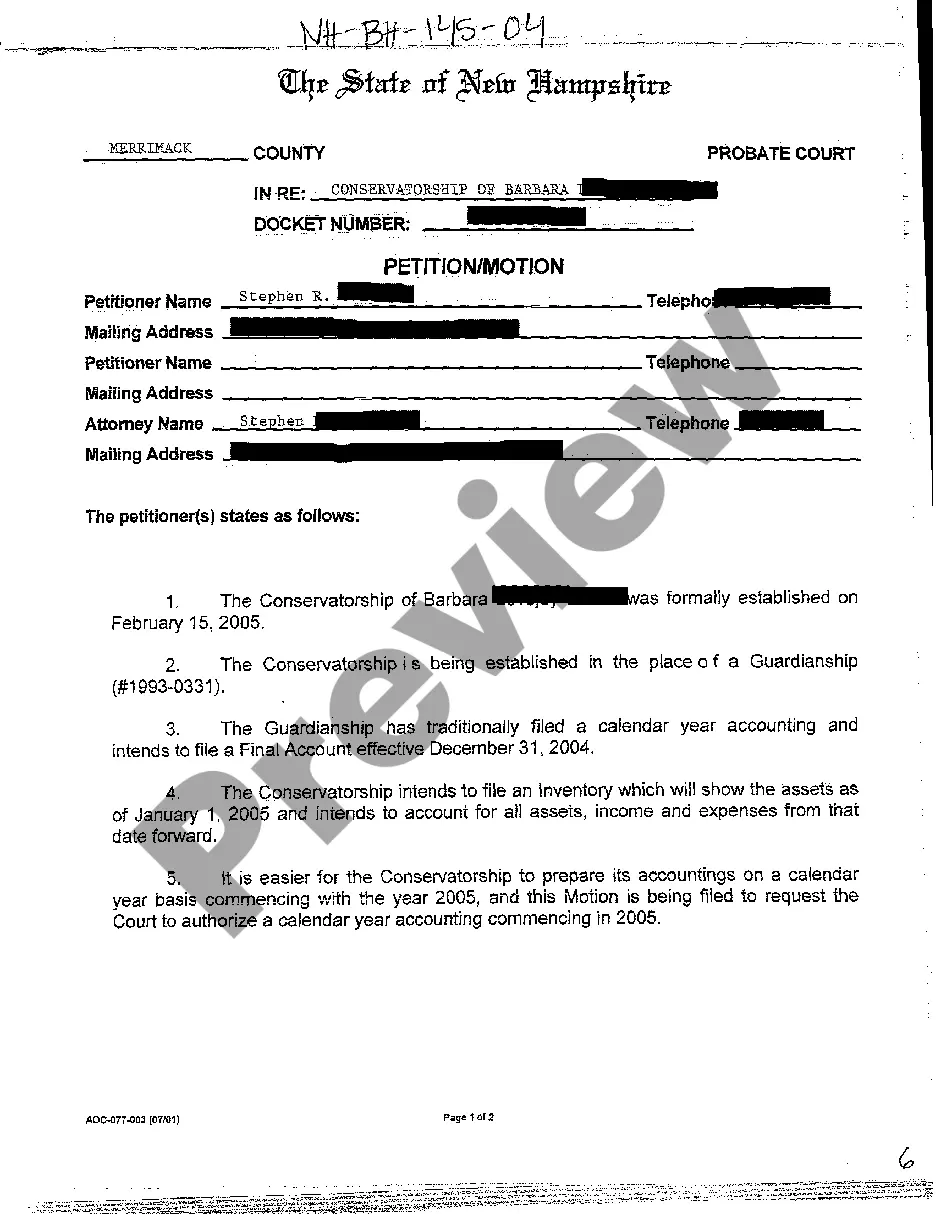

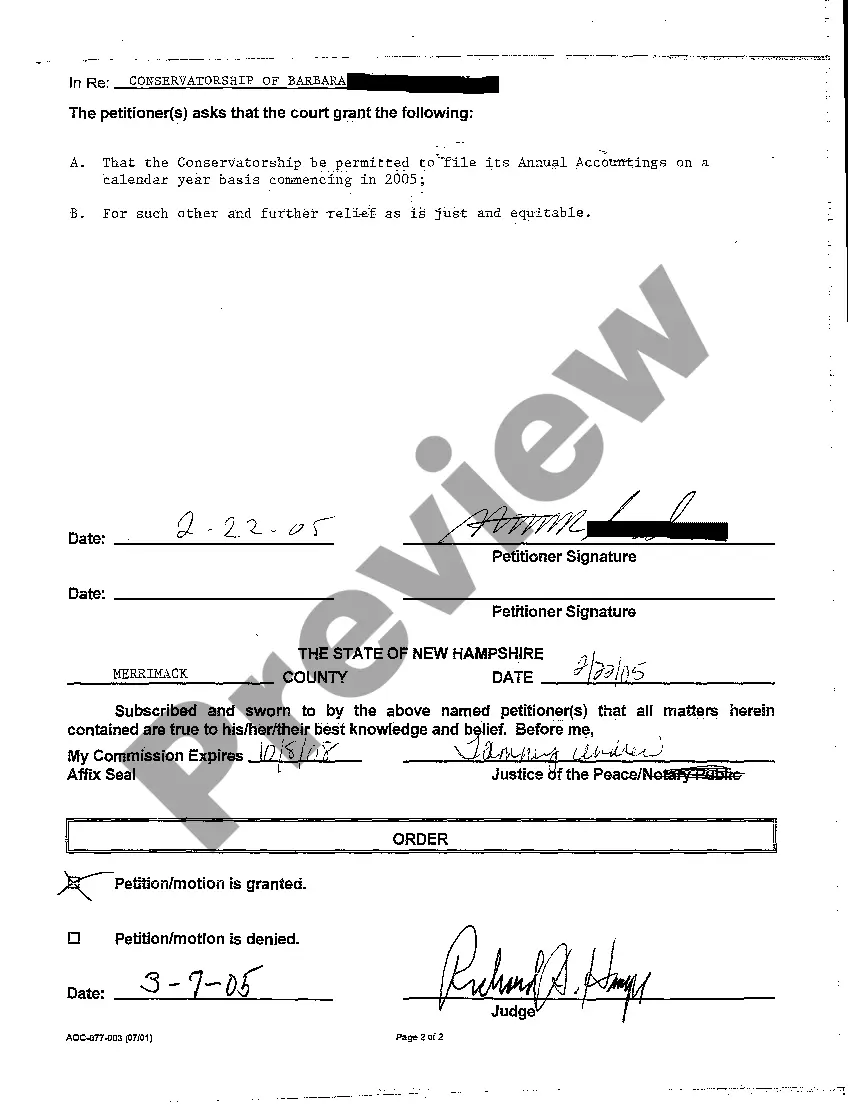

Petition For Accounting

Description

How to fill out Petition For Accounting?

How to obtain professional legal documents that adhere to your state laws and create the Petition For Accounting without hiring an attorney.

Numerous online services offer templates to address various legal circumstances and requirements. However, it might require time to determine which of the available examples fulfill both your needs and legal standards.

US Legal Forms is a recognized platform that assists you in locating official documents crafted in accordance with the latest state legal updates and economizing on legal services.

If you do not have an account with US Legal Forms, then adhere to the following instructions.

- US Legal Forms is not a typical online directory.

- It's a repository of over 85k confirmed templates for various business and personal scenarios.

- All documents are categorized by region and state to streamline your search experience.

- It also features robust tools for PDF modification and electronic signature, enabling users with a Premium subscription to swiftly complete their paperwork online.

- Acquiring the necessary documents requires minimal effort and time.

- If you already possess an account, Log In and verify that your subscription is currently active.

- Download the Petition For Accounting by clicking the appropriate button next to the document title.

Form popularity

FAQ

Yes, beneficiaries are typically entitled to an accounting of the estate. They have the right to see a detailed report that outlines all financial activities conducted during the estate administration. By filing a Petition for accounting, beneficiaries can formally request this information, ensuring they receive clarity about how the estate's assets are handled. Platforms like US Legal Forms provide the necessary resources to help both executors and beneficiaries understand their rights in this process.

To prepare a final accounting for an estate, you need to gather all financial records related to the estate, including income, expenses, and distributions to beneficiaries. Carefully itemize these records in a clear format, ensuring every transaction is documented. Using a Petition for accounting can help present this information formally to the court, ensuring transparency and compliance with legal requirements. Tools like US Legal Forms offer templates that simplify this process, making it easier for you to manage your paperwork.

To demand an accounting means to formally request a detailed overview of financial transactions from a party managing your finances. This process can help clarify any uncertainties and promote responsible management of funds. Utilizing a petition for accounting sets in motion the framework for accountability and ensures that you receive the information you deserve.

