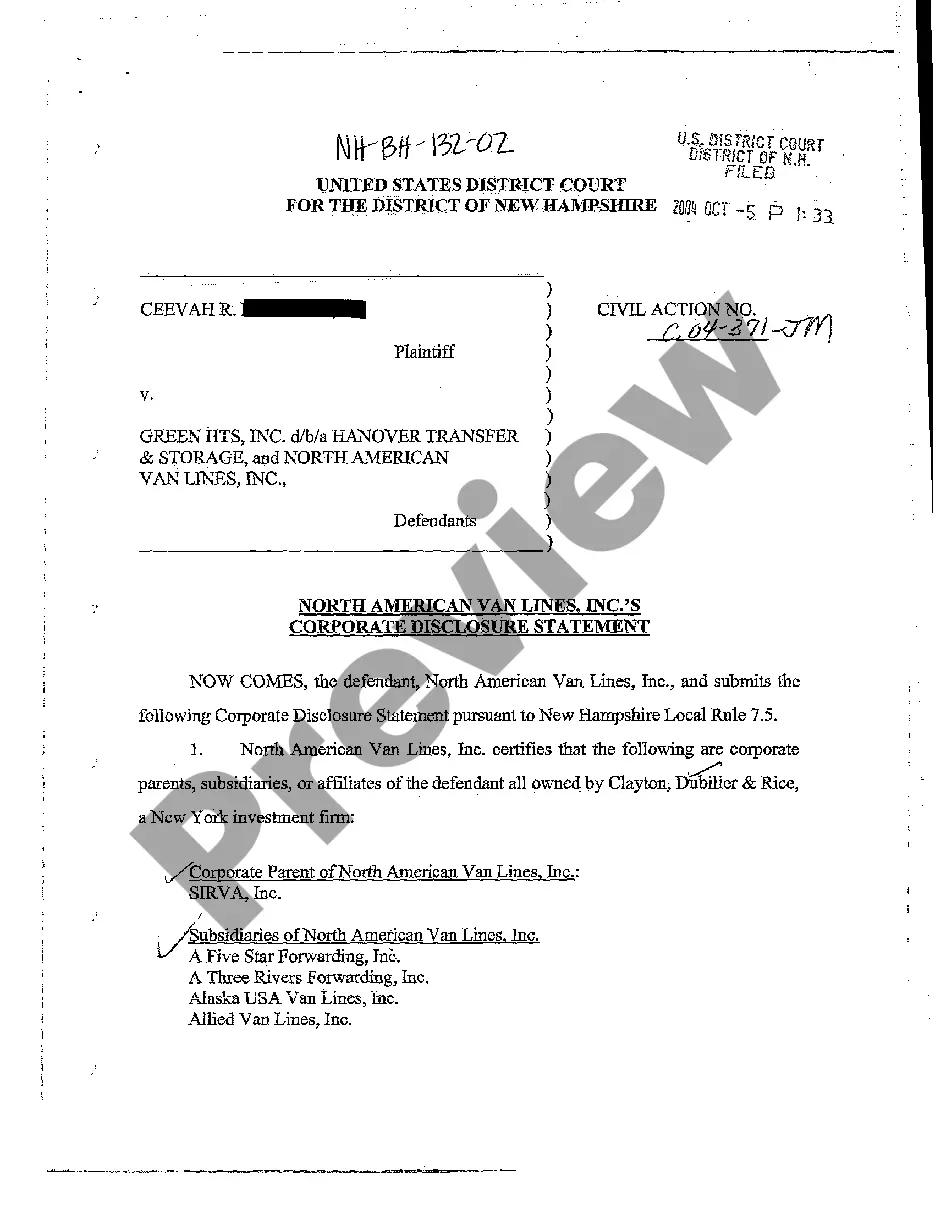

Corporate Disclosure Statement In Federal Court

Description

How to fill out Corporate Disclosure Statement In Federal Court?

Individuals generally link legal documentation with something intricate that solely a specialist can handle.

In some sense, this is accurate since preparing a Corporate Disclosure Statement in Federal Court requires comprehensive knowledge of subject matter, including state and county laws.

However, with US Legal Forms, the process has become more straightforward: an assortment of ready-to-use legal documents for every life and business scenario specific to state legislation is gathered in a single online directory and is now accessible to everyone.

