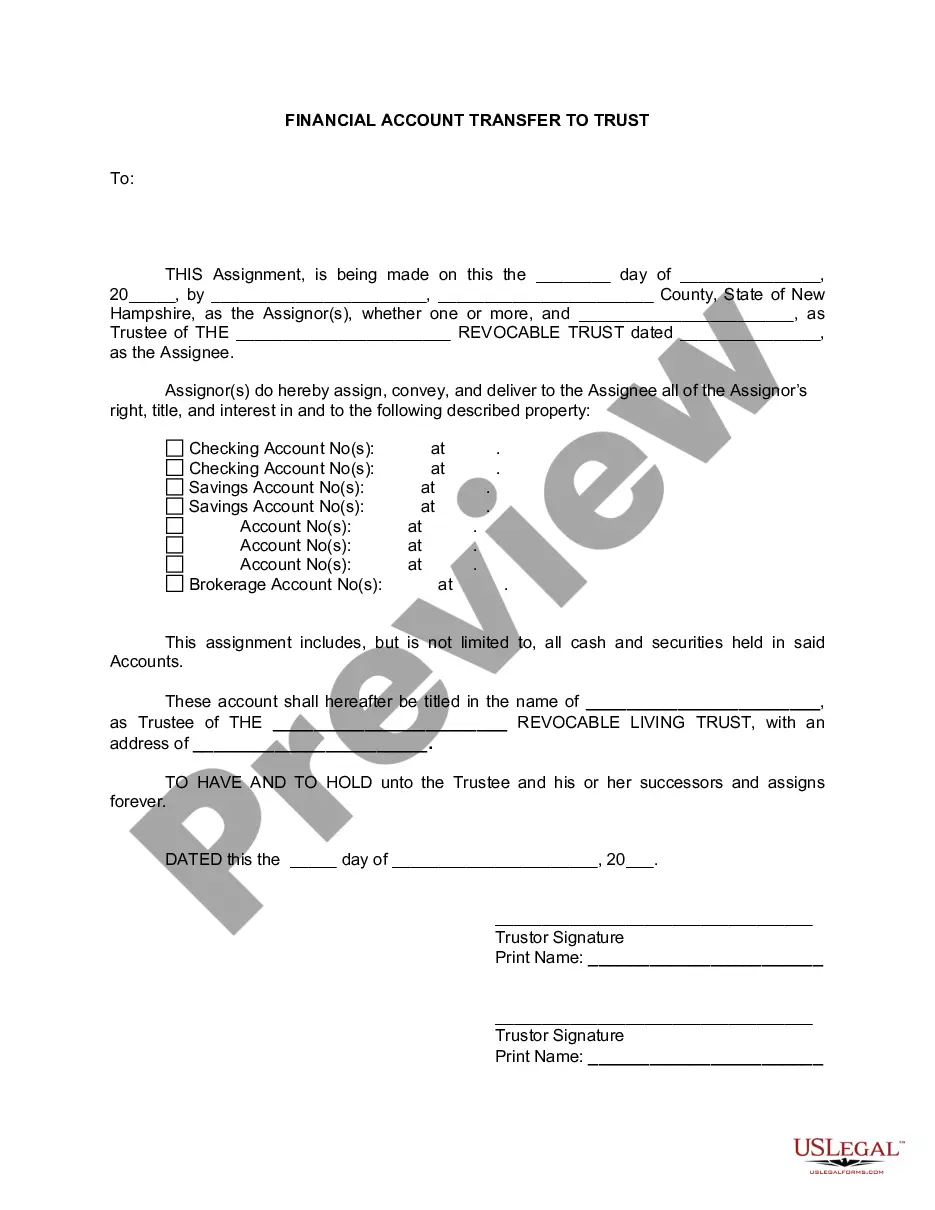

Changing a brokerage account to a trust involves filling out transfer request forms and possibly creating a new account under the trust's name. You will need to provide documentation that identifies your trust and the trustee. This transition can streamline your asset management and ensure your wishes are honored. For assistance, consider using US Legal Forms that offers guides and templates tailored for this process.

Transferring stock to a trust can have various tax implications, such as potential capital gains taxes at the time of transfer. However, if the trust is revocable, you may maintain control and avoid these taxes during your lifetime. It's crucial to consult with a tax professional to understand how this strategy aligns with your financial goals. Staying informed will help you navigate the complexities of an account transfer trust with Fidelity.

The process to transfer a Fidelity account to a trust typically involves completing a transfer form from Fidelity and providing necessary documentation about the trust. You should be prepared to include the trust’s name, tax identification number, and details of the trustee. This procedure can optimize your estate planning and asset protection strategy. Using platforms like US Legal Forms can simplify the paperwork involved.

Some Fidelity accounts, such as certain retirement accounts and accounts with restrictions, may not be eligible for transfer into a trust. It’s important to review your account types and their guidelines. You can find detailed information directly from Fidelity or through an estate planning professional. This step ensures you understand which accounts can be efficiently moved under an account transfer trust with Fidelity.

Yes, you can transfer your brokerage account to a trust. This process usually involves completing specific forms and possibly providing documentation about the trust. It's a straightforward move that can help manage your assets more effectively. For a seamless transition, consider using a resource like US Legal Forms for necessary templates and guidance.