Compel accounting refers to the legal process of forcing an individual or organization to disclose their financial records. This process is crucial for maintaining trust and ensuring fairness, especially in fiduciary relationships. If you suspect financial discrepancies, a petition for accounting can be an effective tool to demand transparency and clarity.

A petition to compel accounting is a formal request made to a court to mandate a party to provide an accounting of their financial dealings. This petition typically arises in situations where trust is compromised or when beneficiaries want to verify the accuracy of financial records. When you file a petition for accounting, you seek to uphold accountability and transparency in financial matters.

To compel an accounting means to take legal steps to require someone to provide a detailed report of financial activity. This process is often necessary when there are concerns about mismanagement or a lack of transparency. By filing a petition for accounting, you can ensure that all parties involved receive a clear overview of the finances at stake.

A petition for accounting is a legal request made to the court for a thorough examination of financial records. This process often occurs in cases involving trusts, estates, or partnerships, where a party seeks clarity on financial transactions. By filing a petition for accounting, you can ensure transparency and accountability in financial dealings, which ultimately helps protect your interests. If you're looking to streamline this process, uslegalforms offers various templates to assist you in preparing your petition efficiently.

If a trustee does not provide accounting, beneficiaries may face a lack of clarity regarding trust finances, which can lead to potential misuse of assets. In such cases, beneficiaries have the right to file a petition for accounting to compel the trustee to disclose financial records. The court can intervene, ensuring beneficiaries receive the oversight necessary for trust management. Taking timely action is essential to protect your interests as a beneficiary.

Yes, a beneficiary can request an accounting at any time, especially if there are concerns about the trustee's management of trust assets. This request is often the first step before escalating to a formal legal petition. It encourages the trustee to maintain transparency and adhere to their duties. If the trustee fails to comply with the request, it may become necessary to file a petition for accounting.

To compel an accounting from a reluctant trustee, beneficiaries may need to file a petition for accounting in court. This legal action serves as a request for the court's intervention to enforce transparency in the trust’s management. Make sure to gather any relevant documentation that supports your case. A knowledgeable attorney can assist in navigating this process effectively.