Choose a pricing plan that suits your needs and budget. Create an account or Log In to move to the payment page. Complete your subscription payment via PayPal or with a credit card. Choose the file format and click Download. Print the document or upload it to an online editor for quick filling. All templates in our catalog are reusable: once purchased, they remain stored in your profile. You can access them whenever necessary via the My documents tab. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and use area, making the search for a Corporate Disclosure Statement in Federal Court or any other specific template quick and easy.

- Users who have previously registered and maintain an active subscription must Log In to their account and select Download to acquire the form.

- New users to the platform must first create an account and subscribe prior to downloading any documents.

- Here is the detailed guide on how to obtain the Corporate Disclosure Statement in Federal Court.

- Examine the page content carefully to confirm it fulfills your requirements.

- Review the form description or inspect it using the Preview feature.

- If the initial option does not meet your needs, find an alternative template through the Search bar in the header.

- Once you locate the appropriate Corporate Disclosure Statement in Federal Court, click Buy Now.

Form popularity

FAQ

You should file a corporate disclosure statement in federal court at the time of your initial filing, typically alongside other key documents. This is essential to provide the court with all relevant information about your corporation’s identity and interests. Timely filing helps avoid any delays later in the process. If you're unsure about the requirements, USLegalForms offers resources and templates to simplify your filing.

Rule 26 of the Federal Rules of Appellate Procedure requires parties in a case to disclose their corporate structure. This rule mandates that any corporations or entities involved must file a corporate disclosure statement in federal court. This practice promotes fairness by revealing any potential financial interests that could affect the case's outcome. Compliance with Rule 26 ensures that the parties are transparent from the start.

An appellant's brief must include a corporate disclosure statement in federal court when the appellant is a corporation or a similar entity. This requirement ensures transparency regarding any corporate affiliations or interests that might influence the case. By providing this information, you help the court understand potential biases. It also helps maintain the integrity of the judicial process.

The Rule 26.1 disclosure statement is a document required under federal rules that provides an overview of a party's corporate structure and ownership. This statement is essential to identify any potential conflicts or biases due to financial interests in litigation. By creating a comprehensive corporate disclosure statement in federal court, parties can strengthen their legal position and contribute to a more efficient judicial process.

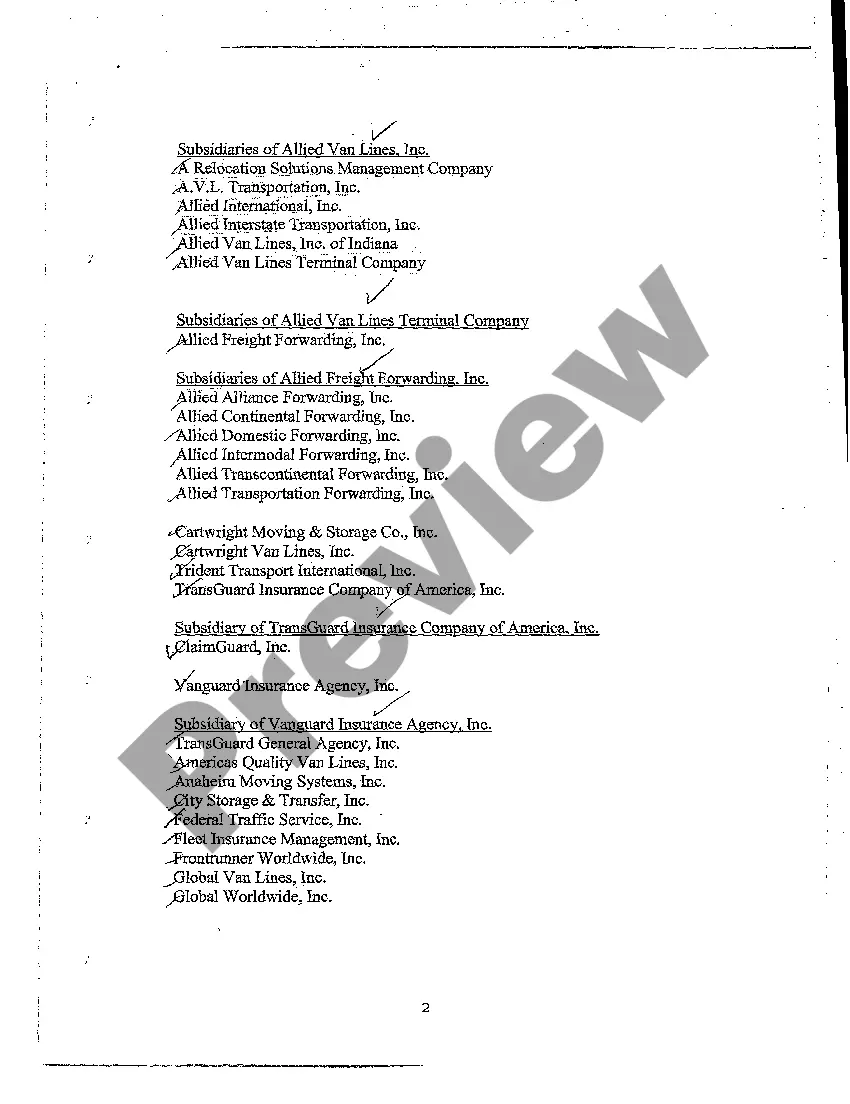

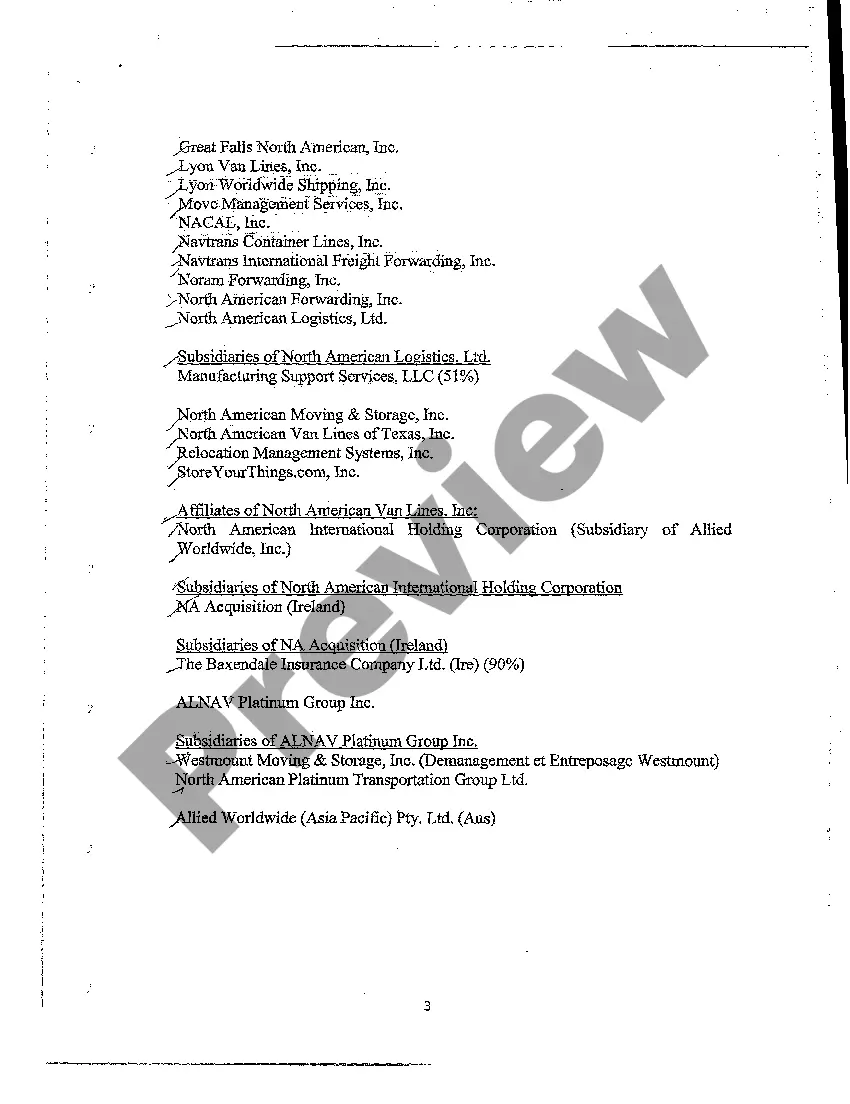

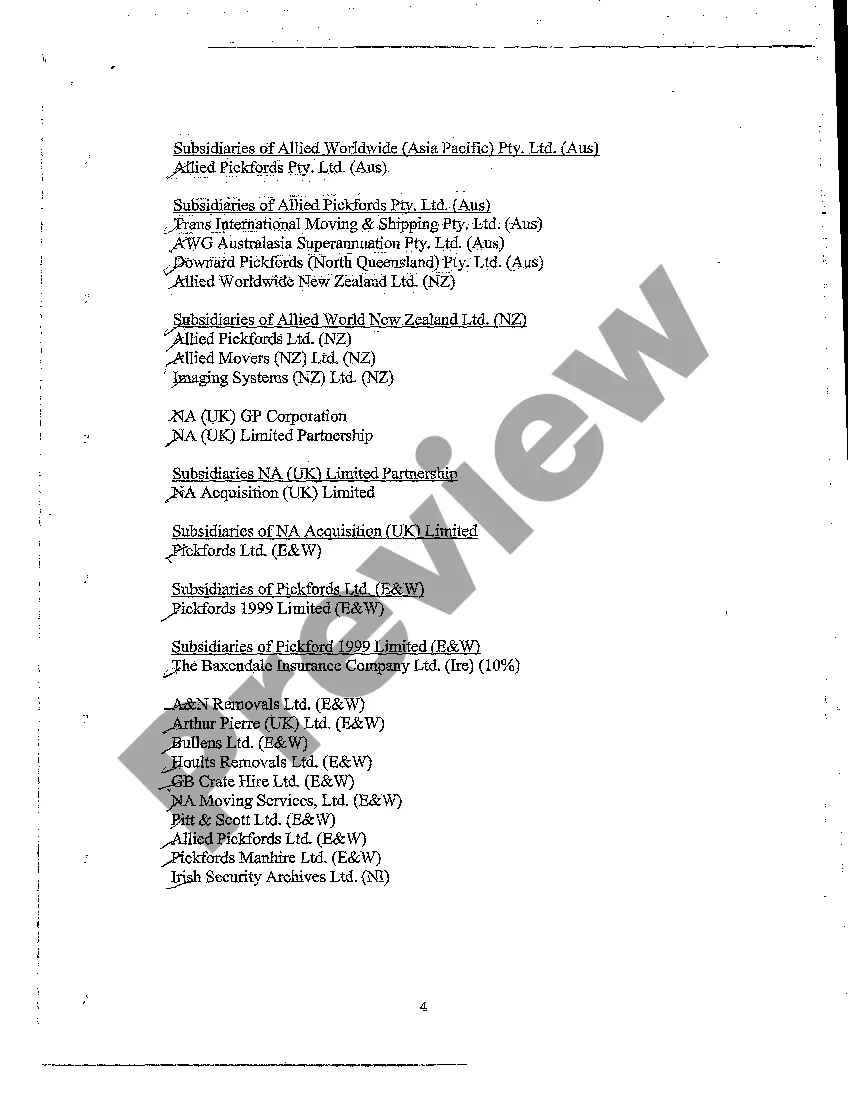

The circuit Rule 26.1 disclosure statement is a specific requirement that varies by circuit but generally mandates parties to disclose information about corporate entities involved in litigation. This statement typically outlines any parent corporations, subsidiaries, and other publicly held companies that own 10% or more of the party. Adhering to these rules enhances transparency and ensures that judges and juries have all relevant facts regarding corporate relationships.

You should file a corporate disclosure statement in federal court at the outset of a case, specifically within 14 days after your first responsive pleading or motion. This timely submission allows the court and other parties to understand the organizational structure of entities involved in the litigation. Meeting this deadline is crucial for maintaining compliance with federal rules and promoting fair legal processes.

The purpose of Rule 26 disclosures is to promote transparency in federal courts by ensuring all parties share vital information at the start of litigation. This process helps to clarify the nature of the claims and defenses, enabling efficient case management. By complying with the requirements for a corporate disclosure statement in federal court, litigants can minimize surprises and facilitate smoother proceedings.

To write a disclosure statement for court, start by gathering essential information about your corporation, including its structure and ownership. Ensure your corporate disclosure statement in federal court includes details about parent companies, subsidiaries, and any relevant financial connections. Clarity and completeness are key; avoid vague language and provide precise information. If you need assistance, consider using ulegalforms, which offers templates and guidance for creating effective disclosure statements tailored to meet federal requirements.

The federal rule for corporate disclosure statements requires corporations involved in federal court cases to disclose their identities and affiliations. This rule helps ensure transparency in legal proceedings by revealing any potential conflicts of interest. Specifically, it mandates organizations to file a corporate disclosure statement in federal court, listing all parent companies, subsidiaries, and other financial interests. Understanding this rule is crucial for compliance and maintaining the integrity of the judicial process.

A corporate disclosure statement in federal court is a document that outlines the details regarding the corporate entities involved in litigation. It identifies the corporation, its parent companies, and any substantial shareholders. This statement is necessary for ensuring all relevant corporate interests are disclosed, supporting fairness and transparency in the legal process.